Empowering Growth: Warburg Pincus' Journey with Equilar RainMaker on Snowflake

April 9, 2024

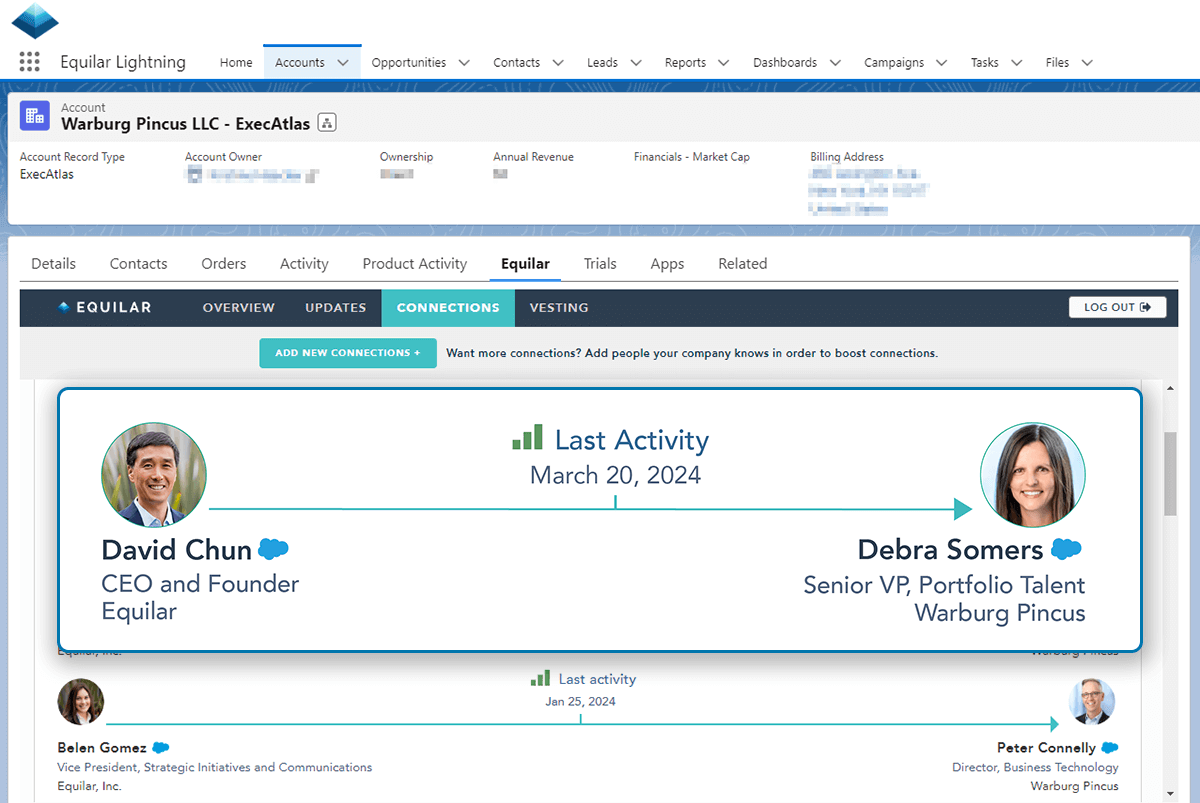

On a recent webinar hosted by Snowflake, experts from Equilar and Warburg Pincus underscored the importance of data-driven decision-making, collaboration, and leveraging advanced technologies to stay competitive in banking and private equity. Peter Connelly, Director of Business Technology at Warburg Pincus, joined Tom Gray, Financial Services Marketplace Principal at Snowflake, and David Chun, Founder and CEO of Equilar, for the discussion.

During the executive panel, the speakers addressed key priorities and challenges in the banking and private equity sectors, as well as the role of data strategies and AI initiatives.

Tom: What are some of the key challenges or workflows that you're looking to solve today?

Peter: Private equity, probably like all industries, continues to shift. Finding an interesting deal opportunity in 2022 is not necessarily the same criteria that define an interesting deal opportunity today. That truism exists across all of our business units. So that's challenging for us. It creates a matrix of deal attributes that are interesting to various teams. Thinking about flexibility and optionality – those are challenges for us to manage all of that.

Tom: What are some key considerations when you're building out a technology and enterprise data strategy like you've done at Warburg Pincus?

