Equilar Institute

Blog Home

Declassified Boards Are Much More Likely to Be Diverse

July 24, 2017

The Equilar Gender Diversity Index (GDI) has reported that, at the current pace of growth in female representation on public company boards of directors, gender parity would not be reached until Q4 2055 for the Russell 3000. However, annually elected boards may already have an edge against their classified counterparts.

Classified boards, also colloquially known as staggered boards, create separate “classes” of directors who are elected for multiple-year terms, with one “class” coming up for re-election each year. Proponents of classified boards say they strengthen a company’s long-term strategy by increasing focus and dedication. Classification may also reduce stress on a board by creating job stability and preventing hostile corporate takeovers. On the other hand, advocates of declassified boards highlight how annual elections can increase accountability and responsiveness to shareholders. Over the past five years, corporations have seen a strong migration away from classified boards to annually elected boards with no director classes. Indeed, almost 90% of large-cap companies now have declassified boards, up from about two-thirds in 2011.

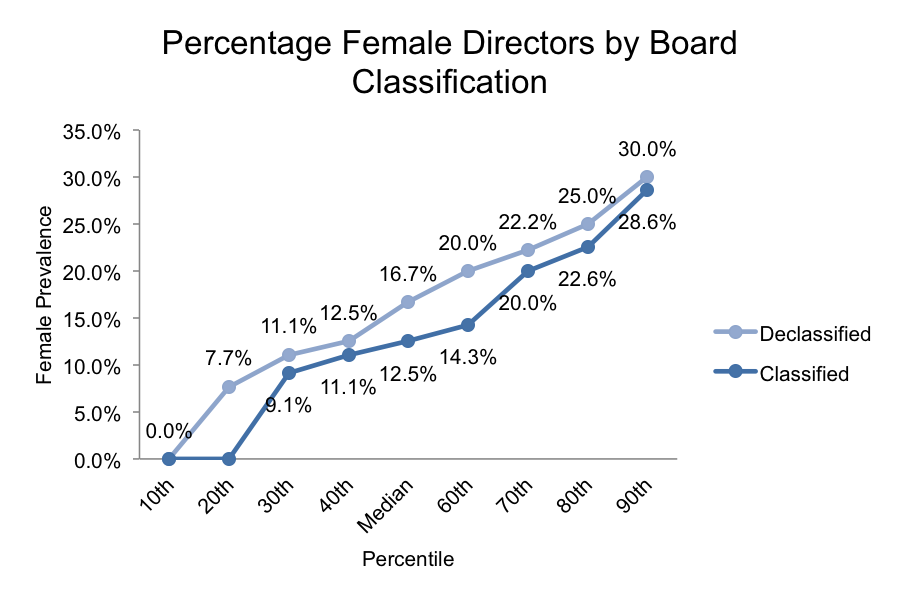

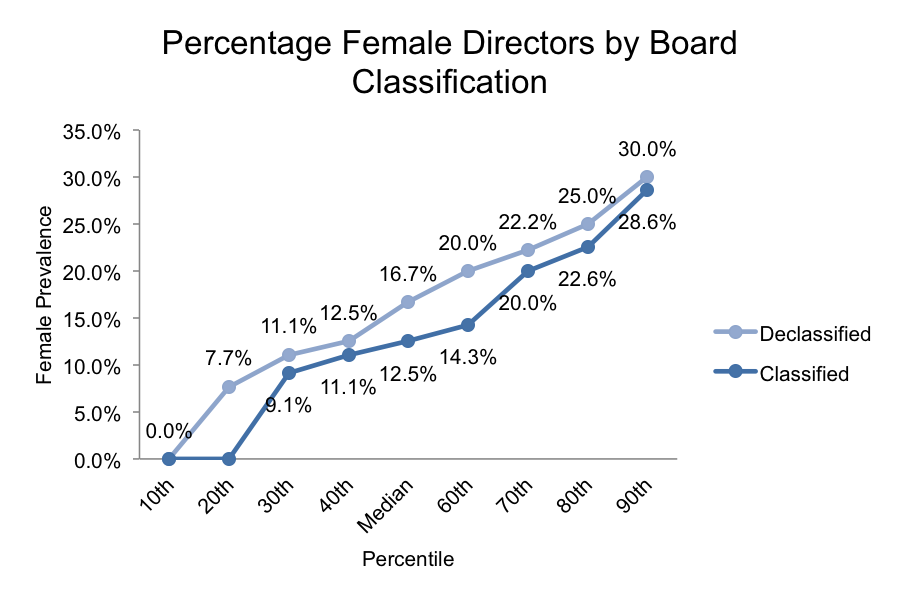

In the Russell 3000, boards are more evenly split. According to a recent Equilar study, more than 40% of boards were classified. Further analysis using data from the forthcoming Equilar GDI—which will publish August 2—elucidates a discrepancy between classified and declassified boards. For the Russell 3000, median prevalence of female directors for Q2 2017 in the Gender Diversity Index was 14.3% overall. However, when split into categories according to whether or not the board is classified, median prevalence differs notably—classified boards had 12.5% female directors at the median vs. 16.7% for declassified boards. The most recent data has shown that declassified boards have consistently outpaced their classified peers in female prevalence across all percentiles.

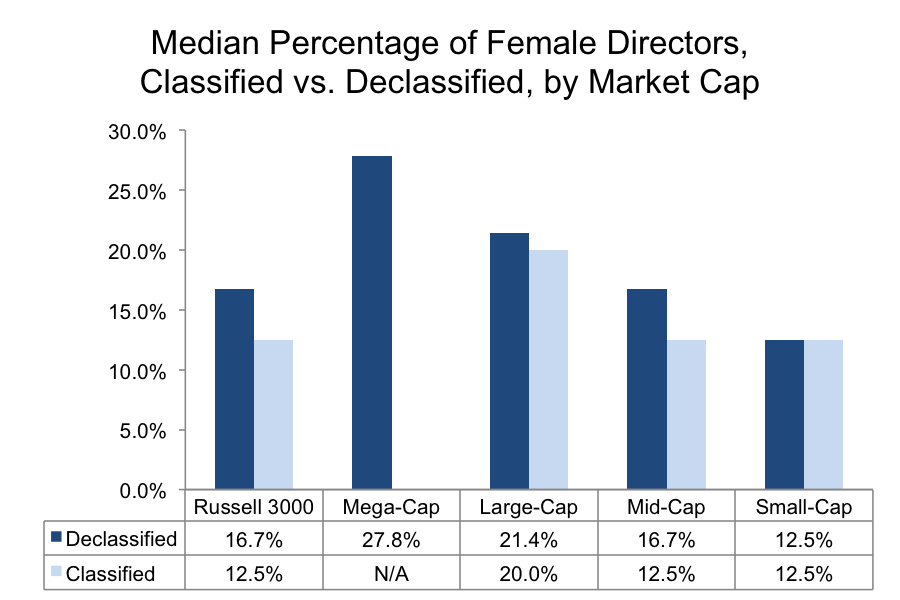

Separating companies by market capitalization provides another look into how market value may affect gender diversity. Size doesn’t mean everything, but when it comes to gender diversity company size it clearly correlates to higher female prevalence on boards overall.

Companies that fall under the mega-cap and large-cap distinctions (greater than $200 billion and between $10 and $200 billion in market cap, respectively) are both ahead of the Russell 3000 median for both classified and declassified boards. Mega-cap companies reached 27.8% female prevalence in declassified boards—notably, there were no classified boards among this group of companies. Meanwhile, large-cap companies beat the index median by 7.5 and 4.7 percentage points for classified and declassified boards, respectively, and declassified boards edged out their counterparts with 21.4% women on boards at the median.

Classified and declassified boards at mid-cap companies have the same median prevalence of gender diversity as the median index overall. Declassified boards for small-cap companies were the only group that dipped below the index median in their category, with a difference of 4.2 percentage points.

Please contact Dan Marcec, Director of Content & Communications at dmarcec@equilar.com for more information on Equilar research and data analysis. Grant Bremer, research analyst, authored this post.

Solutions

Solutions