Tracking PvP Disclosures: The Latest Updates

Last Updated: June 9, 2023

Amit Batish

Without a doubt, the 2023 proxy season will be headlined by the implementation of new SEC Pay Versus Performance (PvP) rules. The PvP rules require companies to disclose information reflecting the relationship between compensation actually paid (CAP) to a company’s named executive officers (NEOs) and the company’s financial performance. Indeed, the first-year disclosures will introduce an added layer of complexity as boards and compensation committees design executive pay packages for future years. As this proxy season will serve as the inaugural year for the PvP disclosures, companies face tremendous pressure to put their best foot forward to adequately tell their pay versus performance story.

To provide context into how the rules are shaping, Equilar is closely tracking PvP proxy disclosures. This segment features examples of tabular and narrative PvP disclosures captured in proxy filings and will be updated through the duration of proxy season. Equilar has also launched a PvP Tracker to track the various calculations and performance measures within PvP proxy disclosures. View the PvP Tracker for the latest updates.

Equity Methods, the industry leader in equity compensation valuation and accounting, will be providing commentary and expert insights to contextualize these disclosures and highlight any noteworthy features.

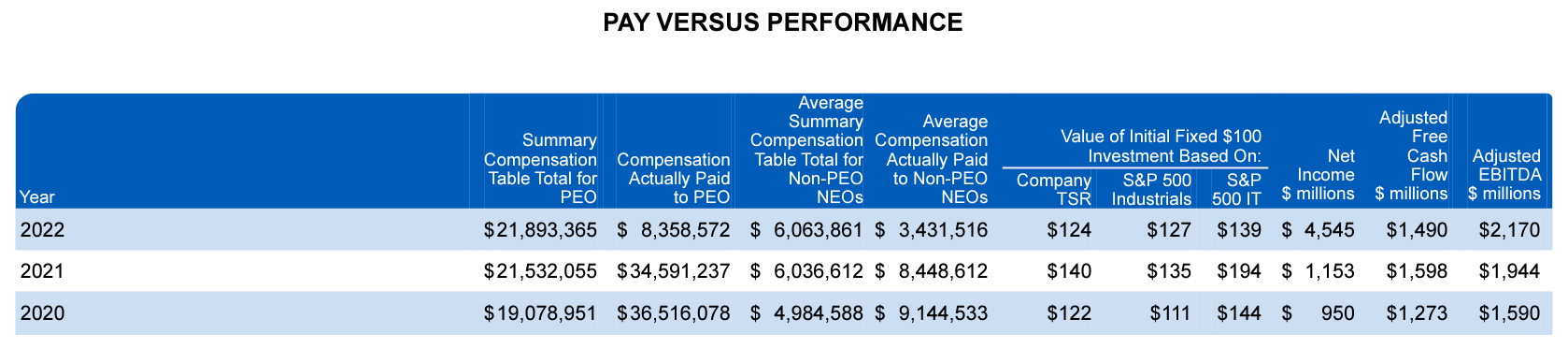

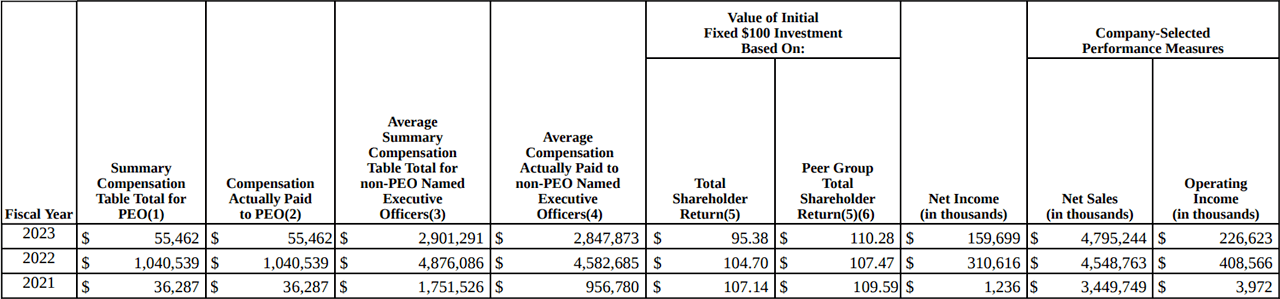

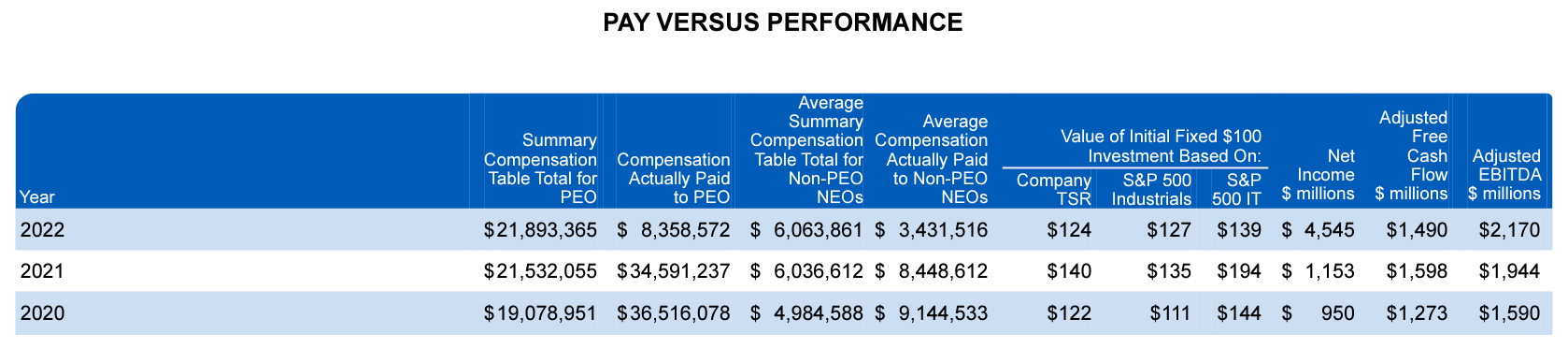

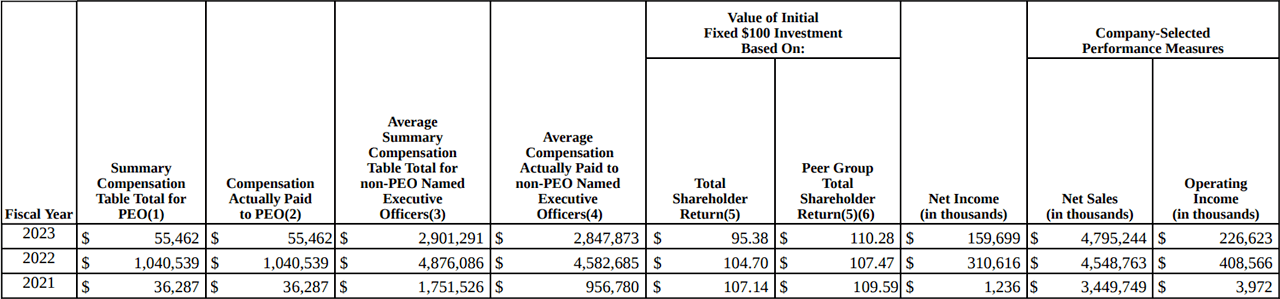

Roper Technologies (ROP)

DEF14A filed 4/28/2023

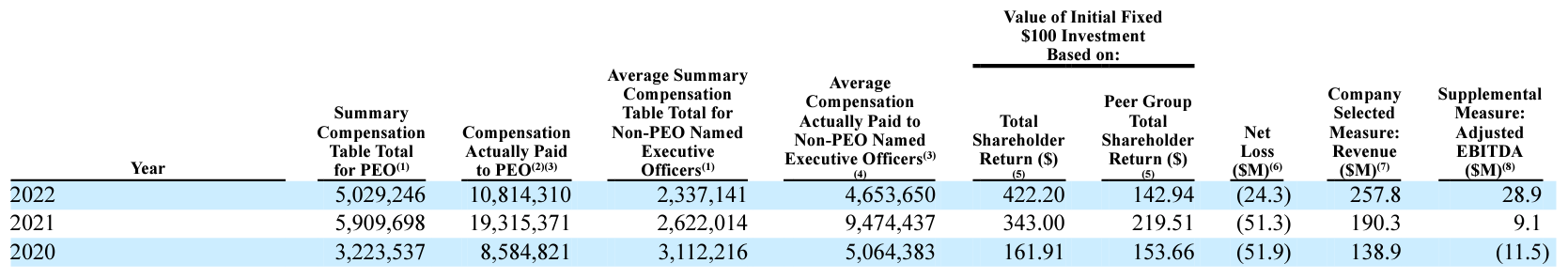

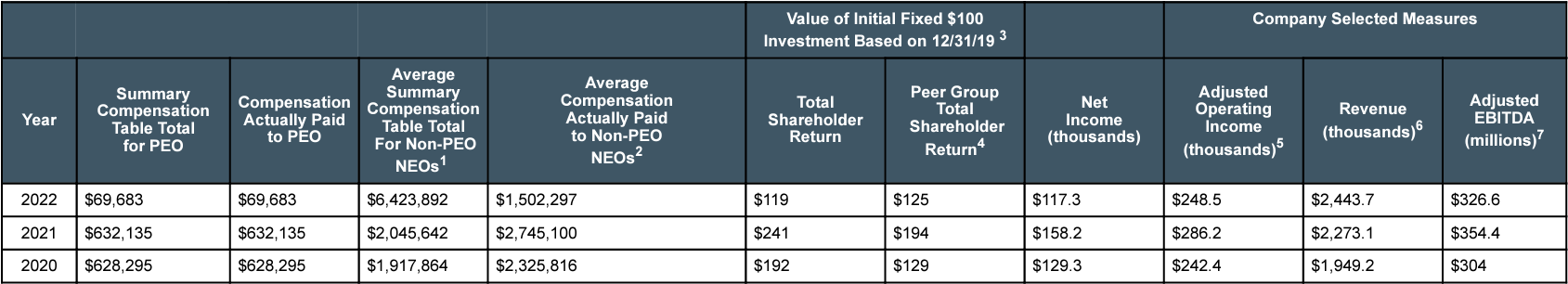

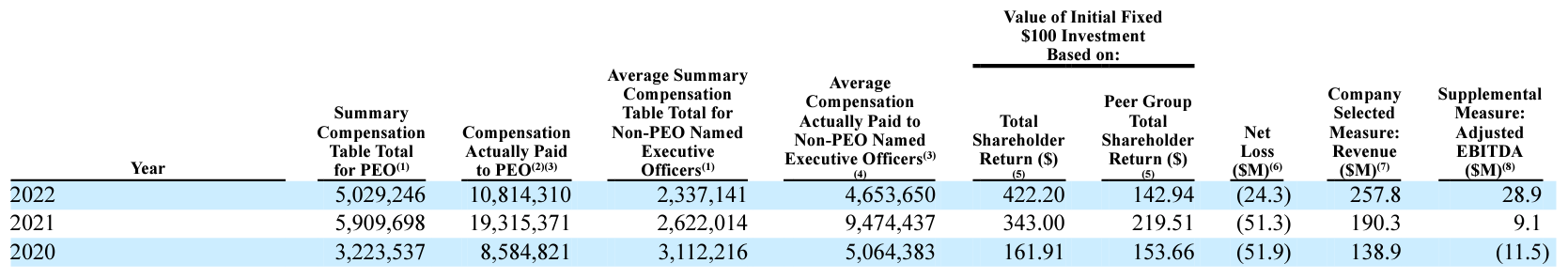

IMPINJ INC. (PI)

