Equilar Institute

Blog Home

Shell to Link Executive Compensation to Carbon Emission Targets

March 25, 2019

Royal Dutch Shell announced in December that following its shareholder meeting, it would begin linking compensation for executives to carbon emission targets. While the exact details are unknown at the present, Shell will be the first company to use this metric in its performance equity grants. Following this development, the boards of other energy companies have experienced increased pressure from their shareholders to adopt similar policies.

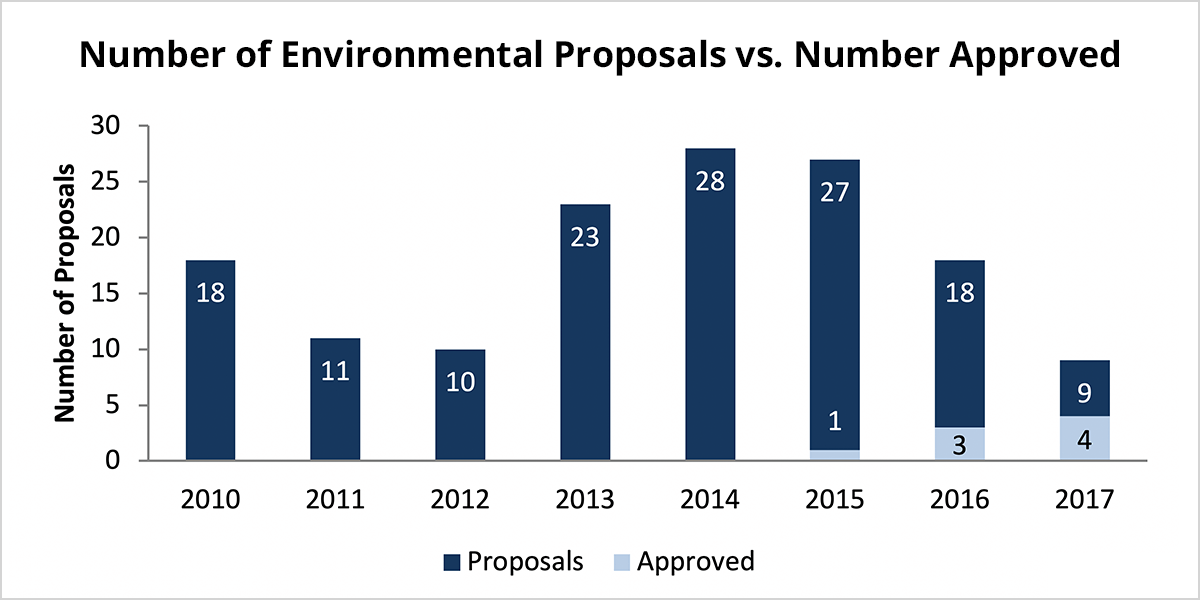

Though Shell is the pioneer in applying this metric, shareholders across many companies in the energy sector have been pushing for boards to pass their own environmental proposals for quite some time, with several seeking to tie executive compensation to sustainability efforts. The chart below shows the number of environmental shareholder proposals introduced at the annual meetings of public U.S. energy companies from 2010 to 2017.

The number of proposals has fluctuated greatly throughout this period, with a large increase from 2012 to 2013 and a high of 28 proposals in 2014. Of course, the high volume of environmental shareholder proposals in the U.S. energy sector is perhaps unsurprising, as these years coincided with the period leading up to the negotiation of the Paris Agreement, which called for a series of measures to mitigate the effects of greenhouse gas emissions on global climate change. Following this peak, the number of environmental proposals, interestingly enough, has fallen rapidly, with a 66% decrease in proposals from 2015 to 2017.

However, this decline does not necessarily indicate a loss in shareholder support for environmental initiatives. Environmental proposals tend to be fairly unpopular with company boards in general, especially among energy companies, who frequently view them as immediate threats to the company’s profitability and shareholder return. Nevertheless, as concern for climate change grows, investors are becoming more and more preoccupied with what the failure to adopt more sustainable practices could mean for long-term shareholder return, and it seems that this concern is finally spreading to board members and company management as well. During the period from 2010 to 2014, zero environmental shareholder proposals were approved by the shareholders, despite large increases in the volume of these types of proposals from 2012 to 2014. Conversely, beginning in 2015, the number approved actually began to rise, with one out of 27 total environmental proposals among public, U.S. energy companies passing the vote for 2015, three in 2016 and four in the most recent year.

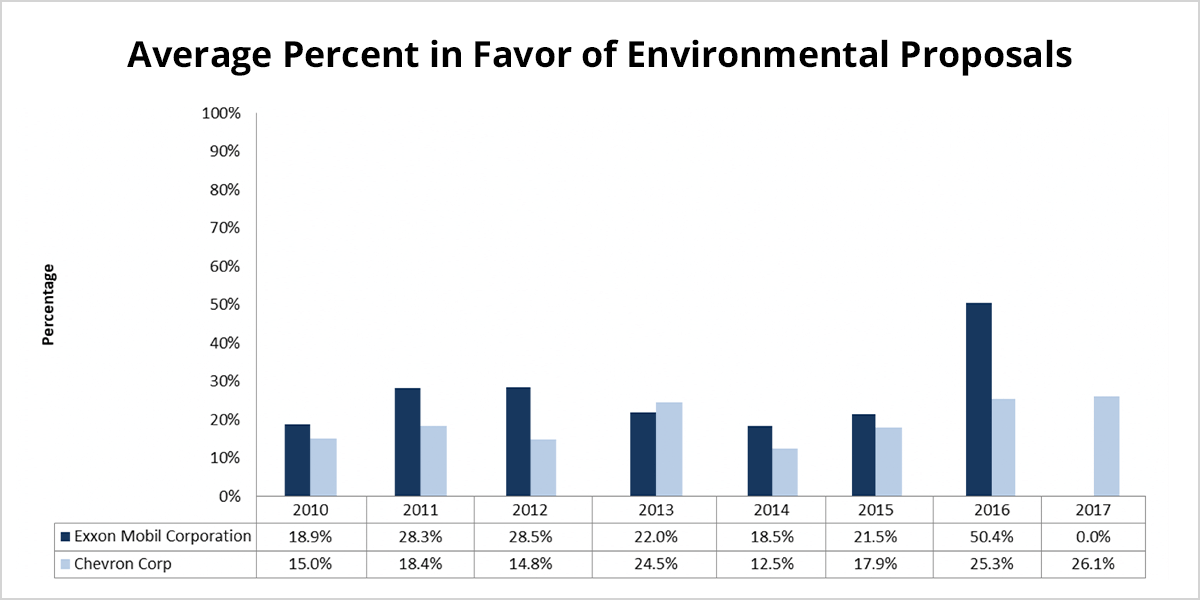

While the news of Shell brings to light environmental shareholder activism throughout the industry as a whole, a more intense spotlight shines on Shell peers—Chevron Corp and Exxon Mobil Corporation in particular. Chevron shareholders have presented 22 environmental proposals to the Board since 2010, but none have passed. For example, an initiative in 2010 to set a sustainability metric for executive compensation received only a 5.6% approval rating from shareholders. Exxon Mobil has seen 20 environmental proposals in this time, but only one was approved in 2016. The proposal, which passed with 62.1% approval, called for the publication of an annual report on the impacts of the company’s climate change policies, beginning in 2018. However, following the successful passing of an environmental proposal in 2016, there were no shareholder proposals surrounding environmental or sustainability issues the following year.

For the most part, Exxon Mobil has experienced slightly higher approval votes than Chevron on environmental-specific shareholder proposals since 2010. The trend in average approval percentage of proposals among these two companies mirrors the approval trends of the industry as a whole. Where approval percentages at these companies have been increasing throughout the last few years, so too have those throughout the U.S. energy sector as a whole.

While it remains to be seen whether the demands of shareholders at Chevron, ExxonMobil and other energy companies will be met, recent trends indicate that environmental proposals have already been receiving greater attention in recent years. Energy companies may reasonably expect to see new environmental proposals at their upcoming shareholder meetings, especially ones regarding carbon emission targets. Although in the past similar initiatives have failed, Shell’s introduction of the new metric may motivate its peers to listen to their investors and vote in favor of these new proposals.

Erin Lehr, Research Analyst at Equilar, authored this post. Please contact Amit Batish, Content Manager, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions