Equilar Disclosure Watch: UPS Puts Emphasis on Diversity

April 10, 2020

Daniella Gama-Diaz

With proxy season in full gear, companies are disclosing their governance policies and compensation practices within proxies. More than ever, investors are paying close attention to not only the information disclosed in proxies, but also how that information is presented. As analyzed in a recent Equilar report, Preparing for Proxy Season 2020, several companies are taking innovative approaches, such as prominent visuals, to effectively showcase their policies to shareholders. This Equilar feature highlights a number of disclosures from the 2020 proxy season.

Disclosure Example 1

Ovintiv Inc. (OVV)

DEF 14A on 3/19/2020

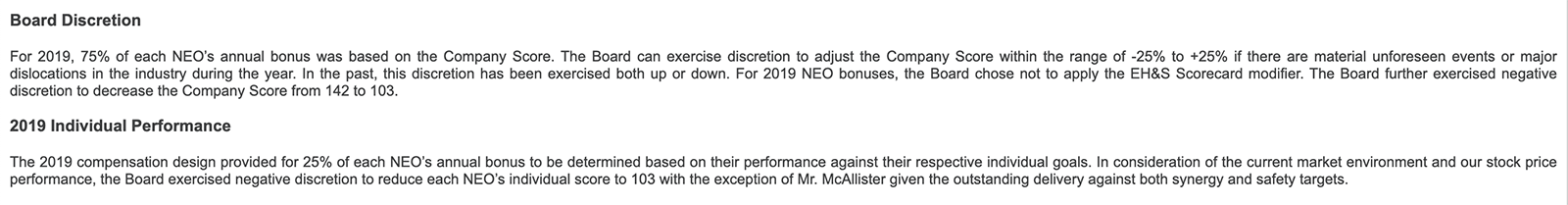

The Ovintiv disclosure shows one of many difficult decisions compensation committees will have to go through this proxy season. Given the current market environment, many companies are looking for ways to save cash. Ovintiv is no exception to this. Even though the company performed well enough for the executives to earn a high score on their performance scorecard, because of the economic downturn, Ovintiv decided to reduce executives’ bonuses earned for 2019. While other companies have taken the approach of deferring bonus payouts to see if the company’s wellbeing improves, Ovintiv took the approach of just modifying earned bonuses now.

