The Tools You Need to Address Year Two of PvP

October 10, 2023

Joyce Chen

With companies preparing to enter the second year of Pay Versus Performance (PvP) requirements, Equilar recently hosted a web presentation to share expert tips and resources for the upcoming disclosure process. Equilar has designed a number of tools to streamline in-house processes for PvP disclosures, enhancing the consolidation of various calculation models. The aim for PvP disclosures is to construct a compelling narrative for investors, potentially influencing recommendations by investors and proxy advisors later in the year. This post summarizes some findings from year one of PvP, the various Equilar resources discussed during the webinar and what to expect in 2024.

Findings from year one of PvP disclosures

Among the many requirements as part of PvP rules, companies are required to disclose a company-selected measure (CSM). The CSM is a financial measure selected by a company as its most important financial performance indicator, linking compensation actually paid (CAP) to the company’s performance during the most recent fiscal year. According to Equilar data, most companies disclosed income-related metrics (62.7%), including EBIDTA, operating income and earnings per share.

While required to list three to five financial metrics beyond the CSM, some companies didn't meet the three-metric requirement, likely due to the nature of their incentive plans. Surprisingly, many firms exceeded the minimum requirement, disclosing over seven metrics. “Even though it’s a requirement to disclose this information, disclosing more than the requirement means that [companies] want to tell their story,” said Luis Mendoza, Head of Client Services at Equilar. This effort aims to provide investors with a more thorough understanding of the company's performance.

Overview of the resources Equilar offers

Through the Exec Comp Navigator program, Equilar offers comprehensive resources for executive compensation professionals across Corporate America to address PvP requirements, including a P4P Profile, TSR Calculator, Incentive Plan Analytics Calculator (IPAC) and Monte Carlo Simulator.