DEF14A filed 4/26/2023

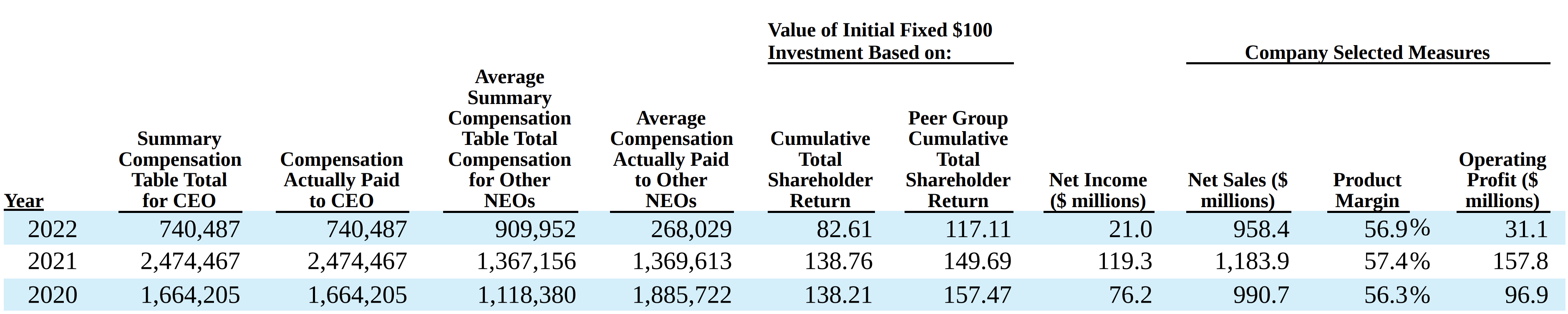

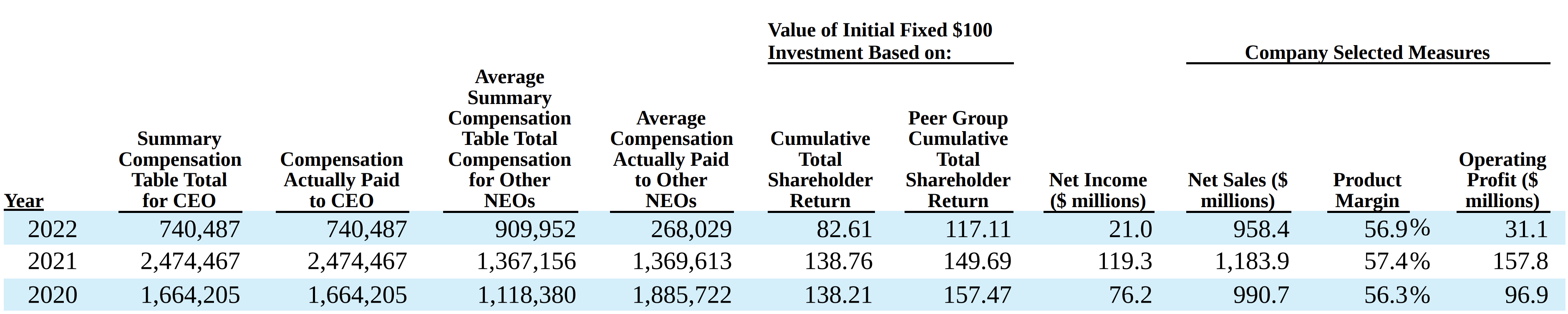

Zumiez, Inc. (ZUMZ)

DEF14A filed 4/21/2023

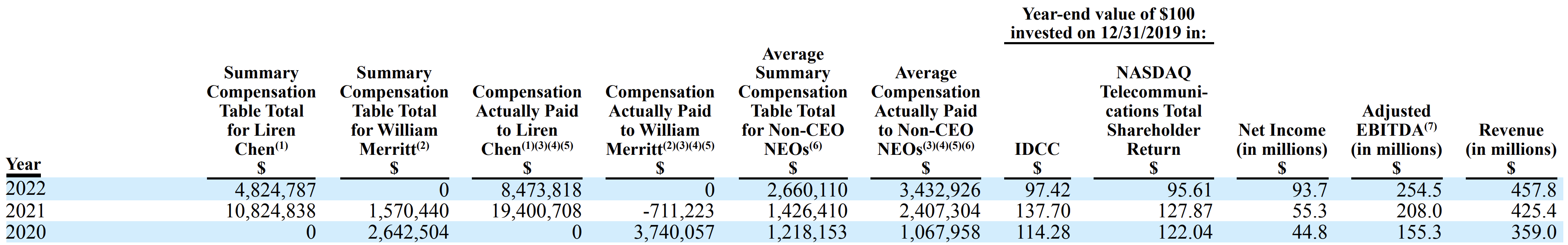

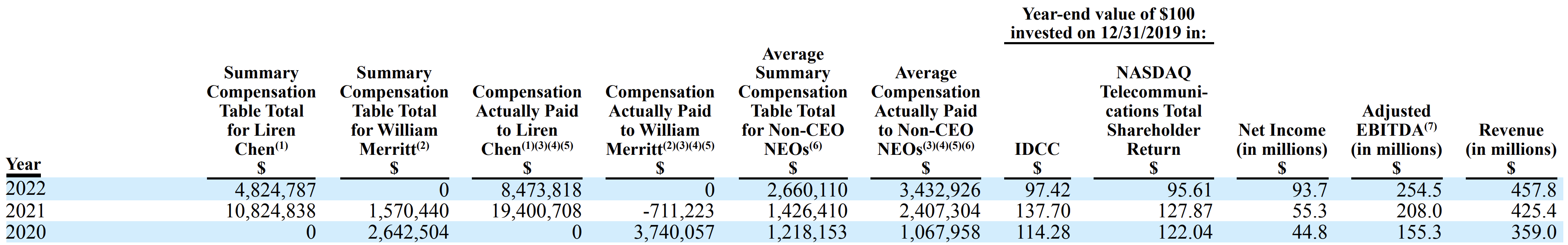

Interdigital (IDCC)

DEF14A filed 4/20/2023

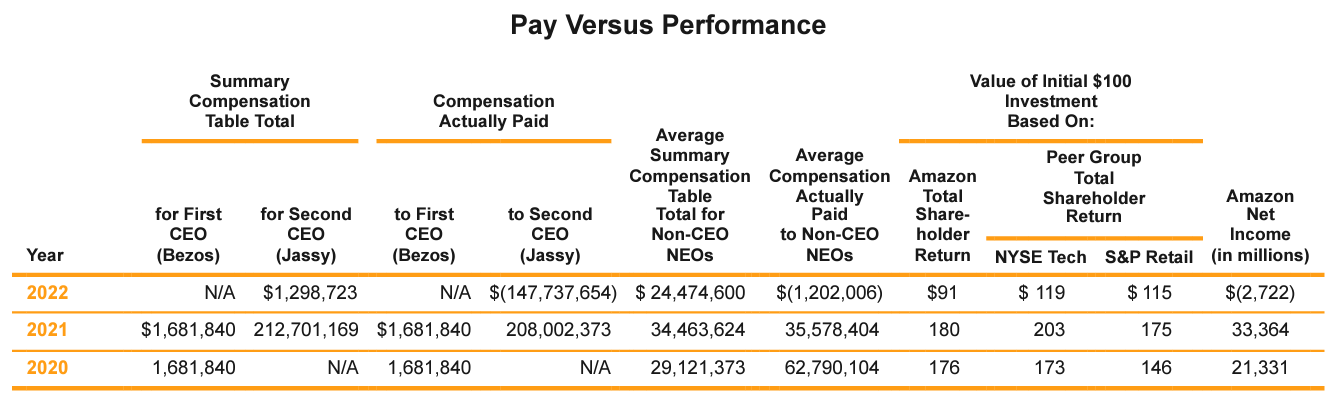

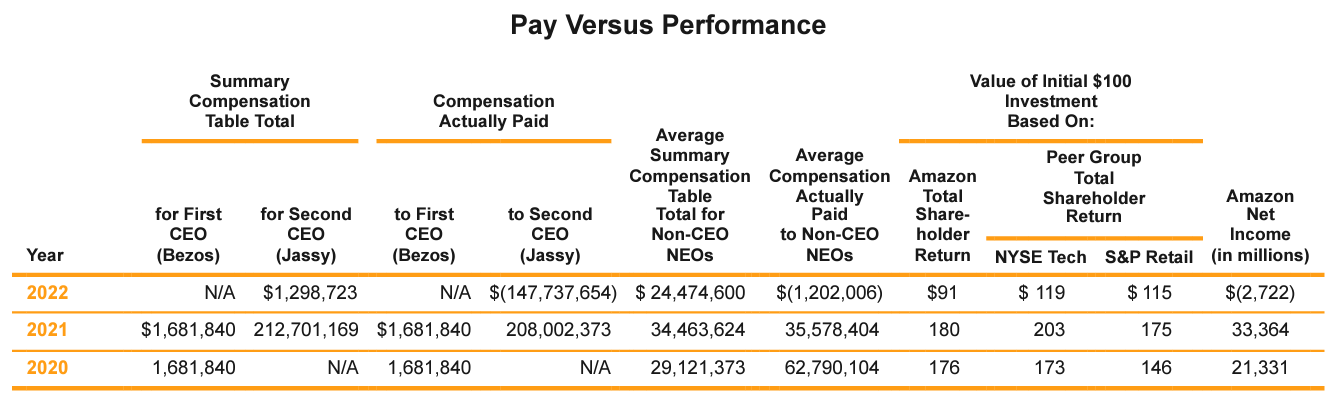

Amazon.com, Inc. (AMZN)

DEF14A filed 4/13/2023

TTEC Holdings, Inc. (TTEC)

DEF14A filed 4/11/2023

Equitable Holdings, Inc. (EQH)

DEF14A filed 4/11/2023

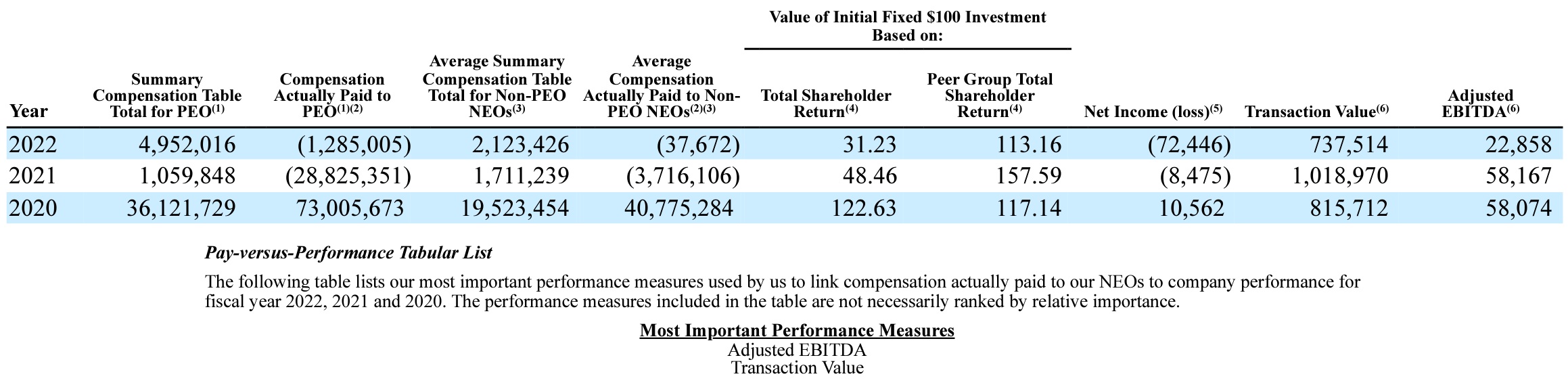

MediaAlpha, Inc. (MAX)

DEF14A filed 4/5/2023

Urban Outfitters, Inc. (URBN)

DEF14A filed 4/3/2023

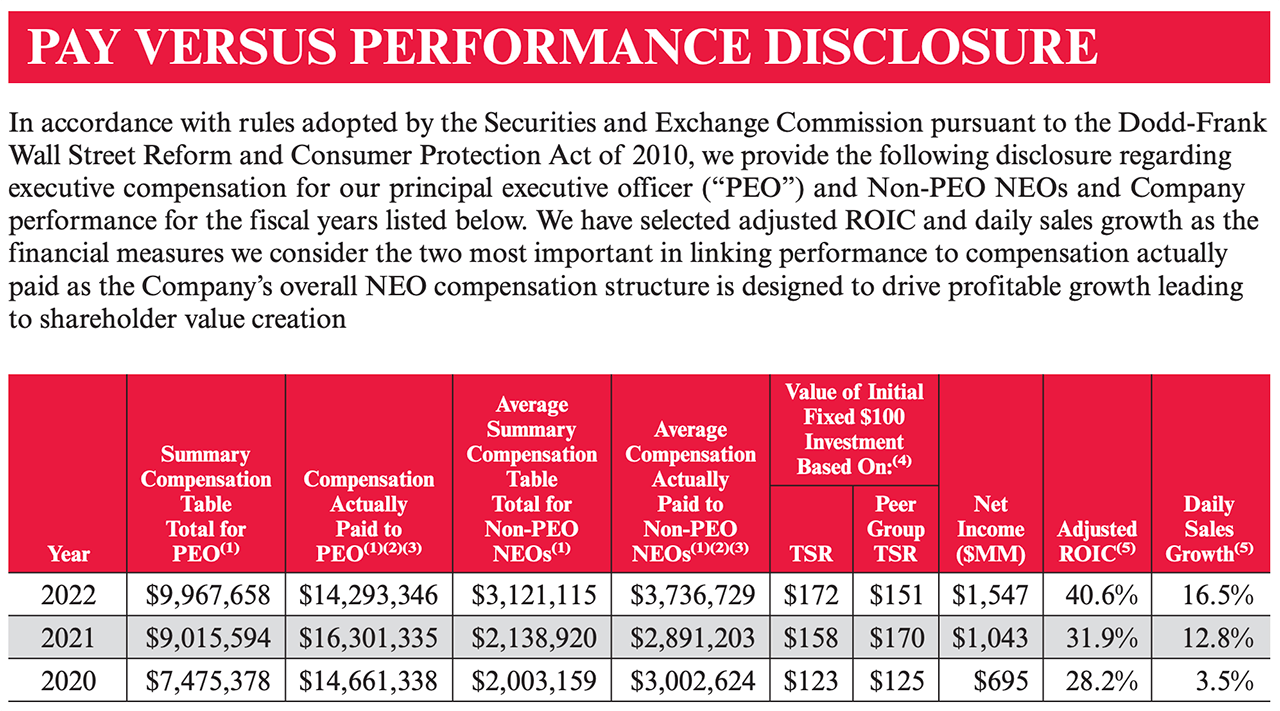

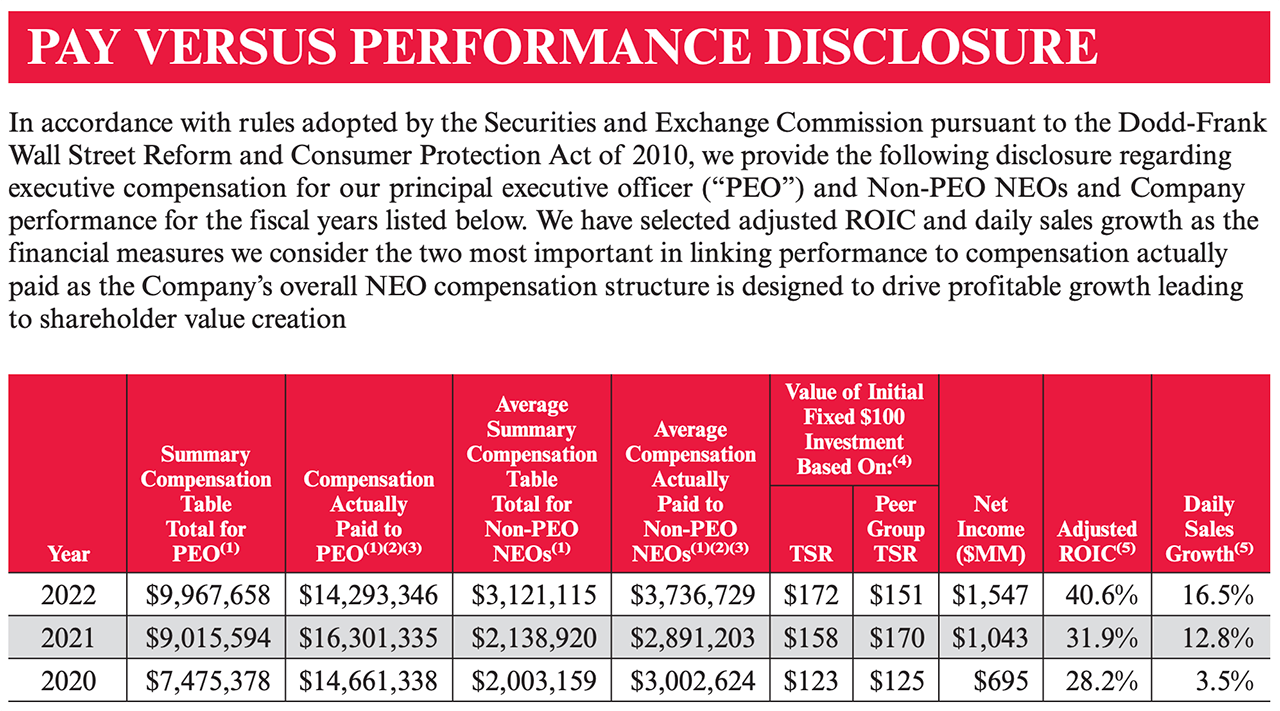

Texas Roadhouse (TXRH)

DEF 14A filed 3/31/2023

Paycom Software, Inc. (PAYC)

DEF14A filed 3/28/2023

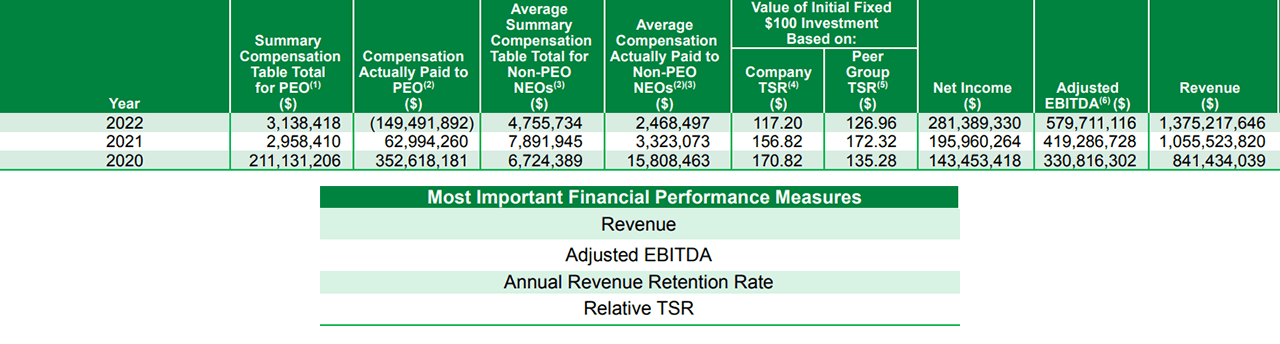

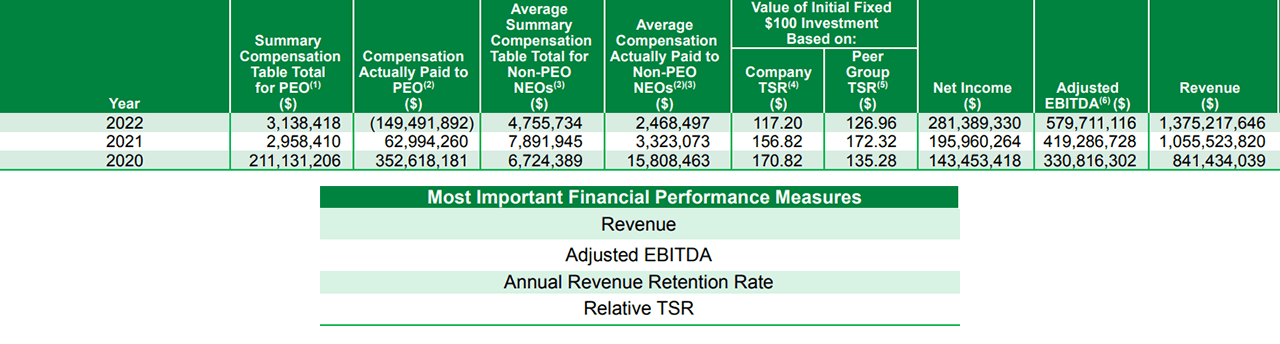

Genpact (G)

DEF14A filed 3/21/2023

ArcBest Corporation (ARCB)

