Equilar Institute

Reports

CFO Pay Has Remained Stagnant Since 2013

October 9, 2018

When it comes to executive compensation, the focus is often placed on the chief executive officer (CEO), yet the buck doesn’t necessarily need to stop there. For example, the means by which companies incentivize and reward their chief financial officer (CFO) is often overlooked. While not as high-profile as the CEO, companies must be cognizant that the CFO is an integral part of the business, and thus, must be compensated as such. As a way to attract and keep executive financial talent, companies are tasked with finding the right balance between the appropriate compensation for retention, while simultaneously not over-paying for a lackluster performance.

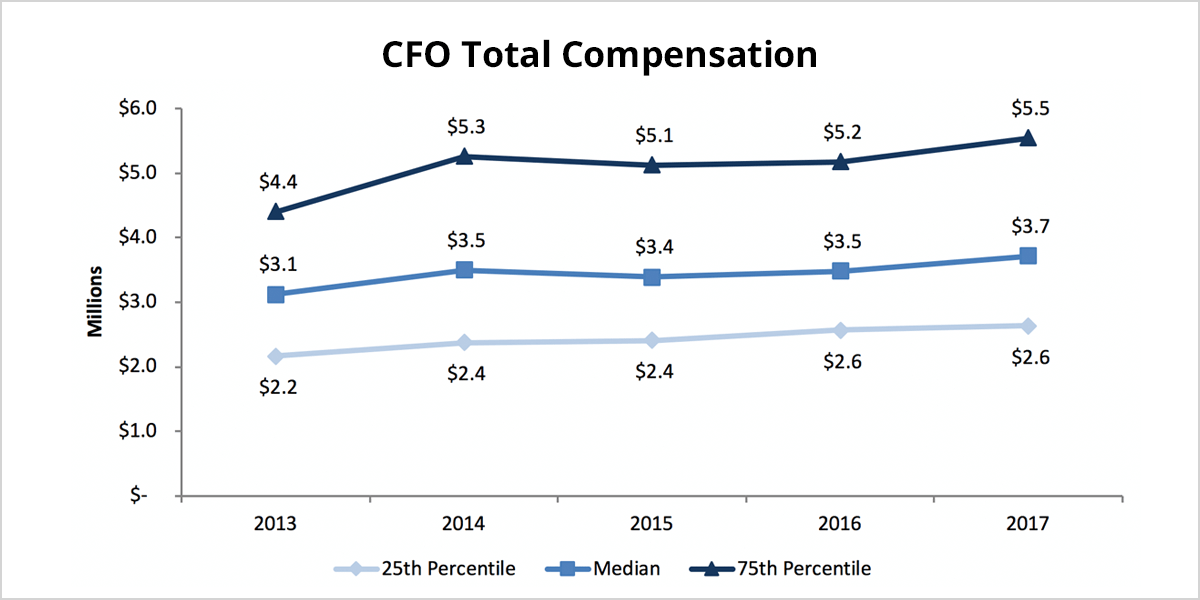

Over the past five years, CEOs in the Equilar 500 have seen their compensation steadily increase and pay mix trends change rather drastically. Options granted to CEOs have increasingly decreased in prevalence, while awards tied to performance have taken center stage, and rightly so. In contrast, CFO compensation trends have stayed relatively stagnant, with the most prominent increase in total compensation taking place this past fiscal year and changes in CFO pay mix contained to only a few sectors.

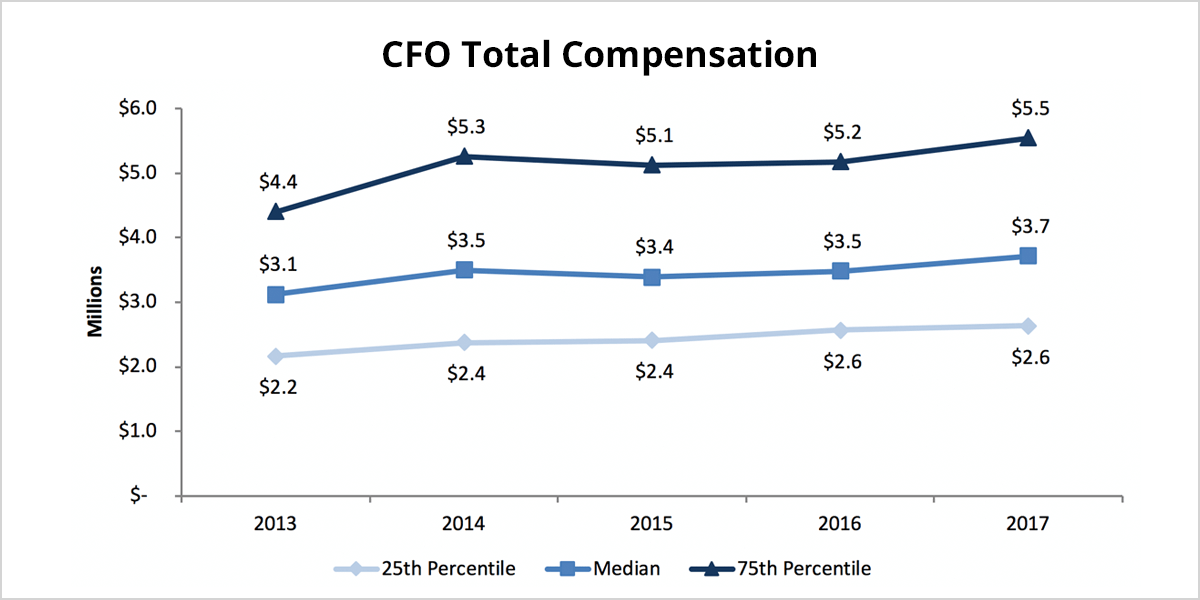

While CFO total compensation grew gradually between 2015 and 2016, the most recent fiscal year witnessed the largest year-to-year increase in CFO total compensation since 2013. The 2017 fiscal year saw CFO compensation increase at the median and 75th percentile by approximately $200,000 and $300,000, respectively. However, these are small jumps in comparison to the growth of CEO compensation. While median CFO total compensation increased $600,000 over the past five years, CEOs at Equilar 500 companies saw their median total compensation increase by $2 million, almost four times the increase for the median CFO over that time frame. It appears that while CEOs and CFOs are closely tied within their work, CEO pay has jumped forward, leaving CFOs to only marginal yearly increases in their overall pay.

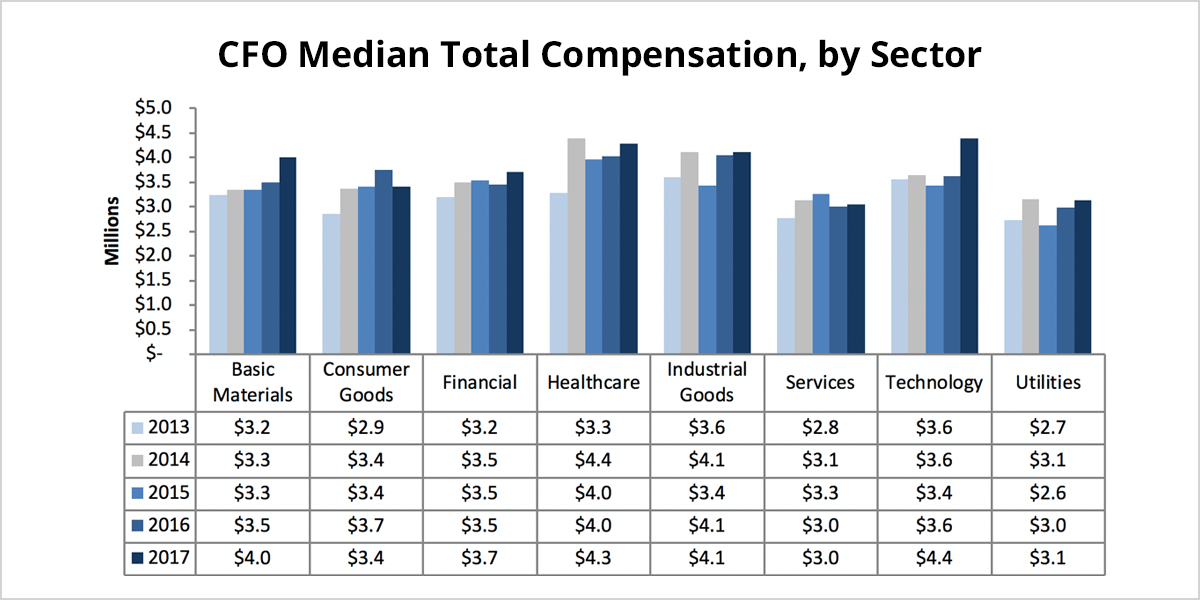

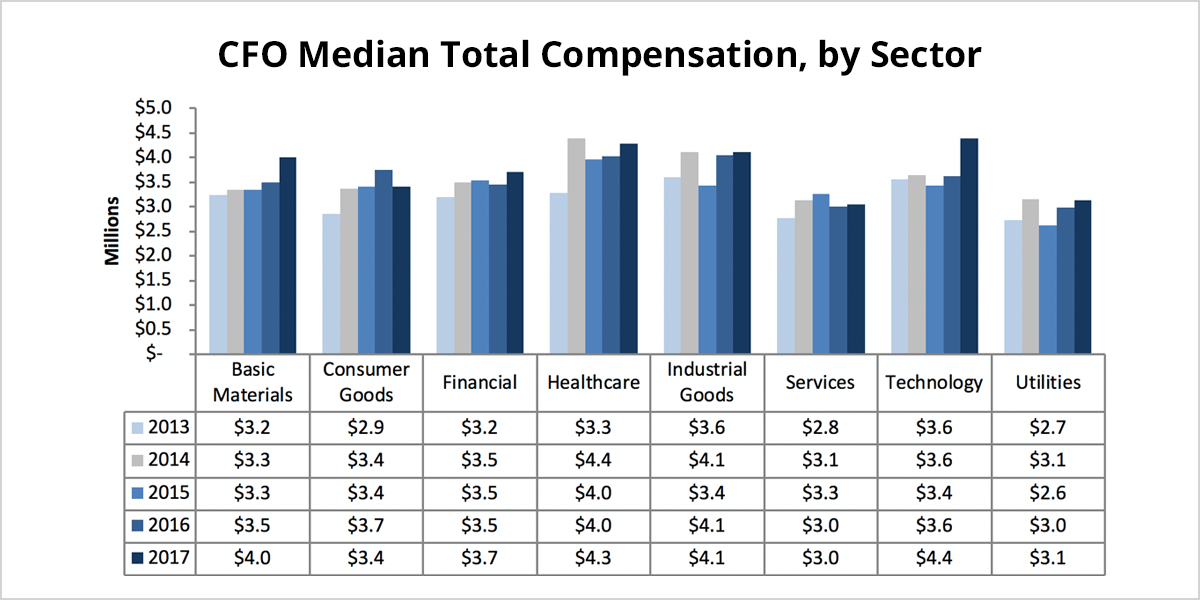

Dissecting the data down further to examine deeper trends, sector analysis provides a more in-depth look at how CFOs have been compensated. In 2017, the technology sector was the frontrunner in terms of median CFO compensation. With a median total compensation of $4.4 million it surpassed both the healthcare and industrial goods sectors to boast the highest median total compensation for financial chiefs. This was a notable $800,000 increase from 2016 to 2017, the largest yearly increase in the study. However, this trend within the technology sector did not show itself in CEO total compensation. For comparison, technology sits at the middle of the pack in terms of median total CEO compensation.

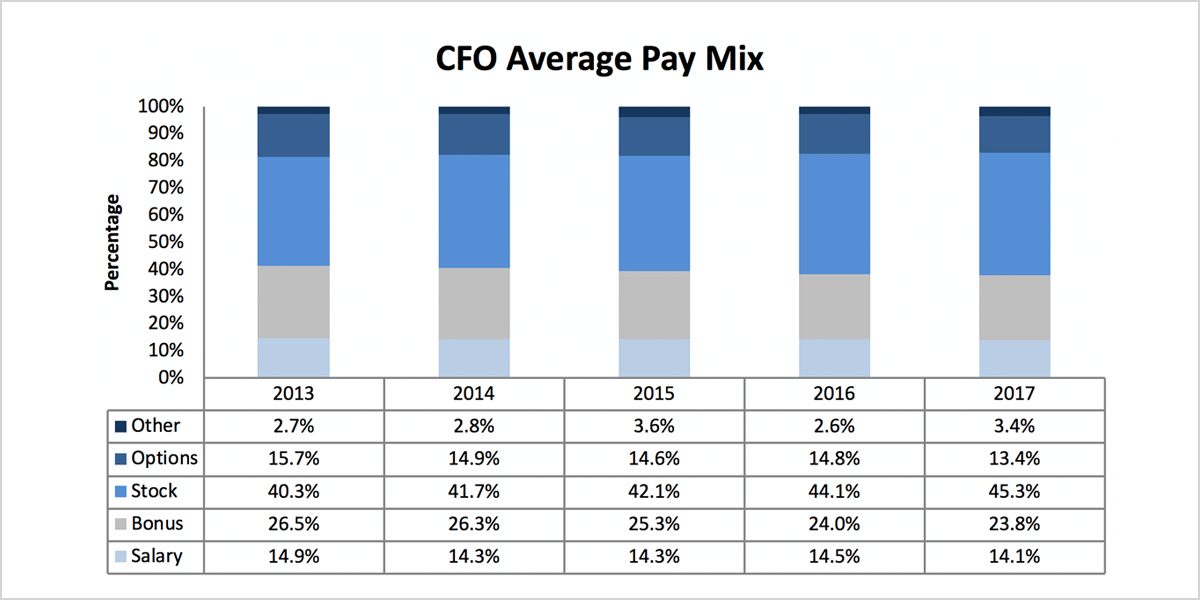

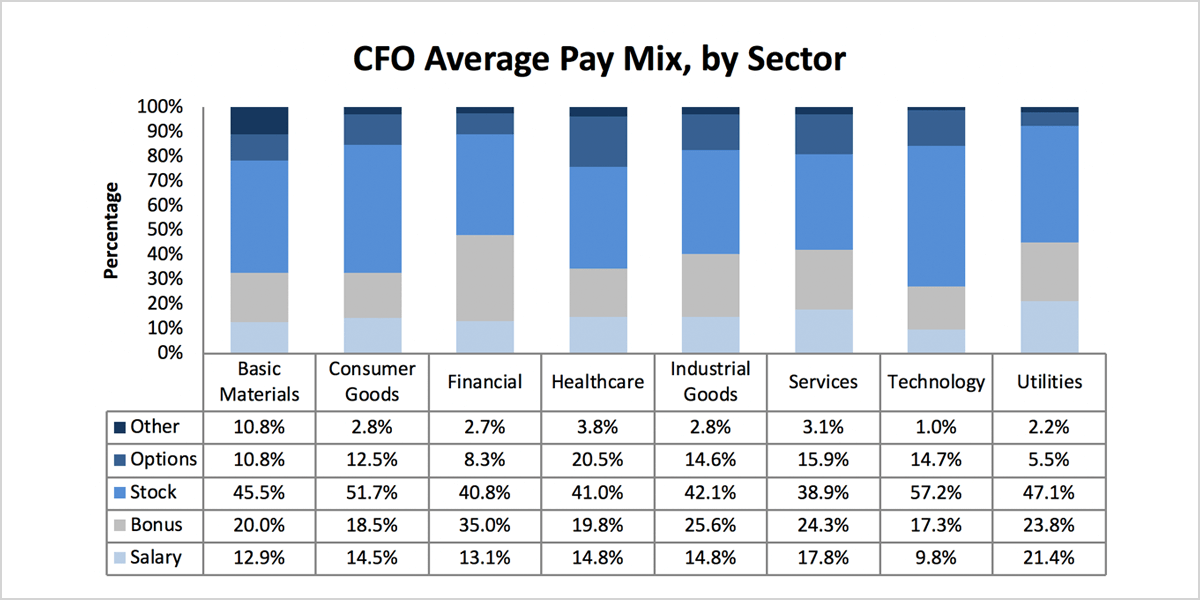

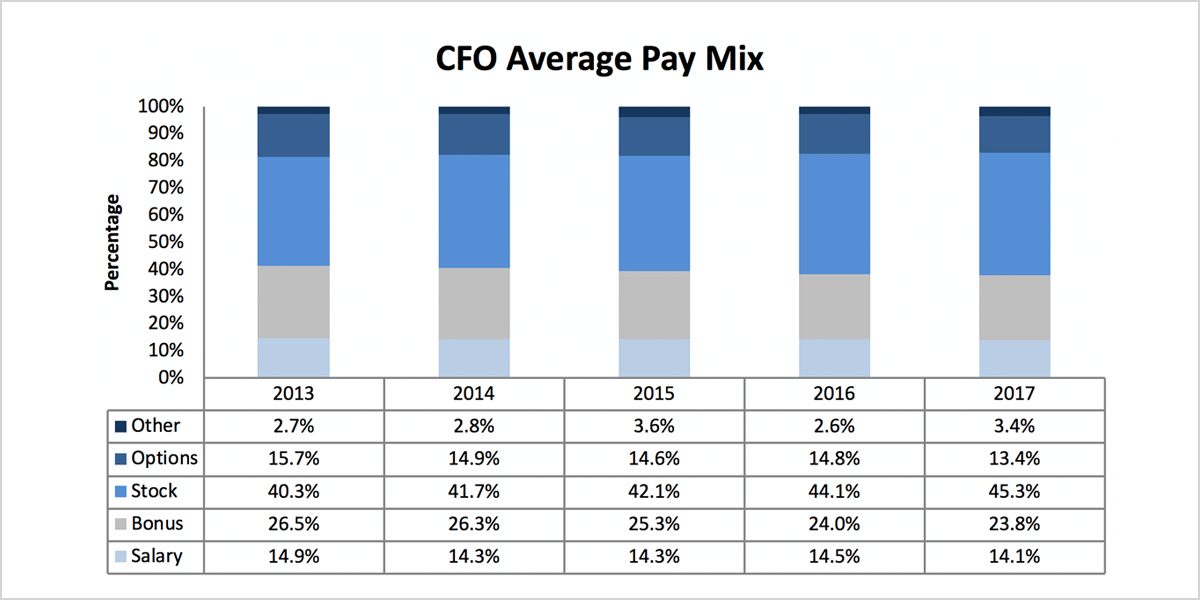

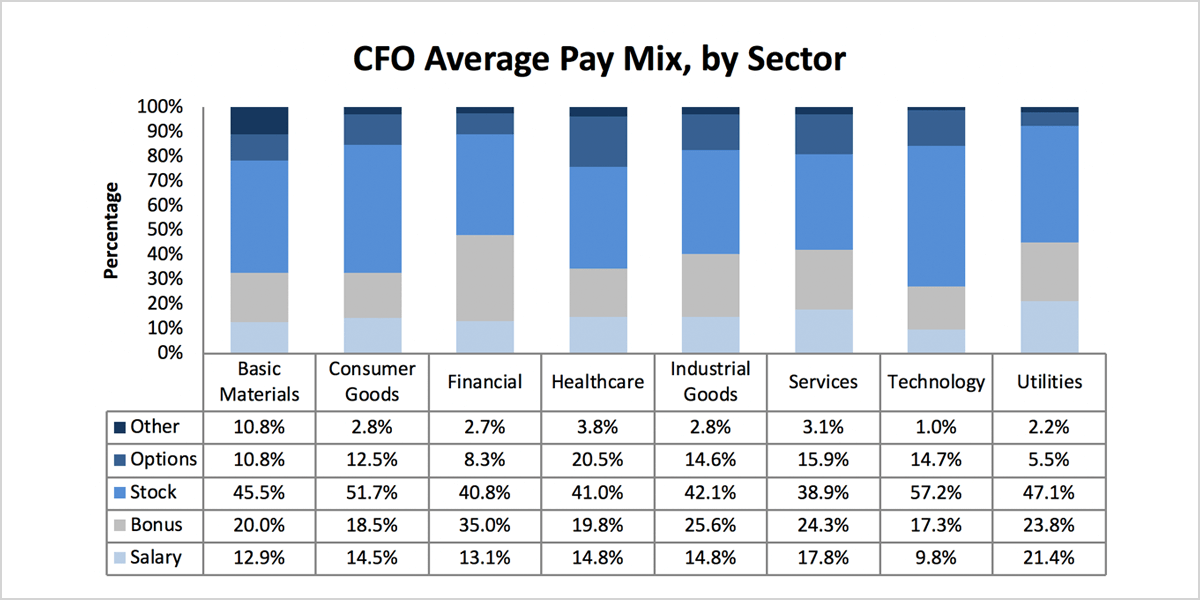

While analysis of overall compensation can be useful, breaking down the components of CFO pay can provide more details. For the past five years, trends of CFO pay mix have been nearly constant, with stock representing little less than half of total compensation, bonus comprised a little less than a quarter, and options and salary making up the smallest percentage of average CFO pay. Similar to median total compensation, the technology sector is an outlier when it comes to pay mix. Stock compensation makes up over half—57.2%--of the average technology sector CFO’s pay, one of only two sectors, the other being consumer goods, with stock over 50%. Comparatively, the financial sector had the lowest average stock compensation mix at 40.8% of the overall pay mix. Additionally, there have been some small changes in CFO pay mix trends. Stock prevalence has gradually increased by five percentage points over past five years while options prevalence has decreased by 2.3 percentage points.

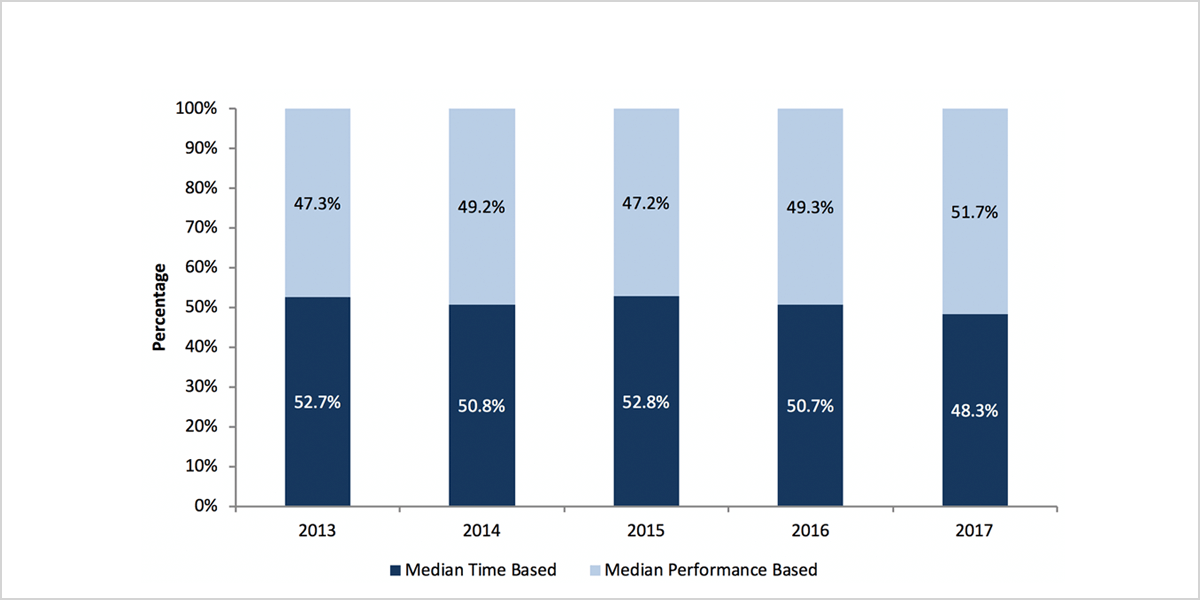

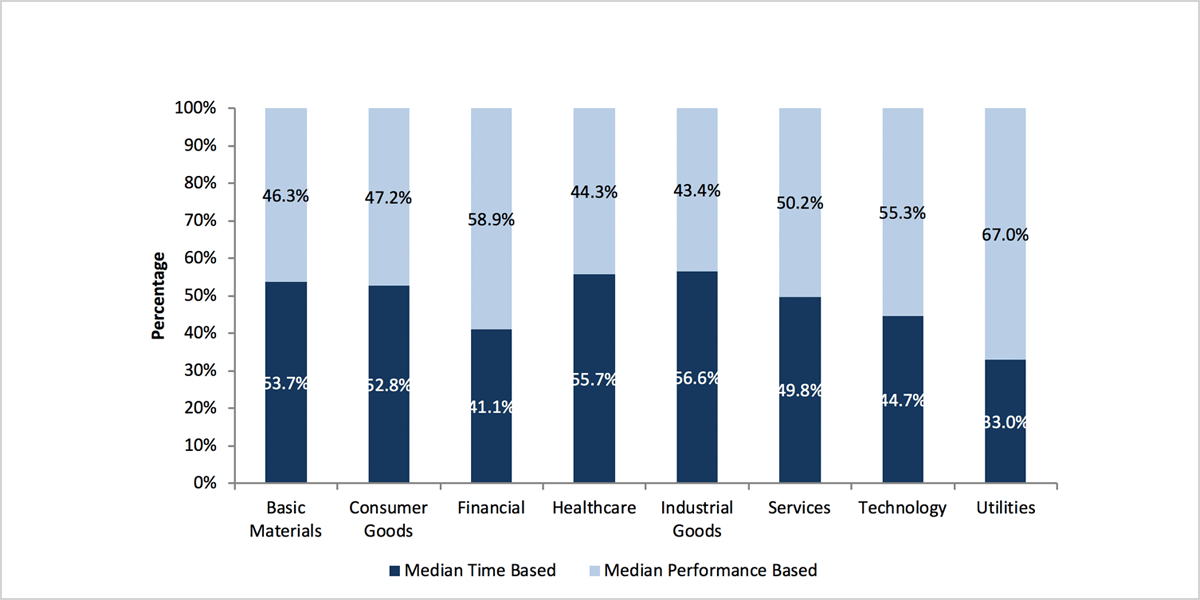

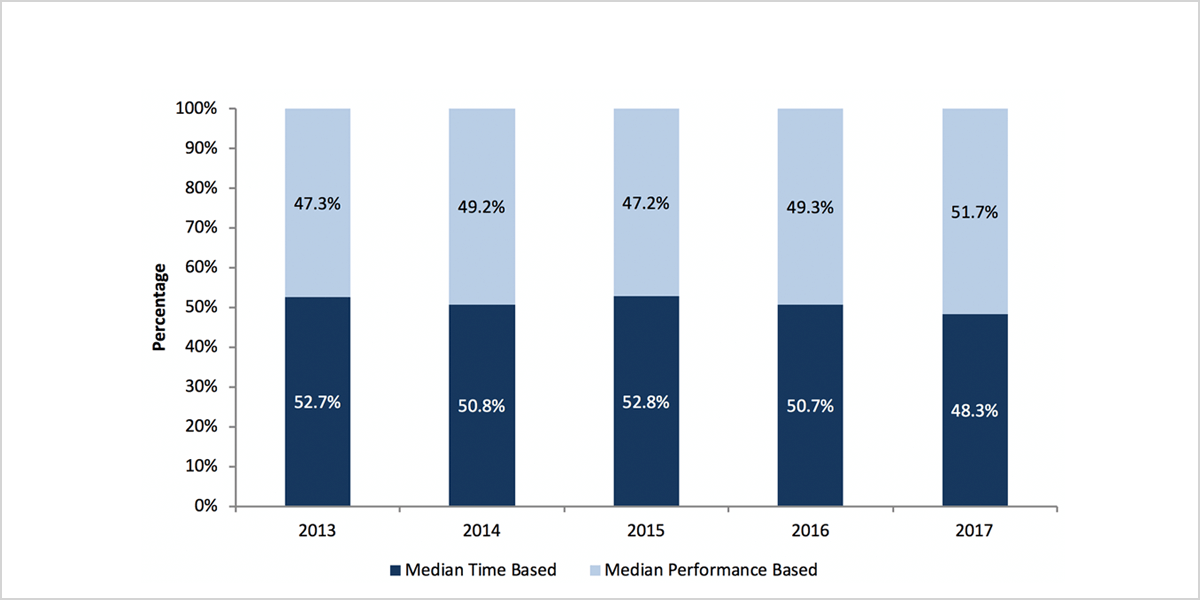

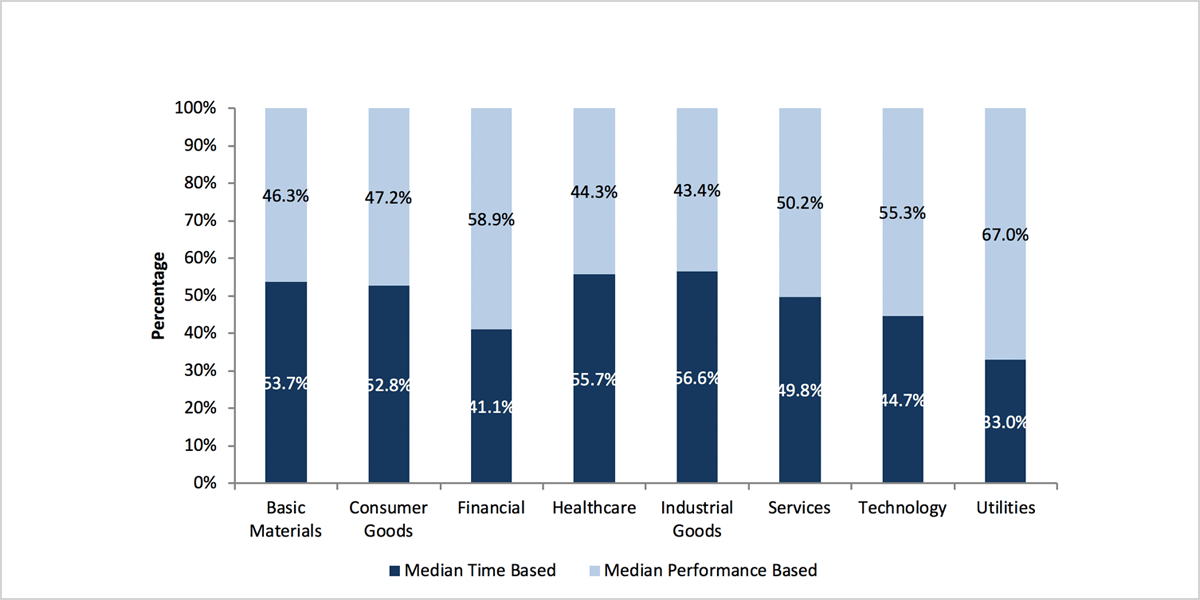

While performance-based compensation has increased in relation to time-based compensation for CEOs, CFOs are still compensated approximately equally in both forms of equity. CEO performance-based compensation increased by 10 percentage points over past five years, while performance-based compensation of CFOs only increased slightly less than five percentage points over the same period. With regard to that slight increase, median time-based and performance-based compensation has consistently stayed at around a 1:1 ratio over the last five fiscal years, only becoming majority performance-based in 2017. Again, a few sectors are outliers in this equity pay mix. Median performance-based compensation for CFOs in the financial and utilities sectors is significantly larger than it is in other sectors, at 58.9% performance-based to 41.1% time-based in the financial sector, and 67% to 33% in the utilities sector. Additionally, the services sector exhibits the least disparity, almost split directly down the middle.

The chief financial officer is an extremely important cog in the machine that is a company, yet compensation seems to have stalled over the years. However, beginning in the most recent year, median performance-based awards became more prevalent than median time-based, a potential sign that CFO pay is becoming more modernized. While not necessarily the same criteria as CEOs in terms of compensation, the ability to fairly compensate a CFO in the eyes of both the executive and the shareholder is vital to companies.

Hailey Robbers, Senior Research Analyst at Equilar, authored this post. Please contact Amit Batish at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions