How Investors Voted on the Top Issues in 2021

November 3, 2021

Nathan Grantz

Maybe it was the fires that turned the sky of San Francisco black and red at midday. Maybe it was the hurricane season that reached a third of the way into the Greek alphabet after using a name for every letter in ours. Maybe it was the millions of people marching across the world for racial justice. Or maybe it was all of these events occurring in a single year. Regardless, the impacts of the last 18 months have been felt collectively across society, and Corporate America was hardly left unscathed.

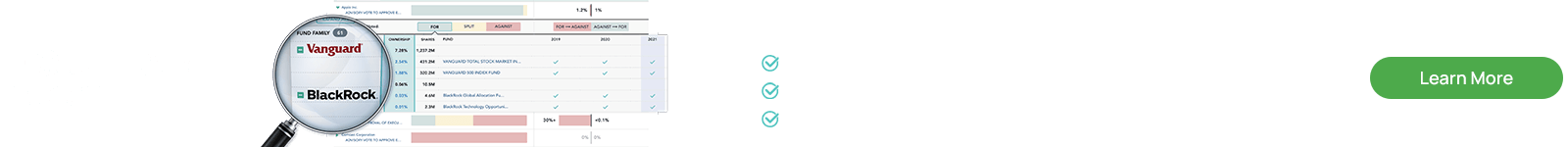

To no surprise, investors are paying close attention to how the companies in which they invest are addressing these critical issues. Investor voting patterns offer some insight into how they believe their companies are faring during these changing times. In the 2020 Equilar report, Investor Voting Trends and Results, it was revealed that most investor votes on shareholder proposals regarding diversity, environmental or political concerns were anemic. No investor voted unanimously for more than 30% of the diversity proposals that year, or 16% of environmental proposals. Some firms split the votes of their constituent funds more often than that, but others voted against up to 96% of the diversity initiatives and most institutions voted against at least 75% of the environmental initiatives that were on the ballot of Russell 3000 companies in 2020. Not so in 2021.

Figure 1: Investor Approval on 2021 Diversity Proposals (Russell 3000)

Figure 2: Investor Approval on 2021 Environmental Proposals (Russell 3000)

Figure 3: Investor Approval on 2021 Political Proposals (Russell 3000)

There has been a seismic shift in the way institutional investors approach shareholder proposal votes. Perhaps to no surprise, given the increased attention around DEI across the country, this year multiple institutional investors voted for more than 60% of diversity proposals that were on the ballot. In particular, there has been heightened attention around diversity at the top levels of an organization, notably corporate boardrooms. Nasdaq’s recently SEC-approved board diversity listing requirements will certainly impact the way the market thinks of diversity, which could ultimately lead to investors voting more strictly on diversity-related proposals.

Meanwhile, environmental initiatives went from being widely opposed to broadly supported, with the majority of firms voting against 50% of initiatives, often less. With climate change and wildfires continuing to be a topic of concern across the globe, investors appear to be searching for greater efforts from corporations on these issues. Proposals around political issues like human rights or campaign contributions were harder to generalize in 2020, but in 2021 support for such initiatives rose overall.

Figure 4: Median Investor Approval by Proposal Type (Russell 3000)

The increased volume of “For” votes coming from institutional investors has contributed to the rise of median approval rates this year. While the median approval rate is still below the 50% passing mark, the increase indicates that more shareholder proposals are being passed than has been the trend in recent years. Diversity initiatives saw the largest increase year over year of 20.9 percentage points, with the 2021 approval rate more than double the approval rate of 2020. However, 2020 itself represented a share departure from the prior two years. The 2021 approval rate of diversity proposals is higher than either 2018 or 2019, but taken together, 2020 looks like the outlier, rather than 2021.

The median approval rate of environmental initiatives rose to 36.8%, continuing a two-year climb, and surpassed the previous high of 29.1% median approval by 7.7 percentage points. Support for environmental proposals was widespread among institutional investors, with only two firms voting fully against more than half of such proposals in the Russell 3000.

Support for political initiatives has been higher than for other types over the last three years, but this category too reached a new height of 36.8% median approval rating.

Figure 5: 2021 Say on Pay Approval by Investor (Russell 3000)

Investor support for Say on Pay does not immediately convey a sense of great change. The vast majority of votes cast by institutional investors were to approve Say on Pay. The changes here are marginal. With one exception, each institution has either increased the number of votes against, or decreased the number of votes for (split votes make it possible to have done one without necessarily having done the other.) When taken with the votes on shareholder proposals, however, it describes a year where investors were increasingly taking action against the status quo.

Whatever led to the acceleration in approval rates for shareholder proposals among institutional investors, there are some indications that this higher level of engagement might be permanent. BlackRock changed how votes are decided this year, transferring some voting authority from its funds to its own large investors, such as pension funds and endowments, which have different agendas and responsibilities than BlackRock itself. 2020 was a year of extremes, and reactions in the subsequent year were to be expected. 2021 began in a similar vein, but has not kept the same frenetic pace. It will be interesting to see how institutional investors will express their opinions through votes during 2022 annual meetings.

Contact

Nathan Grantz,

Senior Research Analyst at Equilar

Nathan Grantz, Senior Research Analyst at Equilar, authored this post. Please contact Amit Batish, Director, Content & Communications, at abatish@equilar.com for more information on Equilar research and data analysis.

Roles

Roles