DEF 14A filed 3/17/2023

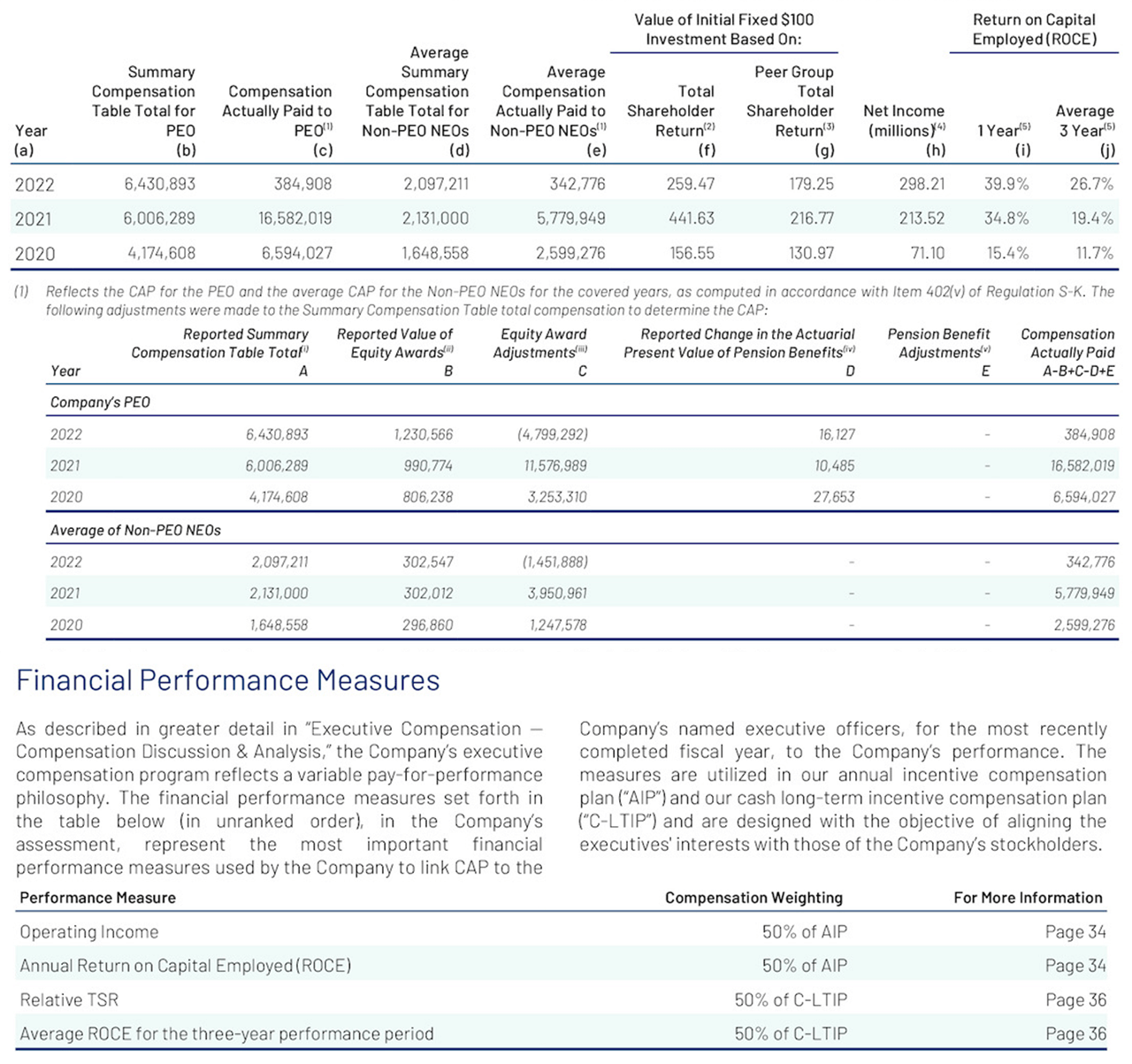

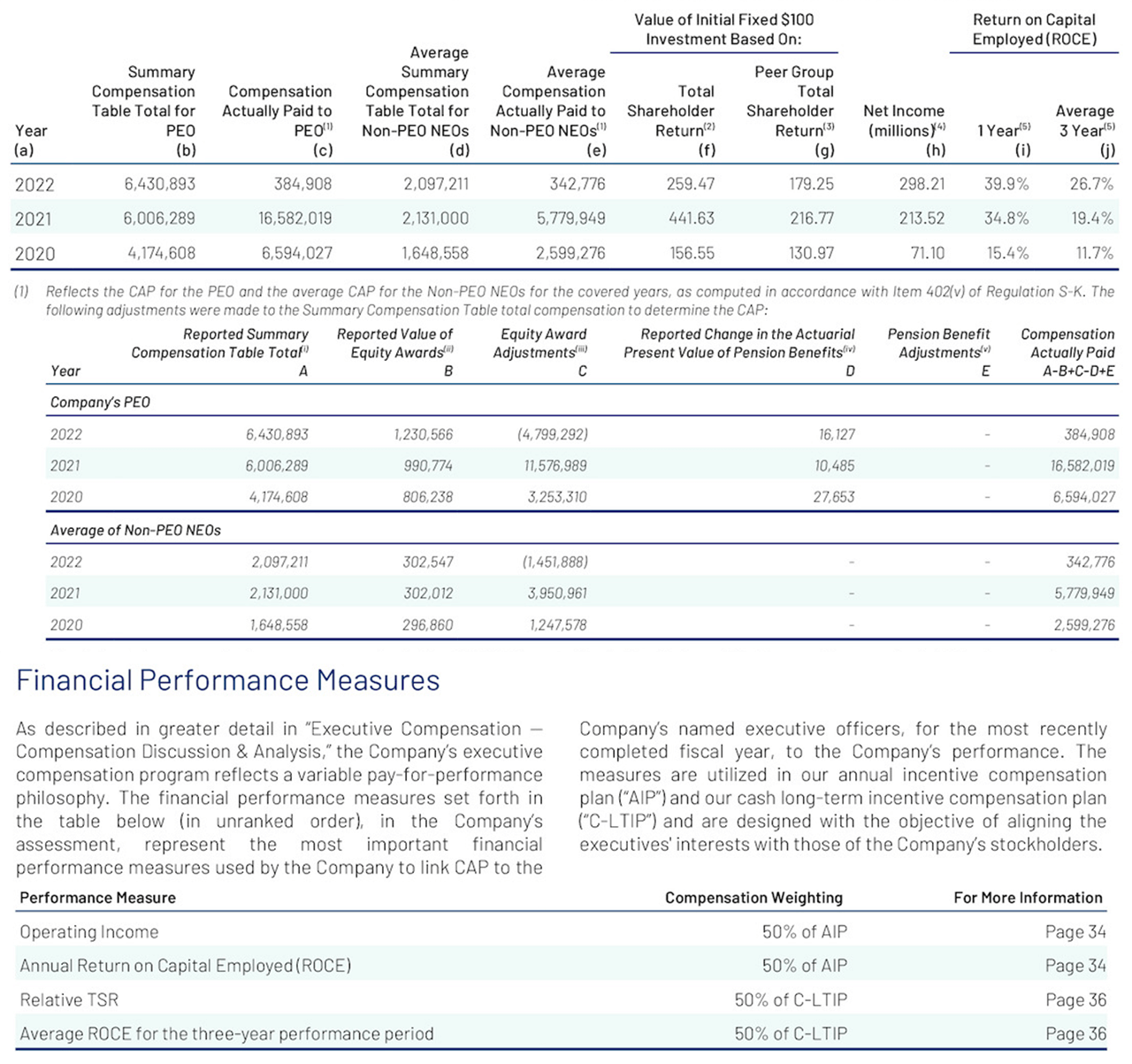

W.W. Grainger, Inc. (GWW)

DEF 14A filed 3/16/2023

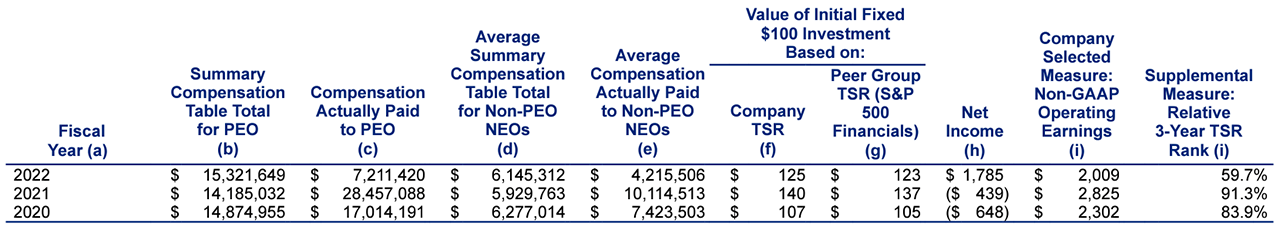

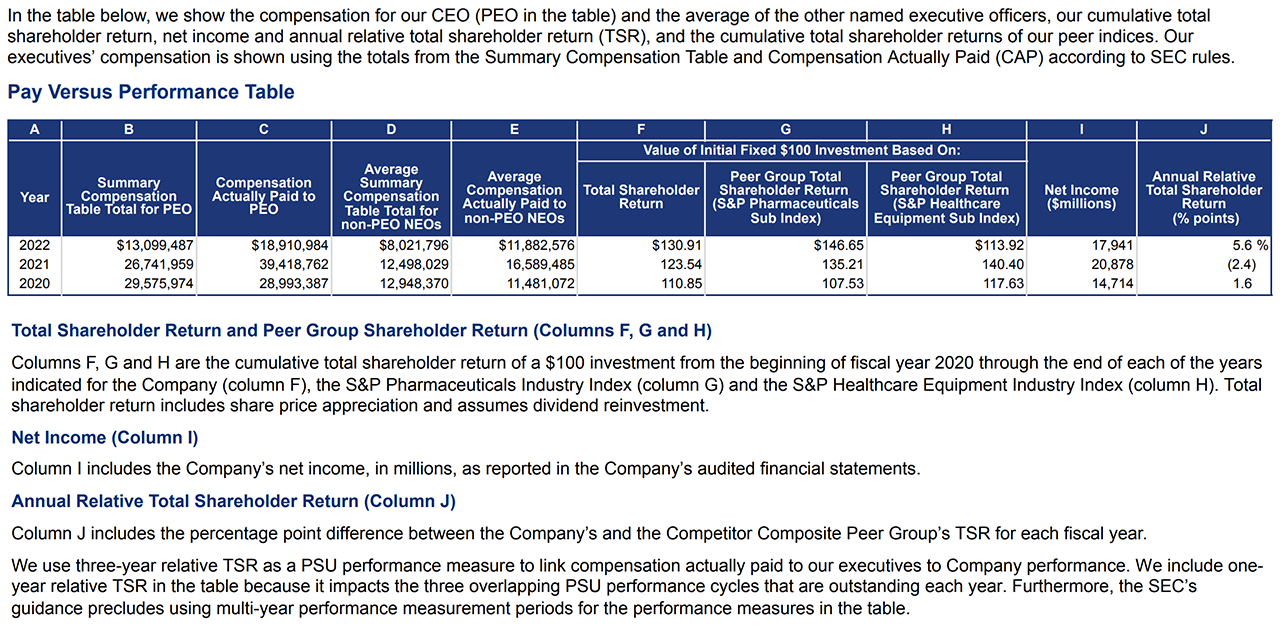

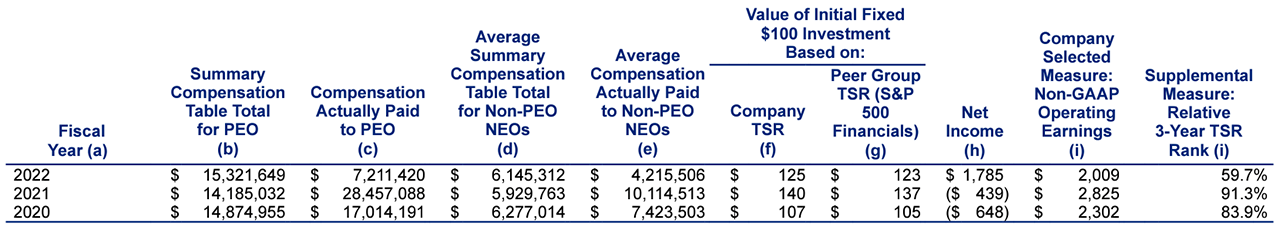

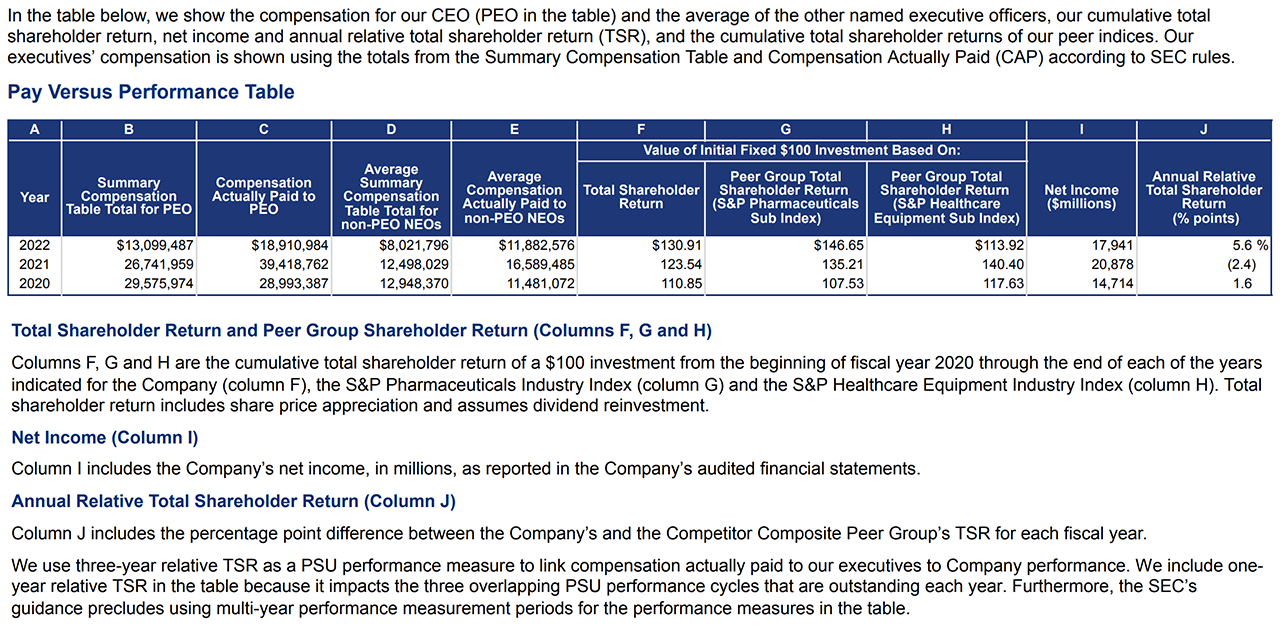

Johnson & Johnson (JNJ)

DEF 14A filed 3/15/2023

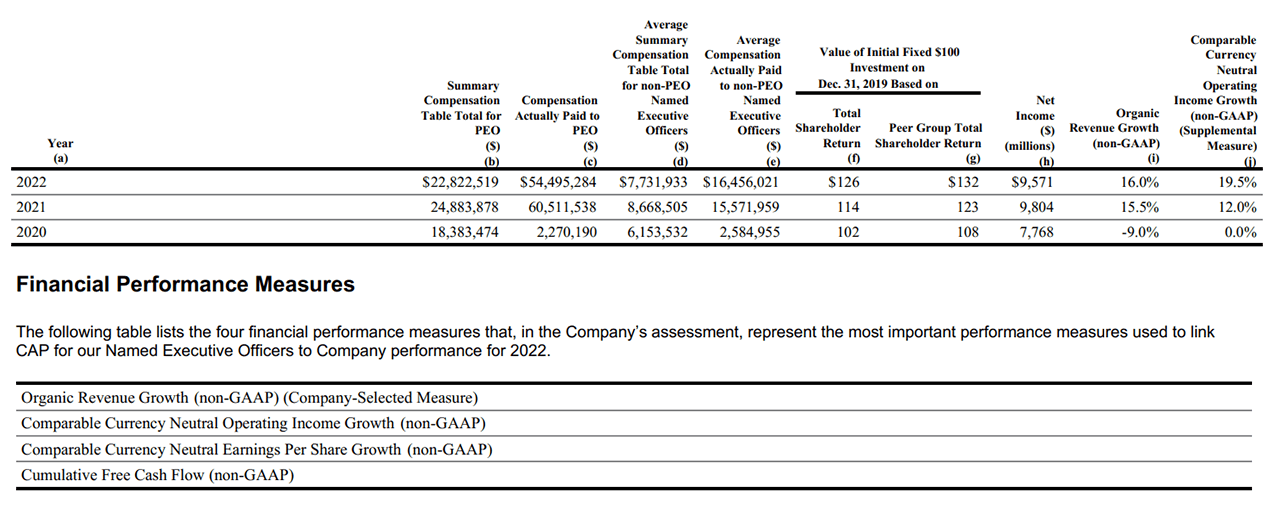

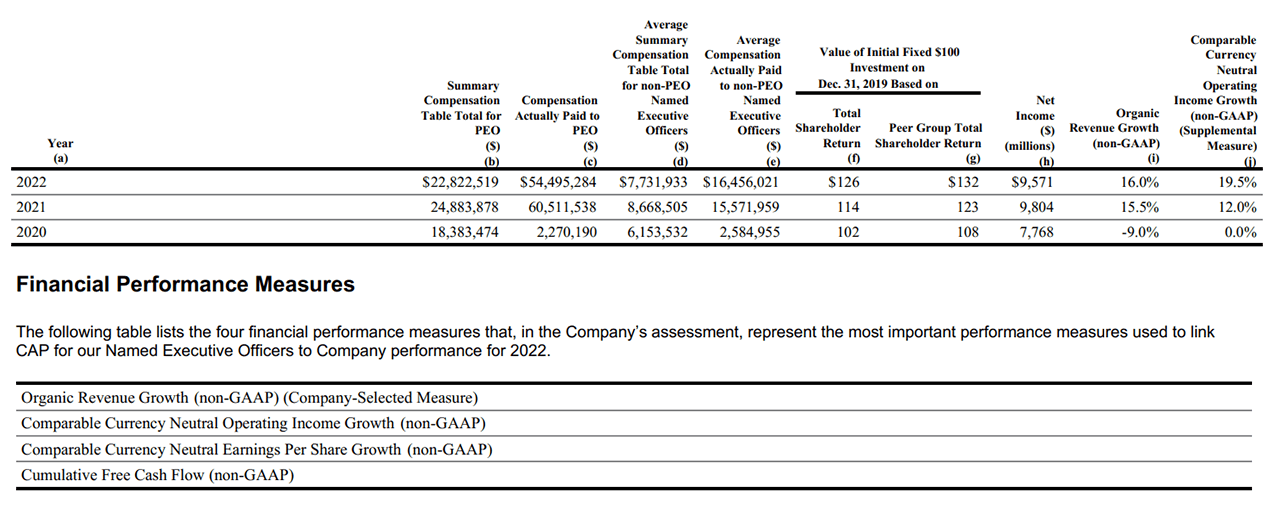

Coca-Cola Co (KO)

DEF 14A filed 3/10/2023

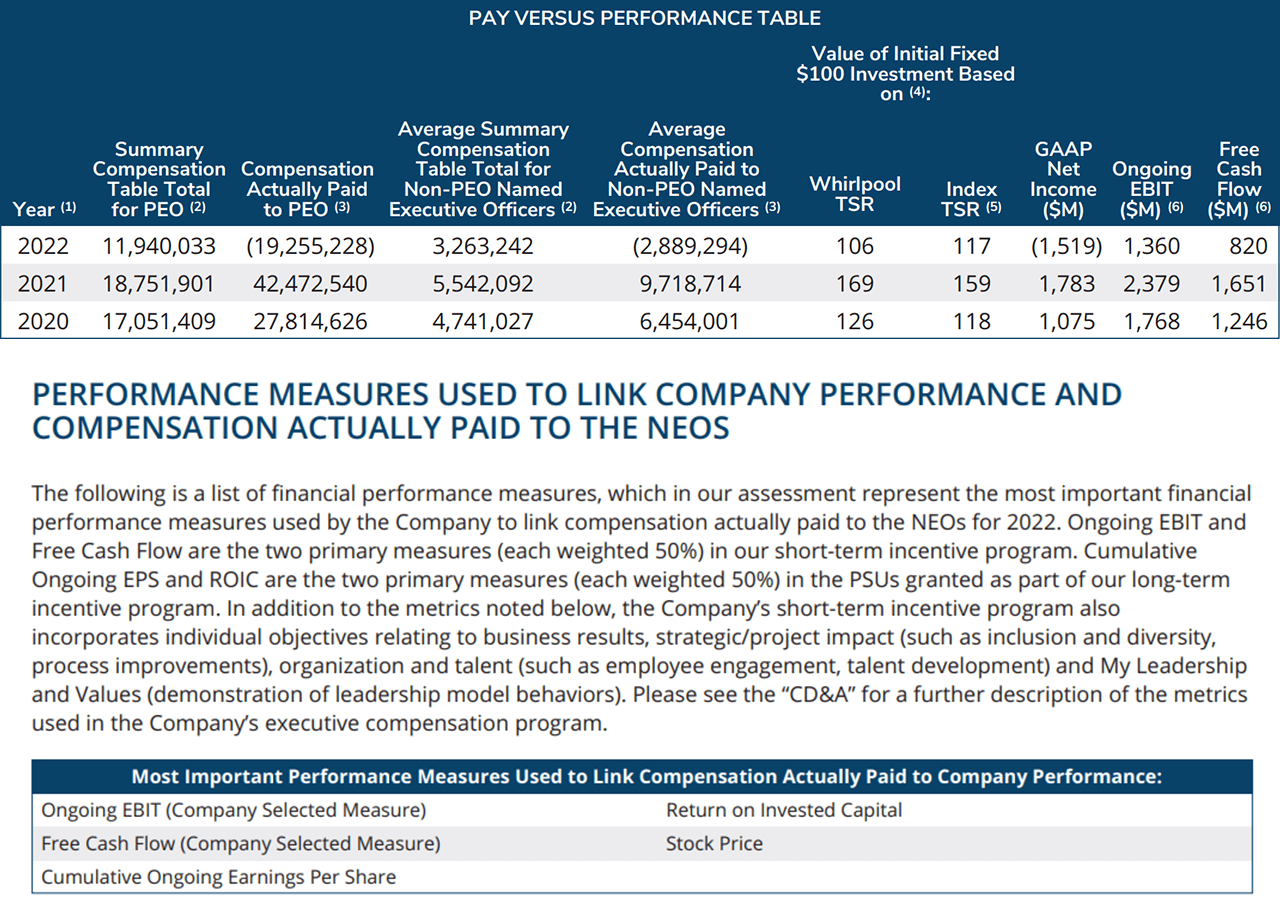

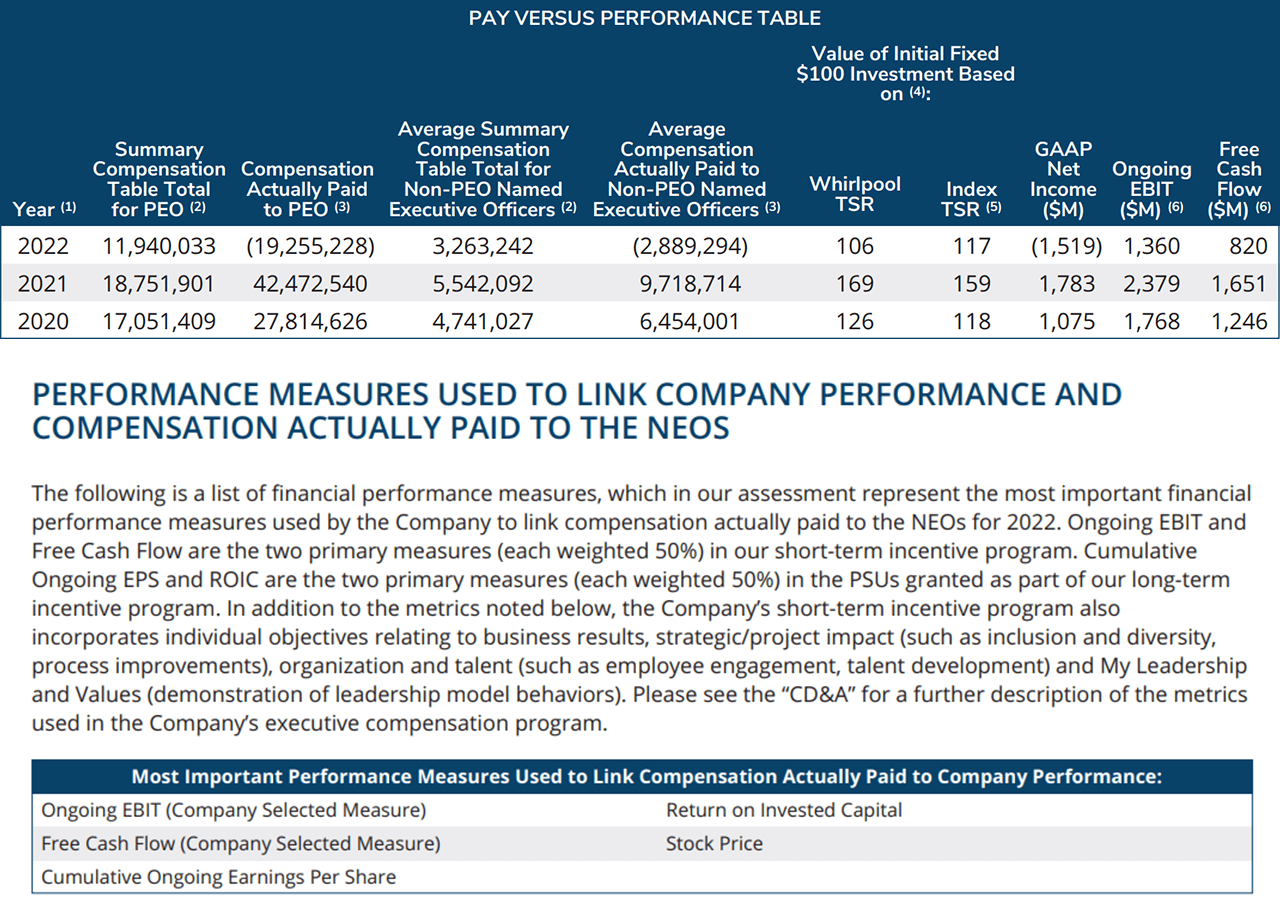

Whirlpool Corporation (WHR)

DEF 14A filed 3/8/2023

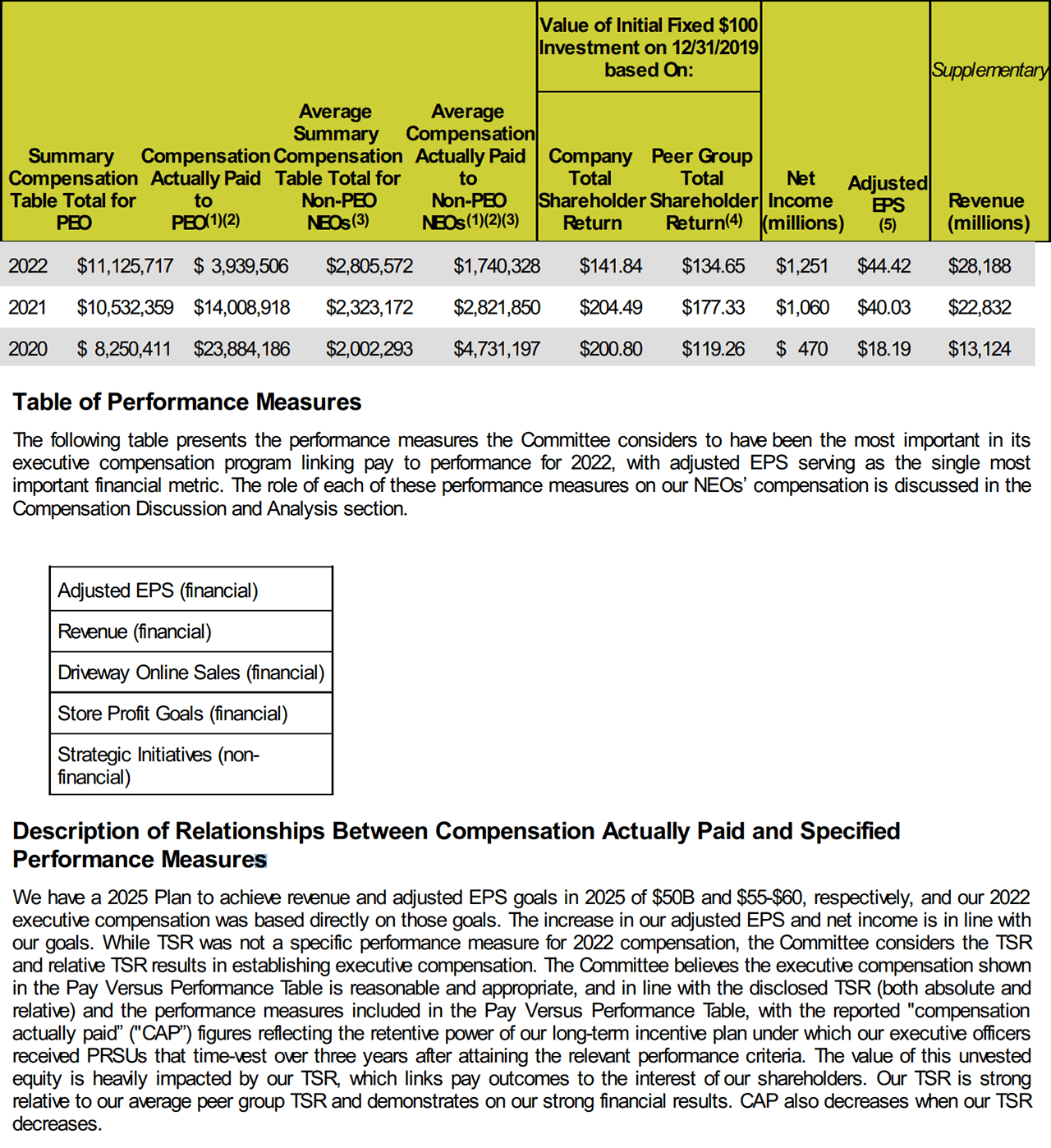

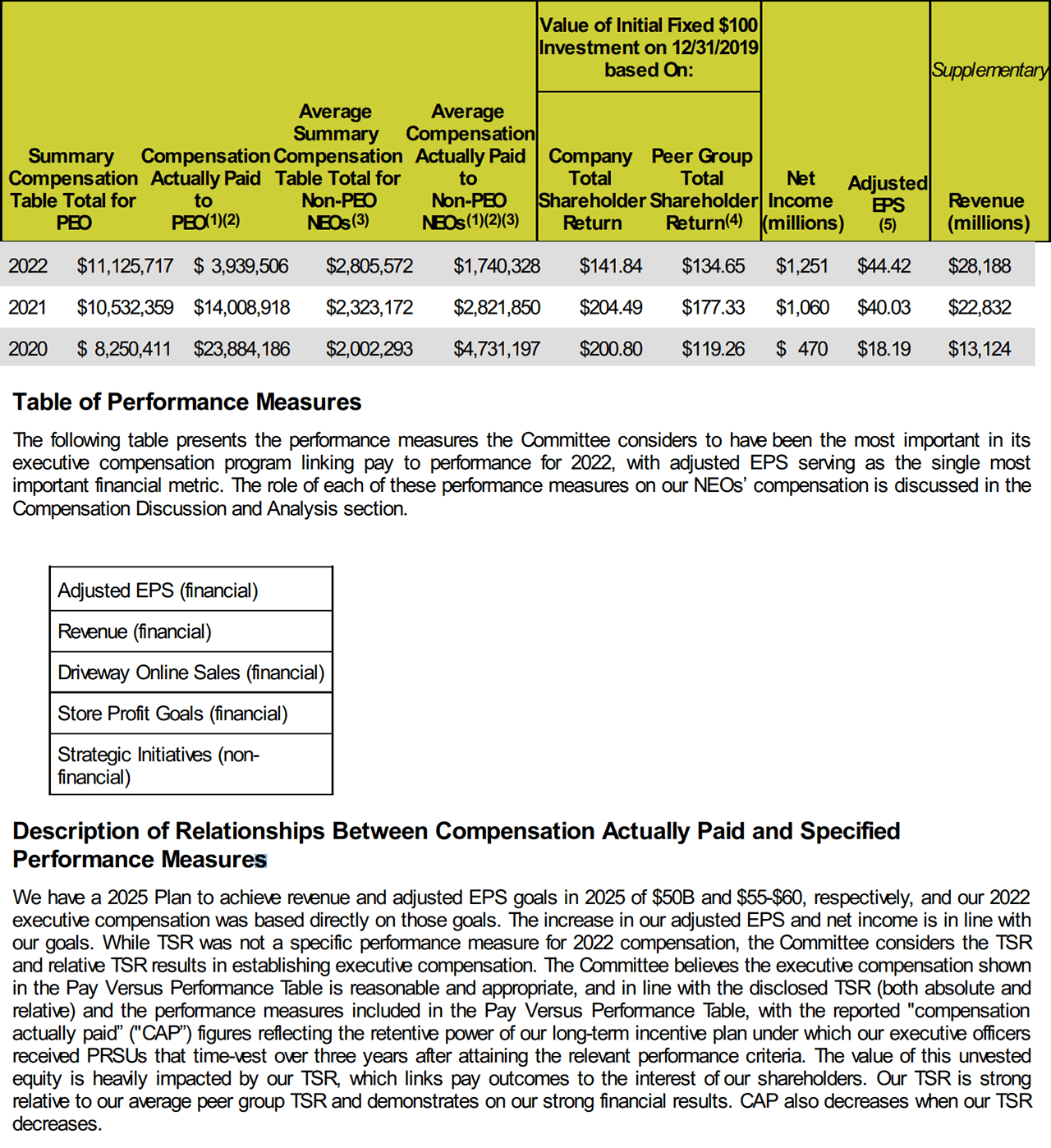

Lithia Motors (LAD)

DEF 14A filed 3/8/2023

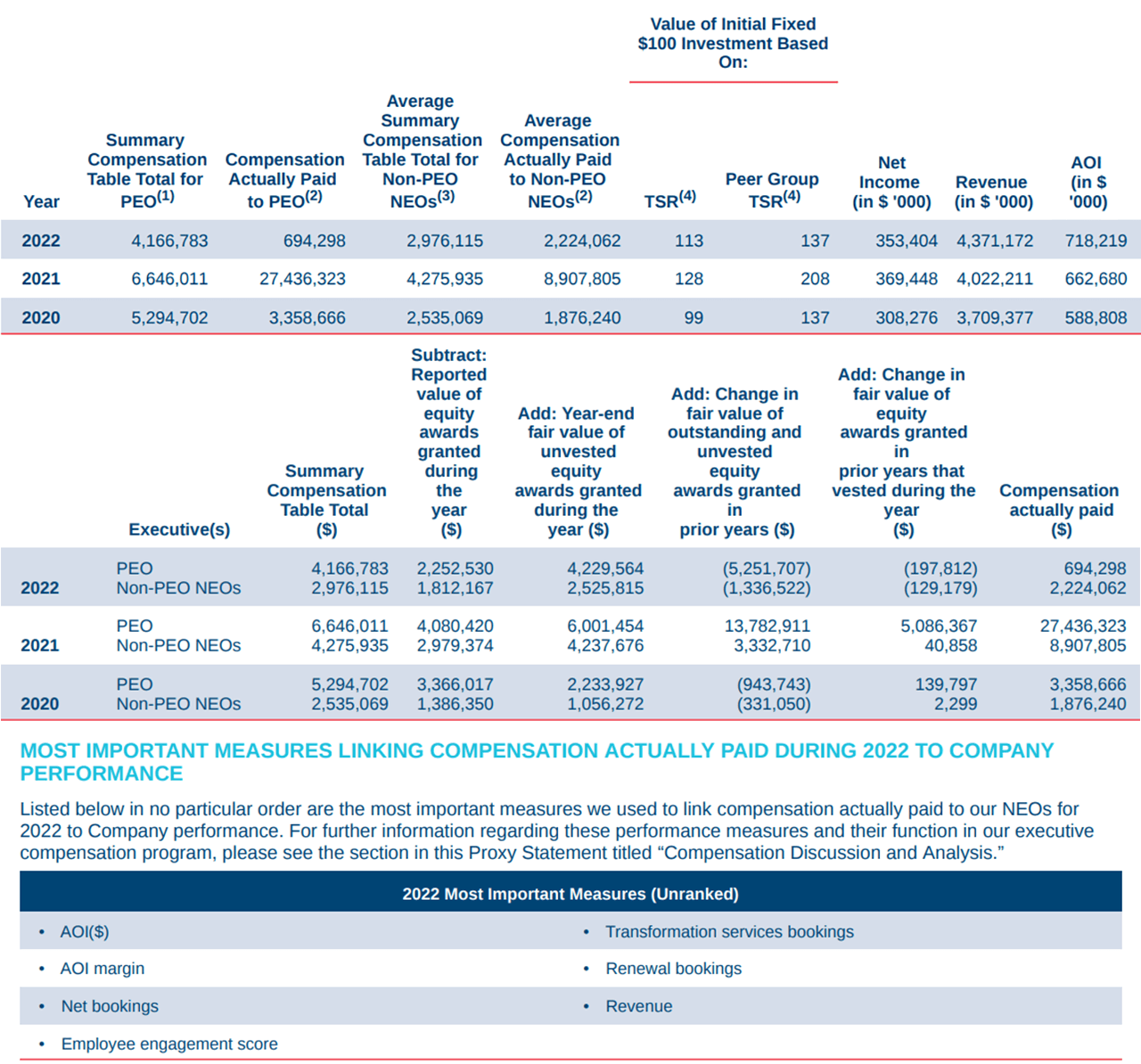

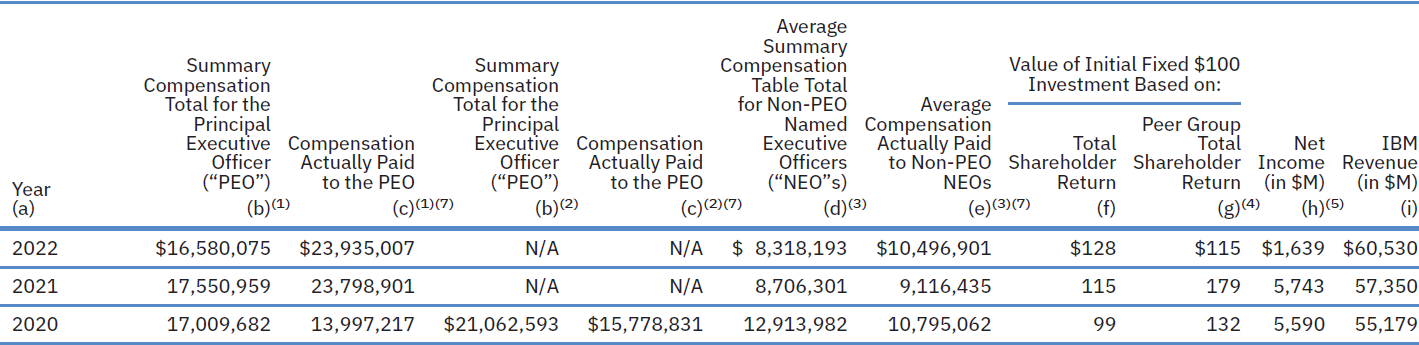

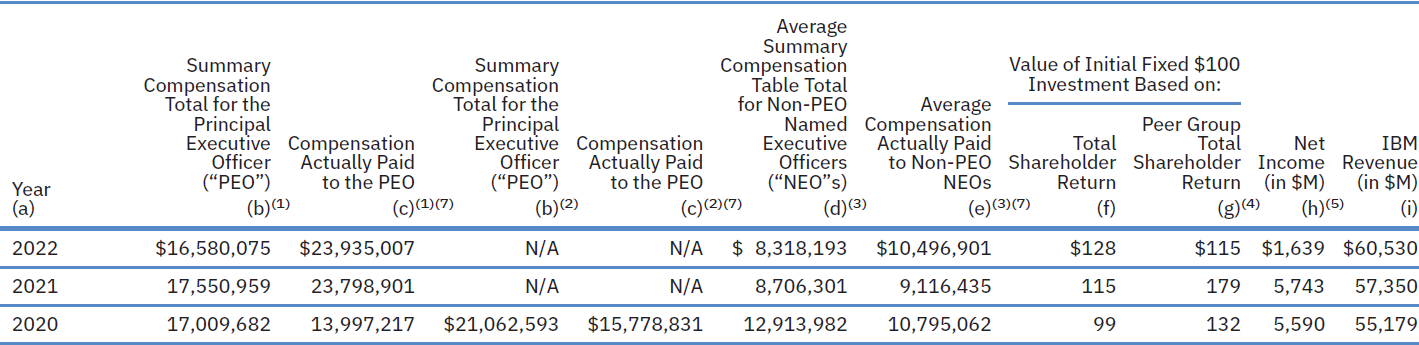

IBM Corporation (IBM)

DEF 14A filed 3/6/2023

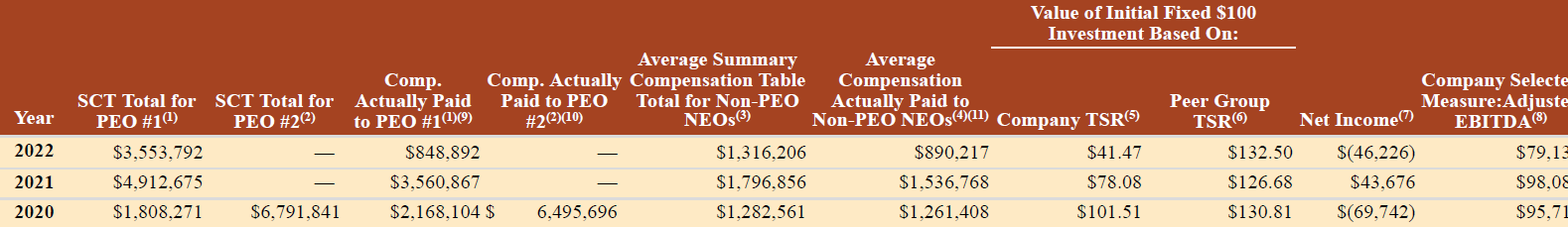

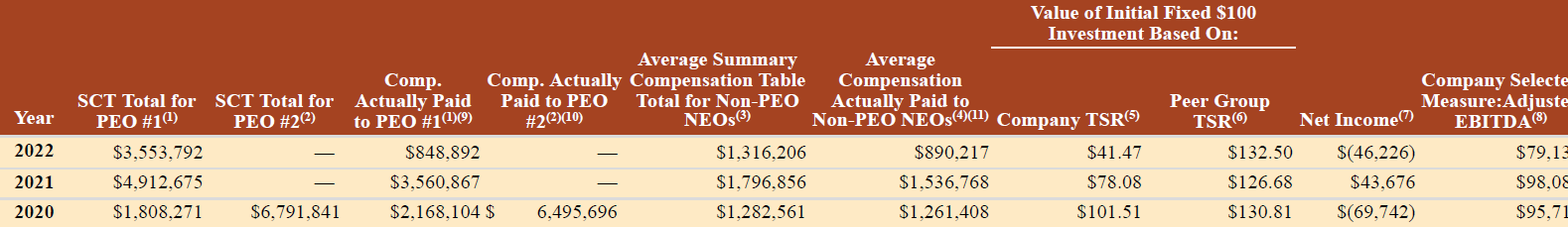

Kaman Corporation (KAMN)

DEF 14A filed 3/3/2023

Equitrans Midstream Corporation (ETRN)

DEF 14A filed 2/23/2023

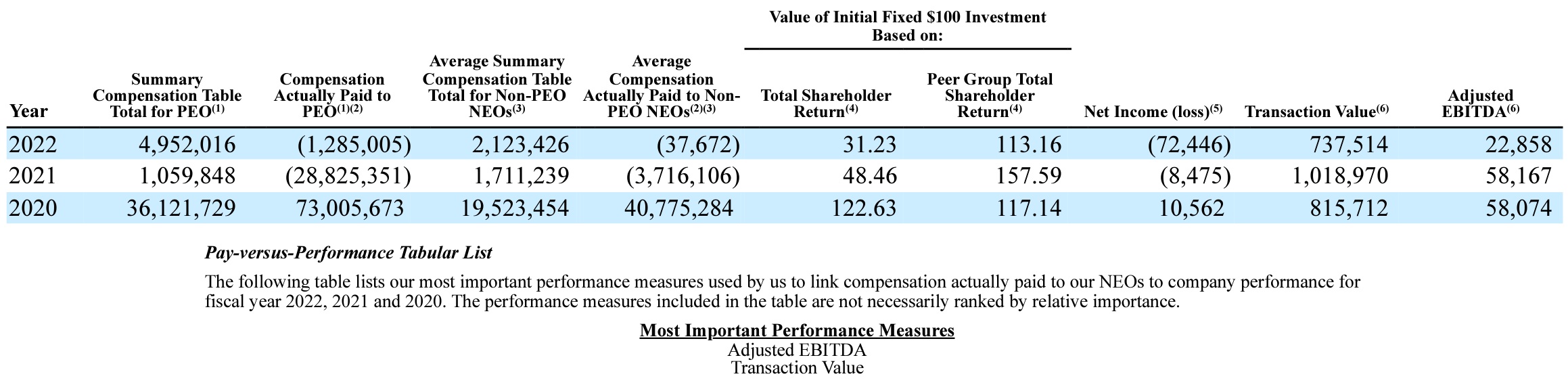

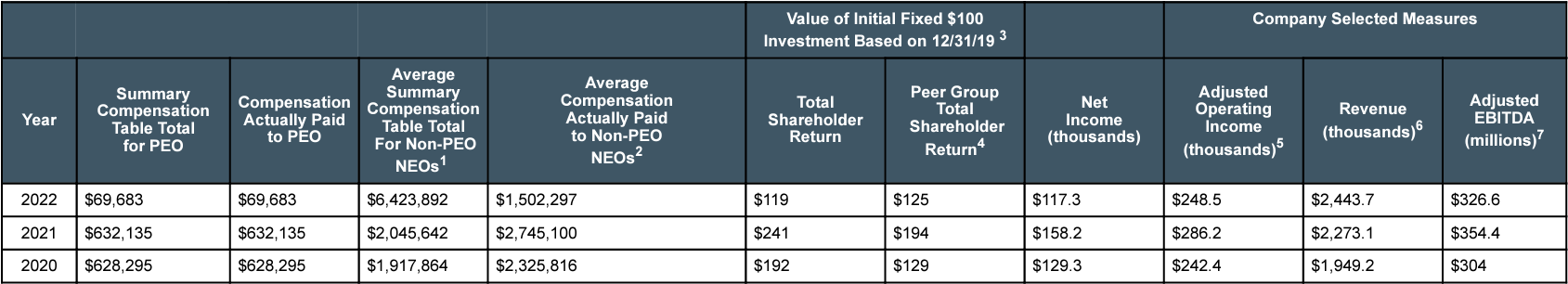

Magellan Midstream Partners, L.P. (MMP)

DEF 14A filed 2/21/2023

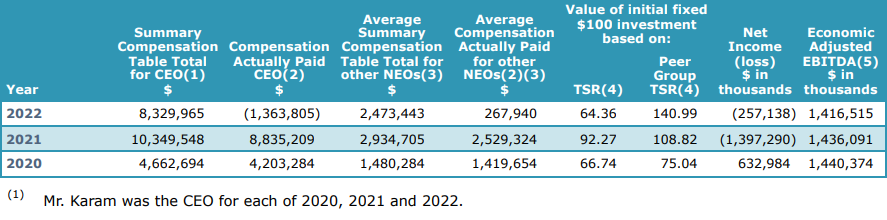

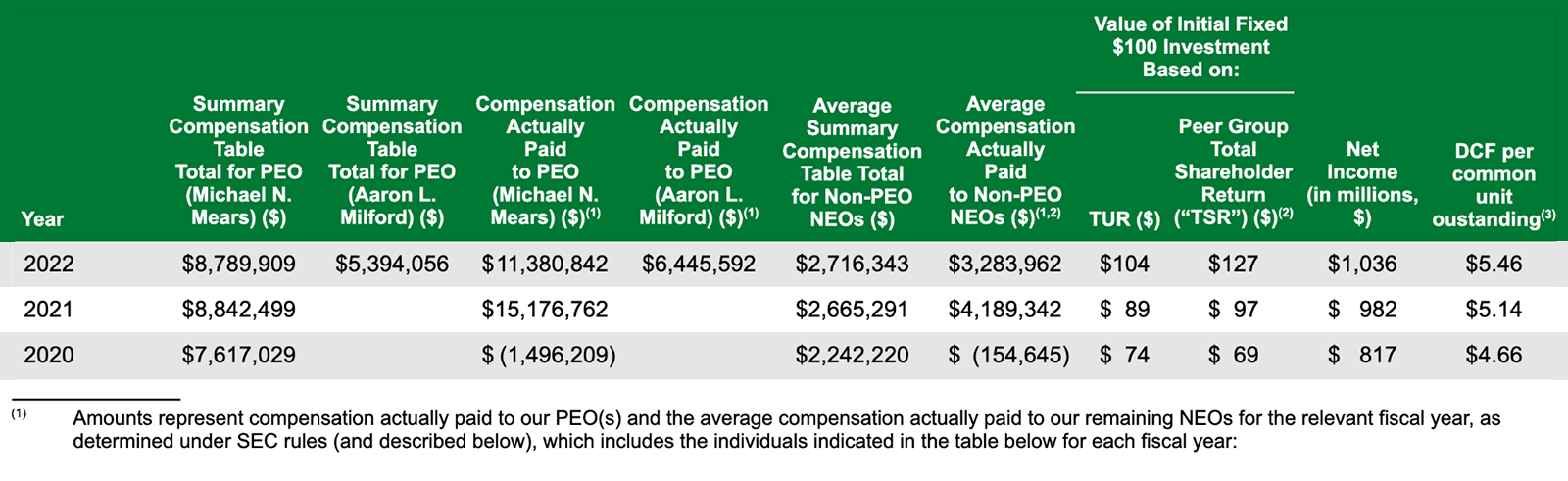

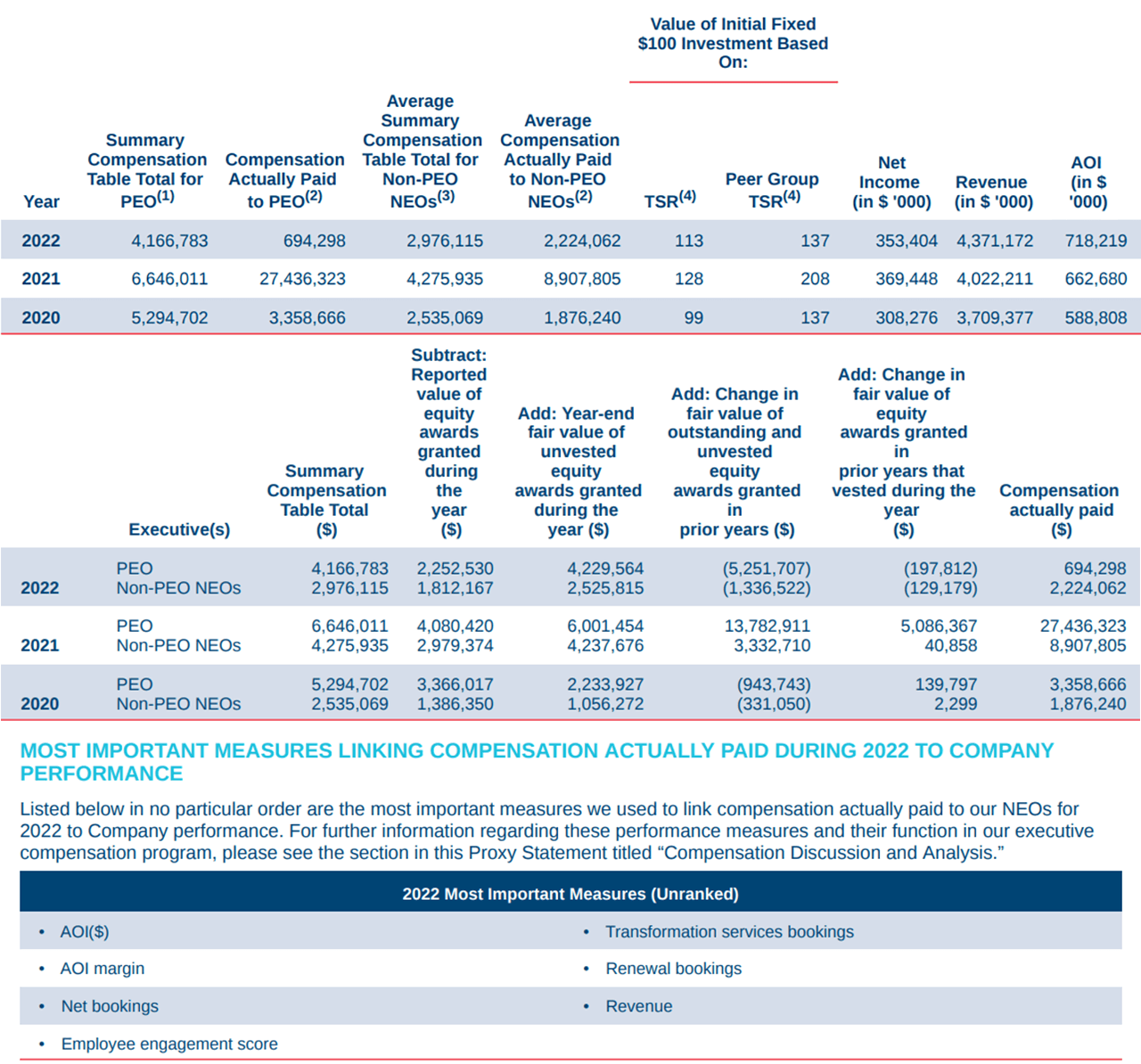

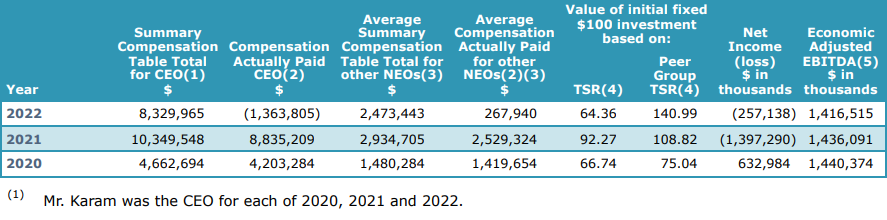

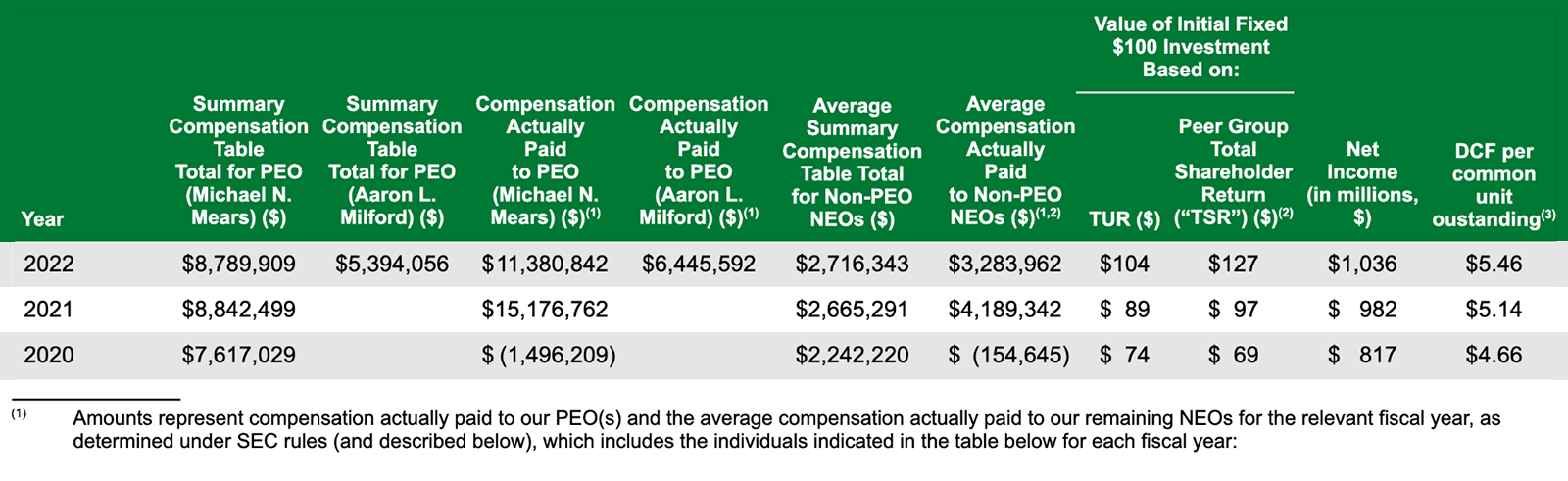

Our CEO is the principal executive officer (“PEO”). The following table sets forth information concerning the compensation of our PEO(s) and other NEOs for each of the fiscal years (“FY”) ending December 31, 2020, 2021 and 2022 and our financial performance for each such fiscal year:

Narrative to Pay Versus Performance Table

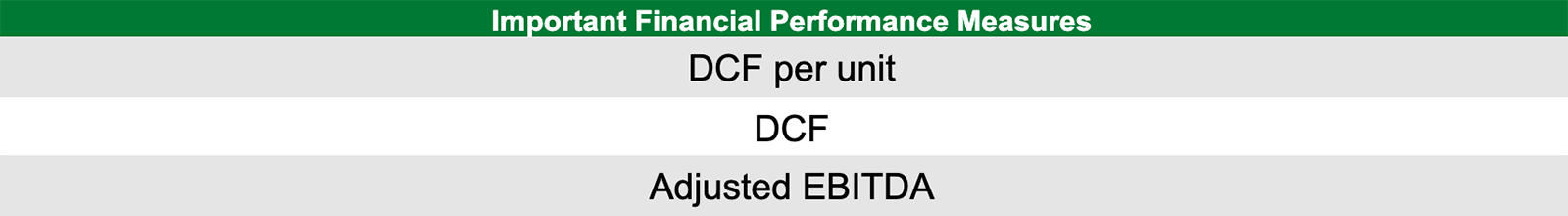

For the fiscal year ending December 31, 2022, the most important financial performance measures used to link compensation actually paid to our NEOs to company performance are DCF per unit, DCF and adjusted EBITDA. Our NEO’s target total compensation is heavily weighted towards short and long-term performance with performance goals aligned with our unitholders’ interests. The majority of target compensation was weighted toward long-term equity performance and time-based awards and the sole financial performance metric for LTIP awards was DCF per unit. The short-term incentive program’s funding metric is DCF required to maintain distribution levels from the last quarter in the prior fiscal year and the financial performance metric under our short-term incentive program is Adjusted EBITDA less maintenance capital.

Equilar and Equity Methods have partnered to develop a new Monte Carlo Simulator. This revolutionary new tool helps support companies’ pro forma modeling and planning, enabling them to stay ahead of the curve in preparation for the new SEC Pay Versus Performance rule. To learn more about the Monte Carlo Simulator, visit www.equilar.com/equity-valuation or contact us at info@equilar.com.

Contact

Amit Batish

Director of Content & Communications at Equilar

Amit Batish, Director of Content & Communications at Equilar, authored this post. Please contact Amit Batish at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions

Takis Makridis, President & CEO

David Outlaw, Managing Director, Valuation & HR Advisory Services

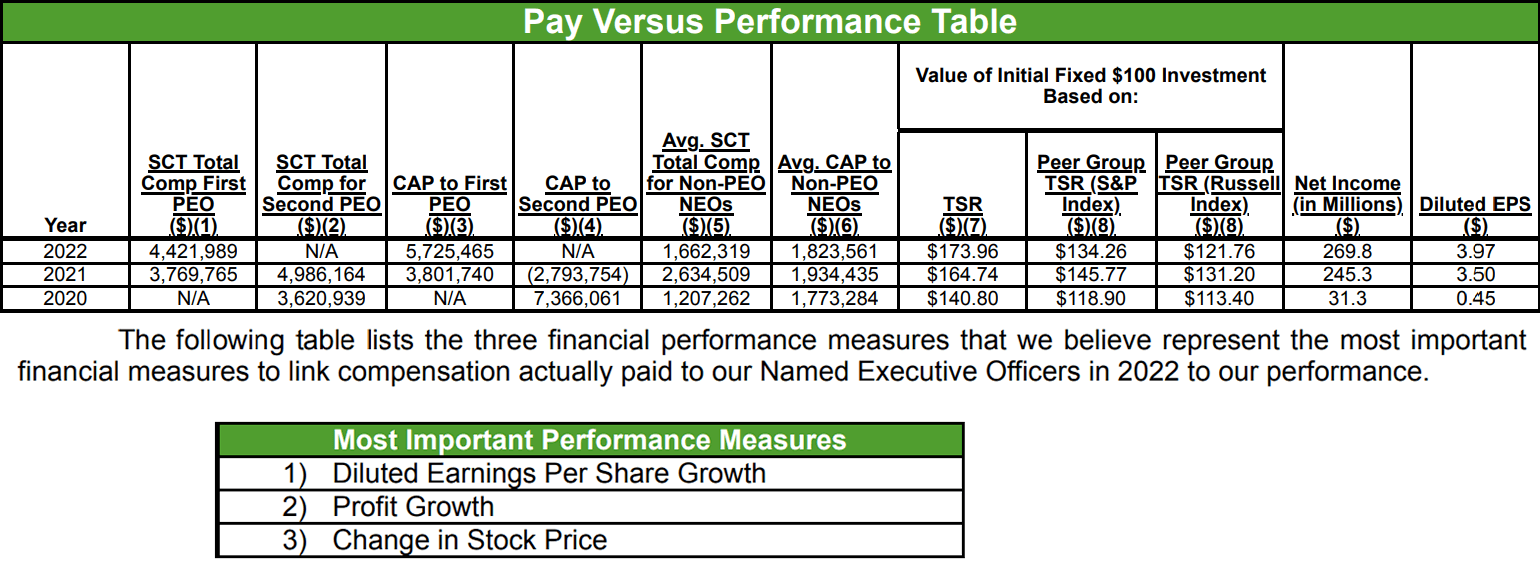

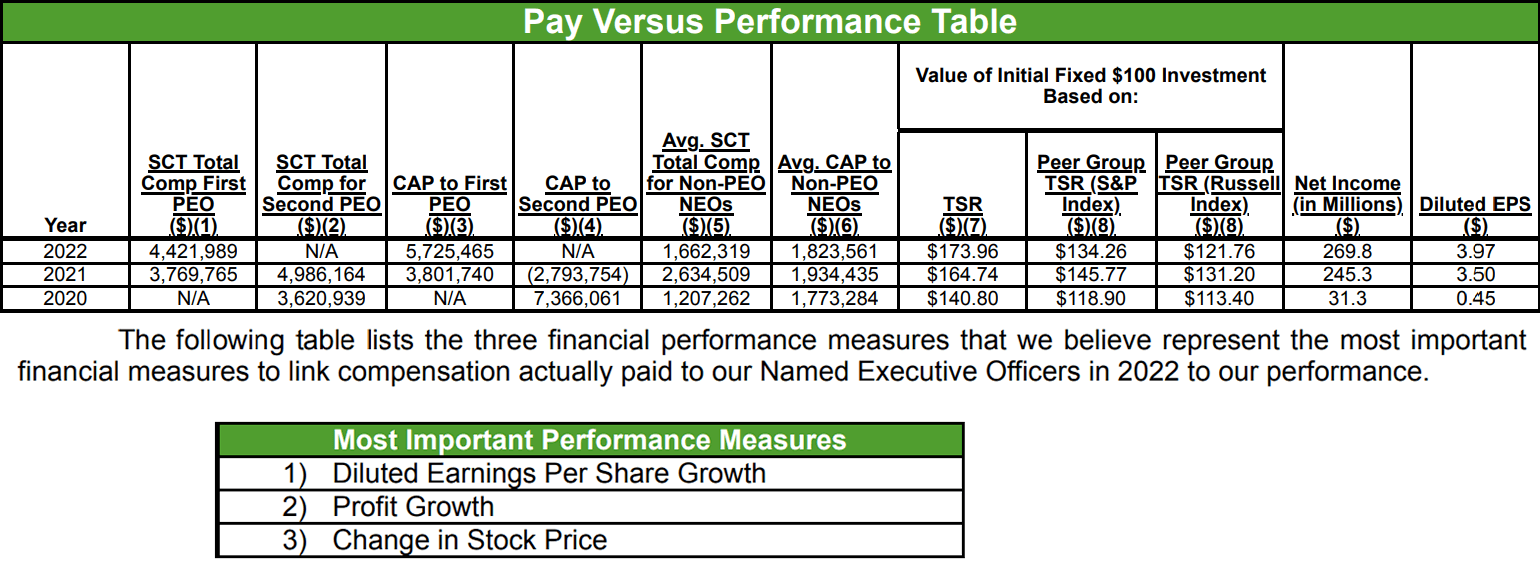

A few notable aspects of Roper’s disclosure jump out. First is their use of two CSMs. They use measures of free cash flow and EBITDA as equally-weighted metrics in their LTIP, so they elected to use both as CSMs in the PvP table. This is allowed under the PvP rule, though we saw other firms elect to simply choose one metric as their CSM and include the other(s) in their tabular list.

This decision reflects a decision point of whether to treat the disclosure as a pure compliance exercise or fit the flow and content to most closely resemble the story in the CD&A. As a compliance exercise, one CSM meets the threshold of the rule. As something more, if there are two equally weighted metrics in the LTIP, then it can naturally make sense to present both as equally important metrics and thus CSMs.

Second, Roper included two different industry indexes for TSR comparison. These two indexes correspond to the two the company uses in their 10-K under item 201(e) of Regulation S-K. Again, the use of two indexes in the PvP table is allowed in these circumstances, but not required.

A final interesting aspect is their use of the relationship disclosure charts to clarify an unusual metric outcome. In particular, they had a sizable spike in GAAP Net Income in 2022 due to the disposition of discontinued operations. To add clarity for investors, they included both that Net Income figure as well as Net Income from Continuing Operations in their chart, painting a more complete picture of the company’s earnings performance.

This discretionary choice illustrates the lack of a bright line surrounding supplemental disclosure. Technically, adding an alternative rendition of net income is a supplemental disclosure, which means it must be clearly labeled as supplemental (and not be misleading or presented more prominently). In Roper’s case, the slight tweak to the relationship chart is wholly benign, but it’s a good reminder to be careful when offering up additional content.