Media Center

Press Releases

Prevalence of Options Decreases as Companies Tie Awards to Performance

REDWOOD CITY, CA (August 23, 2018) —In 2017, 81.6% of companies in the Equilar 500 granted performance equity to named executive officers, a slight decrease from 84.6% in 2016, according to a new Equilar report, Equity Compensation Trends, which features commentary from E*TRADE Financial Corporate Services, Inc.

Though the prevalence of performance equity decreased from 2016 to 2017, a large majority of companies continued to tie awards to performance metrics. In fact, the target of performance awards granted to CEOs in both 2016 and 2017 made up over 63% of total equity granted to CEOs.

“While options are being phased out of equity awards, performance awards have become more and more prevalent,” said Alex Knowlton, Equilar Senior Researcher and Lead Author of the report. “Companies can incentivize their executives while simultaneously providing value to shareholders by granting awards that are tied to performance metrics.”

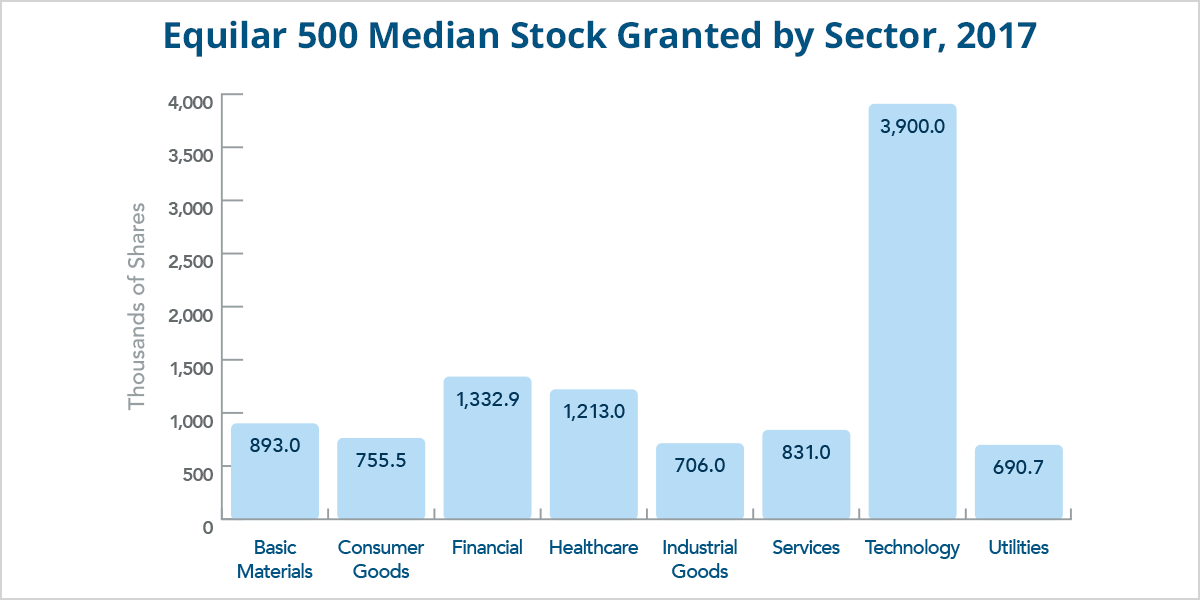

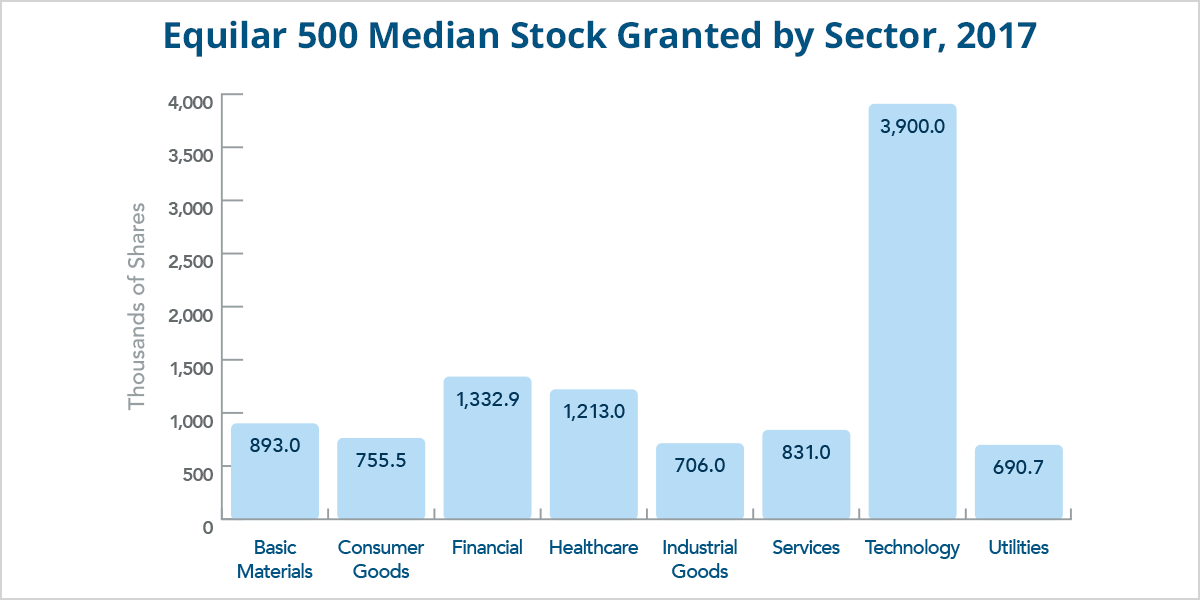

The report also revealed that median stock granted decreased by 9.2% from 2016 and 2017, with a median of one million shares in the most recent year. Equilar 500 companies within the utilities sector granted the least amount of stock, with a median of 690,700 shares, followed closely by industrial goods companies at 706,000 shares. The technology sector granted the most stocks by far, with a median of 3.9 million shares.

“Restricted stock grants have a number of features that make them desirable forms of compensation relative to options, including their relative simplicity for participants to understand and take action,” said Craig Rubino, Director of E*TRADE Financial Corporate Services, Inc. “One important factor for restricted stock vs. stock options is that restricted stock may hold value even in less favorable economic climates.”

Other key findings from the report include:

Stock was used in 96.5% of all equity compensation packages granted to NEOs at Equilar 500 companies in 2017

The average option grant by company decreased by 23.5% from 2013 to 2017, while the average stock grant fell by 13.9% over that same period

The basic materials sector experienced the largest increase in performance equity prevalence with a 23.5 percentage point gain from 2013 to 2017—however, the prevalence of performance equity across the entire Equilar 500 decreased from 2016 to 2017

At 52.5%, relative TSR was the most prevalent performance metric in awards granted by at Equilar 500 companies in 2017—as was the case in the previous four years

To request a copy of the full report, click here.

About the Report

Equity Compensation Trends, an Equilar publication, examines equity compensation design and granting practices of Equilar 500 companies over the last five fiscal years. The Equilar 500 tracks the 500 largest public companies, by reported revenue, with headquarters in the U.S. that trade on one of the major U.S. stock exchanges (NYSE, Nasdaq or NYSE MKT (formerly AMEX)), and adjusted to approximate the industry sector mix of similar large-cap indices. Companies that filed a proxy statement (DEF 14A) or disclosed compensation information in an amended 10-K filing (10-K/A) by May 31, 2018 were included in the fiscal 2017 year. Previous years were defined similarly.

E*TRADE Financial Corporate Services, Inc. offered independent commentary to provide insight and context based on experience regarding how companies structure equity pay.

About Equilar

Equilar is the leading provider of Board Intelligence Solutions. Its data-driven platforms, BoardEdge and Insight, provide tools for board recruiting, business development, executive compensation and shareholder engagement. Companies of all sizes, including 70% of the Fortune 500 and institutional investors representing over trillion in assets, rely on Equilar for their most important boardroom decisions. Equilar also hosts industry-leading board education symposiums, conducts comprehensive custom research services and publishes award-winning thought leadership. Founded in 2000, Equilar is cited regularly by Associated Press, Bloomberg, CNBC, The New York Times, The Wall Street Journal and other leading media outlets. Visit www.equilar.com to learn more.

About E*TRADE Financial Corporate Services, Inc.

E*TRADE Financial Corporate Services, Inc. (“E*TRADE”) is a premier provider of equity compensation management tools for some of the nation’s top companies, serving 1.6 million+ participants¹. We offer flexible, easy-to-use & powerful solutions for complete equity compensation management, including support for most equity vehicles & seamless access to stock plan participant services/education from E*TRADE Securities. For 6 years running, E*TRADE’s proprietary Equity Edge Online® platform was rated #1 for Loyalty & Overall Satisfaction in Group Five’s Stock Plan Administration Benchmark Study². E*TRADE was also rated highest among partial administration plan sponsors in overall satisfaction for brokerage services in the same study.

The data and analysis contained in this publication has been prepared by Equilar. The commentary, where noted, has been provided by E*TRADE Financial Corporate Services, Inc. Equilar is not affiliated with E*TRADE Financial Corporate Services, Inc. or the E*TRADE Financial family of companies.

-

Data collected from the E*TRADE Financial Corporate Services, Inc. Equity Edge Online® platform as of 7/31/18.

-

As of June 30, 2017, Group Five Stock Plan Administration Benchmark Study and Financial Reporting Benchmark Study rated Equity Edge Online® highest in Loyalty and Overall Satisfaction for the 6th consecutive year (2012-2017). E*TRADE was also rated highest among partial administration plan sponsors in overall satisfaction for brokerage services in the same study. Group Five, LLC is not affiliated with E*TRADE Financial Corporate Services, Inc. or the E*TRADE Financial family of companies.

For more information, contact:

Amit Batish

Equilar, Inc.

abatish@equilar.com

650-241-6697

Solutions

Solutions