Equilar Disclosure Watch: Williams-Sonoma Emphasizes Value of Shareholder Engagement

June 3, 2020

Daniella Gama-Diaz

With the 2020 proxy season now complete, thousands of proxy statements have been filed by U.S. public companies. Companies have been finding new and interesting approaches to spice up their disclosures. As seen in the recent Equilar report, Preparing for Proxy Season 2020, investors made it clear that they want increased transparency and communication, making the proxy statement more powerful than before. As a result, companies are including more visuals, more details and clear information so shareholders are completely informed and up to date on the company’s most pertinent decisions and strategy. This final installment of the 2020 Equilar Disclosure Watch series highlights several prominent disclosures from the 2020 proxy season.

Disclosure Example 1

Williams-Sonoma, Inc. (WSM)

DEF 14A on 4/17/2020

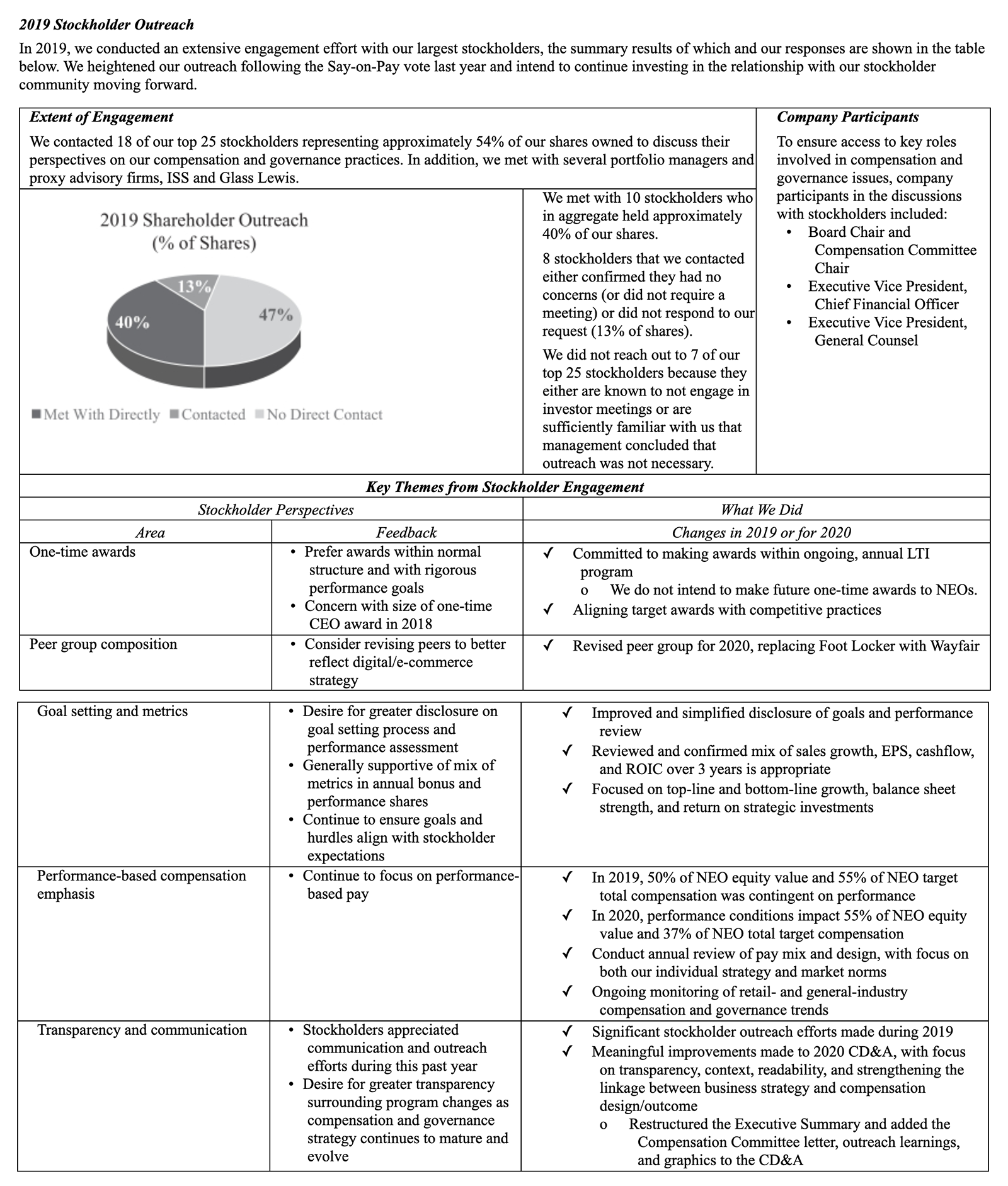

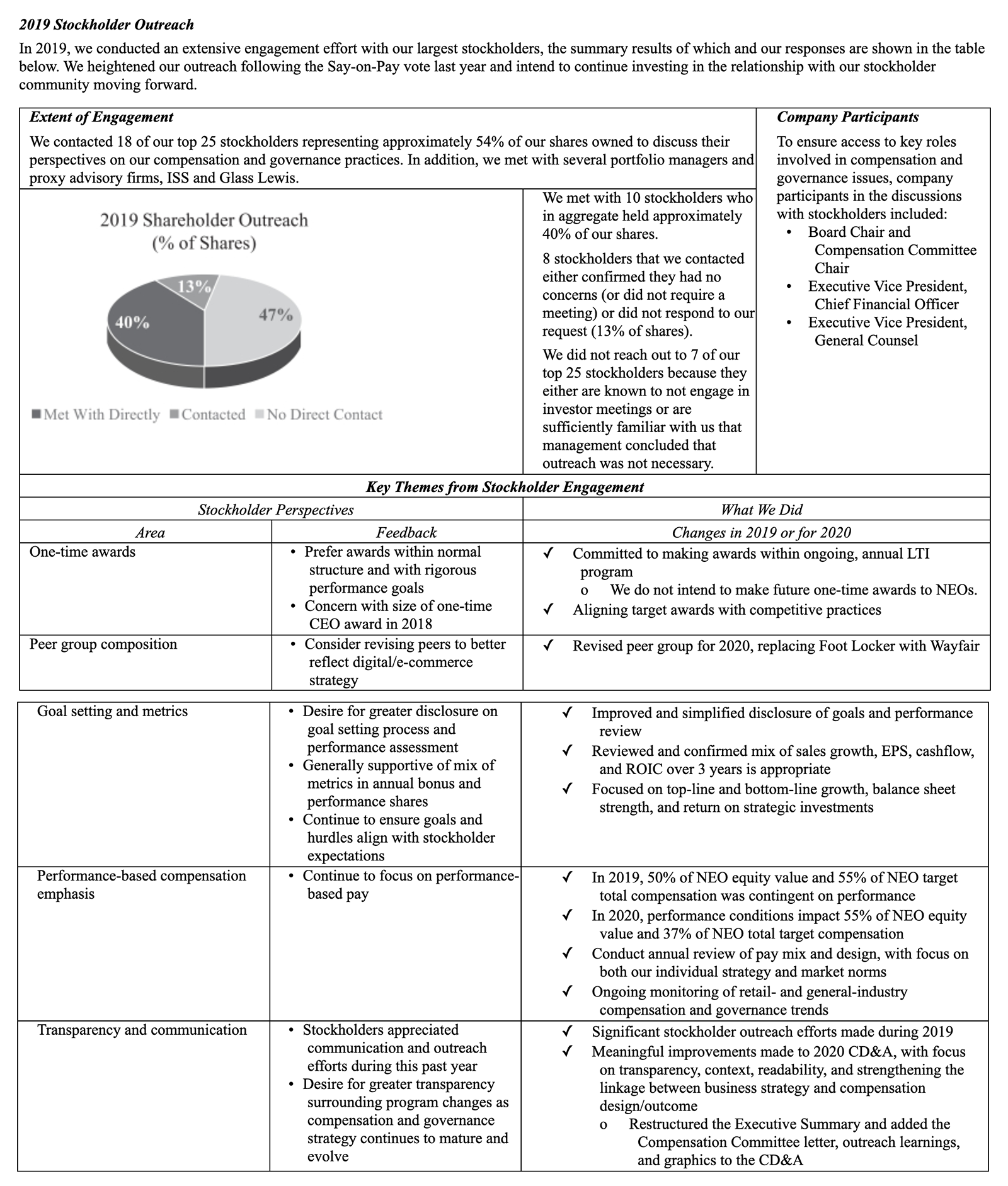

The Williams-Sonoma disclosure is an excellent example of how companies value shareholder engagement. There is a reason companies issue shares, and listening to investors is a key way for a company to maintain a good relationship with them. As shareholders push for more communication and transparency, increased engagement efforts is an effective strategy at ensuring that shareholders are not only informed and aware of the company’s priorities, strategies and goals, but that investors are given a platform to ask questions, share their insights and push for change. Presenting the results of last year’s engagement may also open up the conversation of how the company can make engagement more impactful in the coming year.

Disclosure Example 2

UnitedHealth Group Incorporated (UNH)

