Companies Adjust Executive Pay Amid COVID-19

May 7, 2020

Amit Batish

Equilar will continue to update this post through the duration of the 2020 proxy season. Last updated - May 7, 2020.

The landscape of the world has been significantly impacted by the outbreak of the coronavirus (COVID-19) in a matter of weeks. On March 13, 2020, The Wall Street Journal reported that President Trump declared a national emergency to combat the spread of the disease. As the world adapts and responds to the COVID-19 outbreak, companies across corporate America are taking necessary steps to protect their employees and the customers and clients they serve.

In light of these developments, several companies have elected to make changes to their executive compensation and incentive plans as a means to ease the burden that their employees are facing during this unprecedented time. Equilar is closely tracking disclosures related to these changes through its Disclosure Search platform as they are filed. This segment features examples of the types of adjustments that have been disclosed in efforts to confront the economic threat that COVID-19 poses.

As companies sort through strategies to address executive pay during the pandemic, WestRock Company has elected a different approach with regards to annual bonuses. The Company has a fiscal year end of September 30, 2020, but it is locking down executive annual bonuses now at the threshold level and paying them in stock. While the Company has not indicated how it is tracking against goals for the year, this is most likely an action that adds some predictability and improves retention.

WestRock Company (WRK)

8-K on 5/5/2020

In light of the current crisis, Signet Jewelers has constructed one of the most comprehensive responses a company has taken with regards to executive pay. Actions include 1) reduction of salary with partial exchange for stock; 2) splitting of annual bonus into two halves, with the first half based on liquidity and the second half TBD; 3) a reweighting of equity grants towards more time-based awards; 4) delay of the performance share grant until the fall when goals might be easier to set; and 5) freezing of deferred compensation matching.

Signet Jewelers Ltd. (SIG)

DEF 14A on 5/1/2020

While leaders at companies across the country implement strategies to guide their organizations through the pandemic, the spotlight is on CEOs and how they are responding. Cracker Barrel CEO Sandra Cochran decided to resign from an outside board, Dollar General, so she could focus more on guiding her company through the crisis.

Cracker Barrel Old Country Store, Inc. (CBRL)

8-K on 4/30/2020

The disclosures highlighted in this feature paint a picture that the nation’s top corporate leaders are taking significant steps to help mitigate and ease the financial burden faced by their organizations. As developments on COVID-19 continue to come to fruition, it is highly expected that a greater number of organizations will follow the examples of the companies featured in this segment.

Additional Disclosures

Equilar will highlight several disclosures that pertain to the COVID-19 crisis through the duration of the 2020 proxy season. Please find the examples below.

At the onset of this crisis, several companies elected to eliminate 2019 executive bonus payments as means to provide immediate cash for its employees. ION Geophysical was among those companies. However, in the Company’s recent proxy filing, it indicated that the Board has decided to cancel 2019 bonuses for all employees.

ION Geophysical Corp (IO)

DEF 14A on 4/22/2020

While many small businesses have received loans under the Paycheck Protection Program (PPP), a smaller subset of companies across particular sectors have received much larger loans as part of an industry bailout. Similar to the Troubled Asset Relief Program (TARP) signed into law by President Bush in 2008, the government is receiving warrants for these industry bailout loans, and like TARP, there will be executive pay restrictions. In an 8-K filed on April 21, Southwest Airlines indicated there would be limits on executive compensation at the Company through March 24, 2022, though details on the restrictions have yet to be revealed.

Southwest Airlines Co. (LUV)

8-K on 4/21/2020

UnitedHealth Group announced on April 17 that Company President and Optum CEO Sir Andrew Witty has been asked to co-lead a global effort alongside the World Health Organization (WHO) to accelerate the development of a COVID-19 vaccine. The Company paid Witty a special recognition bonus in the amount of $550,000 for his work so far in 2020 to address the crisis.

UnitedHealth Group Inc. (UNH)

8-K on 4/17/2020

Among the several benefits of the recently passed Coronavirus Aid, Relief and Economic Security (CARES) Act is the Paycheck Protection Program (PPP), which provides forgivable loans to small businesses. One of the caveats of the PPP is that salaries under $100,000 qualify towards forgiveness of the loan, meaning that as long as employees making under $100,000 are not terminated nor have their salaries reduced, those salaries will contribute towards loan forgiveness. MannKind Corporation is among the many companies that will receive a loan under PPP, and the Company announced in an 8-K on April 15 that it will only reduce those salaries above $100,000.

MannKind Corporation (MNKD)

8-K 4/15/2020

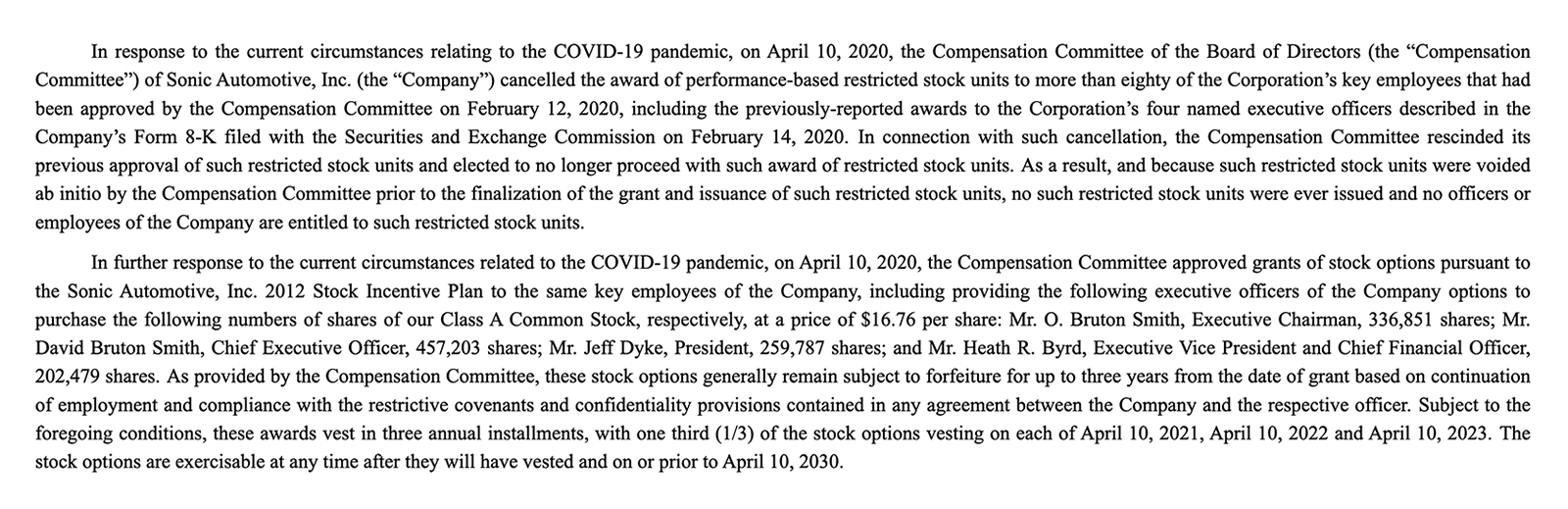

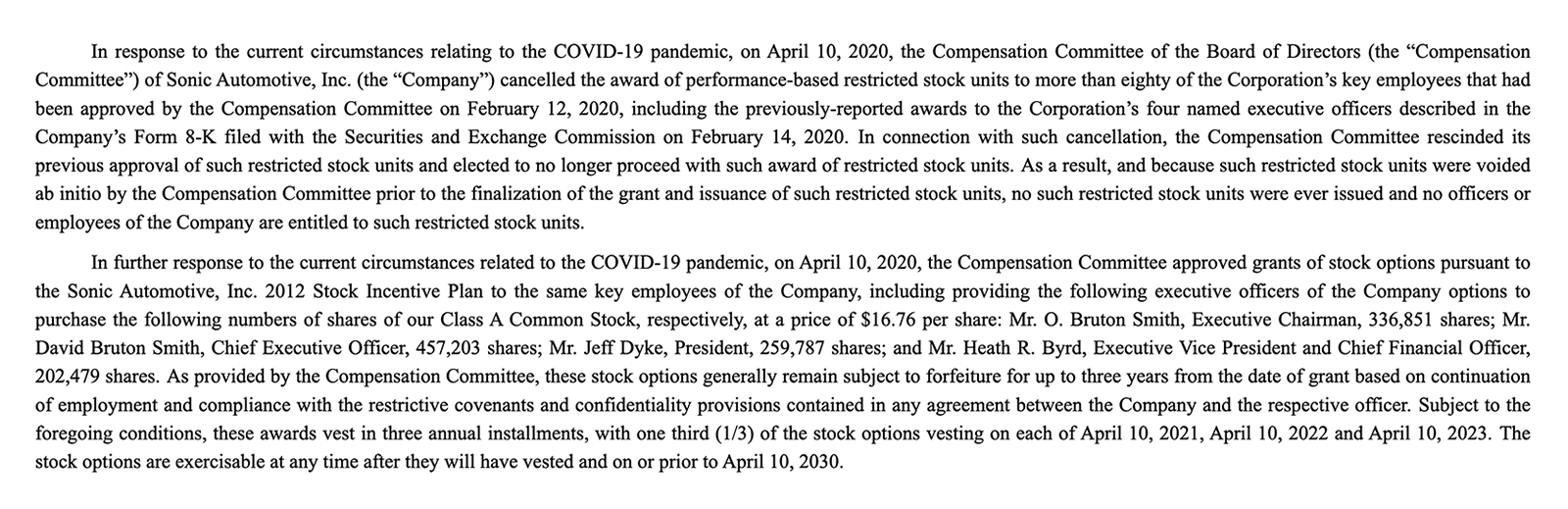

Sonic Automotive is one of few companies that have elected to cancel its 2020 performance share grant. Interestingly, in an 8-K filed on April 14, the Company became the only one to replace the grant with options.

Sonic Automotive, Inc. (SAH)

8-K on 4/14/2020

While several companies have announced their intent to make changes to executive incentive plan metrics, Red Robin has officially elected to move to relative TSR as its 2020 performance metric. The Company anticipates difficulty in setting any sort of operational or financial goal during the pandemic. It is expected that many companies will follow suit.

Red Robin Gourmet Burgers, Inc. (RRGB)

DEF 14A on 4/8/2020

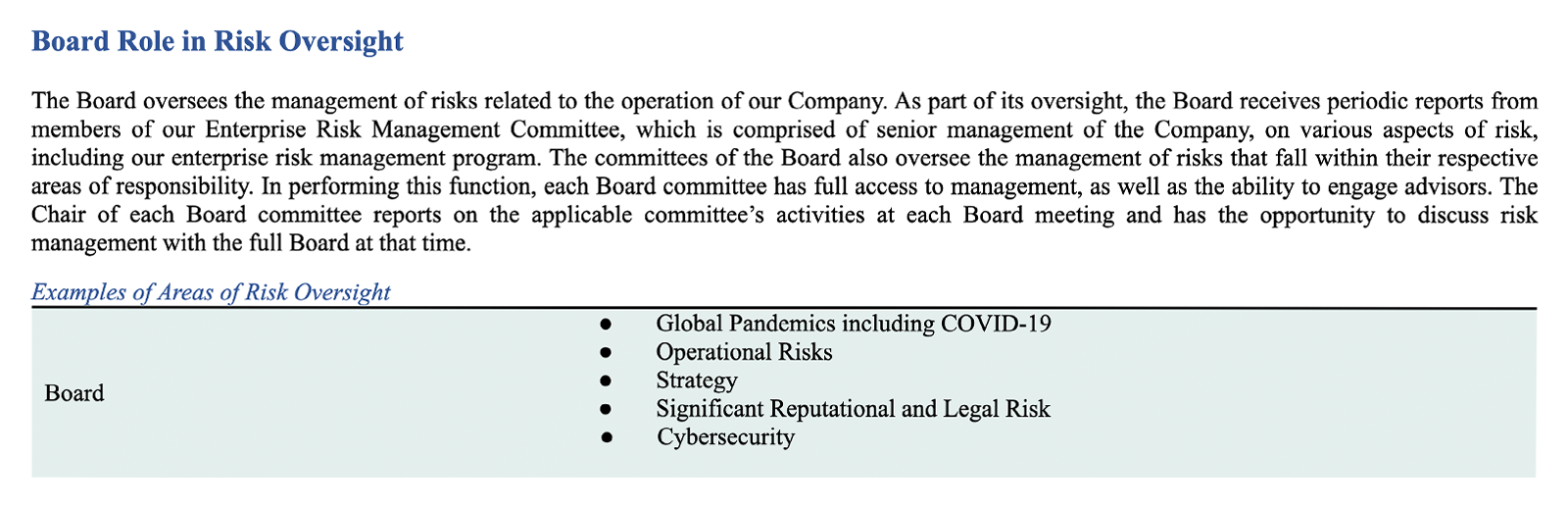

As corporate America continues to navigate through the COVID-19 crisis, risk oversight will indeed be a top area of focus for boards moving forward. Within the Abercrombie & Fitch proxy, filed on April 7, the Company listed corporate response to COVID-19 and other global pandemics as one of the risks the Board is required to oversee. The Company is among the first to add such a requirement, but most certainly will not be the last.

Abercrombie & Fitch Co. (ANF)

DEF 14A on 4/7/2020

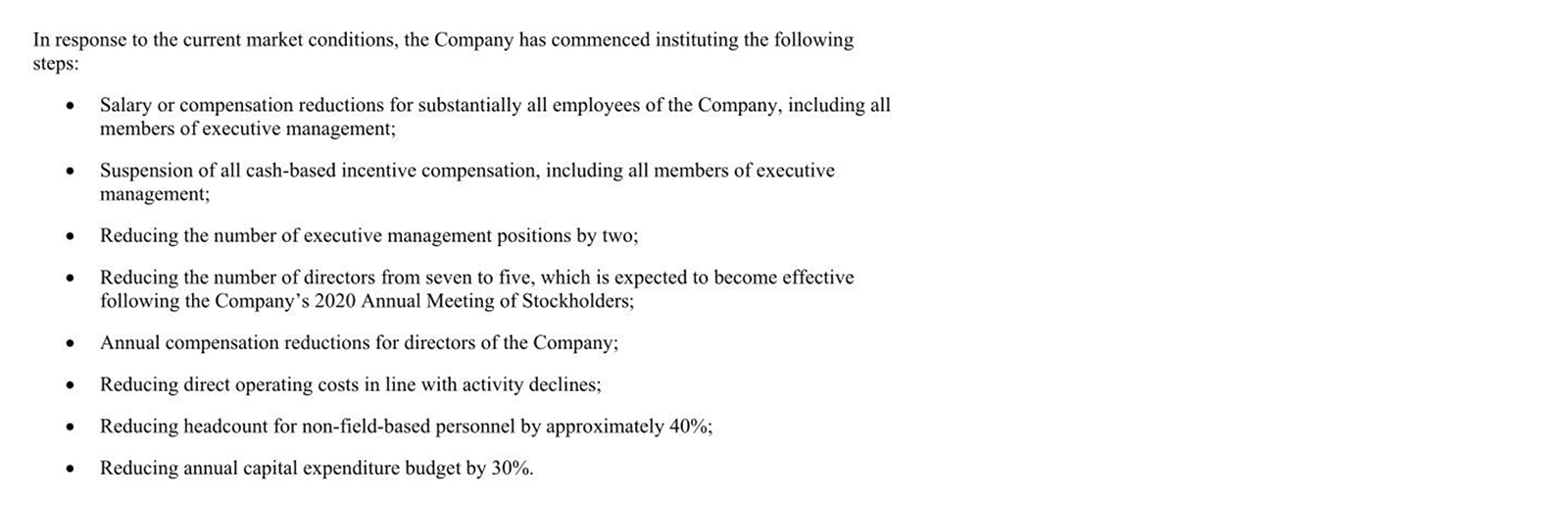

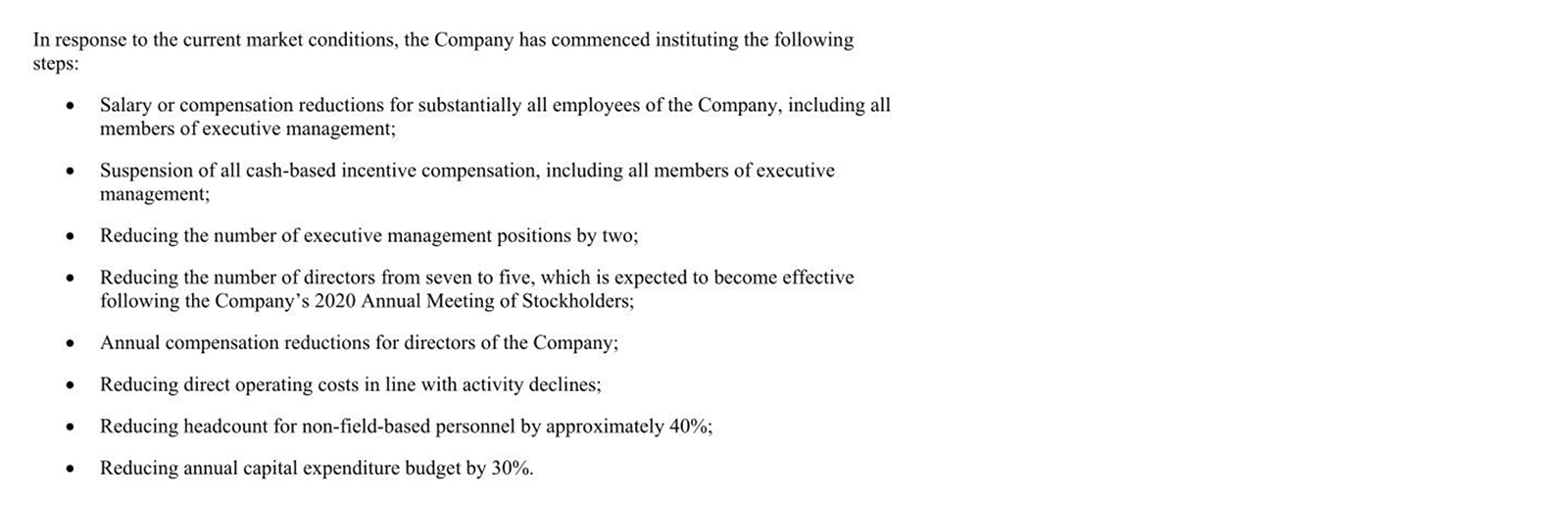

In a rather drastic move, Independence Contract Drilling announced it would reduce the number of its executives and directors to save on costs. The Company is among the first to take such measures, but the move comes as no surprise as the oil and gas industry is facing tremendous challenges due to the COVID-19 crisis.

Independence Contract Drilling, Inc. (ICD)

8-K on 4/6/2020

Companies continue to look for ways to assist their rank and file employees. On April 2, Guidewire Software released an 8-K that indicated that instead of paying a hardship bonus to its rank and file employees, the Company is accelerating a portion of the payment of upcoming annual bonuses, excluding executive bonuses. The payments will be approximately five months early, ahead of the Company’s fiscal year end of July 31.

Guidewire Software, Inc. (GWRE)

8-K on 4/2/2020

While several companies have chosen to modify or eliminate executive bonuses, Moderna, Inc. awarded its Chief Medical Officer a retention bonus worth $1 million. The Company did not disclose a specific reason for the bonus, but the role is certainly critical at the moment and would be difficult to replace.

Moderna, Inc. (MRNA)

8-K on 3/30/2020

Redfin is among the first companies to eliminate annual executive bonuses for 2020. The Company declared its executive officers will not be eligible to earn a bonus as the program has been suspended.

Redfin Corp. (RDFN)

8-K on 3/26/2020

Ford Motor Company took a different approach outside of executive salary reductions. The Company elected to implement a salary deferral, which means a percentage of each NEO’s compensation would be deferred to later in the year. Company executives may achieve that salary back if they achieve a financial objective.

Ford Motor Co. (F)

8-K on 3/26/2020

Retail Opportunity Investments Corp. filed its proxy on March 23, detailing adjustments to its annual and long-term awards. In February, the Company granted the awards, but has since removed all metrics and determined the awards will be measured at the board’s discretion.

Retail Opportunity Investments Corp. (ROIC)

DEF on 3/23/2020

More companies are finding ways to address the hardships faced by their employees. On March 23, ADP joined the list of these companies when it announced it would pay its rank and file employees a $1,000 hardship bonus.

Automatic Data Processing, Inc. (ADP)

8-K on 3/23/2020

As the U.S. government continues to explore the possibility of a corporate bailout, the proposition is being met with some backlash. On March 16, Nikki Haley informed The Boeing Company that she is stepping down from the board immediately on the principle that the Company should not seek support from the government during this time of crisis.

Boeing Company (BA)

8-K on 3/19/2020

With incentive plan season right around the corner, companies are determining adequate executive performance goals. Six Flags had previously decided to grant its NEOs performance shares and established set metrics. However, in light of COVID-19, on March 19, the Company noted within its proxy that it will now take some time to determine new performance goals.

Six Flags Entertainment Corporation (SIX)

DEF 14A on 3/19/2020

Given the current landscape, several airline passengers have cancelled their flights for safety concerns, leading to an economic hit for airline companies. In response to the latest struggles, United Airlines Holdings filed an 8-K on March 10 that stated Company CEO Oscar Munoz and President Scott Kirby will forgo salaries through at least June 30, 2020. While United Airlines was among the first airlines to take such measures, it will certainly not be the last, as Alaska Air Group has also taken similar action.

United Airlines Holdings, Inc. (UAL)

8-K, 3/10/2020

The hospitality industry is another sector that is facing severe financial struggles amid the COVID-19 outbreak, particularly as hotels and resorts prepare to shut down to prevent greater spread of the disease. On March 16, Park Hotels & Resorts, Inc. filed an 8-K that stated the Company intends to establish a $2.5 million corporate-level fund that will be made available to address hardships faced by its employees. Park CEO Thomas Baltimore elected for a voluntary salary waiver to fund $500,000 of this corporate-level fund.

Park Hotels & Resorts Inc. (PK)

8-K, 3/16/2020

Alternatively, some companies have elected to provide each of their employees with cash bonuses to help cope with the crisis. On March 14, Workday approved a one-time cash bonus equivalent to two-weeks of pay for each active employee of the Company.

Workday, Inc. (WDAY)

8-K, 3/16/2020

While several CEOs are taking pay cuts during this time of crisis, a number of companies have also announced the reduction in pay for its other named executive officers (NEOs). On March 16, Ashford, Inc. announced it would reduce the pay of CEO Monty Bennett by 20%, while the pay of all other NEOs, including the Company’s Chief Financial Officer, would be reduced by 15% until the effects of COVID-19 have subsided.

Ashford Inc. (AINC)

8-K, 3/16/2020

Click here to view more disclosures similar to those highlighted in this segment.

About Equilar Disclosure Search

The Equilar Disclosure Search is the most comprehensive solution to accurately examine SEC public disclosures. The accessible interface allows you to search within all publicly disclosed SEC forms, including 8-K, 10-K, 10-Q, DEF14A, S-1 and more, using a variety of filters. You may search by keywords, tickers or within your peer group, or by financials, geography, and several other criteria. Results are displayed in excerpt form with the ability to click on a link to open the actual disclosure and the exact location of your search term. Please visit Disclosure Search or contact info@equilar.com to learn more.

Contact

Amit Batish,

Content Manager

Amit Batish, Content Manager at Equilar, authored this post. Please contact Amit Batish, Manager, Content & Communications, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions