Analyzing Equity Participation Rates With AI Search Copilot ERIC

January 30, 2025

Andrew Gordon

Equity has long been considered the most effective way to align the interests of executives to shareholders. Every year, the board of directors benchmarks compensation for its executive team and decides what portions to allocate to cash vs. equity and fixed vs. variable pay. However, the human resources department also has to consider the rest of the company, and equity budgets as well as ISS allowable industry burn rate caps put a limit on how much equity can be spread over the remainder of the organization. There are many debates and studies on the impact of broad-based equity usage on stock price returns due to increased employee motivation and retention, so it’s an important consideration for companies to decide how deep in the organization they want to grant equity, and what size and form that should take.

Public disclosures about equity usage generally consist of granular details for the named executive officers (NEOs) in the proxy, and overall grant activity for the full company in the annual report. Outside of surveys, there’s no easy way to determine how deep into the organization equity usage goes. Even the recent disclosure enhancement of a human capital section of the 10-K rarely addresses this topic. However, there is one small nugget of data that’s disclosed when companies request additional shares for their equity incentive plans, and that’s an “eligibility” section that often provides a number of employees eligible to receive awards.

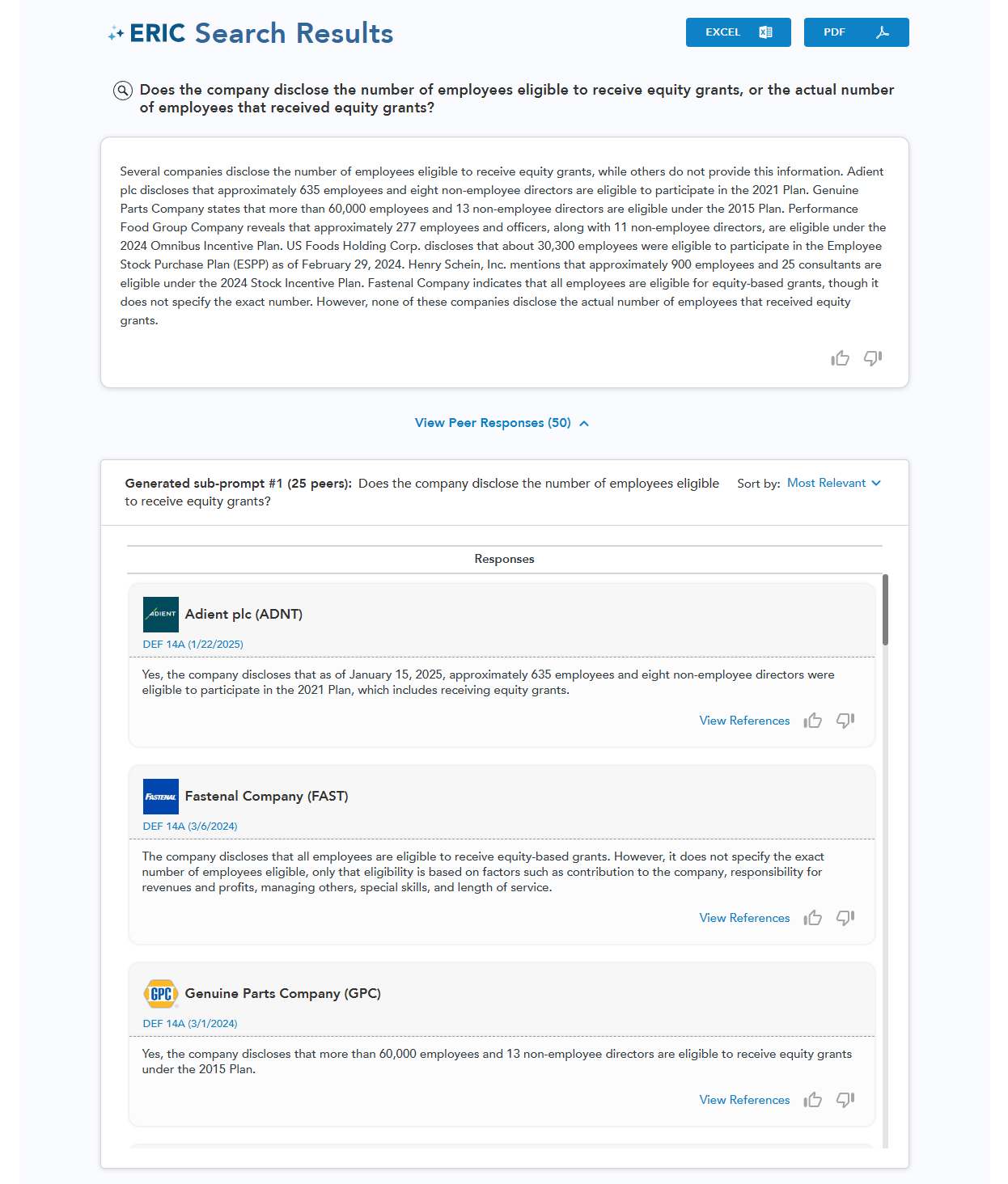

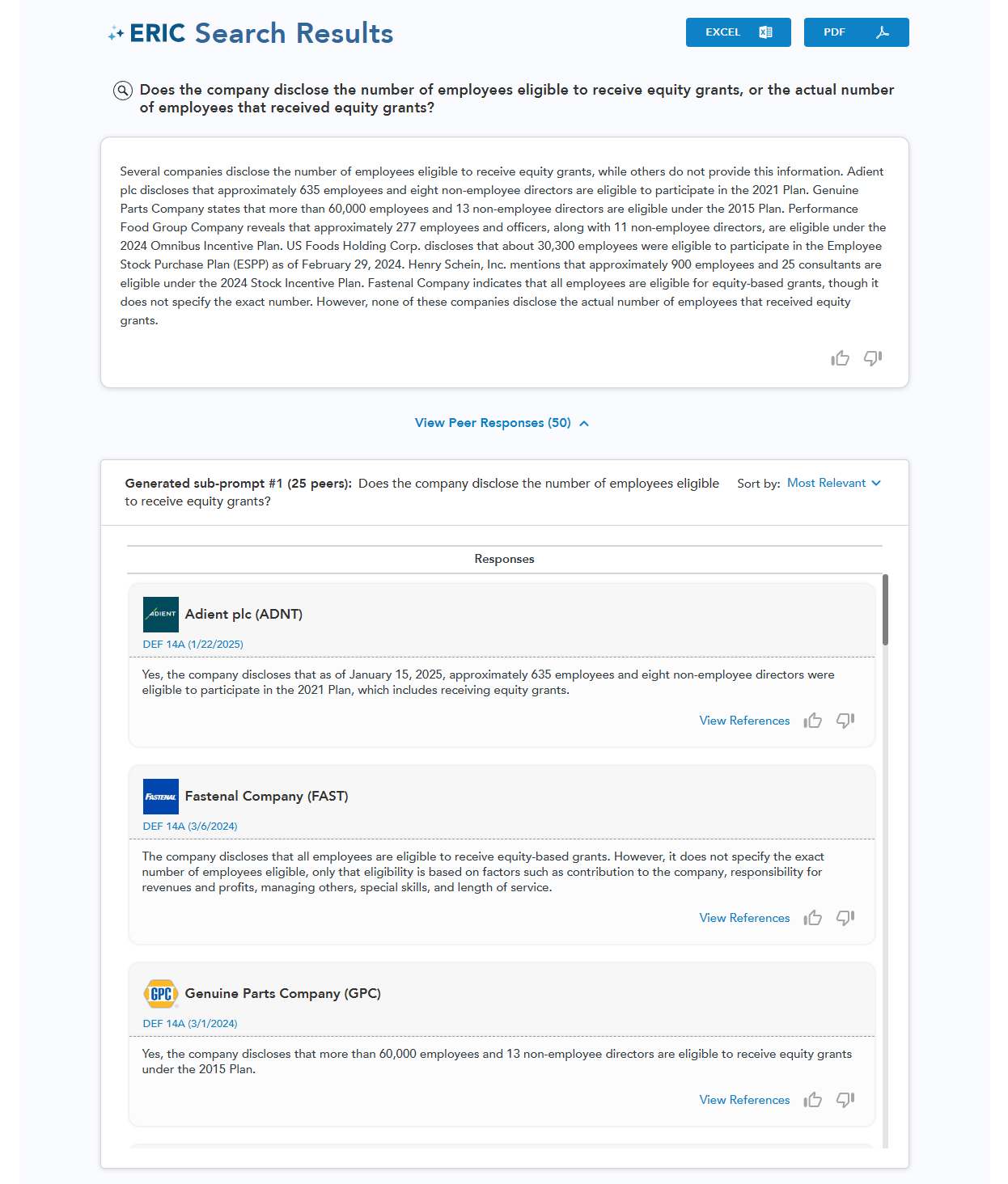

