Private Equity Industry Insights: Navigating the Path to a PE-Backed Board Seat

November 4, 2024

Morgan Zombolas

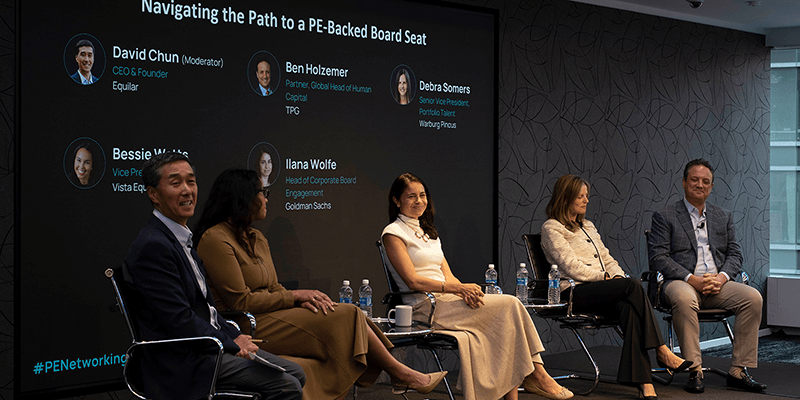

At our recent PE Networking Breakfast and Panel, we hosted an insightful discussion centered around "Navigating the Path to a PE-Backed Board Seat." Moderated by David Chun, CEO and Founder of Equilar, the panel featured industry leaders sharing their experiences and strategies for those aspiring to serve as independent directors on PE-backed boards. The experts included:

- Debra Somers, Senior VP of Portfolio Talent at Warburg Pincus

- Ben Holzemer, Global Head of Human Capital at TPG

- Bessie Watts, Vice President at Vista Equity

- Ilana Wolfe, Head of Corporate Board Engagement at Goldman Sachs

Understanding the Diversity of PE-Backed Boards

A key theme of the conversation highlighted the diversity in the types of private boards, from venture capital to large scale buyouts, each with different governance models and expectations. Panelists emphasized how potential board members should consider their fit based on these varying expectations and the stage of company growth. Ilana Wolfe touched on the importance of “being able to leverage our network and relationships to suggest really exceptionally talented folks who fit whatever expertise or skill set our clients are looking for, while at the same time adding greater diversity.” She expanded on diversity during the session, adding that when boards are looking for diversity “whether in the traditional sense or not, our network is strong and robust. The talent speaks for itself. I think some of the trends we're seeing is, when you think about today and all of the different considerations and what's going on in the macro landscape and markets and geopolitics, the role of a director is increasingly more complex.”

Strategic Importance of Independent Directors in Private Equity

When discussing the role of independent directors, Bessie Watts spoke to changes in the timing of adding such members. “As we're doing value creation, as we're thinking about how to evolve the product, you want to hear from the buyer, you want to hear from that expert in the industry, you want to hear from the customer. And so making those decisions, and having that viewpoint, has been incredibly helpful. We've only just moved up the need in our whole period with the company to add independents.”

She also commented on the differences found when it comes to public and private independent board directors. “On the other side, if you look at a private equity backed company, the bulk of the board are executives that are working on this company night and day. So there is no way a public independent board member is going to have that level of interaction, because that's their day job as well. It's just a different level of interaction.”

Impact of Board Composition on Company Strategy

The conversation also turned to how board composition can help determine the strategy of an organization. Specifically, Ilana Wolfe touched on the value in “having someone in the boardroom who's living and breathing these decisions and choices day to day. Bringing that expertise to our boardroom and how they're navigating these challenges and opportunities has become increasingly valuable.” When it comes to strategically allowing your own executives to serve on board roles at other organizations, Ben Holzemer commented on the value. “There has been almost a generational change in mindset around that to almost completely the opposite, which is one of the best ways to retain your top talent on an executive team.”

Board Member Recruitment and Readiness

Our panelists explored the process of recruiting board members and how to be ready to serve as a board member. Debra Somers discussed historically when organizations would look to start recruiting board members, noting that “in the last ten years, we were adding people to boards in the private markets right before IPO. So 18 months before, you hire someone to do an IPO readiness exercise and they're like, you actually need a bunch of board members. And then we scramble and try to find them. But, I think now there's been a different approach.” PE firms are looking to bring on board members as early as the start of an investment. When it comes to how many board seats are available through a PE firm in a given year, Debra also noted the dependency on volume and the current slowness of the M&A market.

Ben Holzemer gave advice to those looking to serve as PE-backed board members, explaining that you shouldn’t “assume that the super busy CFO recruiter had time to pass your resume along to the board search person in the firm. You have to make that connection. And then with respect to investment firms, private equity, growth equity, and venture capital, an awful lot of board placements are people that have helped out in some other way.”

Looking Ahead

This panel underscored that today’s path to a PE-backed board seat is shaped by diverse board types, evolving roles of independent directors, and strategic impacts from board composition. Executives seeking these roles should align their expertise with a board’s specific governance style and readiness needs early in the investment cycle. As PE boards continue to prioritize both expertise and diversity, aspiring members should actively build and leverage their networks to demonstrate value and readiness. Access the full panel recording here.

ExecAtlas connects PE firms with real-time executive intelligence, offering targeted insights into critical networking paths via a breadth of profiles and the Equilar Diversity Network. By unifying executive profiles and leveraging relationship data, ExecAtlas enables PE firms to strengthen board composition and identify top candidates through Advanced Search.

Ready to elevate your talent strategy? Equilar ExecAtlas empowers private equity clients to build a robust pipeline of top-tier talent for portfolio companies. Discover how ExecAtlas can streamline your processes, helping you identify exceptional leaders who drive value creation and strengthen portfolio performance. Learn more today.

Contact

Morgan Zombolas

Marketing Program Manager at Equilar

Please contact Belen Gomez at bgomez@equilar.com for more information.

Roles

Roles