DEF 14A on 4/17/2020

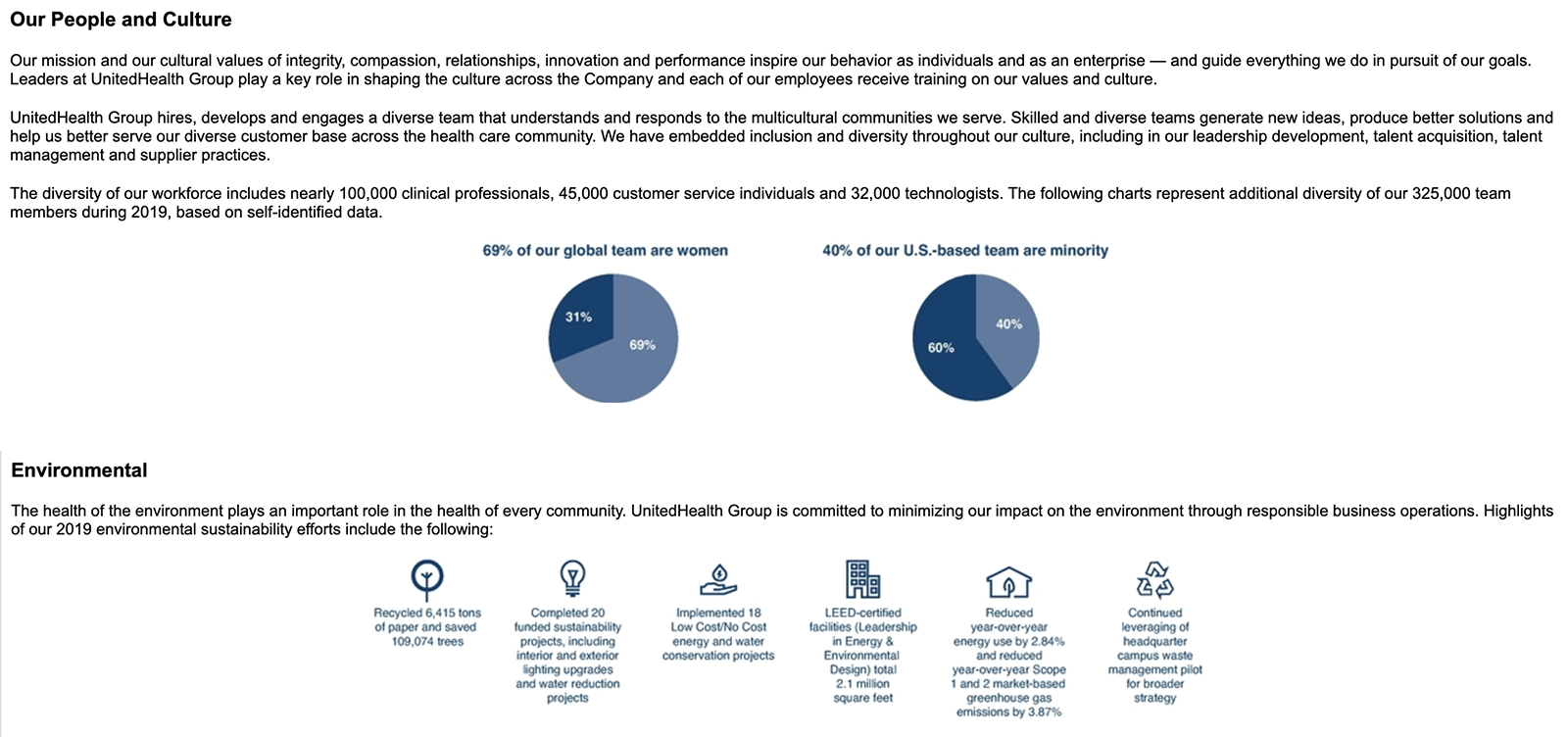

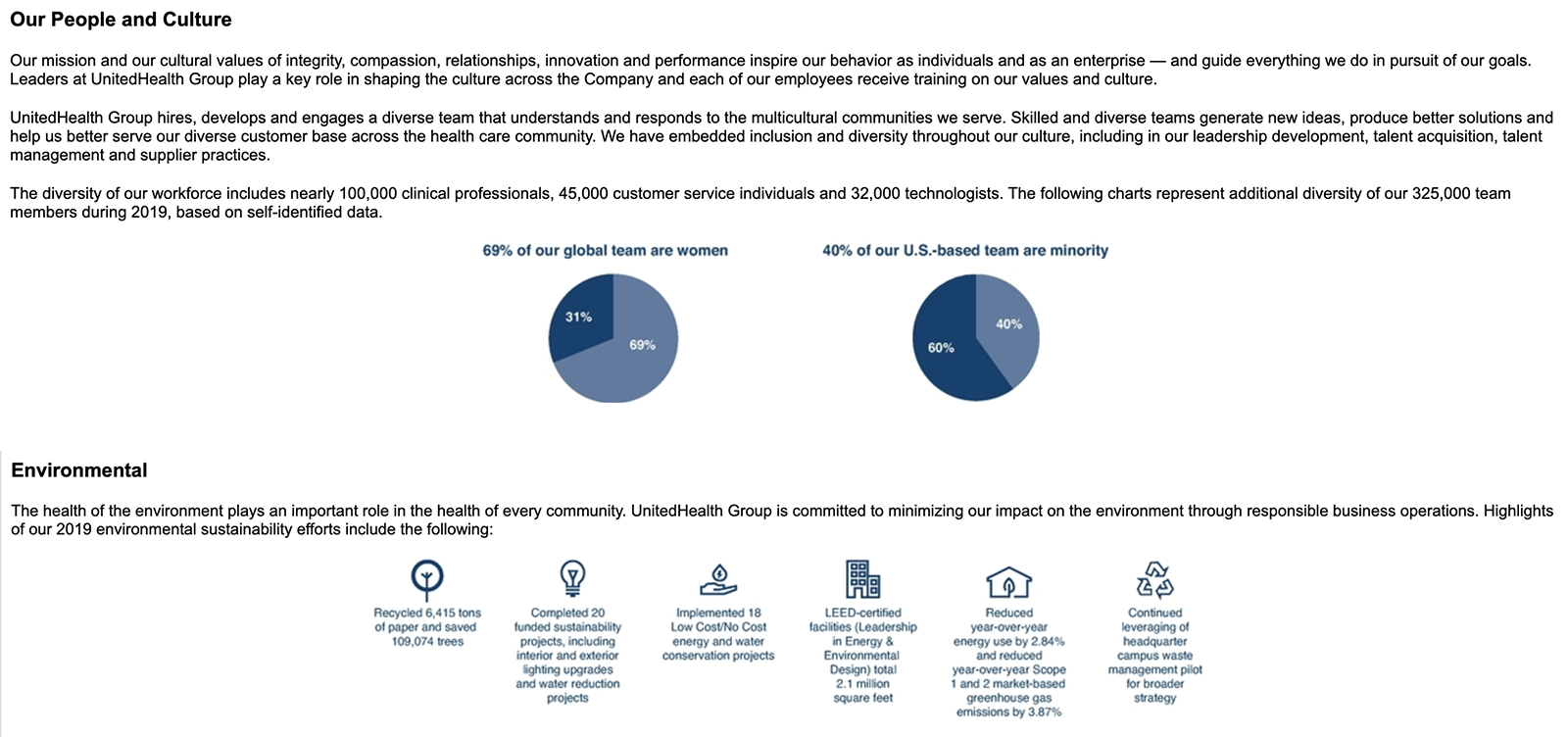

The UnitedHealth disclosure combines important topics with clear visuals. Environmental, social and governance (ESG) topics have become a top priority for shareholders as both legislation and societal values push for more equality in and out of the boardroom for companies. This disclosure highlights three important categories for ESG: human capital, compensation and environmental goals. Investors want to see companies hire more diverse talent, both by gender and ethnicity, and the disclosure clearly shows the progress the Company made. In terms of pay equity, investors want to ensure that everyone, including the executive suite, is earning what they deserve. And as environmental issues become increasingly important, environmental metrics are useful for investors to see how they are working to align goals with business strategy.

Disclosure Example 3

Zion Oil & Gas, Inc. (ZN)