In this blog, we used our AI search tool, ERIC (Equilar Research Intelligence Copilot), to review eligibility disclosures in the most recent proxy for all companies in the Equilar 500—the 500 largest U.S. public companies by revenue. The specific prompt used was “Does the company disclose the number of employees eligible to receive equity grants, or the actual number of employees that received equity grants?”

Companies don’t request shares every year, so the results were limited to the companies that either had a share request or that disclosed equity participation elsewhere in the proxy (usually the CD&A). Out of the 500 companies, 96 had such a disclosure. After reviewing the 96 results, it was clear that “eligibility” had two common meanings. The first meaning was a definition of who the company legally could make grants to, where a broad definition allows more flexibility. The second meaning was a more specific carve-out of who actually receives equity awards. Given that the first meaning doesn’t convey much information and is typically close to, if not the full, employee population we restricted the results to the second meaning, which we defined as eligible employees divided by total employees of less than 80% (“the eligibility rate”).

After removing the 43 companies that disclosed an eligibility rate greater than 80%, we were left with the following 53 results:

| Eligibility Rate |

Prevalence |

| 50% to 80% |

1.9% |

| 20% to 50% |

9.4% |

| 10% to 20% |

11.3% |

| 5% to 10% |

24.5% |

| 2% to 5% |

30.2% |

| 1% to 2% |

17.0% |

| < 1% |

5.7% |

Although it’s a small sample size, within these 53 companies the technology and energy sectors had the highest eligibility rates of around 19%. A little over half of the 53 companies had a participation rate below 5%.