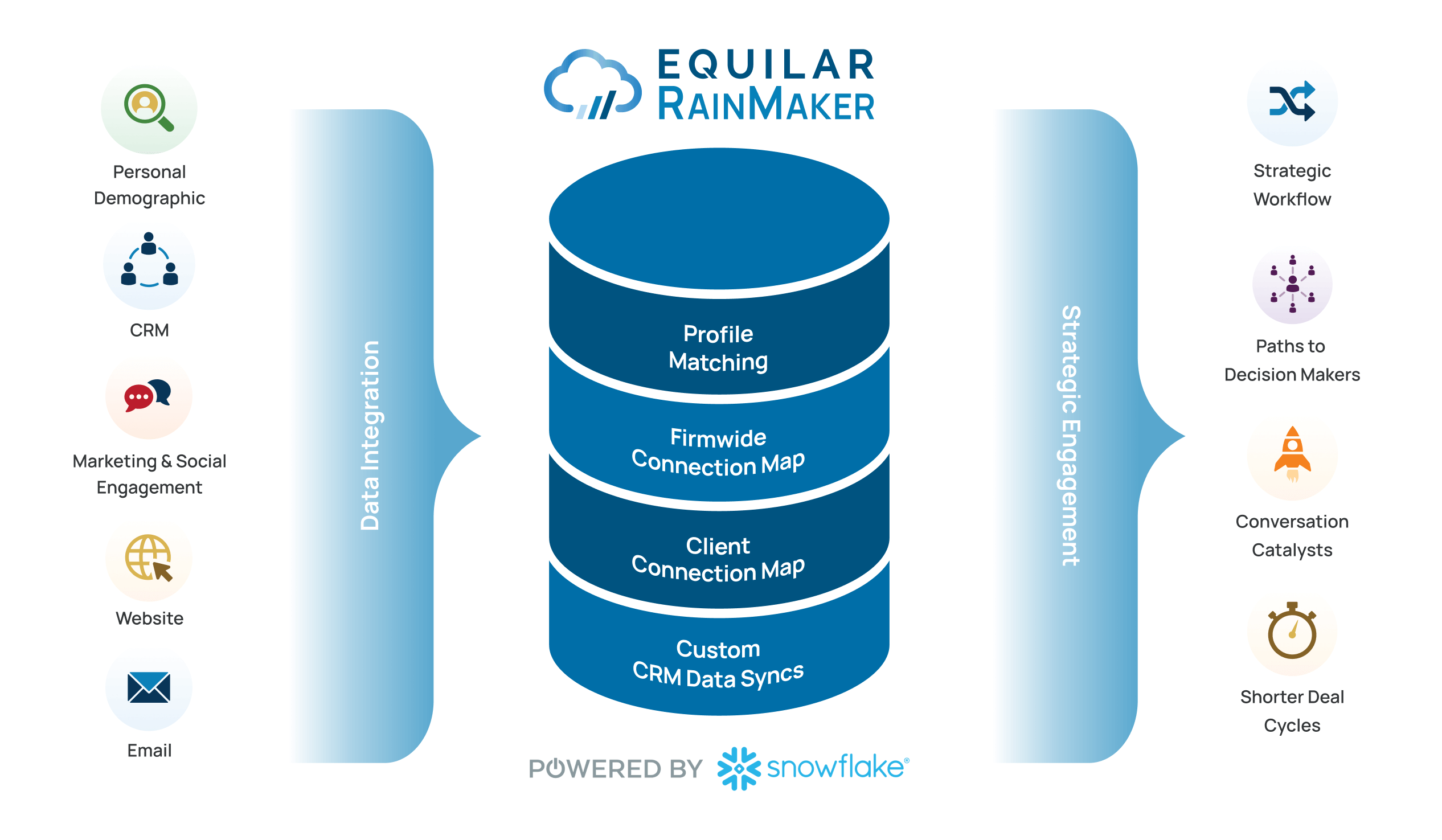

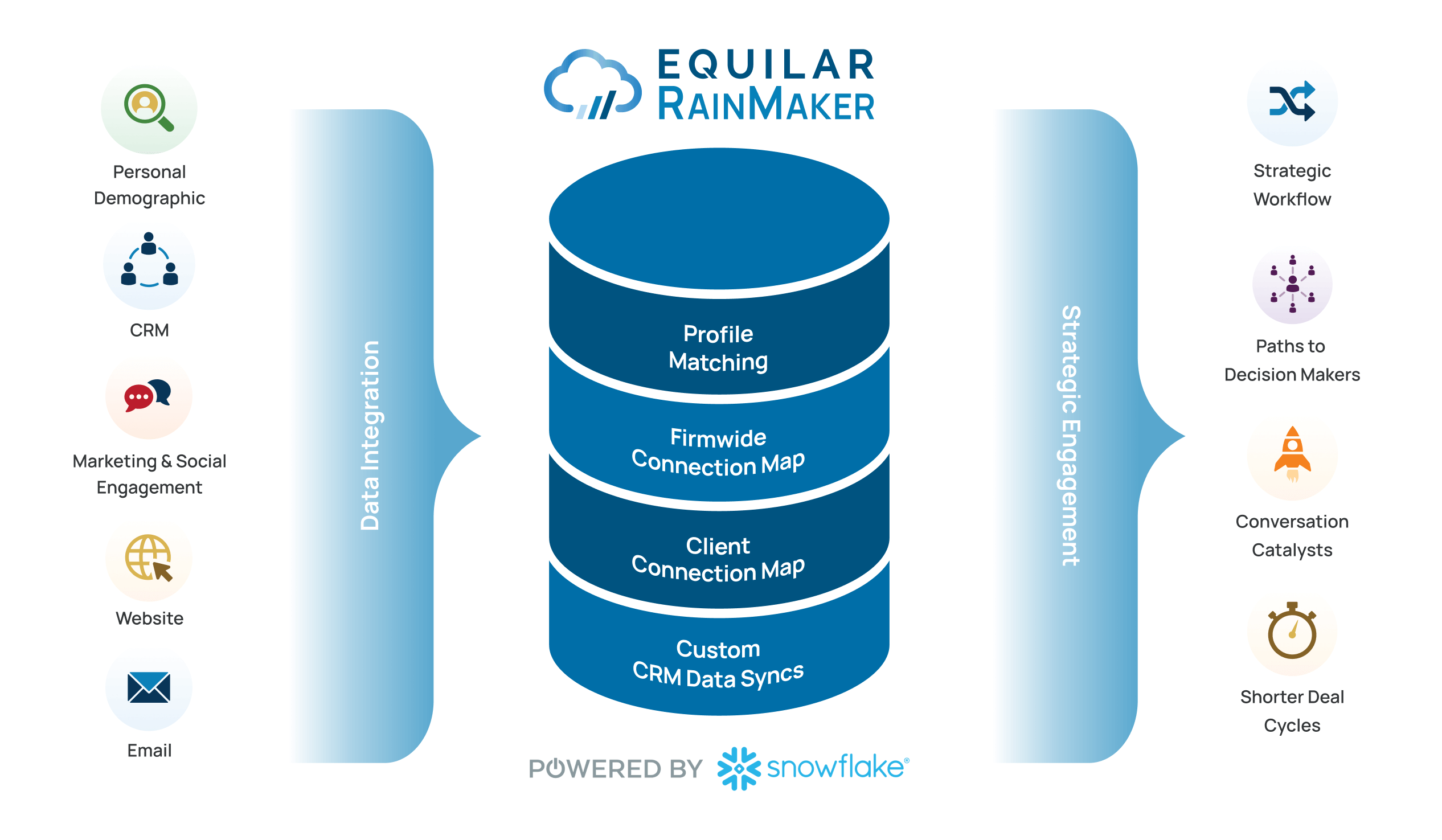

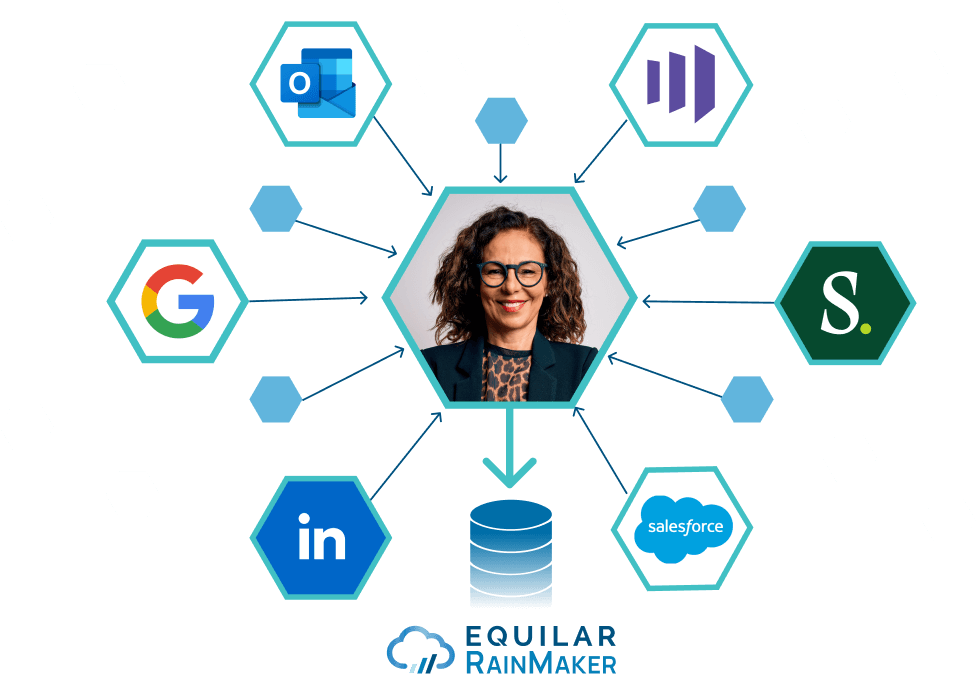

Peter: Flexibility is a primary consideration. We need to be able to adapt to this changing environment, whether that's a new asset class or just a general change in priority. Time to market; of course, we don't have the luxury of taking a year to implement technology or data solutions. I don't think anybody does. With third-party data, the ability to easily and quickly ingest that data, share it, break down those data silos, and combine that data with ours – those are key considerations when we looked at tools like Equilar RainMaker.

Equilar RainMaker Powered by Snowflake

Tom: Third-party data is obviously near and dear to our hearts. David, on that topic, of building RainMaker as a foundation, why do you think it's critical for organizations to think about data strategies and how tools like Snowflake native apps and RainMaker can fit into that strategy?

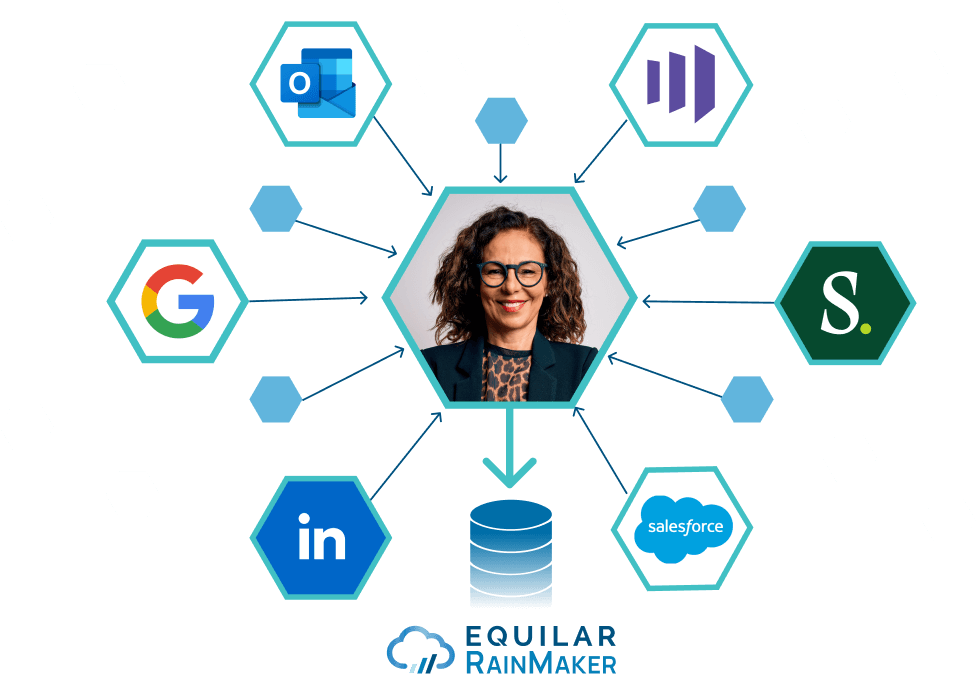

David: At the end of the day, why do you need data? It's to be able to make decisions. You want to ensure you make informed and accurate decisions. As Peter pointed out, we're in a sea of data. We're just being flooded with it. It's not a quantity issue. It's a quality issue. The key here is to recognize there are disparate data silos, and you can aggregate it all. Then, you look for opportunities to enrich what you have. It's a classic one plus one equals three where we're able to take what's sitting in, for example, Warburg Pincus' email server and then layer on our data to say, “Look, these executives that you know that you've been working with or emailing, look how they're connected to all these other individuals.” Now, all of a sudden, we've built this incredible asset that you didn't have before.

