Products

Solutions

Solutions

Compensation & Governance Insights

Board meeting preparation and analysis

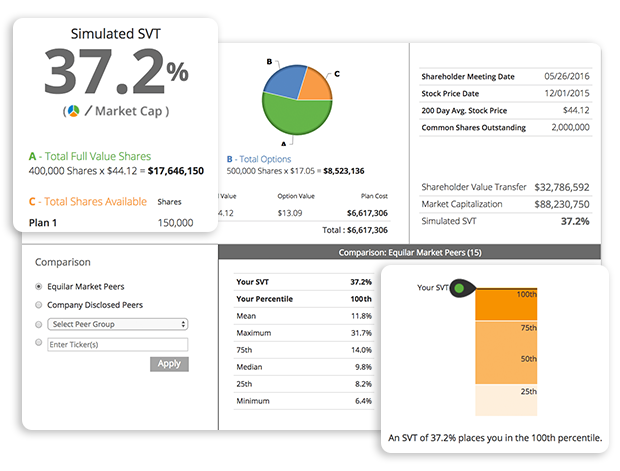

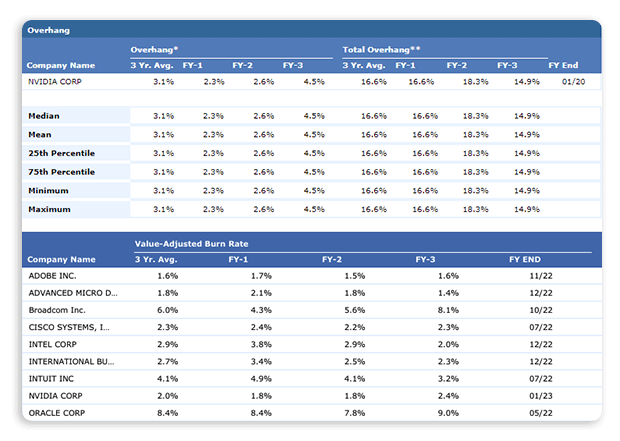

Executive Compensation

Benchmark executive pay

ERIC (AI-Powered Proxy Analysis)

Extract proxy insights using AI

Visit the new ExecAtlas.com to learn more about ExecAtlas, our Executive Engagement and Relationship Intelligence platform.

Resources

Visit the new ExecAtlas.com to learn more about ExecAtlas, our Executive Engagement and Relationship Intelligence platform.

ExecAtlas