Many factors can influence equity usage, such as industry, company size, stage in the corporate life cycle, having a founder CEO or even simple compensation philosophy. We analyzed one variable, employee count, to see if there was any relation between number of employees and eligibility rate, as follows:

| Employees |

Companies |

Average Eligibility Rate |

| 100,000+ |

7 |

4.7% |

| 50,000 - 100,000 |

13 |

7.9% |

| 20,000 - 50,000 |

19 |

6.0% |

| 10,000 - 20,000 |

7 |

11.0% |

| < 10,000 |

7 |

18.1% |

While limited, these particular results would indicate a lower eligibility rate for higher employee organizations, but a larger study would be needed to confirm how much that trend holds.

The ERIC AI search tool provides an easy way to write questions in plain English and return quick, accurate and summarized results. Unlike previous generations of search tools, ERIC does not require exact matching of search terms, which historically is the main cause of missed results. Equilar’s Custom Research Services Team, in combination with ERIC, is a fast, powerful and cost-effective way to review complicated questions over much larger sample sizes than previously possible.

Want to learn more about ERIC or Equilar’s Research Services? Contact us for a custom overview.

Contact

Andrew Gordon

Senior Director of Research Services at Equilar

Andrew Gordon, Senior Director of Research Services at Equilar, authored this post. Please contact Amit Batish, Sr. Director of Content & Communications, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions