Q4 2020 Equilar Gender Diversity Index

Gender Parity on Russell 3000 Boards Projected by 2032

March 3, 2021

Amit Batish

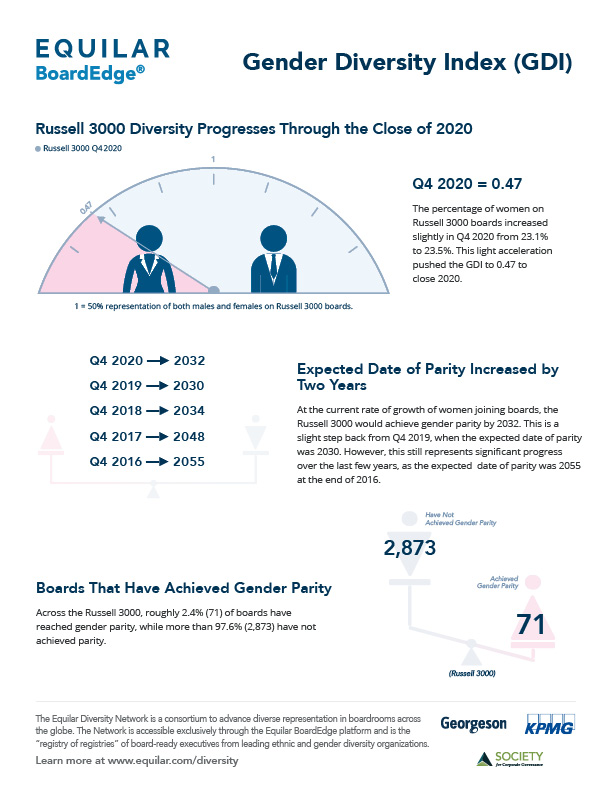

As the world celebrates International Women’s Day on March 8, the focus on board diversity has never been so prominent. While 2020 posed several challenges to companies across Corporate America, one area where progress persisted was gender diversity on boards. By the end of 2020, gender diversity on Russell 3000 boards reached an all-time high. As featured in a recent CNBC segment, the Equilar Gender Diversity Index (GDI) moved to 0.47, where 1.0 represents gender parity across Russell 3000 boards. Women now hold 23.5% of all Russell 3000 board seats, representing a 1.7% increase from the previous quarter.

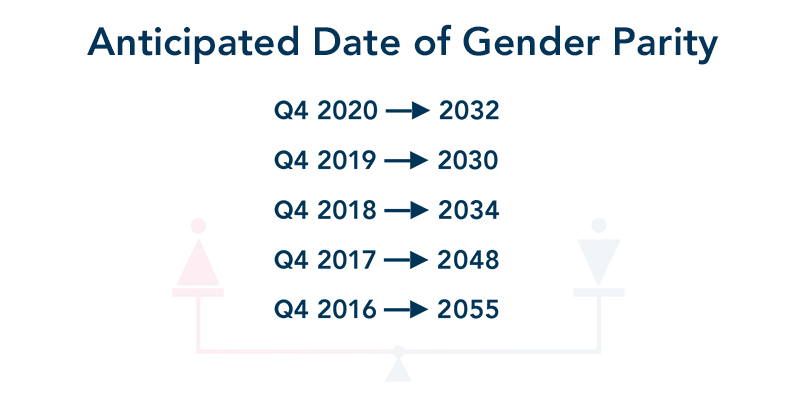

Although progress has been encouraging, its pace has slowed in the last year. According to the Equilar analysis, the Russell 3000 is expected to reach gender parity by 2032 at the current rate of growth of women on boards. In Q4 2019, the anticipated date of parity was 2030, two years earlier than the current anticipated date. This trend could be attributed to the fact that the prevalence of women filling new board seats has regressed, with 39.1% of board seats being filled by women in 2020— down from 44.3% in 2019.

“Gender parity on boards is, and continues to be, a realistic aspiration over the next decade or so,” said Susan Angele, Senior Advisor, Board Governance at The KPMG Board Leadership Center. “The slight slowdown in measured 2020 growth compared to the 2019 growth rate does not change that conclusion. The 23.5% metric of board seats held by women is still an increase over the 21.5% reported in Q4 2019, and there is no indication that growth will not continue at some level going forward.”

In recent years, several large institutional investors have implemented policies against overboarding, which could also potentially explain some of the slow in growth. “As overboarding policies become stricter, individuals who hold a greater number of board positions than investors consider sensible may be forced from some positions,” said Brigid Rosati, Director of Business Development at Georgeson. “Equilar’s 2020 Q4 GDI shows that more female directors serve on multiple boards when compared to male directors (25% and 17%). As a result, more new female directors who have not served on a board in the past need to be added to the candidate pool for board nominees for us to stay on track to reach gender parity in less than 15 years.”

Despite the slowdown in progress, the rate of women on boards increased steadily over the last four years. When Equilar began tracking the percentage of female Russell 3000 directors in Q4 2016, the anticipated date of parity was 2055. With the exception of Q4 2020, each year since saw significant progress, bringing the anticipated date closer and closer. In just four years, the gap closed by 23 years.

Several factors have contributed to the strides made over the last four years, particularly as key stakeholders have become more vocal in their desire to see more diverse boardrooms. In December 2020, Nasdaq filed a proposal with the SEC to adopt new listing rules related to board diversity and disclosure. The new listing rules would require all companies listed on Nasdaq’s U.S. exchange to publicly disclose statistics related to the composition of their boards. Additionally, the rules would require most Nasdaq-listed companies to have, or explain why they do not have, at least two diverse directors. In essence, the proposal is a stepping stone for companies to make a conscious effort to think about diversity.

Investors are also increasingly showing support for proposals and disclosures promoting diversity, and showing disapproval when companies do not showcase efforts towards diversifying their boards. BlackRock, for instance, has been vocal on its stance on board gender diversity among its portfolio companies. More recently, State Street Global advisors sent a letter to public board chairs of its portfolio companies, asking them to disclose information on a series of diversity issues, including gender.

At the legislative level, in 2018, most famously, California passed SB 826, which mandated that the boards of California-based companies contain at least one female director, and that larger boards contain more depending on their size. Washington similarly passed a law that went into effect in June 2020, requiring public boards to include at least 25% women by January 1, 2022. Companies based in other states may reasonably expect to be affected by gender quotas in the upcoming years, as Illinois, Hawaii, Pennsylvania and New Jersey already have proposed legislation.

On a related topic, the discussion around human capital management (HCM) at public companies has heightened in the last year, particularly given the global landscape. Of course, diversity is a key topic within HCM. The SEC recently expanded disclosure requirements in that a public company is now required to disclose the number of employees and a description of its human capital resources, along with any human capital measures or objectives. While these requirements are focused at an organization-wide level, the impacts could certainly be felt at the board-level as well.

“This leads to two implications for board diversity,” said Angele. “The first is straight-forward, in that as candidates are recruited for boards, there is a much-needed focus on enhancing gender, racial and ethnic diversity, and a growing awareness of the importance of LGBTQ+ diversity. The second implication is that the increasing interest in HCM as a strategic business concern elevates the importance in the boardroom of what would previously have been labeled 'soft' skills, such as talent strategy, culture change, workforce wellness and authentic leadership.”

In the United States, the nation is currently in the midst of a social movement around equality, which is having an impact on HCM policies across Corporate America. “The SEC’s new disclosure requirements come at a poignant time in the U.S,” said Rosati. “While in past years, investors' focus largely centered on board gender diversity, ongoing social unrest and protests over systemic racism have catalyzed an expansion to now include consideration of racial and ethnic diversity, as well as broader workforce diversity.”

While the topic of diversity is becoming more prevalent at the company-wide level, there is no question that gender diversity on boards will continue to be an area of interest for key stakeholders in the years to come. The Russell 3000 has taken several steps forward over the last four years, and the continued progress, though slow and steady, is indeed an encouraging sign for the diversity movement.

About Equilar Gender Diversity Index

The Equilar GDI reflects changes on Russell 3000 boards on a quarterly basis as cited in 8-K filings to the SEC. Most indices that track information about board diversity do so annually or even less frequently, and typically with a smaller sample size, sometimes looking back more than a full year by the time the information is published. While this data is reliable and accurate, the Equilar GDI aims to capture the influence of the increasing calls for diversity from investors and other stakeholders in real time.

The Equilar GDI is powered by Equilar BoardEdge, a database of more than one million public company board members and executives. BoardEdge includes exclusive features that show how board members and companies are connected to each other, as well as the Equilar Diversity Network (EDN), a “registry of registries” of board-ready executives from leading ethnic and gender diversity partnerships, organizations, and publications.

Contact

Amit Batish

Director of Content

Amit Batish, Director of Content at Equilar, authored this post. Brendan Cullen, Samar Feghi, Brielle Ferdinand and Kristen Tang contributed data and analysis. Please contact Amit Batish at abatish@equilar.com for more information about this article.

Solutions

Solutions