Incentive Plan Tariff Adjustments During Trump’s First Term

February 20, 2025

Andrew Gordon

Incentive compensation—pay that varies based on performance—is typically the largest and most scrutinized portion of an executive pay package. When setting targets, boards have to balance the need to retain and motivate executives against the demands of shareholders to see continuous growth, or at least the outperformance of peers. Boards also have to maintain fairness by determining if certain factors, positive or negative, were outside the control of the executive team and should be adjusted for when measuring metric results.

Incentive plans often have built-in flexibility in the form of allowable adjustments for common occurrences such as exchange rate movements, accounting changes, M&A activity, etc. However, sometimes unpredictable factors arise such as war, natural disasters or pandemics that severely impact results, and boards have to decide to what extent that impact should be mitigated at a time when stock price performance might be suffering as a result. For long-lasting events companies may have the time, after the first year is impacted, to anticipate future effects on performance in their initial target setting such that no further post-performance adjustments are required (assuming the prediction was reasonably accurate). When their prediction isn’t accurate, boards have to decide yet again if more adjustments are warranted.

During his first term, President Donald Trump imposed tariffs of 25% on steel and 10% on aluminum imports from most countries, later extending these to include the European Union. The administration also levied tariffs on various Chinese goods, escalating into a trade war that prompted retaliatory tariffs from China. Upon taking office in 2021, President Joe Biden maintained many of the existing tariffs, particularly those targeting Chinese imports. However, in October 2021, the U.S. and the European Union reached an agreement to ease the steel and aluminum tariffs imposed during the Trump administration.

Many companies didn’t incorporate tariff impacts into their 2018 performance targets given they were announced shortly after most companies finalized their plans for the year. The tariffs created negative headwinds for certain sectors of the economy which required decisions on whether or not to adjust for these unplanned events, and whether any adjustment should be partial or in full.

In order to try to predict how companies might respond to the latest round of tariffs in their 2025 incentive plans, we reviewed 2019 and 2020 proxy filings to highlight how affected companies previously adjusted their incentive plans for the 2018 and 2019 tariffs. While some companies made no adjustments, and others made line-item adjustments with little to no explanation in the proxy, we were able to identify several companies with explicit discretionary adjustments for the impact of tariffs on their results, as follows:

Hyster-Yale Materials Handling, Inc.

DEF 14A filed 3/26/2019

Adjustments In calculating the various 2018 incentive compensation performance targets and results, adjustments were made for certain non-recurring or special items (similar to the adjustments listed for the ROTCE calculation on page 25). These adjustments were established by the Compensation Committee at the time the targets were set. In particular, the Compensation Committee approved an exclusion from the calculation of 2018 incentive compensation for the after tax cost of any law or regulation change (in excess of the amount included in the AOP, if any). During 2018, the U.S. Government enacted tariffs on (i) steel and aluminum imports under Section 232 of the Code and (ii) certain goods imported from China, including forklift trucks and components, under Section 301 of the Code (the "Tariffs"). Although the Company implemented price increases and a tariff surcharge to offset the material cost inflation driven by the Tariffs, the Company's 2018 full-year operating results suffered due to a lag in time between full realization of the price increases/surcharge and when the Tariffs and material cost increases were first realized. The Compensation Committee determined that the Tariffs were the result of "law or regulation change" within the meaning of the previously-approved adjustment and that they should not adversely affect 2018 incentive compensation payments as they were not within the control of the 2018 Incentive Plan participants. Accordingly, the ROTCE and operating profit targets and results disclosed on the tables for the Short-Term Plan and the Long-Term Plan have been adjusted to exclude the impact of the Tariffs.

Cooper Tire & Rubber Company

DEF 14A filed 3/26/2020

At the time the Compensation Committee was setting 2019 targets for the AIP and LTIP, certain new tariffs on tires being imported into the U.S. from China were being implemented or contemplated. In particular, on February 15, 2019, the same day these targets were set, anti-dumping and countervailing duties totaling 42.16 percent were imposed on the Company's truck and bus radial (“TBR”) tire imports into the U.S. from China. In addition, effective September 24, 2018, the Company was subject to a 10 percent tariff on passenger, light truck and TBR tires, raw materials and tire-manufacturing equipment imported into the U.S. from China pursuant to Section 301 of the Trade Act of 1974. The impact of these 10 percent tariffs were included in the Company's plans and the incentive targets. However, it was expected that these tariffs might increase, decrease or be eliminated due to trade negotiations between the U.S. and China. The tariff rate was increased from 10 percent to 25 percent on May 10, 2019.

Given the uncertainty and changing nature of these specific tariffs at the time the 2019 targets were being set, their large potential impact on the Company and its 2019 results, the limited ability to adapt to them in the very short time after their implementation, and the difficulty in quickly adjusting the Company’s plans and incentive targets for them, the Compensation Committee determined at the time it set the 2019 targets to not reflect the impact of these new and increased tariffs in the performance targets, but to instead adjust 2019 performance results for the impact of these tariffs, as well as any pricing actions that the Company implemented to offset their effects. In accordance with this decision made at the time the targets were set, the Compensation Committee excluded the impact of these tariffs, as well as tire pricing actions to offset their impact, from the 2019 performance results for the purpose of calculating incentive award payouts.

In addition, on December 17, 2018, U.S. Customs and Border Protection published a final rule announcing regulatory changes to duty drawback that are part of the Trade Facilitation and Trade Enforcement Act of 2015. The enactment of the Modernized Drawback Final Rule included several changes, including changes allowing the Company to obtain the refund of certain duties it had previously paid. Under the rule, recovery of duties is allowable for up to five years subsequent to the incurrence of the duty. For the Company, the change in regulations allowed for a greater population of tire exports from the U.S. to be utilized to offset duties on tires imported into the U.S. However, because duty drawback claims require detailed matching of import and export activity as part of the filings, the amount of the potential duty drawback opportunity was not known at the time the 2019 performance targets were set. The Company was able to recognize $20,091 of such recovered duties in the fourth quarter of 2019. Since these duty drawbacks were an offset of the Company's increased duty costs on tires imported to the U.S. from China, the Compensation Committee determined to exclude these duty drawbacks from the 2019 performance results for the purpose of calculating incentive award payouts.

In total, the net impact of the new anti-dumping and countervailing duties on TBR tires and increased Section 301 tariffs enacted/increased in 2019, net of tariff-related price increases and duty drawback recoveries, reduced operating profit by $18,401 ($13,083 net of tax). The net impact of these tariff items has been excluded from the Company's performance results, as defined below.

Lowe’s Companies, Inc.

DEF 14A filed 4/16/2020

The Compensation Committee adopted adjustment guidelines in January 2011 and refined the guidelines in November 2019 and March 2020. The adjustment guidelines generally relate to (i) amounts required to be reported separately under applicable accounting standards as extraordinary items, (ii) gains or losses as a result of changes in accounting principles, (iii) impact of changes in tax regulations, (iv) business results from unplanned acquisitions and divestitures, (v) costs and any other non-recurring items related to acquisition and divestiture activity, (vi) unplanned debt restructuring costs or costs associated with change in capital structure, (vii) costs of significant unplanned initiatives or investments, and (viii) significant changes to stock buyback programs or capital restructuring.

The adjustment guidelines include the following specific items as potential adjustments for consideration: (i) impact of foreign currency fluctuations; (ii) impact of tariffs and unanticipated regulatory and policy changes; (iii) asset impairments or write-offs, including store closing costs; (iv) restructuring costs; (v) litigation costs and settlements for historical transactions; (vi) timing impact for items accelerated or delayed near year-end; (vii) acts of God; and (viii) impact of global pandemics and public health emergencies.

In March 2020, the Compensation Committee reviewed the Company’s 2019 performance relative to the adjusted sales, adjusted operating income and inventory goals to determine the annual incentive awards earned under the annual incentive plan for fiscal year 2019. Adjusted sales results of $72.060 billion resulted in a payout above threshold but below target. Adjusted operating income results of $6.579 billion fell below the required payout threshold goal due to the unprecedented impact of tariffs. Throughout the course of the year, the Company was able to take actions to mitigate the majority of this tariff impact on our operating results. However, given the timing of the tariff increases and scale of the impact on our operating results, the Committee determined to provide partial relief and make an adjustment of $74 million for incentive compensation performance achievement. Following the adjustment approved by the Committee, the adjusted operating income achievement result of $6.653 billion resulted in a minimum payout at threshold. The inventory results fell below the required payout threshold goal, resulting in no payout for the metric under the plan.

Five Below, Inc.

DEF 14A filed 5/5/2020

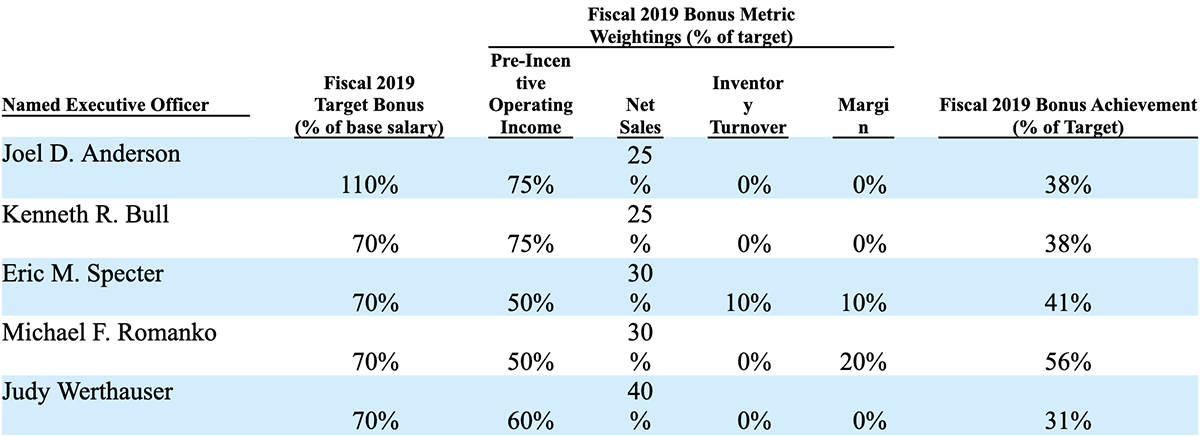

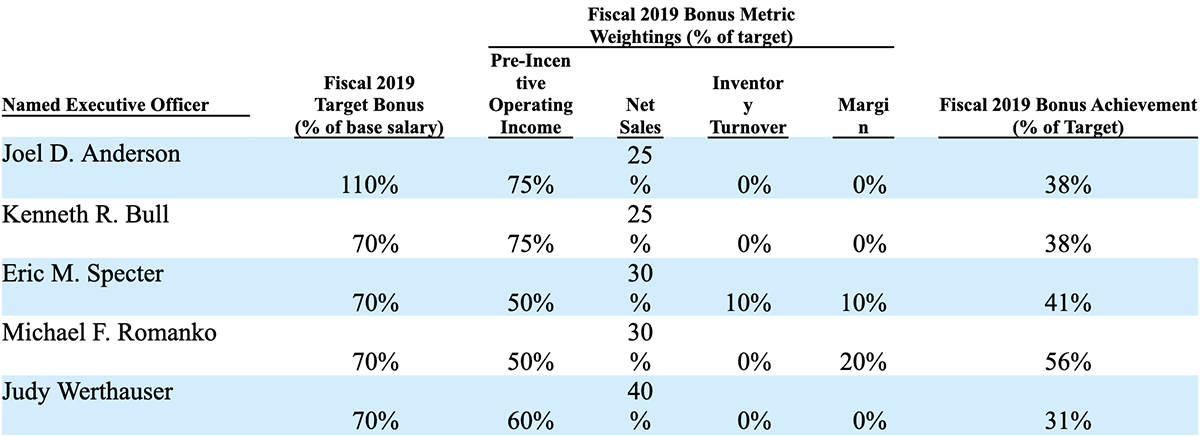

The target bonus opportunities, weighting of performance metrics, and bonus achievement for each of our Named Executive Officers for fiscal 2019 were as follows:

Subsequent to the end of fiscal 2019, in light of the impact on the Company of tariffs imposed by the United States on certain imports from China and the substantial efforts of the executive team to fully mitigate such impact, the compensation committee authorized an adjustment to the bonus payout to the NEOs under the Incentive Bonus Plan to provide each NEO a fiscal 2019 bonus equal to 50% of their respective targets.

If you're interested in learning more about how companies adjusted their executive incentive plans in light of tariffs, the Equilar Research Services team can provide valuable disclosure insights. Contact the Equilar Research Services team for in-depth analysis on how companies have adapted their executive compensation programs in response to tariff-related challenges.

Contact

Andrew Gordon

Senior Director of Research Services at Equilar

Andrew Gordon, Senior Director of Research Services at Equilar, authored this post. Please contact Amit Batish, Senior Director of Content & Communications, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions