Equilar Institute

Eye on the Environment

Environmental and social issues join board diversity and executive compensation as a top three area of investor interest.

The 2020 proxy season will be “year three” of a recent, yet intensifying, trend featuring exponential growth in companies discussing E&S issues affecting them in their proxies. This is above and beyond the rebuttal language typically provided in response to shareholder-sponsored proposals on these issues.

This joins, but does not push aside, continuing interest in:

- Board diversity, whether measured by gender, race, ethnicity, national origin, age, tenure, or skills and competencies. Here, investors want to know that the board collectively has the requisite experience and competencies to meet the company’s strategic needs, including present and anticipated future challenges. Investors are equally interested in the processes that will sustain this diversity, including board evaluation and director recruitment processes.

- Executive compensation, particularly CEO pay. While “pay for performance” remains the mantra, investors have long asked companies to explain clearly “how pay is aligned with the business strategy” and, if that strategy is evolving, is the pay program evolving in tandem? Recently we have seen more companies address this head-on, and this approach seems to help investors support company Say on Pay proposals in the face of negative vote recommendations from proxy advisors.

Discussion of traditional environmental issues, such as carbon output/air quality, energy and water conservation, waste disposal, and social issues, such as political contributions/lobbying, workplace diversity and gender pay equity, are rapidly being joined by a sharpening focus on human capital management (HCM). This includes talent management/cultivation, diversity and inclusion, health and safety, employee engagement, community involvement and an expanding array of related topics.

Related to the issues themselves, another way to look at “ESG” is focusing on governance over E&S. Investors want to know that these issues receive board-level attention, with E&S risks and opportunities being a regular part of board discussion along with overall business strategy and enterprise risk management. We are seeing an increasing number of companies make this board-level involvement very explicit.

What Is Driving This Increased E&S Focus?

The primary driver of these expanding disclosures is investor interest as opposed to regulatory requirements. That said, the SEC has proposed rules to modernize disclosures of business, legal proceedings and risk factors under Reg. SK which, when enacted, would expand HCM reporting.

Indexed investors consider themselves not just “long-term,” but rather “permanent” investors, and will own particular companies as long as they remain in the indices these investors track. For this reason, these investors, while concerned about planetary sustainability, also ask their portfolio companies, “How sustainable is your company and business model in the face of climate change, and potential regulatory, technological, and competitive responses?”

The “big three,” largely indexed investors—BlackRock, Vanguard and State Street Global—collectively own approximately 20% of corporate America. It is now estimated that $12 to $15 trillion in U.S. assets under management (one out of four dollars) apply some ESG considerations in their investment selection process. Further fueling this focus on ESG is the proliferating array of ESG “raters and rankers” that investors and others can utilize for data collection and investment screening.

Where and How Companies Disclose This Information

Companies primarily report on these issues in corporate social responsibility (CSR) or sustainability reports on their websites—with some companies choosing to provide information on their website, but not in the form of a report. The proxy disclosure typically is an excerpt or highlights from the more comprehensive website reporting. As for how companies report this information, there are some widely followed reporting frameworks companies can use, including the GRI Standards framework, SASB, TCFD and others. Some companies use a multi-standards approach to their disclosure to meet the widest possible range of investor interests.

These Disclosures Are Evolving—Not “Set It and Forget It”

Early E&S proxy disclosures are particularly interesting because most companies say more in subsequent years. Some clients tell us, “We are working on our first CSR report, and once that’s accomplished then we’ll consider citing some highlights in subsequent proxies.” While we can appreciate that, it doesn’t mean you “say nothing” until that time.

As discussed earlier, in year one you could discuss the governance of E&S, including that it is receiving board-level oversight, without going into specifics. By year two you may have identified particular E&S risks and opportunities that you are prepared to disclose. Year three may feature some material, qualitative, decision-useful data on your progress toward those identified objectives.

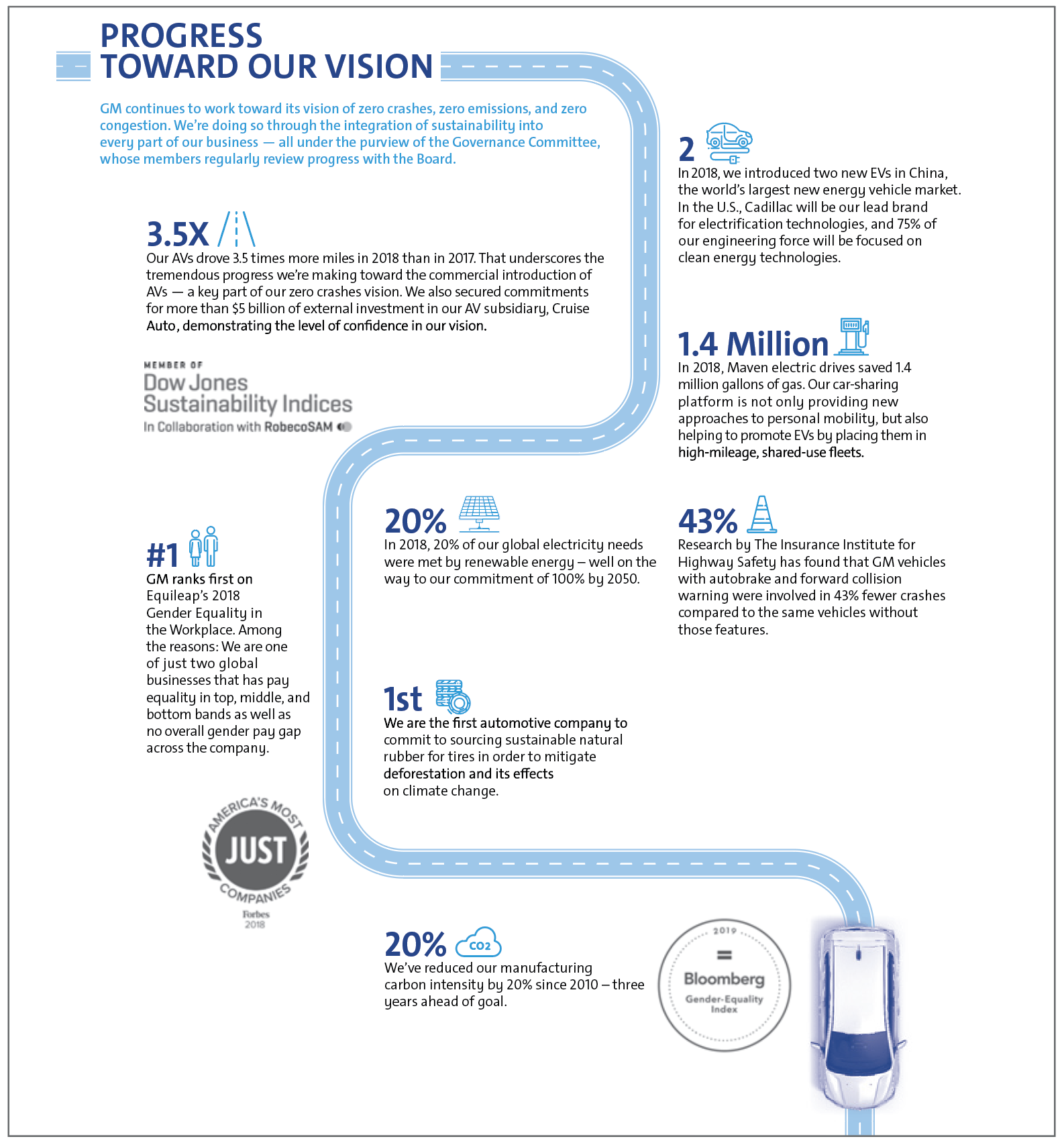

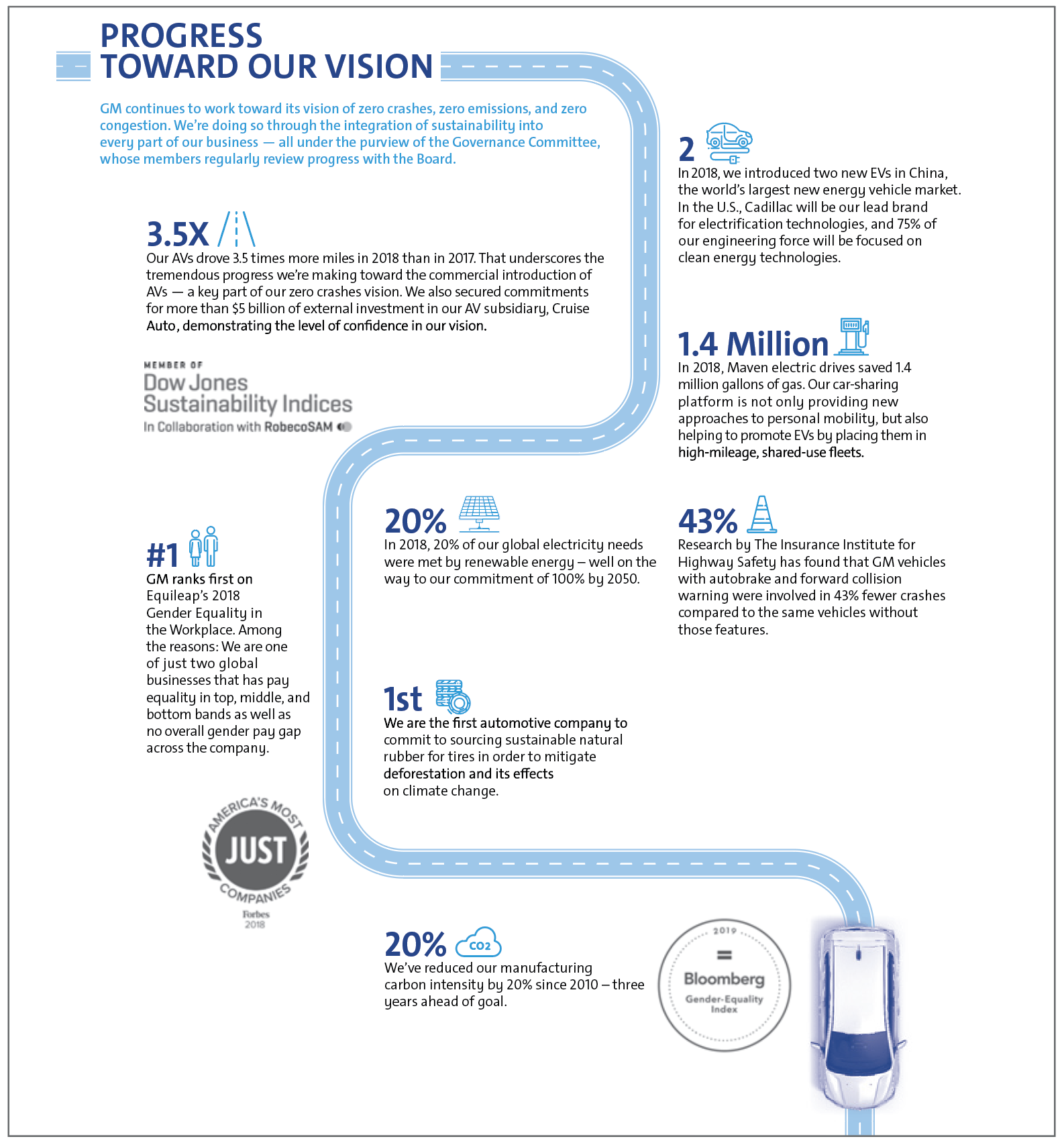

A good example of providing E&S highlights in an engaging, visual fashion that reflects progress on the company’s sustainability journey is in General Motors’ 2019 proxy, shown in Figure 1.

Figure 1

Roles

Roles