Disclosure Example 2

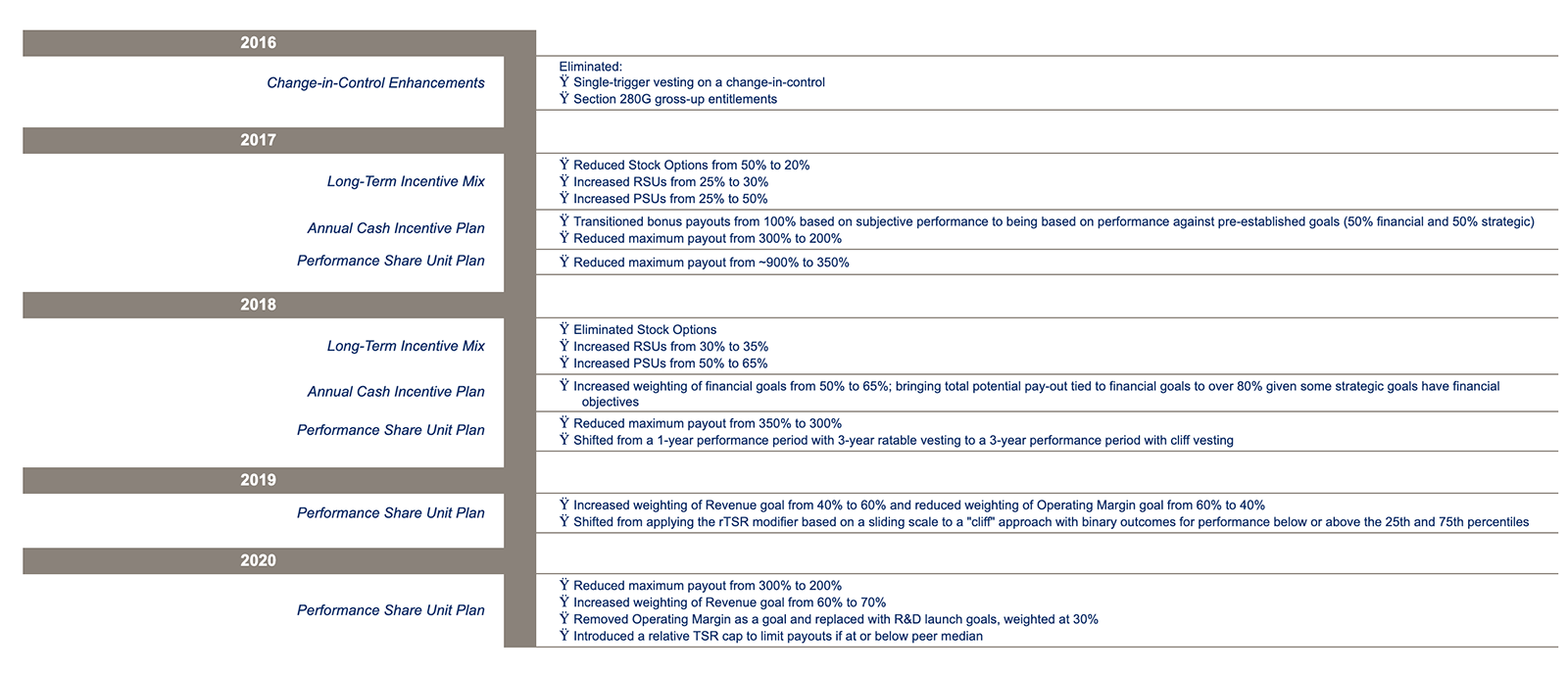

Alexion Pharmaceuticals, Inc. (ALXN)

DEF 14A on 3/26/2020

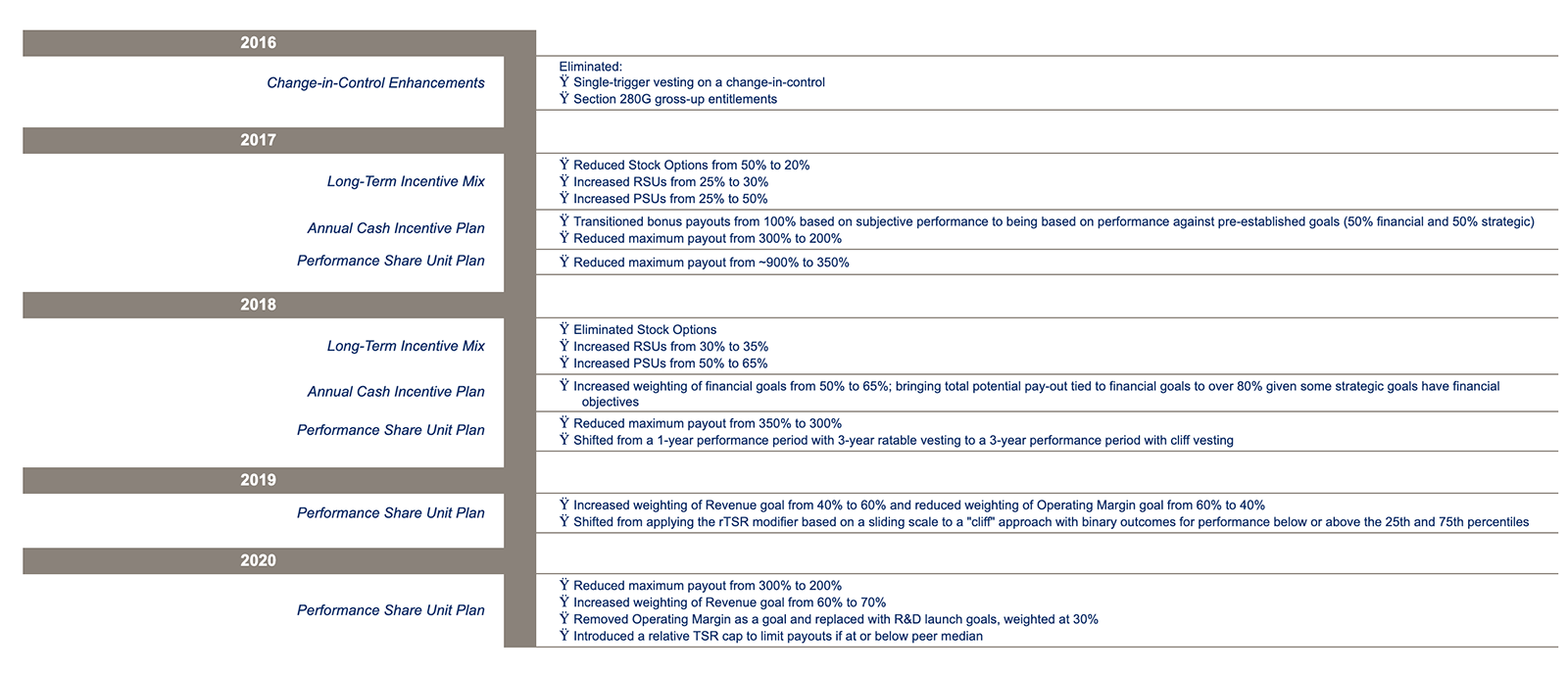

The Alexion disclosure presents critical changes in compensation and governance practices the Company has put in place since 2016. Investors can see a clear timeline of how the Company has prioritized and shifted its compensation best practices over the years. In the era of Say on Pay, shareholder engagement, and transparency, Alexion Pharmaceuticals is showing how they’ve adapted to investor feedback and trends in executive compensation to continuously improve their compensation plans.

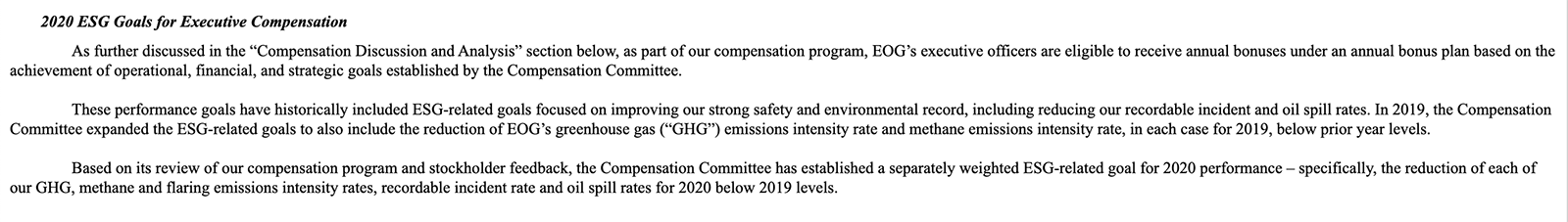

Disclosure Example 3

EOG Resources Inc. (EOG)

DEF 14A on 3/20/2020

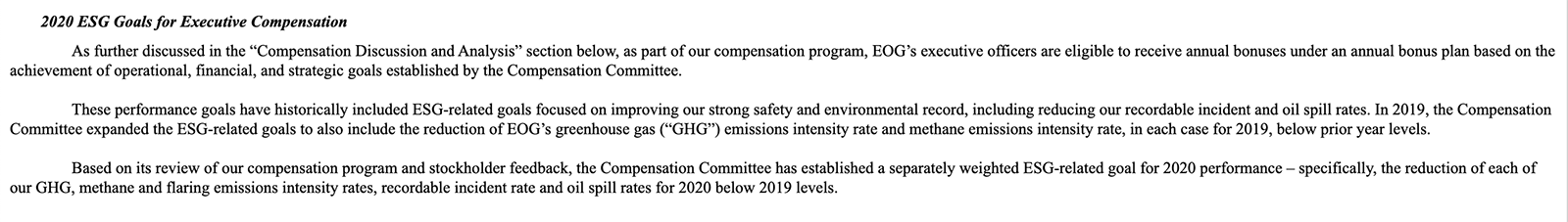

The EOG disclosure strongly highlights how environmental, social and governance (ESG) initiatives will be used as metrics for gauging performance. Shareholders have recently pushed for more transparency around ESG topics. By separating ESG metrics from the strategic goals category into its own category, investors can clearly see how the company listens to their shareholders and values these initiatives.

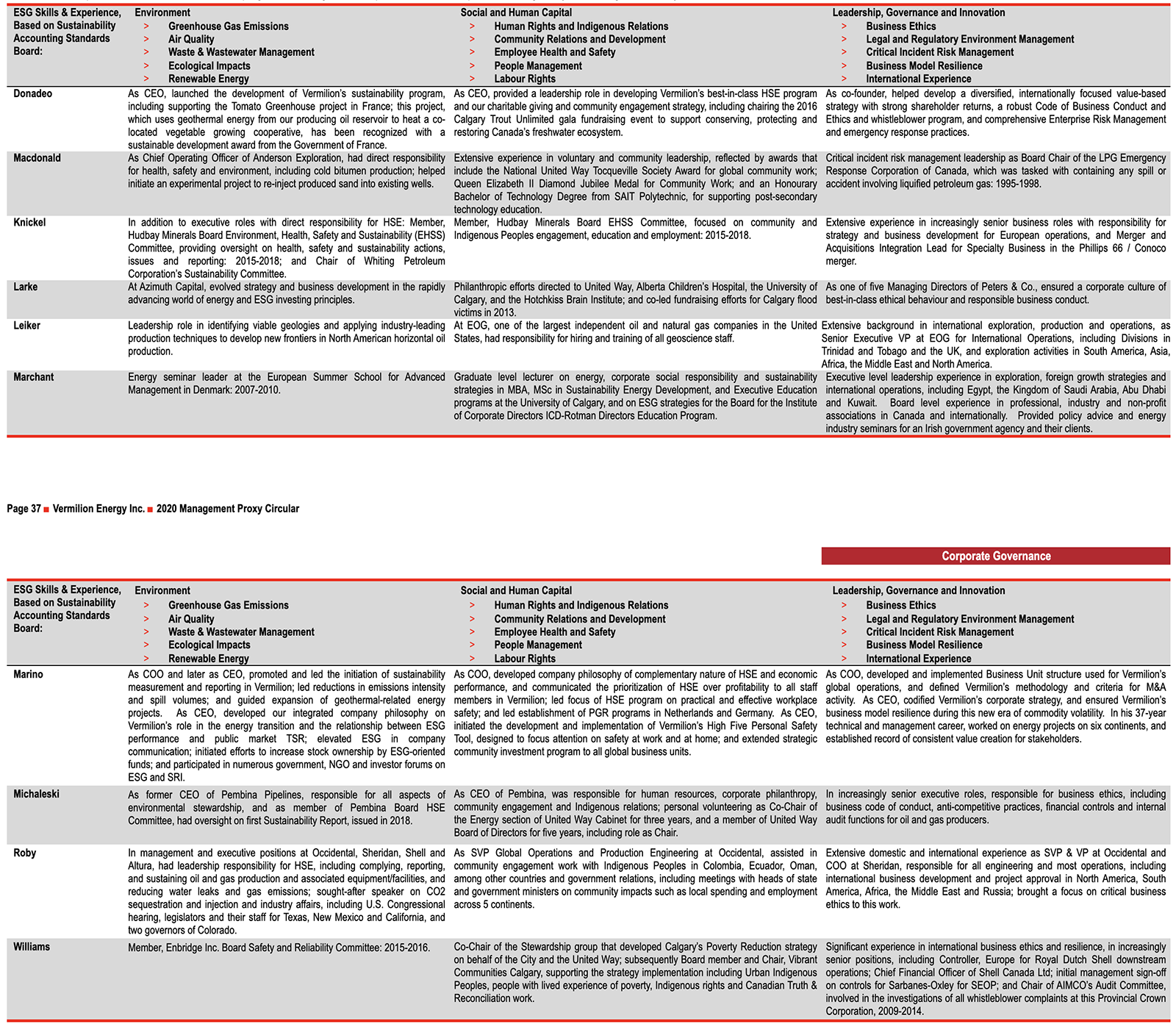

Disclosure Example 4

Vermilion Energy (VET)

6-K filed 3/24/2020

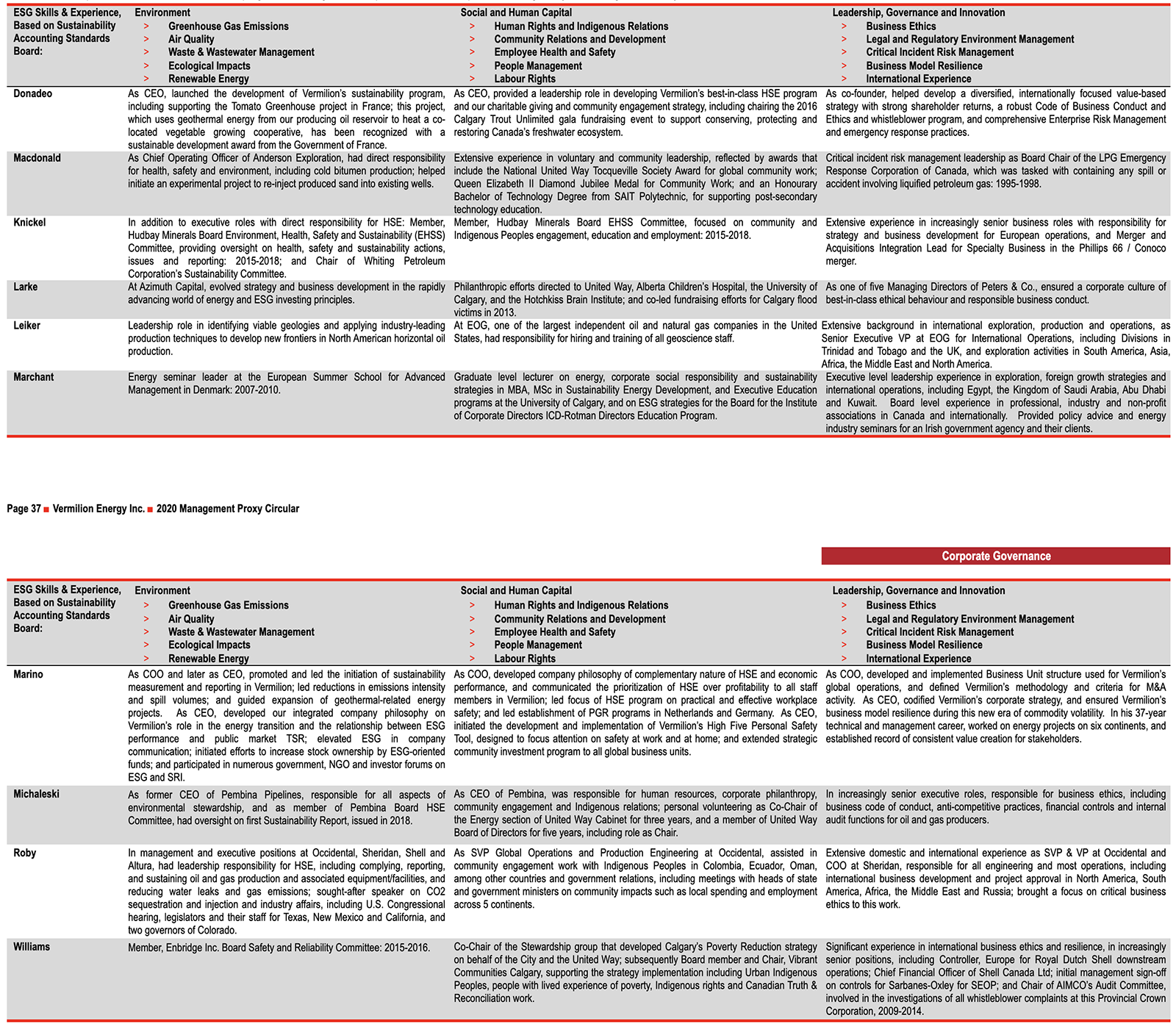

The Vermillion Energy disclosure clearly lays out how each director has the qualifying skills to carry out ESG initiatives for the year. Most skills matrices only group directors into broad categories. Going beyond that of a traditional skills matrix, Vermillion Energy dives deeper into how each director qualified to help the company work towards its ESG goals.

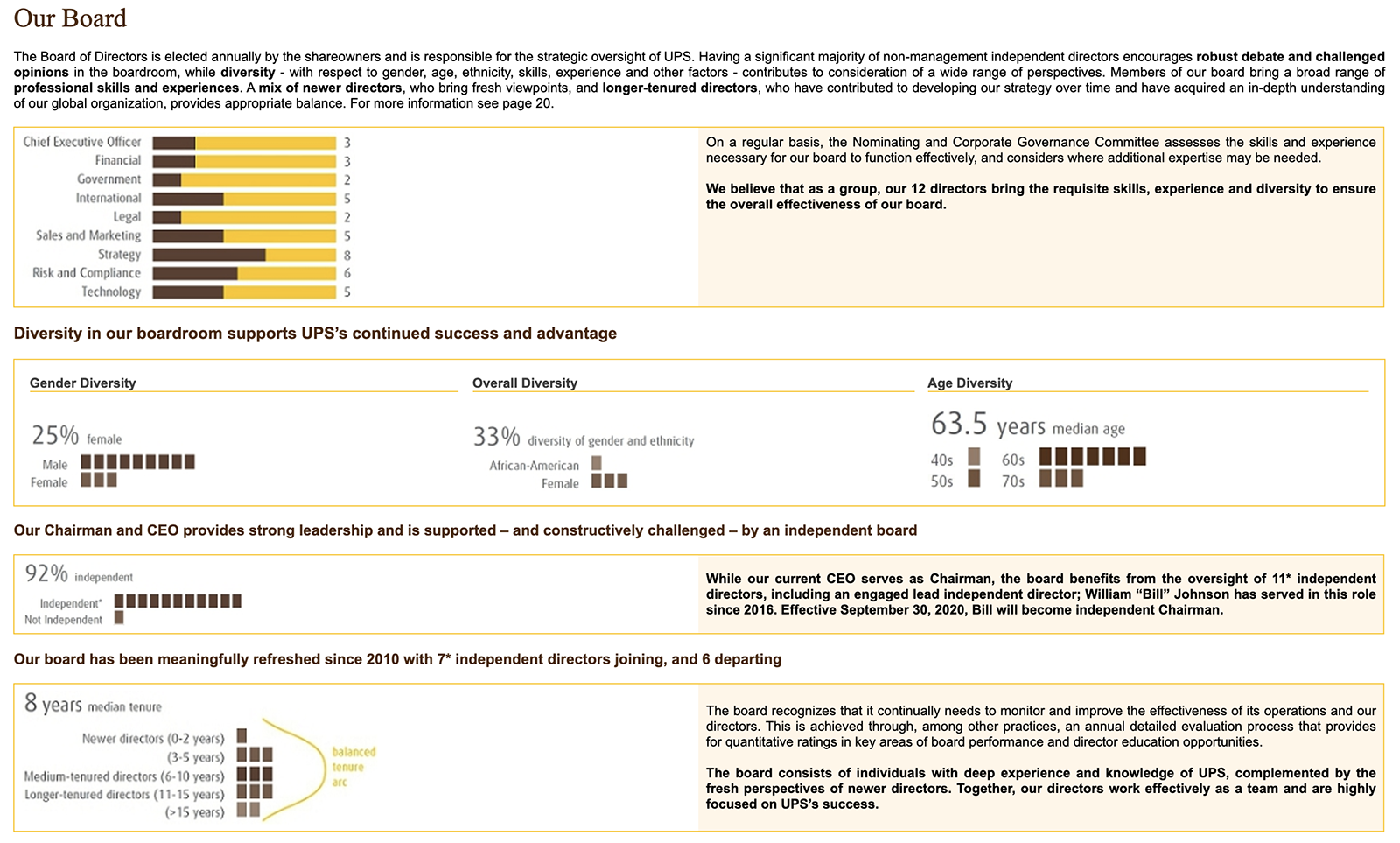

Disclosure Example 5

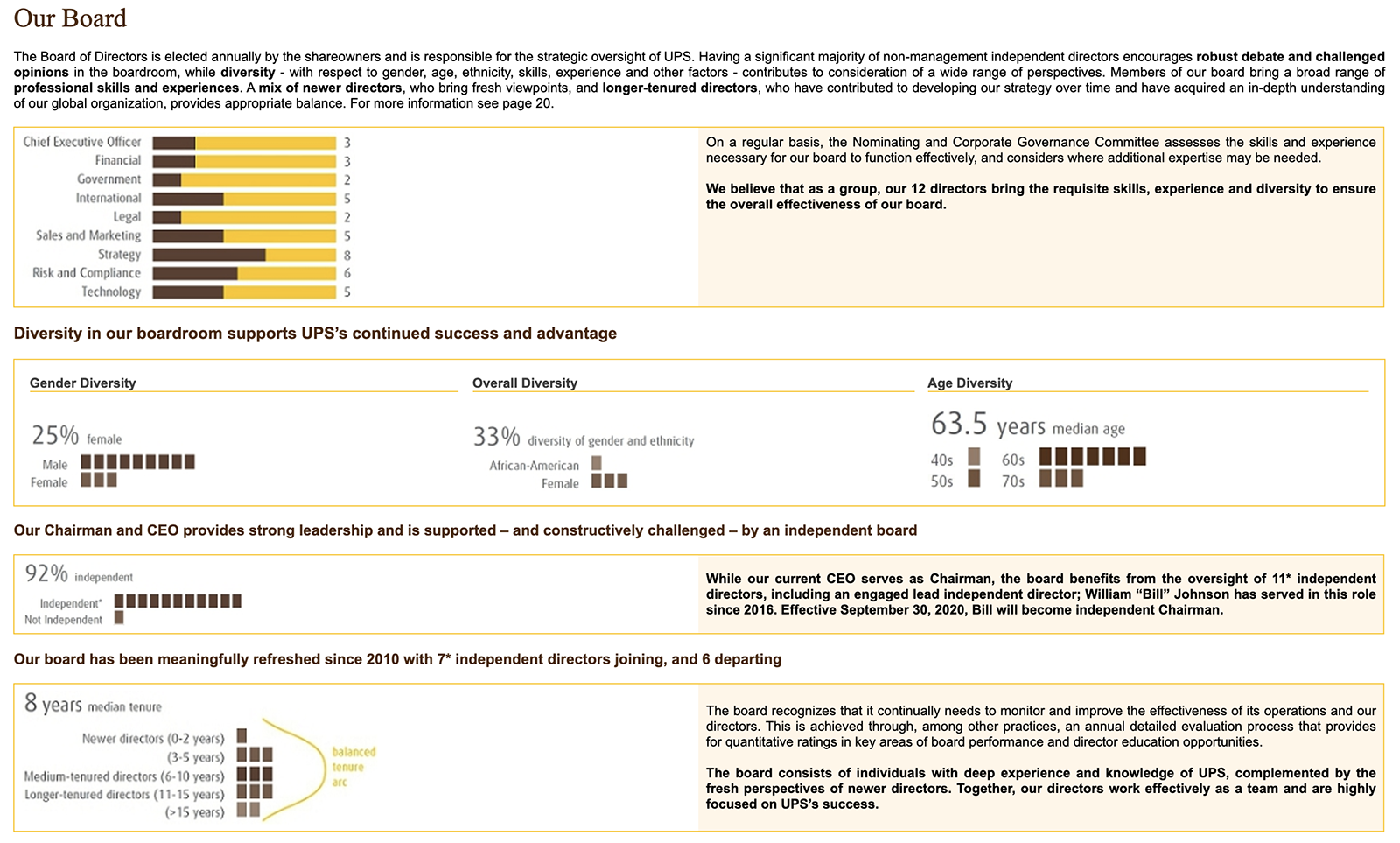

United Parcel Service Inc. (UPS)

DEF 14A on 3/20/2020

This UPS disclosure features a visual representation of the Company’s diversity, as well as the skills of their board. Data has shown that shareholders are increasingly seeking transparency from companies in terms of diversity, such as race, gender and age in the boardroom. Although not required by the SEC, diversity disclosures are useful for investors not only for their own interests, but to ensure companies remain compliant with any legislation mandating boardroom diversity, such as in the case of California. By clearly showing what skills a company’s board has, shareholders can determine if the current make-up of the board is sufficient enough to lead the company through current and future challenges.

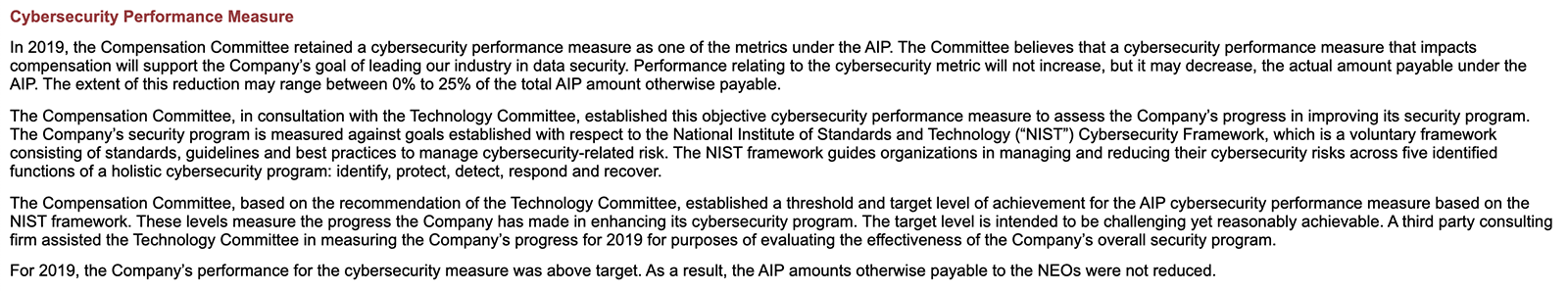

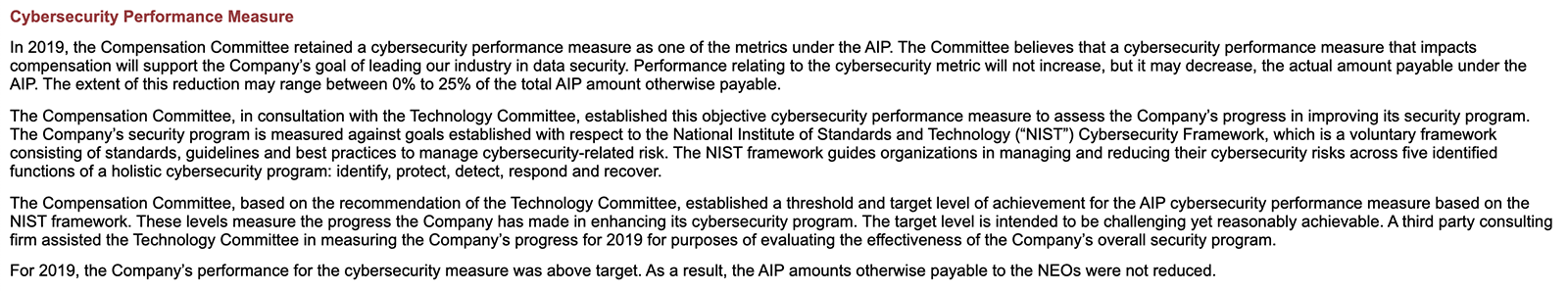

Disclosure Example 6

Equifax Inc. (EFX)

DEF 14A on 3/27/2020

The Equifax disclosure proves to shareholders that they’re taking cybersecurity seriously after the infamous data breach of 2017. Now, cybersecurity is a metric for executive performance, with the bonus decreasing if there are cybersecurity issues in the company. This shows that not only is Equifax prioritizing the safety and security of their users, but they are also increasing transparency for shareholders over a serious matter.

Contact

Daniella Gama-Diaz,

Associate Editor at Equilar

Daniella Gama-Diaz, Associate Editor at Equilar, authored this post. Please contact Amit Batish, Manager, Content & Communications, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions