Diversity Requirements Push Boards to Expand Their Perspectives

October 20, 2021

Dan Marcec

Recent state legislation, voting guidelines from investors and now new listing requirements from Nasdaq are collectively ramping up the pressure for public company boards to add more diverse members to their boards of directors.

Anna Catalano, a board member with Front Door, Kraton, HollyFrontier and Willis Towers Watson, and Melissa Anderson, Managing Editor for Financial Times’ Agenda, joined Equilar for a recent webinar to discuss key strategies and tactics to evaluate board composition in this environment.

In the past few years, the prevalence of public company corporate directors that are both women and individuals from underrepresented racial and ethnic groups has grown significantly. For example, 25% of all board seats in the Russell 3000 now belong to women, up from 15% in 2016 when Equilar began tracking this data for its Gender Diversity Index report. The pace of change is also noteworthy, as 47% of open board seats went to women in Q2 of 2021, which has increased from 25% in 2016.

When it comes to race and ethnicity, Equilar data shows that total representation is about 18% by people of color among companies in the Russell 1000. About half of these directors are Black, and the other half mostly comprises individuals from Asian/Pacific Islander or Hispanic/Latino ethnicities.

Similar to the increasing share of board seats filled by women, 47% of new directors came from racial and ethnic minority groups in the past year as well, according to Spencer Stuart data. That represents a 213% increase from five years ago. Much of the acceleration in the past year stemmed from the addition of Black directors in light of the environment following the racial justice movement in the summer 2020.

“When we look at the intersection of gender and ethnicity, women of color don’t necessarily see the growth and opportunity as we see more broadly across the underrepresented groups,” said Belen Gomez, Vice President of Strategic Initiatives and Communications for Equilar. “There has been a lot of great progress in terms of bringing visibility and tracking how we’re trending on gender and ethnicity data, but there are areas for improvement along the way.”

The Real Reasons Behind Board Diversity Requirements

There have been a number of regulatory changes that have had an impact on board diversity over the last couple of years, starting with several in California that have been highly visible. The ultimate result is that many boards in California now have non-white, non-male directors that didn’t have them before. While there are some debates over whether these legislative mandates are legal, they ultimately have achieved their purpose: They’ve proven that when boards look for diverse directors, they can find them.

“These excuses that we hear about the pipeline problem, there aren’t enough women to be on my board in my industry or my geography, what we saw is that’s just not true,” said Agenda’s Anderson. “It shows that when boards are nudged to diversify they can do it.”

But more important than the quota itself is the discussion and the serious consideration of diverse candidates that these laws have wrought. In order to really push the ball forward, boards have to take a deliberate and focused approach to bringing diversity on and not leave it to chance. That’s the main change that’s driven a lot of the progress over the last five years, said Catalano.

“In the boardroom, it actually feels really great because we’ve gone beyond ‘we have to do this because someone’s requiring it’ to ‘what’s the real advantage and what’s the real reason why diversity is important?’” she said. “The real reason is so that a business can adjust to the challenges that are happening in a global world. The belief is that the more you have different people around the table, the better you’re going to be able to tackle those challenges, not only today but in the next 20 years as we go forward. And therefore you have to ask what voices are you missing around the table that you want to have?"

While the laws provide a specific benchmark for companies to hit in certain geographies, the push from proxy advisors and the largest institutional investors is likely to have a bigger impact overall. Since these companies have an outsized influence on approval ratings and ultimately whether or not boards of directors are reelected to their positions, their opinions are meaningful, and from a market standpoint, their reach is much further than a state law—even one as large as California.

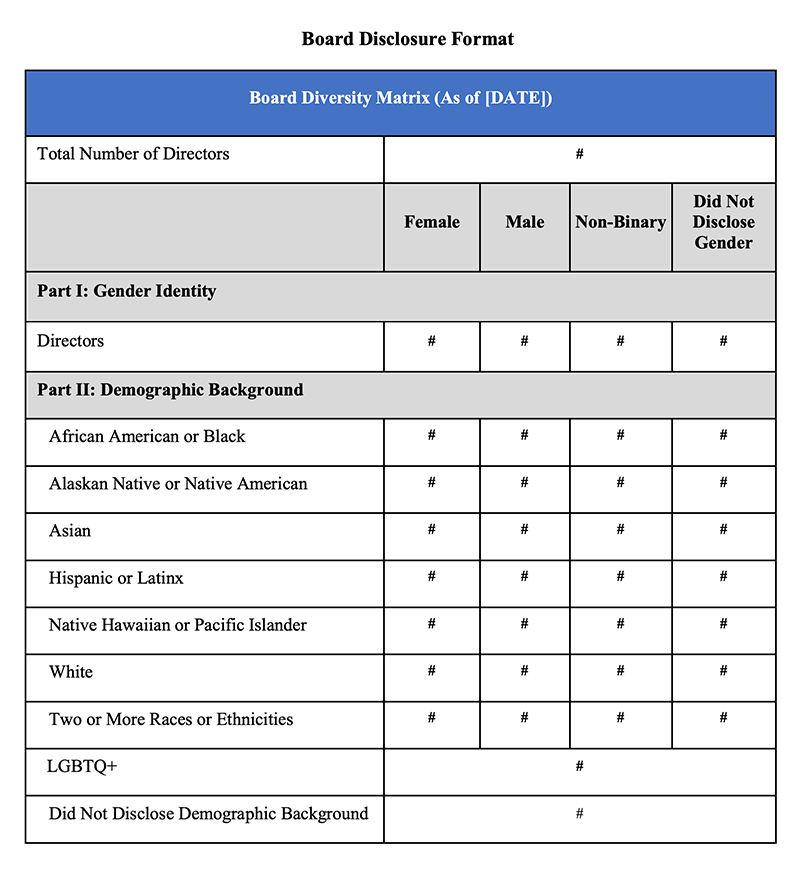

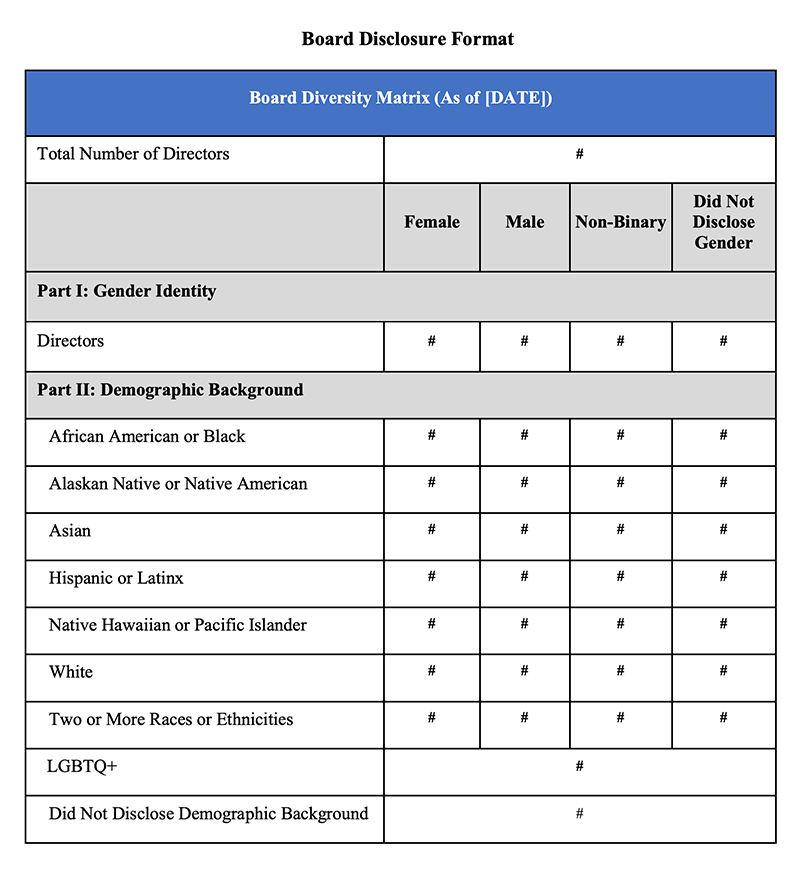

And then came Nasdaq. In December 2020, the stock exchange issued new rules that required both public disclosure of board diversity metrics as well as thresholds to hit for diversity.

Approved by the SEC in August 2021, the quotas receive most of the attention. But the more urgent demands from these requirements will provide transparency into the board selection process so that stakeholders may see for themselves how the board is approaching its composition. By August 8, 2022, all Nasdaq companies will have to include the board matrix shown below as well as an explanation of their diverse membership either in their proxy statement (if filed) or on the company website.

“Being someone who is a woman and person of color, I always worried whether I might only be considered for these positions because someone has a quota to meet,” said Catalano. “That being said, I see what it has caused. I think that’s really driving the realization that we can’t just go to a group of people we know and we’ve worked with, which is actually very limiting. It’s amazing who is out there that isn’t among the names that have been circulating for the last 30 years.”

Indeed, resources such as the Agenda Diversity 100 and Equilar BoardEdge have cropped up to aid the search process, showing that the “pipeline problem” is a myth. There are more than enough candidates on the market for board positions.

“Boards are diversifying for a number of reasons, not just because of listing requirements, and I think there’s going to be a snowball effect,” added Anderson. “Once boards have diverse members, their networks expand to include more diverse candidates.”

Contact

Dan Marcec

Senior Editor at Equilar

Dan Marcec, Senior Editor at Equilar, authored this post. Please contact Amit Batish, Director, Content & Communications, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions