Equilar Institute

Blog Home

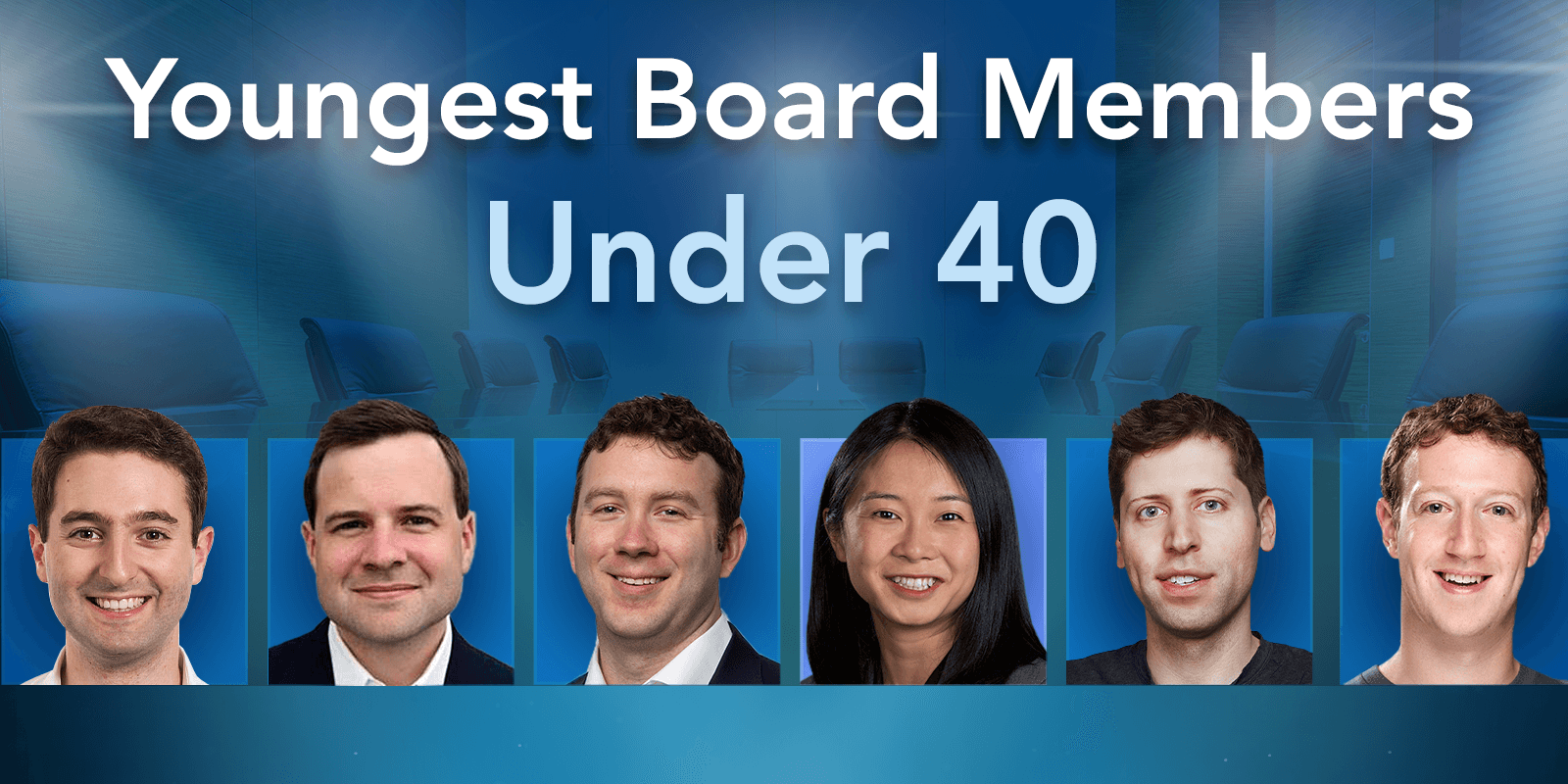

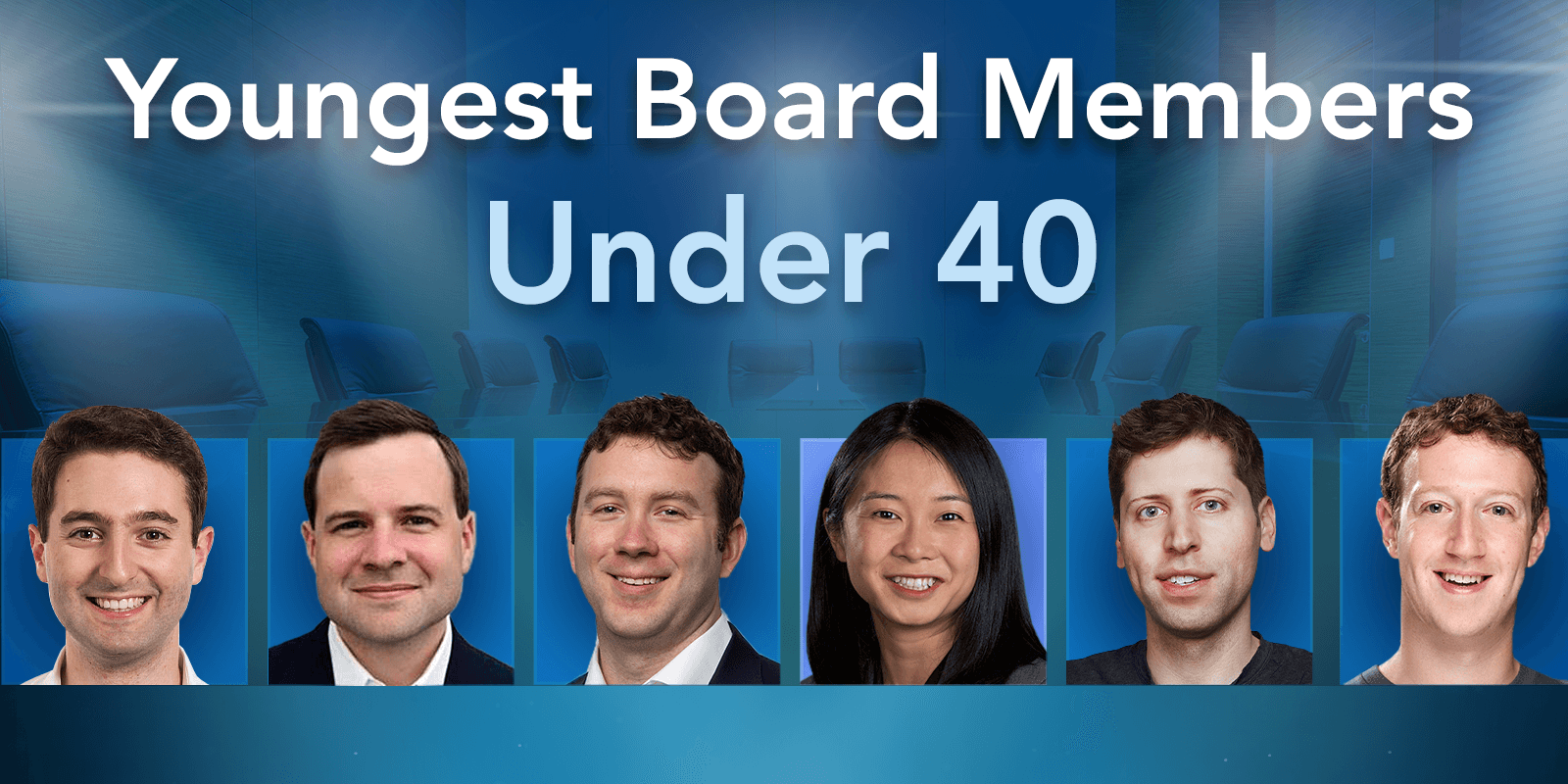

Board Members Under 40

Can Young Directors Shift Corporate Priorities?

December 9, 2019

Connor Doyle

As companies grapple with increased scrutiny in the world of corporate governance, many boards are attempting to recruit a diverse set of directors to their ranks. While gender diversity has become the most pressing issue—with California legislation coming into effect that would punish companies with without female representation on boards—age has also become an area of focus for boards that are looking to respond to disruption in their industries, as well as the emergence of new technologies like blockchain and artificial intelligence. By shifting the makeup of the board with younger directors, companies can attempt to steer company culture and focus on an increasingly diverse set of business challenges that will arise in the 21st Century. The following table (Table 1) lists current directors under 40 years old in the Equilar 500:

Table 1

|

Director

|

Company

|

Age

|

Gender

|

Of the 31 directors in the list, 21 are men and 10 are women, leaving the group at 32.3% women. While this dataset provides only a limited snapshot of governance trends, it does provide a glimpse of how boards are moving towards gender parity. As directors look to find younger recruits to offset their aging populations, they are finding more and more women that fit the bill. With an influx of young candidates entering boards each year, they will be able to leverage their networks in order to fill seats as they open up in the future. This trend has had a moderate impact on median director age within the Equilar 500. Table 2 below shows median director age in the Equilar 500 in each of the past five years.

Table 2

In the past five years, the median director age in the Equilar 500 has remained flat at 63. This suggests that while existing directors continue to age, those that leave are being replaced by younger directors who keep the median age in balance. Some companies, such as Facebook and Walmart, have significantly lower median director ages. This group of companies, primarily in the technology and services sectors, are relying on younger directors who can guide businesses through turbulent disruptions in their industry with the emergence of game-changing technologies. Below are the 60 companies in the Equilar 500 with the lowest median director age.

Table 3

|

Company Name

|

Median Director Age

|

Industry

|

Of these 60 companies, 13 are in the technology sector and 29 are in services. These industries experience significant disruption with the emergence of new technologies, compared to sectors like utilities and healthcare, each of which only has one company in the above data set. Companies in the healthcare sector have a disproportionately low representation in our list of the top 60 companies with the lowest median director age. Of 40 healthcare companies in the Equilar 500, only one ended up in our list. This makes sense if their boards are relying more on directors with legacy and years of experience, and are less concerned about technologies disrupting their business practices.

Perhaps the most pressing issue for younger directors to take on is the rising threat of climate change. Shareholders are putting greater pressure on companies to adopt formal policies on their climate targets, according to a recent article in Agenda. The article cites the CEO of Sustainability Accounting Standards Board, Madelyn Antoncic, who emphasizes how “boards need to talk about the business model in 2030, 2040 and beyond ‘in every board meeting.’” This focus will be much more intuitive to young directors, who are already accustomed to worrying about the world that they are inheriting from previous generations.

As younger directors continue to take the place of those retiring from the board, they will likely be in a better position to guide their respective companies towards increasing diversity, embracing new technologies, and forming a comprehensive approach to climate responsibility. All of this must be kept in balance by a group of older directors who have years of experience in corporate governance, and can guide the next generation through the mechanics and process of overseeing the growth of their companies through their positions as directors.

About Equilar

Equilar is the leading provider of Board Intelligence Solutions. Its data-driven platforms, BoardEdge and Insight, provide tools for board recruiting, business development, executive compensation and shareholder engagement. Companies of all sizes, including 70% of the Fortune 500 and institutional investors representing over trillion in assets, rely on Equilar for their most important boardroom decisions. Equilar also hosts industry-leading board education symposiums, conducts comprehensive custom research services and publishes award-winning thought leadership.

Equilar BoardEdge is a searchable database of more than 300,000 public company board members and executives. BoardEdge includes exclusive features that show how board members and companies are connected to each other, as well as the Equilar Diversity Network (EDN), a “registry of registries” of board-ready executives from leading ethnic and gender diversity partnerships, organizations, and publications. Visit https://www.equilar.com/boardedge.html to learn more.

Connor Doyle, Research Analyst at Equilar, authored this post. Please Contact Amit Batish, Content Manager, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions