Media Center

Press Releases

CEO Incentives Depend More on Shareholder Return

REDWOOD CITY, CA (April 13, 2016) — More and more companies are paying CEOs based on company performance,

and they are increasingly doing so by measuring “performance” as total shareholder return, a

a new Equilar report has found.

The percentage of S&P 500 companies that use performance awards as part of CEO pay packages has increased

from 63% to 83% in the past four years, according Equilar data. In that time frame, the percentage of

awards that were paid out based on relative total shareholder return (TSR)—an increase in company stock

price and dividends to shareholders in relation to competitors—nearly doubled from 12.3% to 25.2%.

“Since 2011, when the SEC ruled that shareholders would conduct a mandatory vote on executive

compensation—better known as Say on Pay—the pressure to show how pay and performance are related has

intensified,” said Matthew Goforth, research and content specialist at Equilar and lead analyst for the

report. “The mass movement toward the use of TSR reflects the effort to link executive pay with shareholder

returns and gain investor approval of compensation packages.”

“Performance-based equity provides compensation value with a close correlation to company performance,

without having to rely on stock options,” added Carrie Kovac, Senior Vice President of Relationship

Management at

E*TRADE Corporate Services,

which contributed independent commentary for Equilar’s report. “Performance-based equity is very much still

in its relative infancy, however. Today there is no silver bullet in rolling these plans out, and each company

should take a hard look at their culture and business goals to understand what will work best for them.”

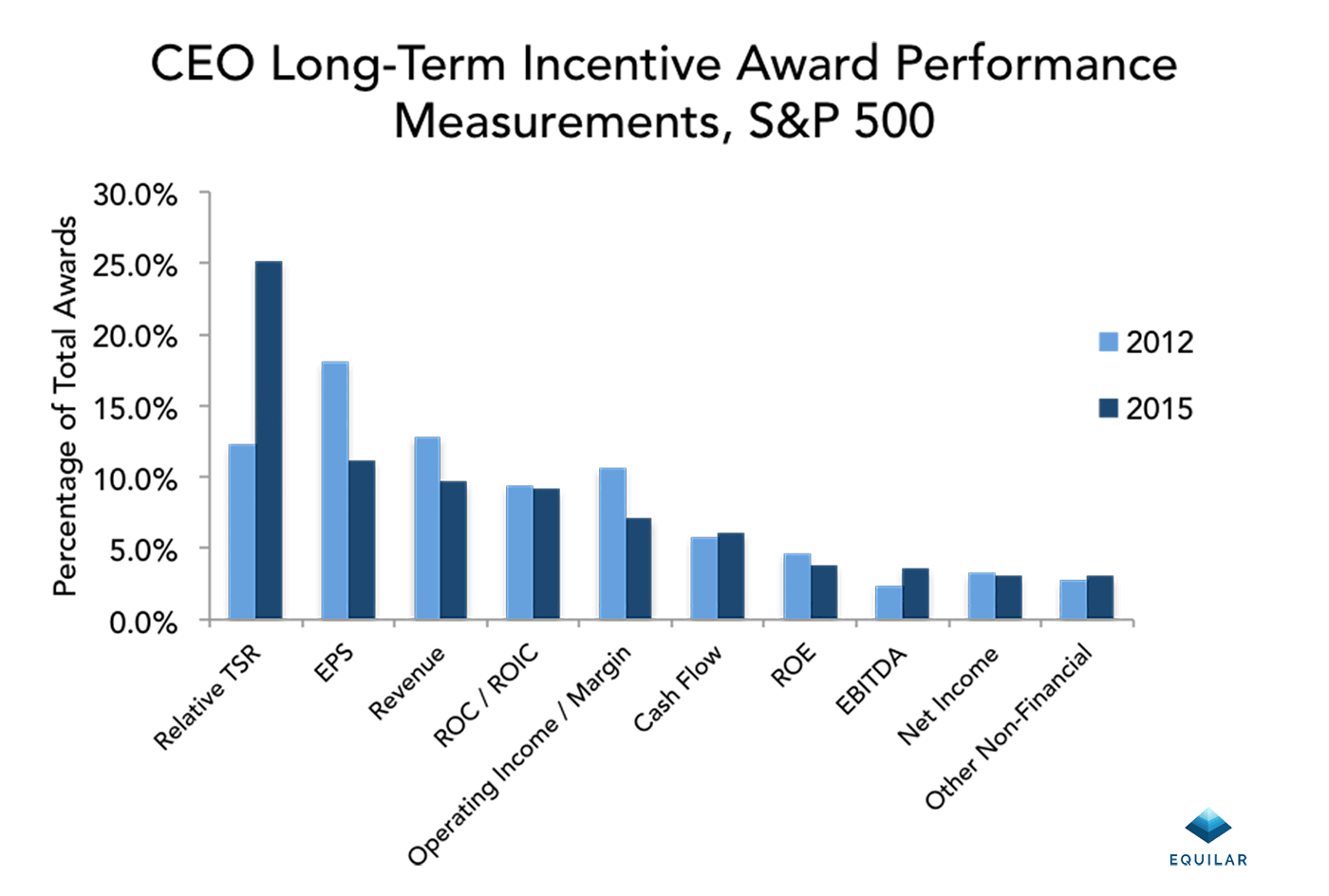

Interestingly, relative TSR is the only one of the five most popular performance measurements for CEO

long-term incentive plans to increase in the last four years, according to the report. Earnings per share

(EPS), revenue and operating income/margin in particular have dropped off significantly. For example, 18.1%

of CEO performance awards utilized EPS in 2012, and that figure dipped to 11.1% in 2015.

Meanwhile, though included as a performance measurement for a much smaller number of awards, cash flow,

EBITDA (earnings before interest, taxes, depreciation and amortization) and “other non-financial” metrics

have seen growth over the past four years.

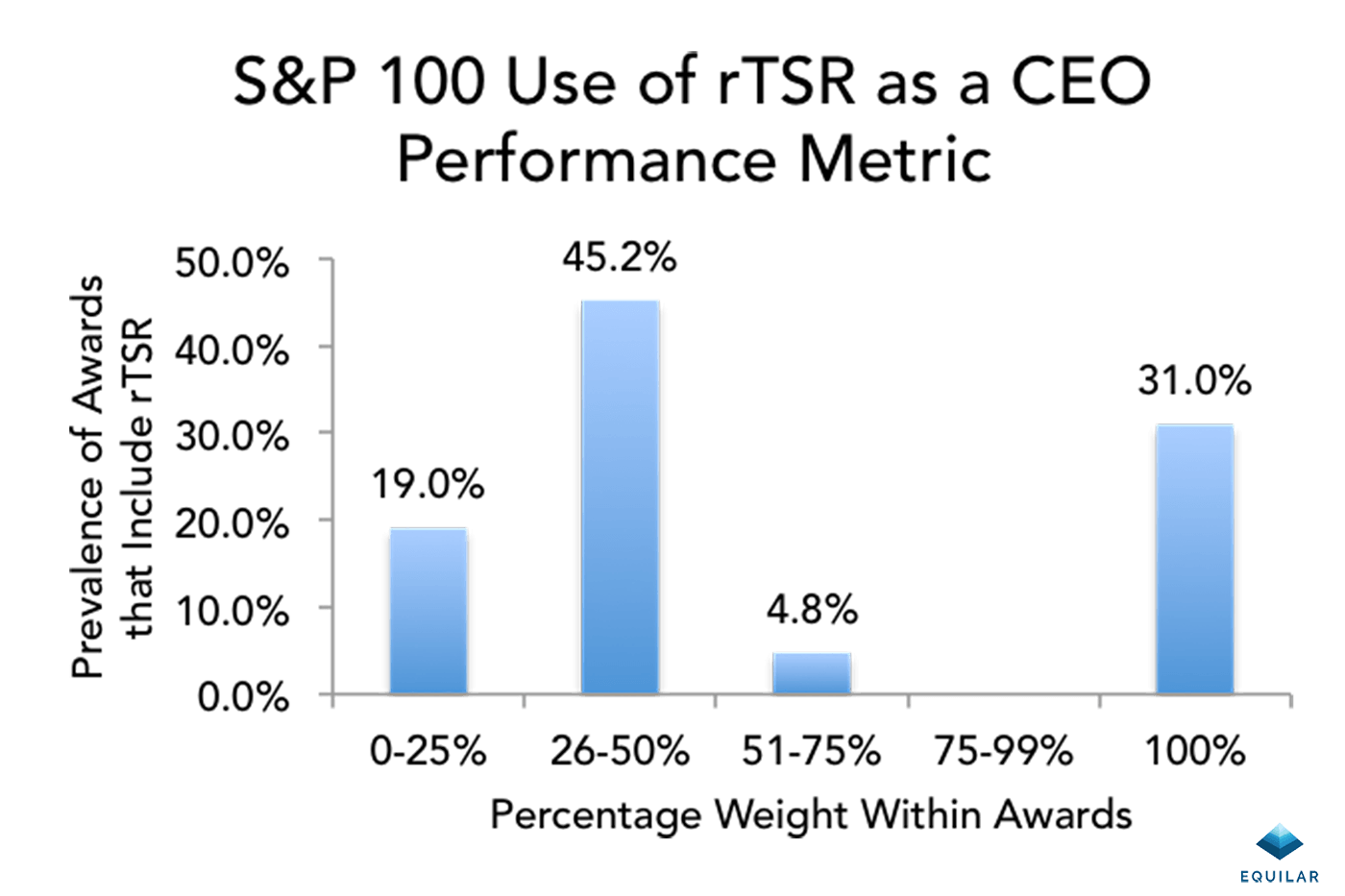

A deep dive into specific plans of the S&P 100 showed a similar trend as the broader index—TSR is by far

the most popular metric. For the companies studied, TSR was nearly twice as common as any other measurement

attached to CEO performance awards. Furthermore, in nearly one-third of the awards that included TSR as a

performance measurement, the payout was 100% tied to TSR growth.

There has been growing controversy around the use of total shareholder return when it comes to executive pay.

For example, one study from

compensation consultant Pearl Meyer and Cornell University found that there was no

evidence that use of TSR as an incentive metric improves company performance.

Over a 10-year period, TSR shows how companies are creating value for their shareholders, but over three

years—by far the most common length of a CEO long-term incentive plan, according to Equilar's report—it is

an outcome metric, not a leading metric. In other words, critics note that CEOs can influence TSR, but can't

control it in the same way the can directly reduce costs or increase cash flow, and therefore it's not an

appropriate "performance" indicator.

The rise of TSR has occurred in part due to the rise in shareholder activism and a focus from many stakeholders

on short-term market returns. Proxy advisors like ISS have pushed for companies to benchmark their pay to TSR,

and the SEC itself is close to passing a requirement that companies

disclose pay as it relates to performance

defined as total shareholder return. As these stakeholders push for some companies to focus more heavily on

performance goals that increase shareholder value, others may be following suit in response to their peers’

reactions.

Executive Incentive Plans: How Leading Companies Pay for Performance, featuring commentary from E*TRADE

Corporate Services examined the prevalence of performance metrics and performance periods for annual

cash incentives and long-term incentives of CEOs, CFOs and other NEOs at S&P 500 companies over the last four

fiscal years. The data collected for this detailed study includes performance metrics and their weightings,

performance ranges as a percentage of target performance, and payout ranges as a percentage of target payout.

Analysis for both the S&P 500 and S&P 100 study was conducted on a “by award” basis, and data reflects the

percentage or number of awards befitting the category.

Read or download the full report

here.

For more information and further discussion of this topic,

please join our webinar

on April 14, 2016.

Equilar is the #1 provider of executive data, collecting information on more than 150,000 executives and

board members from thousands of public companies. Our cloud-based platforms organize executive data into

easily digestible formats, delivering compensation benchmarking, corporate governance and shareholder

engagement tools with accuracy and integrity. These platforms bring together companies, shareholders and

advisors to inform better business decisions and drive exceptional results. Founded in 2000, Equilar is

the trusted data provider for 70% of the Fortune 500, and is cited regularly by The New York Times,

Bloomberg, Forbes, Associated Press, CNN Money, CNBC, The

Wall Street Journal and other leading media outlets.

Amit Batish

Director of Content & Marketing Communications

abatish@equilar.com

650-241-6697

Solutions

Solutions