Centralized Relationship Intelligence

Tom: Are there any other priorities that stand out to you that will be top of mind for the industry this year?

David: What we're seeing is a tremendous amount of interest from business leaders like Peter recognizing the rise of Chief Data Officers and Chief Digital Officers, and PE firms are recognizing that they've got all these assets. They recognize the need to unify the data to build a strategic asset. Take a great firm like Warburg Pincus. They have an amazing network of executives that they've worked with over the years. To be able to harness those relationships across various teams within Warburg, it's exciting to see firms recognizing that opportunity.

Peter: I think the obvious ones are always top of mind, like data security and Gen AI. What we're focused on is the increasing complexity and competitiveness of the industry overall. Thus a need for data solutions, not just for operational efficiencies, but also to enable intelligent decision-making.

Tom: The last year can only be described as the year of generative AI. Peter, can you speak about how the financial services sector should be thinking about AI initiatives?

Peter: I hesitate to tell all financial services how to think about it. I'll tell you what I think about it. I think the most important focus is the outcome. What problem statement are you trying to solve with the AI? I think that's challenging in the current environment where AI is like this open spigot, where everybody thinks everything can be solved with AI. That leads to the second thing that's top of mind for me, which is education. What does it take to implement an AI solution? How do you get your users to understand what the actual art of the possible is? Then, the third top-of-mind issue for me is partnership and alignment. Bringing the business and technology close together meaningfully so that the solutions are accounting for workflow and process. Too often these solutions are created in a vacuum. I think that risk goes up substantially in this kind of energetic and excited atmosphere. So, it's a little bit of a caution statement. Get back to some of the basics and remember you're trying to solve a problem.

David: I can't agree more with Peter. Watching CNBC right after the holidays, they were talking about AI. There was a quote that less than 10% of companies actually have the data, the foundation data layer in place to really effectively take advantage of AI. As Peter pointed out, there's a rush to move fast but it's critical to get the house in order. If you've got data models that are flawed, you can throw the best AI at it but you're going to get flawed results. You're going to get hallucinations. There's a series of steps that need to be done upfront. You need to understand what you're trying to solve and make sure you have the best data assets to support, so you get the results that you expect.

Tom: Peter, why did Warburg Pincus select Equilar and Snowflake to support your strategic growth initiatives?

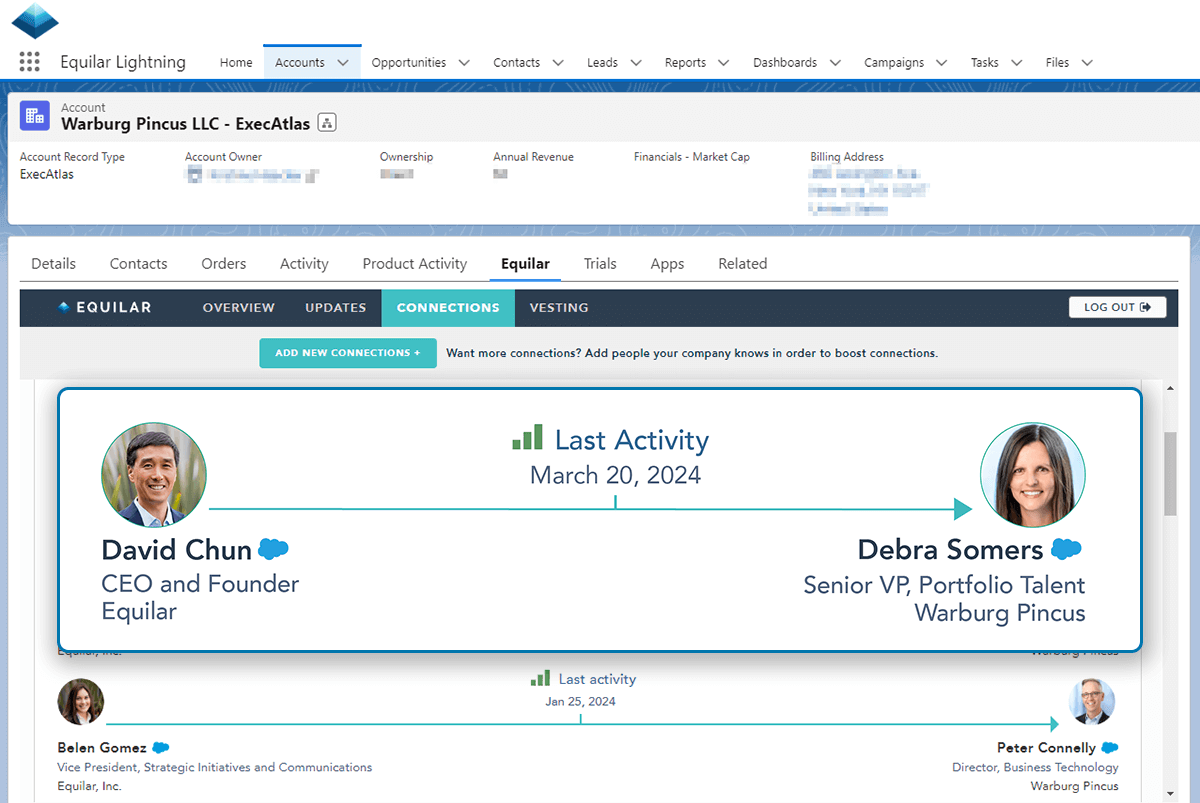

Peter: The RainMaker solution surfaces information in a very easy to consume format. Our dealmakers need to look at a glance, glean intel, and take action. Our users are doing prospecting work inside of our CRM. Surfacing relationship intelligence where they're already working is very important to us. The RainMaker tool enables us to visualize our own relationships across the firm and our portfolio companies. Combining all this great information with Equilar and Snowflake provides a holistic picture to identify the strength of the relationship. How meaningful is it? Then, deal maker A has a good sense of whether to contact deal maker B. They have a good gut instinct of whether that's worth their time. It provides a starting point. It's a visual starting point for these teams to take action. That's pretty impressive.

Seamless CRM Integration

Tom: By the year 2030, do you have predictions about how top financial services organizations will be doing in terms of investments in data, AI, and cloud collaboration?

David: I think you touched on it a second ago. It's the collaboration aspect of things. We feel very fortunate to be part of the Snowflake ecosystem because of our ability to quickly get RainMaker up and running for Peter. Not only getting up and running but also maintaining it. Once the data is there, being able to push that out and share it with the teams and systems that would most benefit from that information is critical.

Peter: It's very hard to forecast out to 2030. As I think about this, it's actually happening now. We've talked about all the pieces. You get to a great AI outcome, and how you think about it and approach it. The data is key. So for me, these partnerships become ever more important. That's a lens for me that I'm thinking about. Which third-party providers are thinking this way and on the leading edge of this? Think about their data, not as silos, but as a collaborative tool to really share with clients. No data provider is ever going to get the solution right in a vacuum. Every firm like Warburg and others, they're going to want to ingest it. They're going to want to apply their own thinking, logic and AI against that, and they will want to do that very quickly. They're going to want to be able to be very flexible and change. So providers that are thinking, how can I start to really collaborate and share this data with my clients? That's going to be important. Fundamentally getting these solutions in place supports that framework. Snowflake, RainMaker – these are very important solutions to us because they let us ingest data quickly and get to those outcomes quickly. So that's how we're thinking, and I can't see that changing anytime soon. It's just going to compound and become even more complex and challenging, but it's also super exciting. It's a really exciting time to be working in this space.

Tom: Any final thoughts, maybe any takeaways you guys want to leave?

David: I would just point out that the native app makes it very easy to go in and start with your LinkedIn connections, and quickly see some results. When people see RainMaker in action, the reaction is typically, oh, that's pretty amazing! We're excited to be able to share that with everybody.

Peter: I would say, if you're interested in this, dive in. David and the team have been really great to work with. This is a good firm to work with, and you get to see the outcomes very quickly. You can really ingest the data very quickly, and that's meaningful.

Contact

Belen Gomez

Vice President of Strategic Initiatives and Communications at Equilar

Please contact Belen Gomez at bgomez@equilar.com for more information.

Roles

Roles