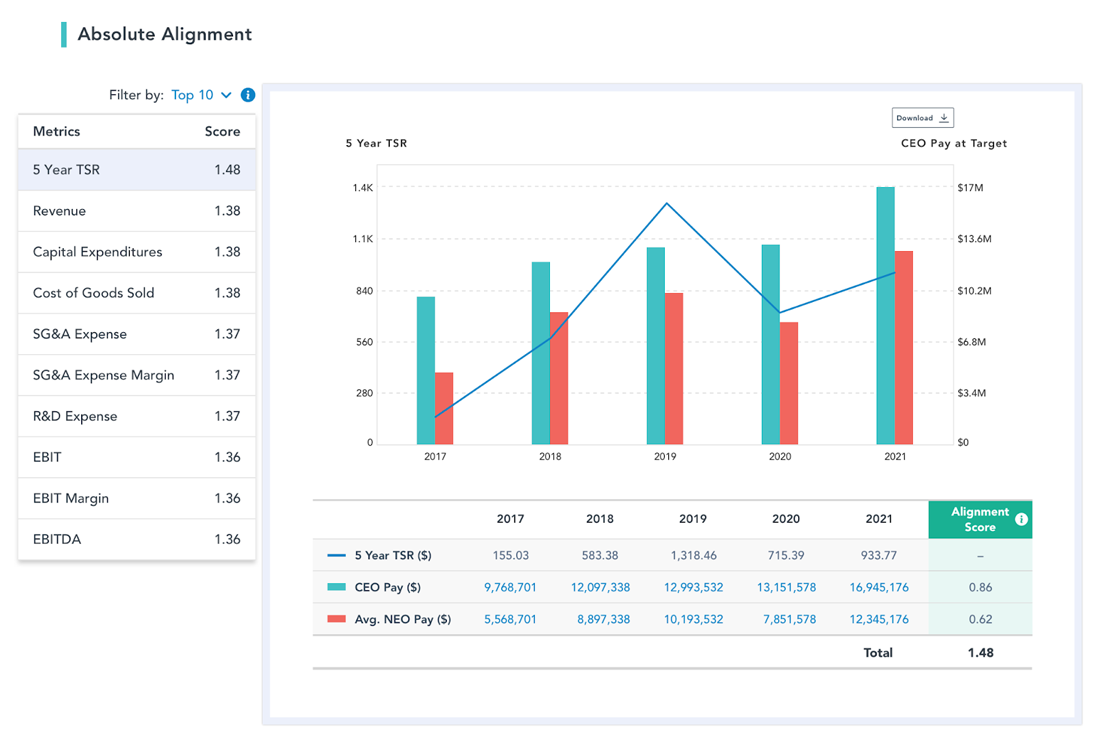

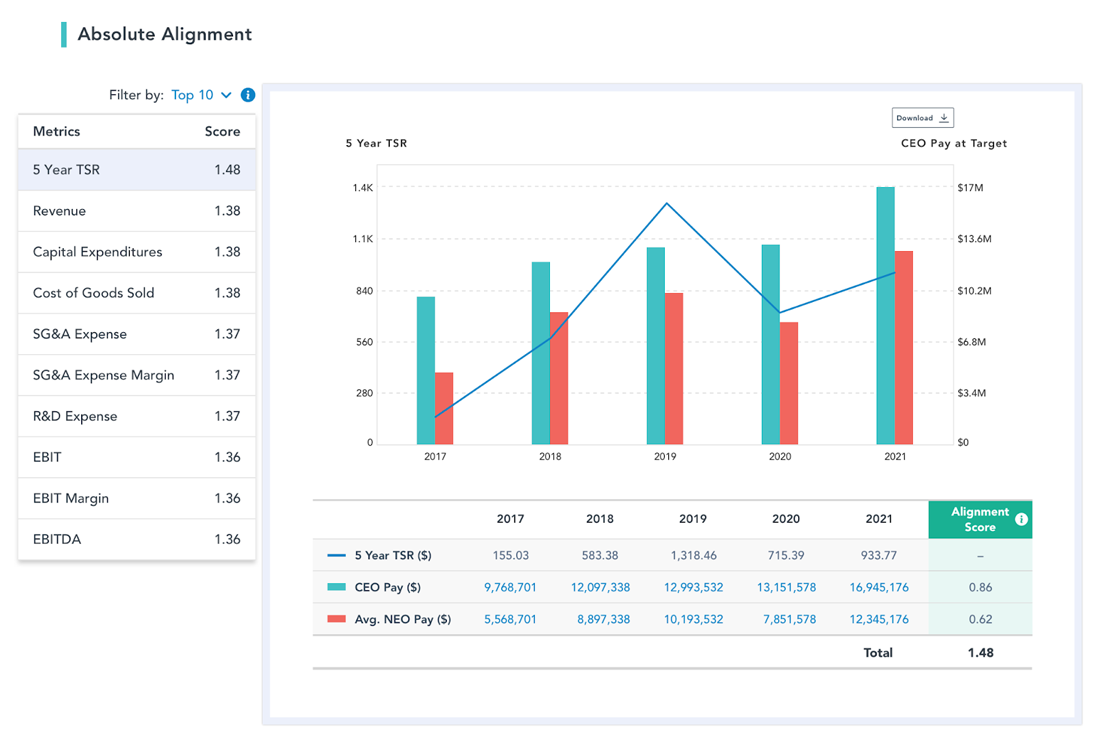

The P4P Profile is a tool used by top institutional investors, such as Vanguard, State Street and BNY Mellon, to assess executive compensation practices at companies in which they invest. The tool provides a graphical representation of custom performance measures compared to executive pay alignment. “Investors utilize this tool because it provides flexibility in terms of how you’re looking at your overall pay versus performance alignment,” said Mendoza. The P4P Profile helps companies provide data in their proxy statements to explain why a particular metric makes sense for executive compensation. “In a couple of clicks, this gives you the statistical backing you need to tell and support your story,” said Will Main, Director of Sales at Equilar. It facilitates data-driven storytelling by providing easy access to the data needed to explain executive pay decisions.

P4P Profile

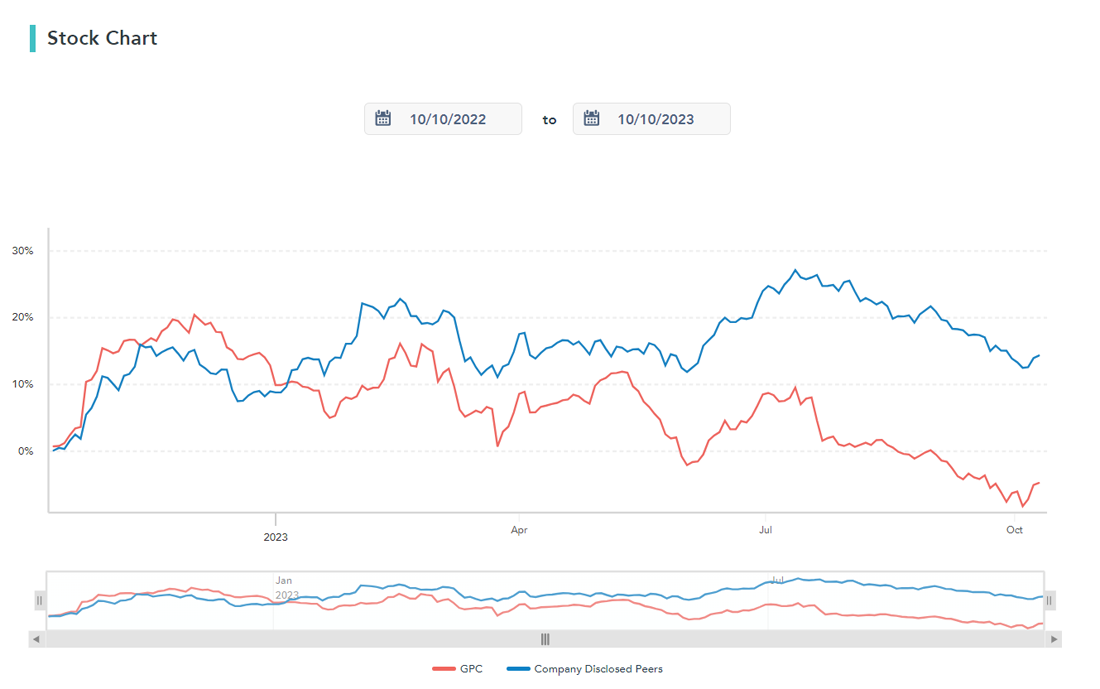

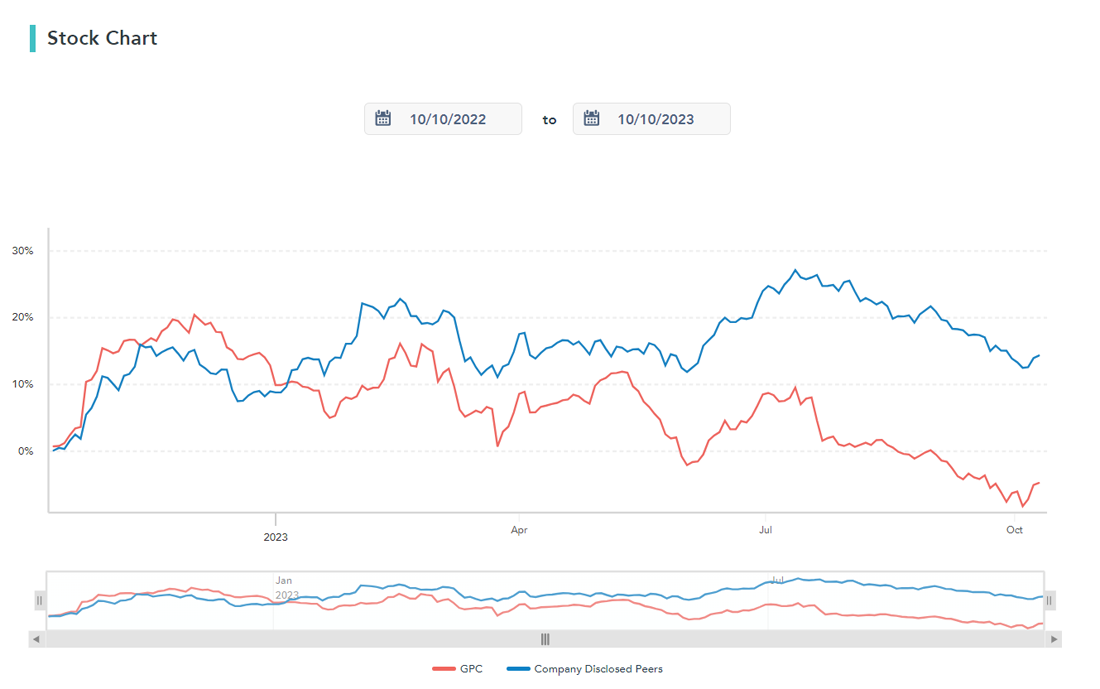

As part of PvP rules, companies are required to disclose their TSR and their peer group’s weighted TSR. The requirement's intention is to show alignment between their performance and pay, and isolate their performance from market fluctuations. The Equilar TSR Calculator helps users stay up to date on their TSR and their peer group weighted TSR to prevent any surprises prior to publishing their PvP table.

TSR Calculator

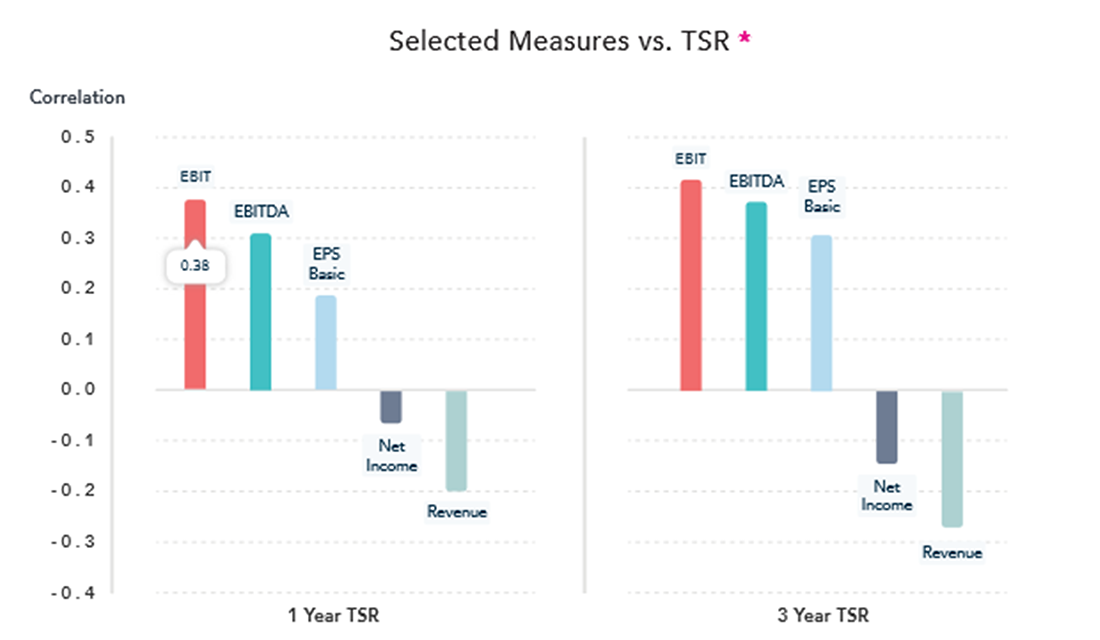

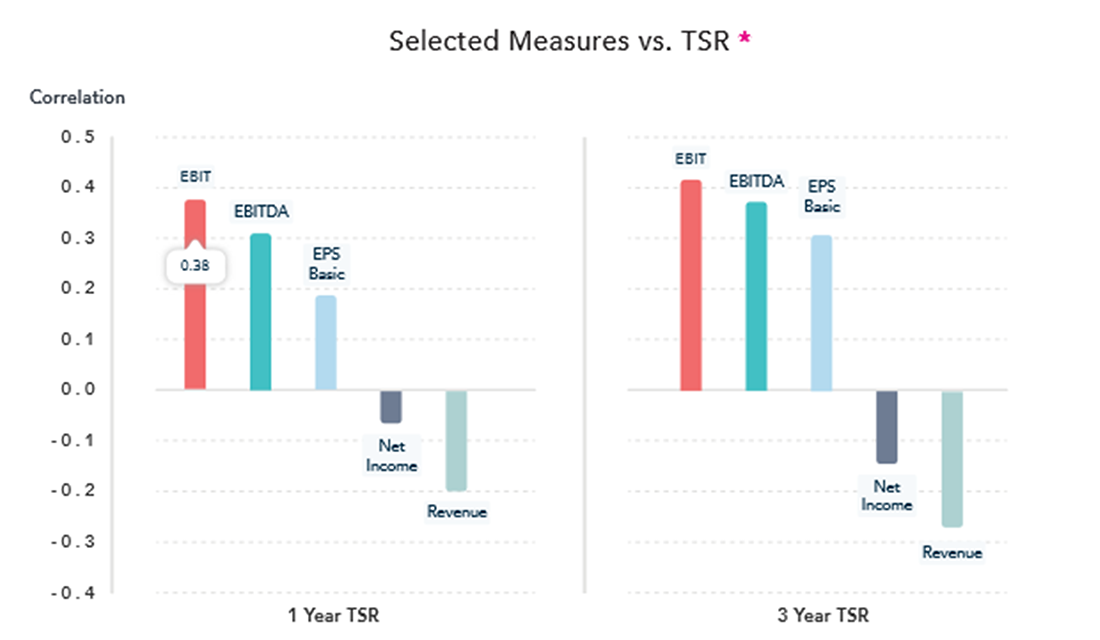

The Incentive Plan Analytics Calculator (IPAC), developed in collaboration with the HR Policy Association, empowers issuers to make informed decisions about their incentive plans. By analyzing metric correlations with shareholder value and return over multiple years, this tool assists companies in selecting metrics that best align with shareholder interests. Mendoza noted that the data can be used to “support your narrative around why the metric you selected makes sense for your company.”

Incentive Plan Analytics Calculator (IPAC)

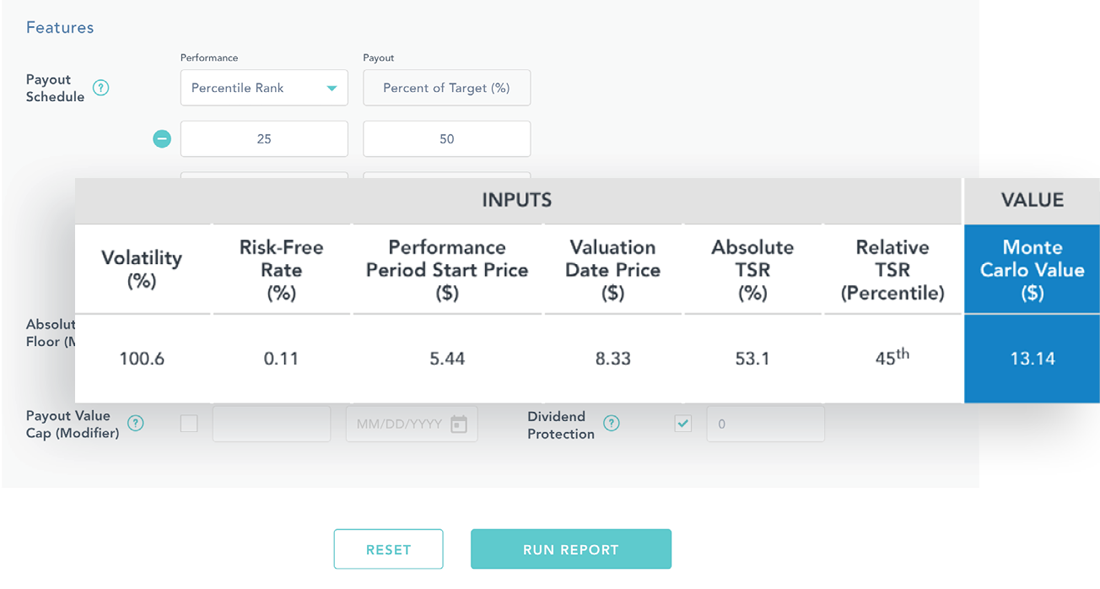

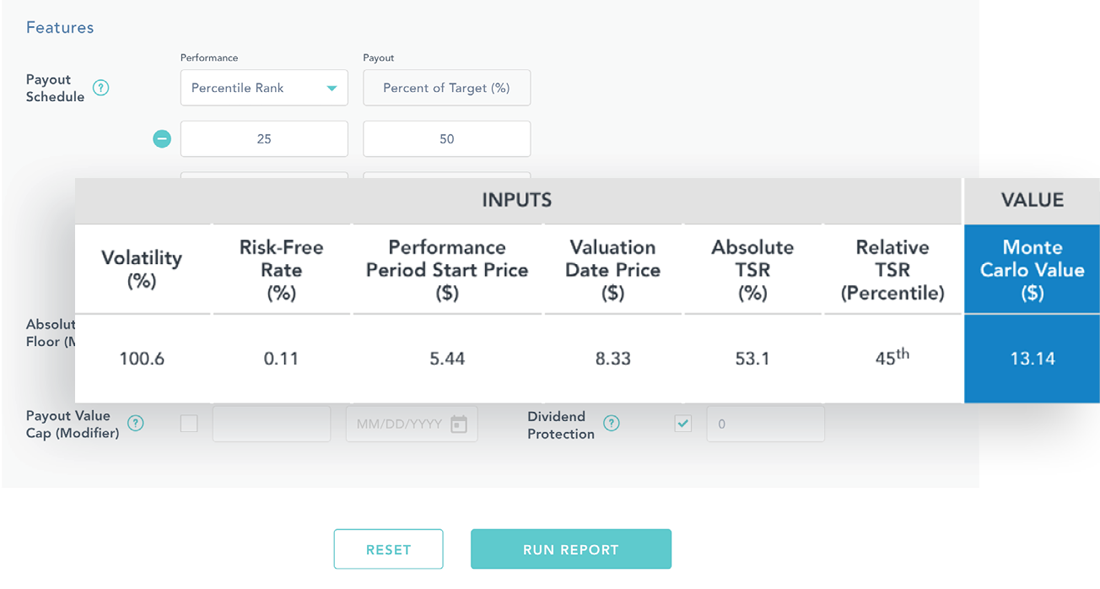

Finally, the Monte Carlo Simulator is a powerful solution for companies to conduct analyses and valuation of TSR-based awards, crucial for determining CAP values as of a specific effective date. Equipped with expertise from Equity Methods, it's designed to empower finance teams and equity stock plan administrators to perform Monte Carlo simulations and valuations in-house. The simulator incorporates key values like the volatility of return, risk-free rate, performance period start date, valuation date price, absolute TSR and relative TSR to generate a Monte Carlo value. Clients rely on this tool for future design considerations, allowing them to assess how different design choices would impact the future value of an award.

“Equilar’s goal is to bring power and control back in-house over these issues for the actual issuers themselves,” said Main. The Monte Carlo Simulator helps companies take control of their executive compensation and performance alignment narratives internally, reducing reliance on external consultants.

Monte Carlo Simulator

What to expect from investors and proxy advisors in 2024

In 2024, investors are likely to delve deeper into understanding the impact of executive compensation alignment and may commission studies for a retrospective look at PvP disclosures. They may also refine proxy voting guidelines and engagement processes. Proxy advisors are expected to take cues from investors in shaping their policies regarding PvP disclosures, although formal, prescriptive policies from proxy advisors may not emerge by year-end. Proxy advisors could continue focusing on other aspects of executive compensation, like burn rate readjustment calculations, while monitoring investor approaches to PvP disclosures.

Access the on-demand replay to view the full presentation.

Contact

Joyce Chen

Associate Editor at Equilar

Joyce Chen, Associate Editor at Equilar, authored this post. Please contact Amit Batish, Sr. Director of Content & Communications, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions