Equilar Institute

Blog Home

Dissecting CEO Pay Mix Across Sectors

September 13, 2019

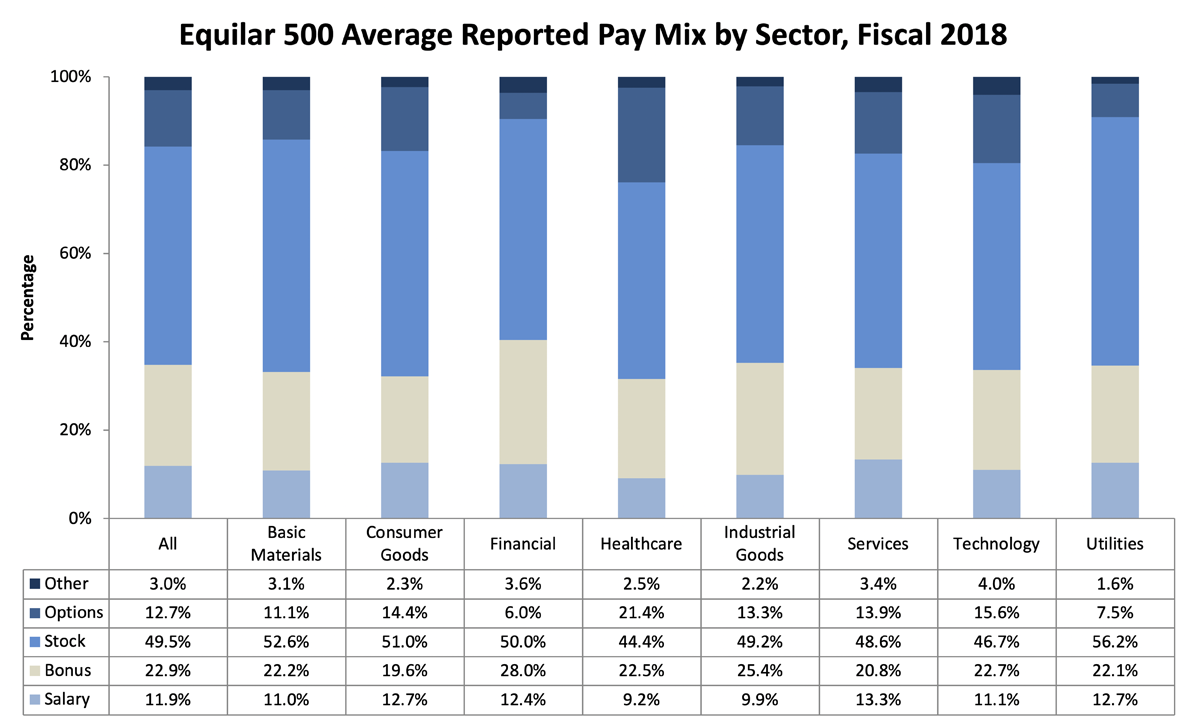

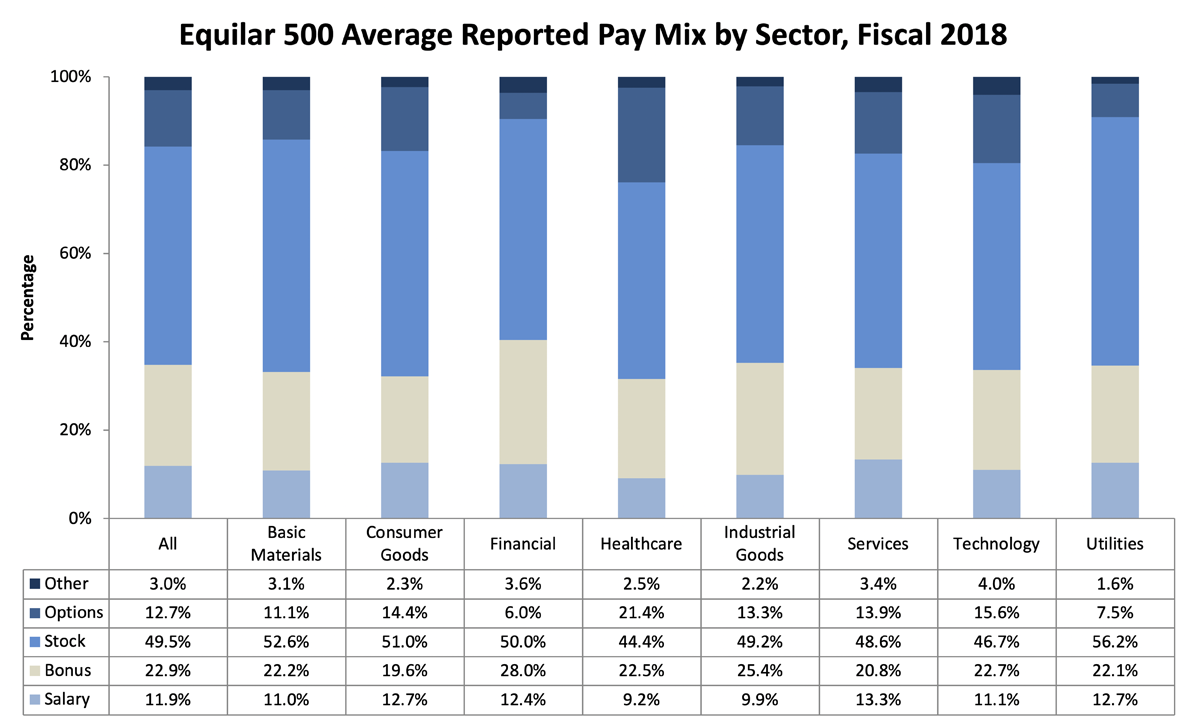

CEOs of public companies in 2018 America were, for the most part, all compensated similarly. That is not to say that they were paid at the same level— there was still a large disparity between the highest-paid CEOs and the rest. Indeed, 2018 had the largest ever disparity between the top-paid CEO and the runner up, at least on paper. However, the pay mix of CEOs was remarkably similar across industries. The average CEO in the Equilar 500 received about a tenth of their total compensation in salary, another fifth in the form of a cash bonus, another tenth as stock options and fully half of their total compensation as either time or performance-vesting stock, with the remainder made up of other benefits. When broken out by sector, these trends largely hold true with three major exceptions: the financial, utilities and healthcare sectors.

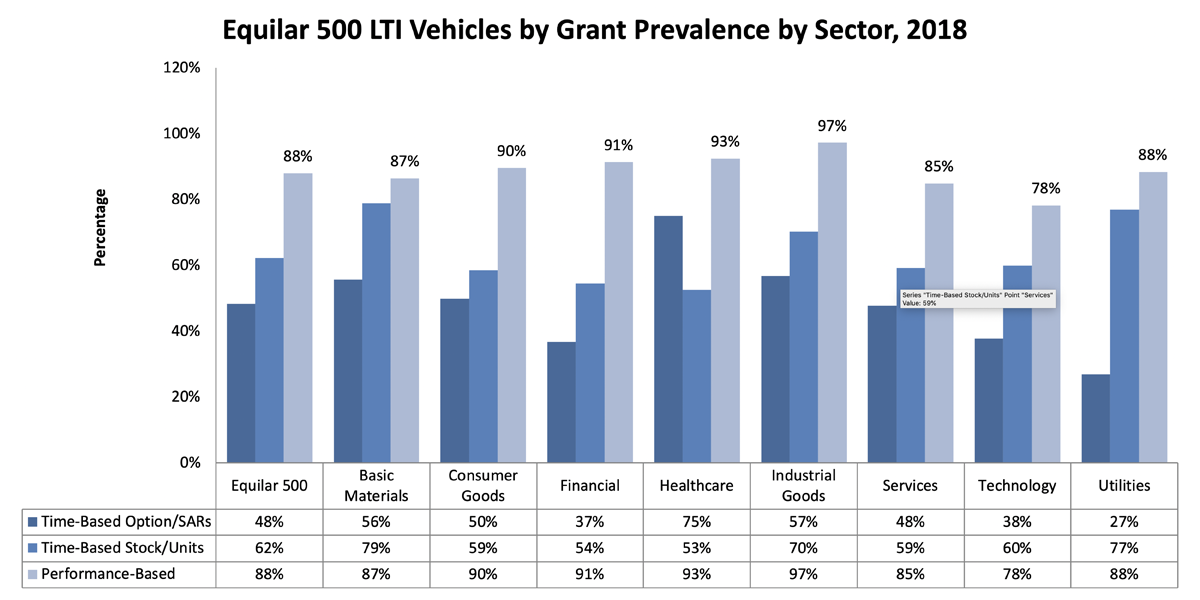

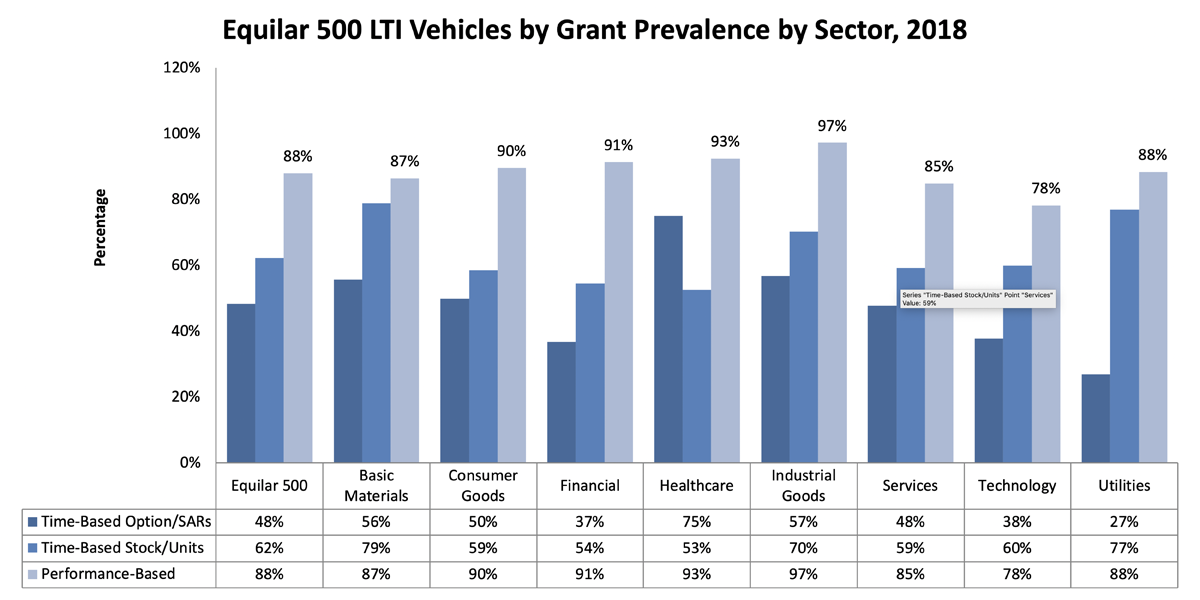

The utilities and financial sectors both issued far fewer options as a percentage of total CEO compensation than any other sector, 7.5% and 6.0%, respectively. The utilities sector made up for the low percentage of options through stock, which made up 56.2% of the average compensation in that sector. Across the financial sector, the difference was made up with slightly higher salaries (12.4% as opposed to the 11.9% average) and much higher bonuses (28.0% versus 22.9%). Utilities companies were also far less likely to award options in general, with only 27% granting them at all. Healthcare, in contrast, was the only sector where a higher percentage of companies granted options than time-vesting stocks or units (75% versus 53%). The average healthcare CEO’s compensation was 21.4% options, which was far higher than the Equilar 500 average of 12.7%.

Options have been waning in popularity since their heyday in the nineties. They fell from favor in part due to rampant abuses of reloads and questionable practices surrounding their award and exercise which led to changes in accounting rules. Accordingly, in 2018 options were the third most popular award vehicle in all but one of the sectors of the Equilar 500. The outlier was the healthcare industry.

There are a variety of possible explanations for why the healthcare sector alone maintained widespread, substantial use of options—75% of healthcare companies granted options in 2018, and they made up 21.4% of the average healthcare CEO’s compensation. Options are only more valuable than stock awards when stock prices are on a sharp upwards trajectory, or when one might be expected in the near future, which is another reason why in 2018 they were not as popular as they were during the booming economy of the nineties. The healthcare sector is certainly in a boom right now, with a high stock price for the index and continual growth over the last five years. However, healthcare is not the only sector to have experienced substantial growth recently and thus could not be the sole contributing factor. Another possible explanation is the nature of the industry. Healthcare includes two major types of companies: insurance and pharmaceuticals. Pharmaceutical companies have an unusual hurdle in getting new products to market in the FDA. The process for approving new drugs can be long and outside of the control of company executives. Passing FDA thresholds often appears as part of performance incentive awards in this industry, but options provide extra incentive. If these goals are met, even outside of the original performance period, there is a significant payoff for the executives who stayed through this process.

Outside of healthcare, each sector followed a similar pattern. Performance awards were the most prevalent award vehicle, though they were not universal in any sector, followed by time-based awards, and then options. The combination of performance awards, which are at-risk and drive executives towards specific goals, and time-based awards, which are designed to promote long-term retention by providing guaranteed compensation if an executive stays with a company through their vesting, was the most popular equity compensation blue-print today. This pairing follows the principal of pay for performance, while at the same time provides executives with the incentive to serve at the same company for the long-term.

Nathan Grantz, Research Analyst at Equilar, authored this post. Please contact Amit Batish, Content Manager, at abatish@equilar.com.

Solutions

Solutions