DEF 14A on 4/16/2020

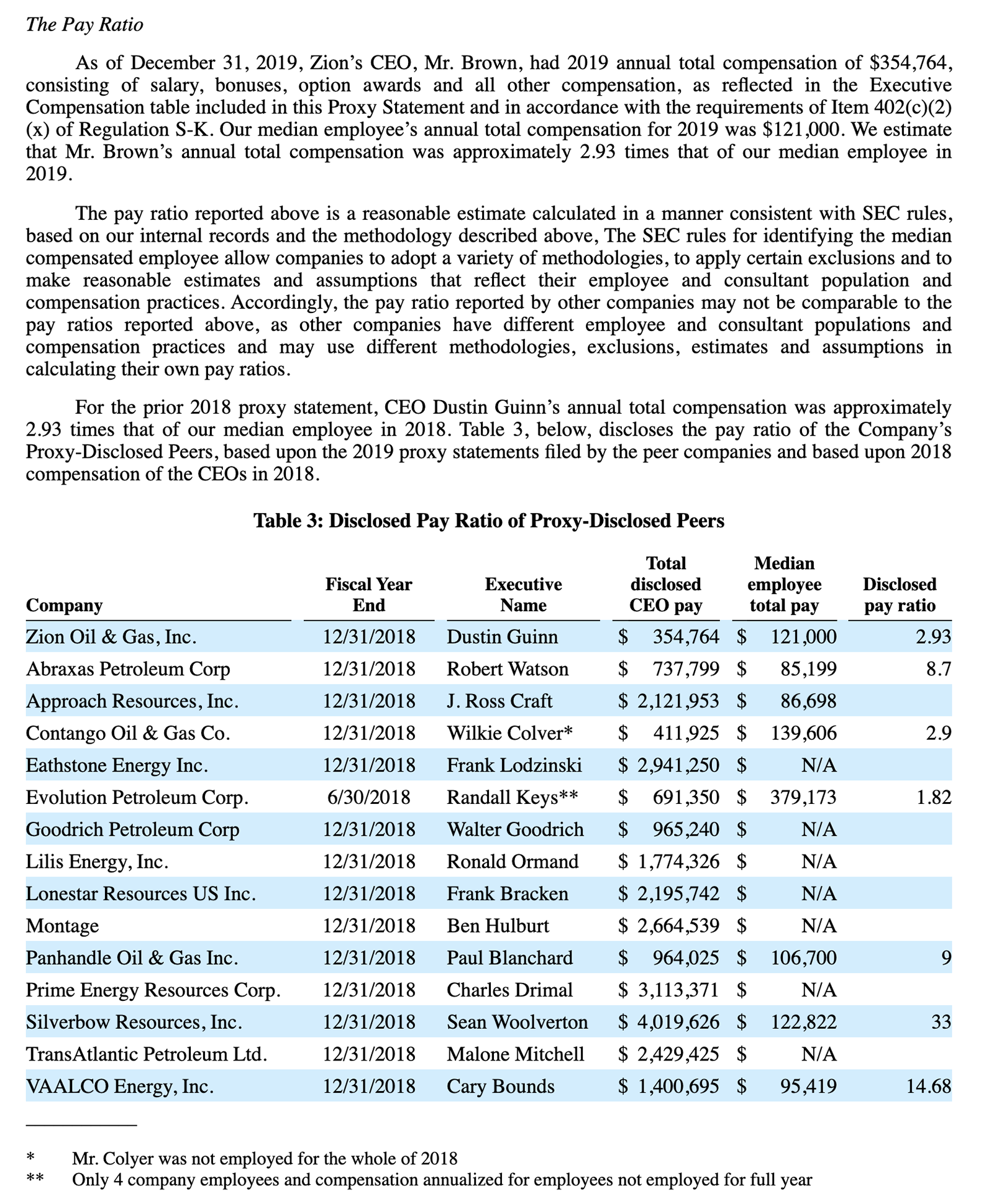

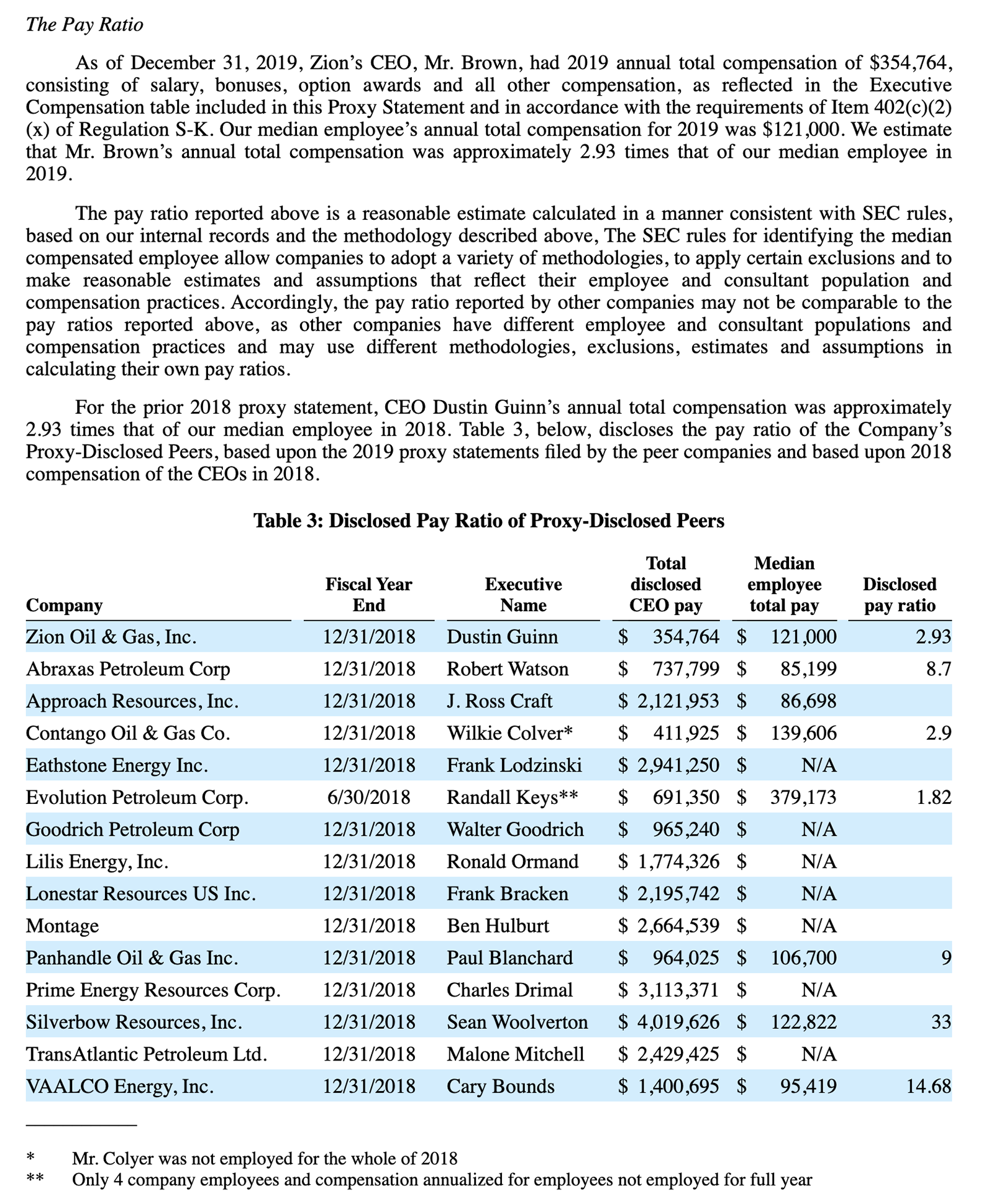

The Zion disclosure is an interesting example of how companies use peer group analyses to benchmark compensation. The Company begins by disclosing the compensation for the CEO, John Brown, and the pay ratio for employees. Not only does it show what they expect his total compensation to be, how it arrived at this rate, and historical pay trends, but it goes further by providing a visual chart on its peer’s compensation practices. While most companies do not disclose ratios for their peers, Zion went above and beyond in transparency. This way, investors can clearly and quickly see how Zion compares to competitors with similar methods. For more information on executive benchmarking, check out the Equilar tools for executive compensation.

Disclosure Example 4

Golden Star Resources Ltd. (GSC)

6-K on 3/30/2020

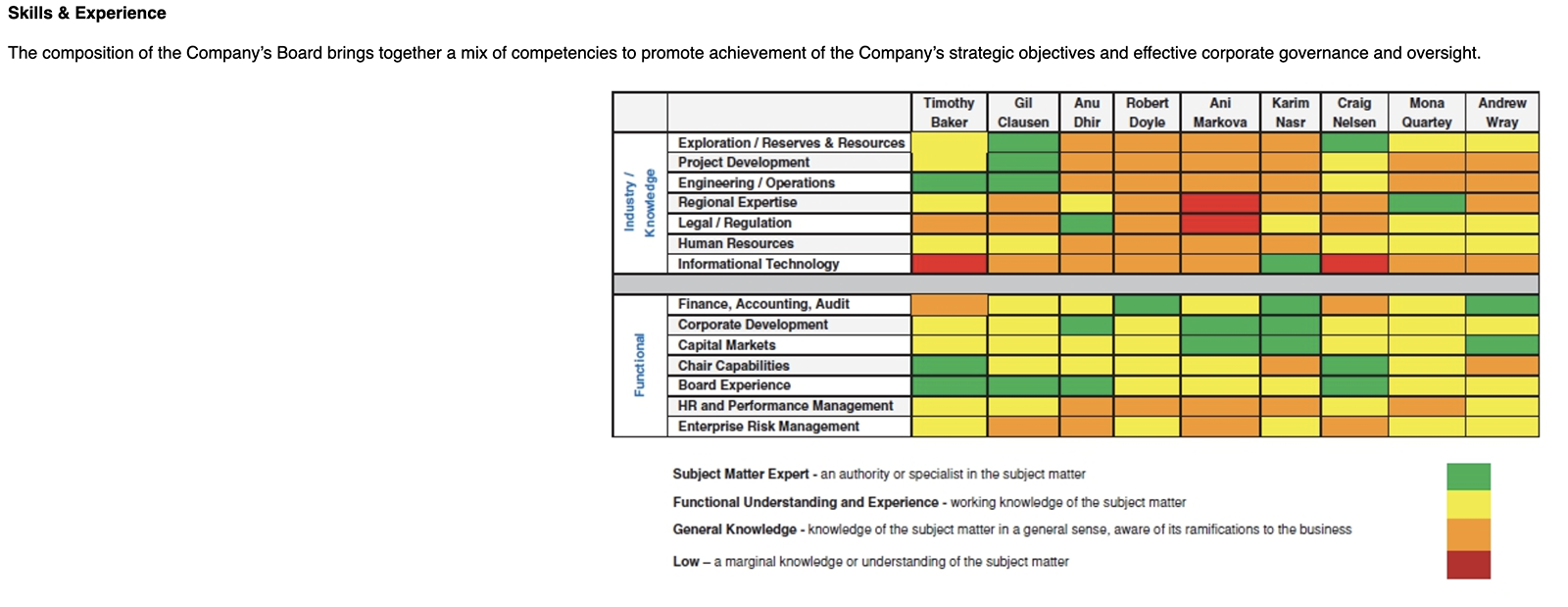

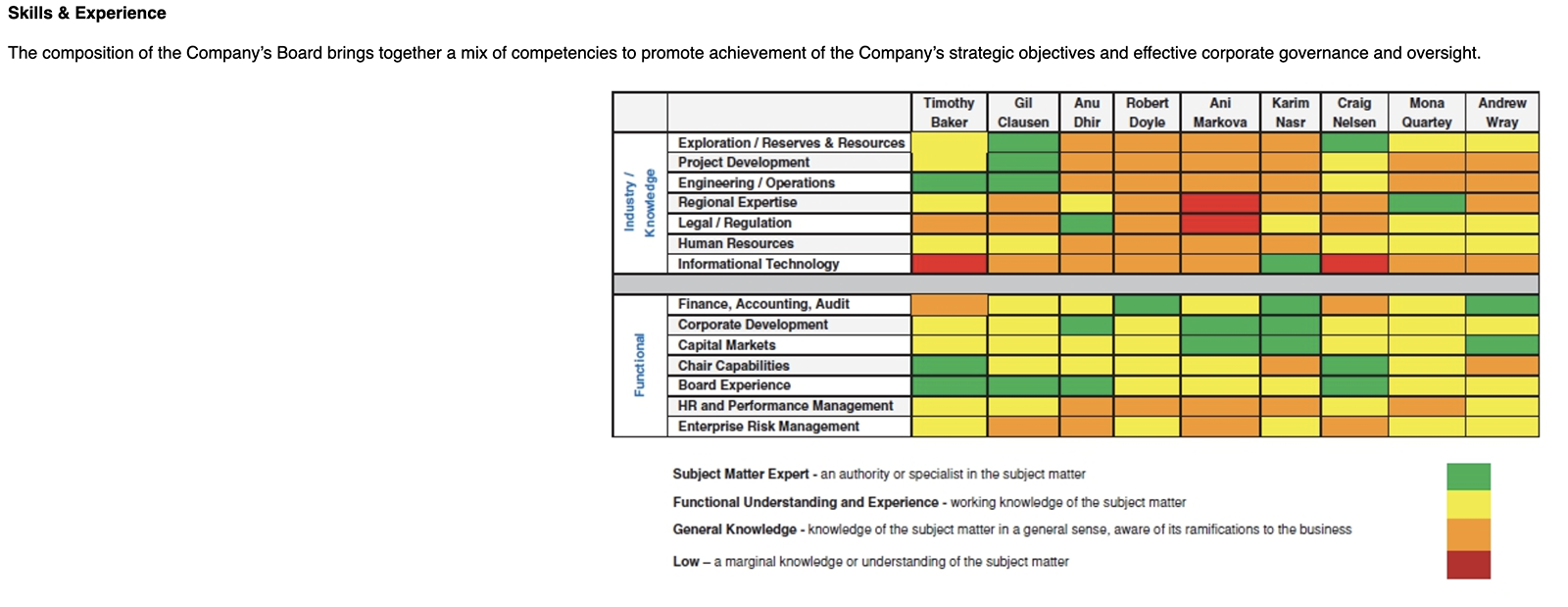

The Golden Star disclosure lays out, in a very visual approach, how each director contributes qualifying skills to carry out business initiatives for the year. Going very in-depth, the matrix is color coded to rank the competencies of each board member. As seen, no one director is a subject matter expert in every category, and no one director ranks poorly in every category. They all have their strengths and weaknesses, and this is useful not only to predict how well they will ensure the strategy is consistent, but also help provide insight into board refreshment for the future.

Disclosure Example 5

Walmart Inc. (WMT)

DEF on 4/23/2020

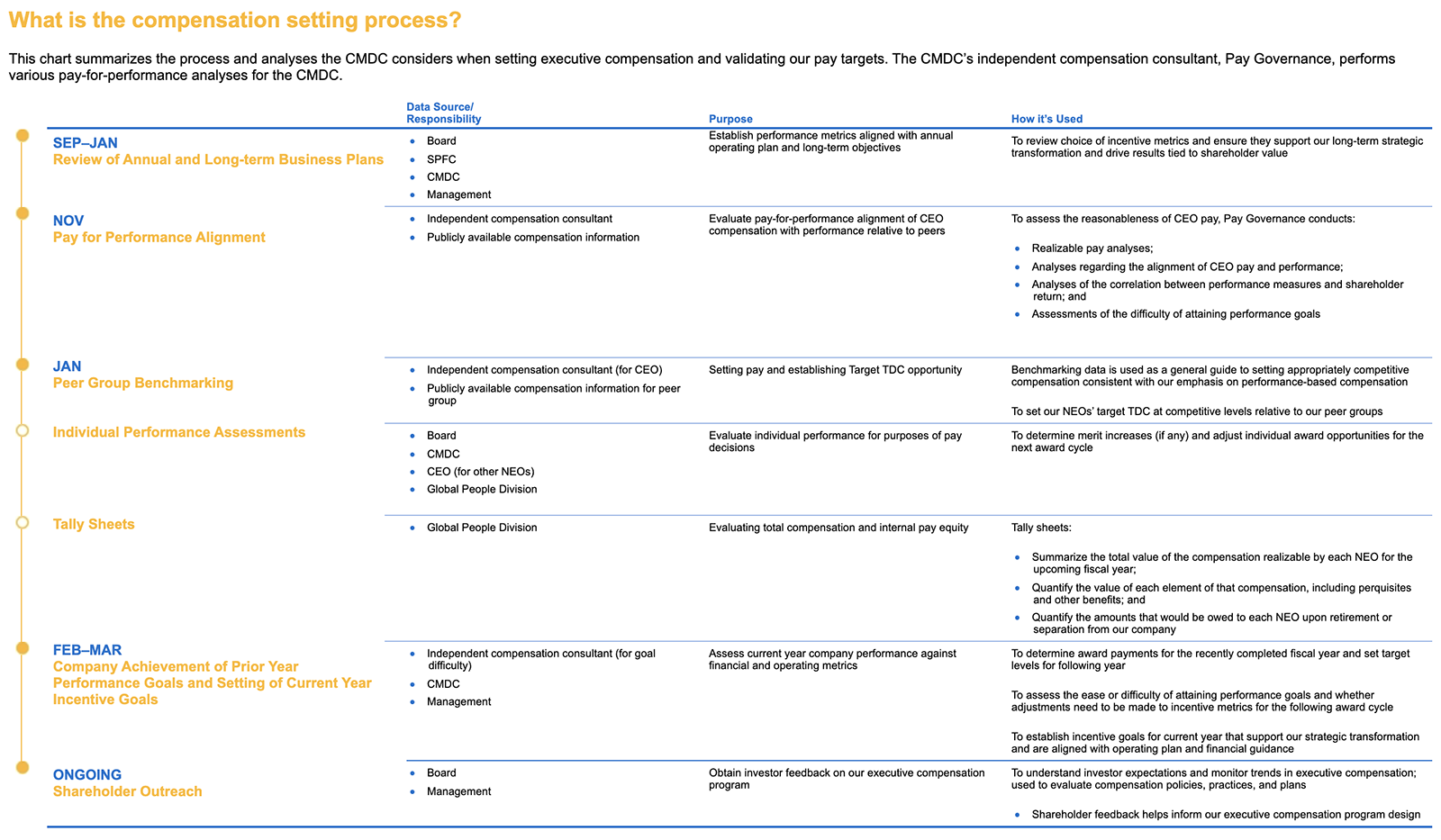

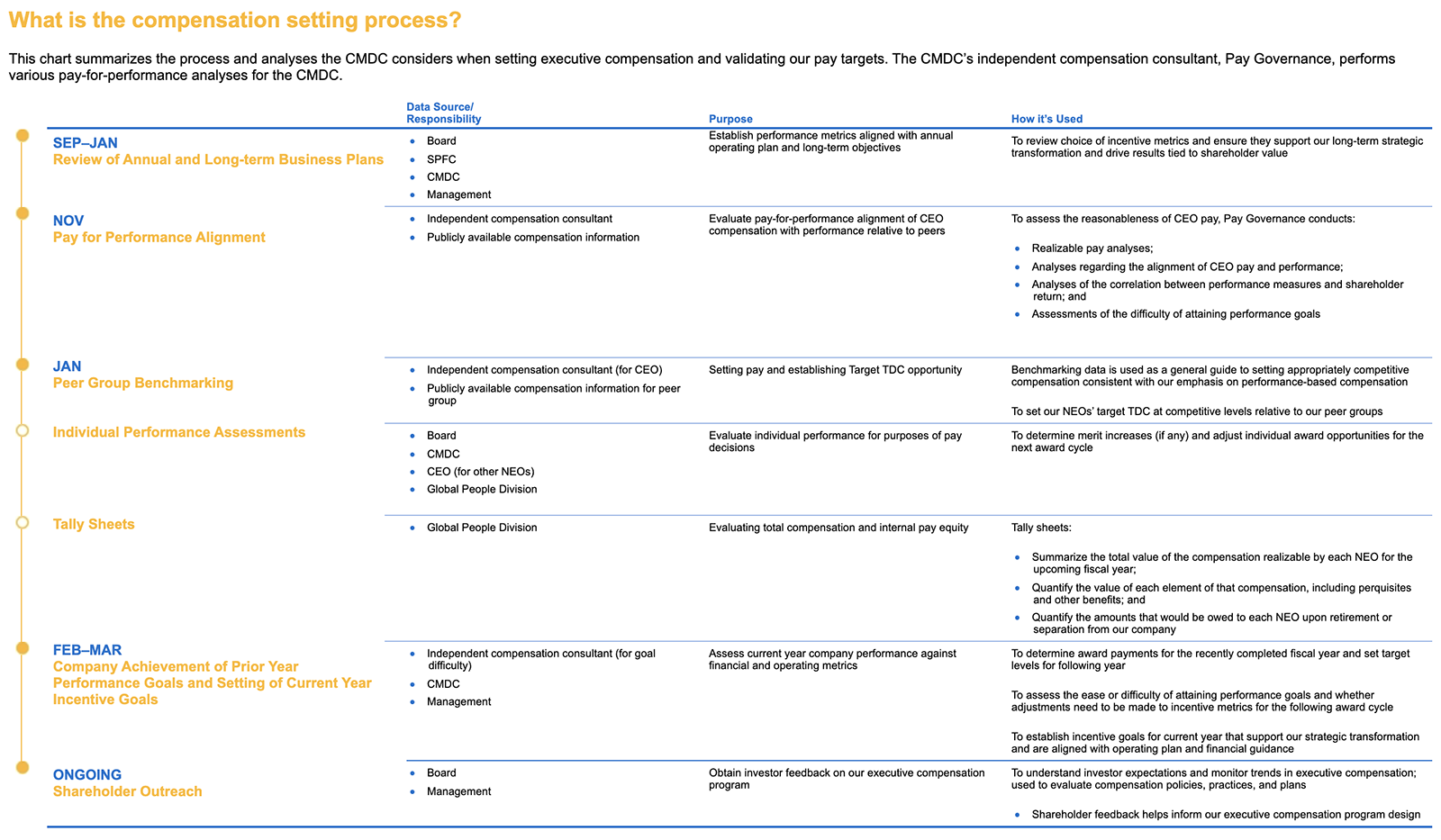

The Walmart disclosure is unique in that it very clearly breaks down how factors affect pay decisions for the entire year. This allows investors to not only know exactly what to expect for each month of the year, but who to reach out to with questions on that particular activity. Furthermore, it describes in detail the purpose of the activities, to ensure that shareholders are completely in the know on compensation setting, as well as how executives will be assessed, and the importance of shareholder engagement.

Disclosure Example 6

Spirit Realty Capital (SRC)

DEF 14A on 4/24/2020

The Spirit Realty disclosure highlights the trend of moving towards performance-based pay. This year, the company chose to change how it approaches salary, bonus design and long-term incentives to increase pay for performance alignment. Not only this, but laying it out in a clear format, highlighting the key differences between 2019 and 2020 and explaining why these changes were made aids in shareholder understanding of the strategy. For more information on trends in long-term incentive plans, read the Equilar report Executive Long-Term Incentive Plans 2020.

Daniella Gama-Diaz

Associate Editor at Equilar

Solutions

Solutions