Knowledge Center

Blog Home

Multi-Boarded Directors Become More Common, Are Paid More

April 14, 2017

The concept of “overboarding” has become a trending topic in corporate governance. Investors, advisors and public boards alike have expressed concern that a director may not have sufficient time and energy to effectively serve if he or she has too many other commitments. However, many also see multi-boarding as an asset. They argue that an individual with concurrent public directorships can provide a board with valuable shareholder engagement and corporate governance experience, and apply lessons learned across companies in real time.

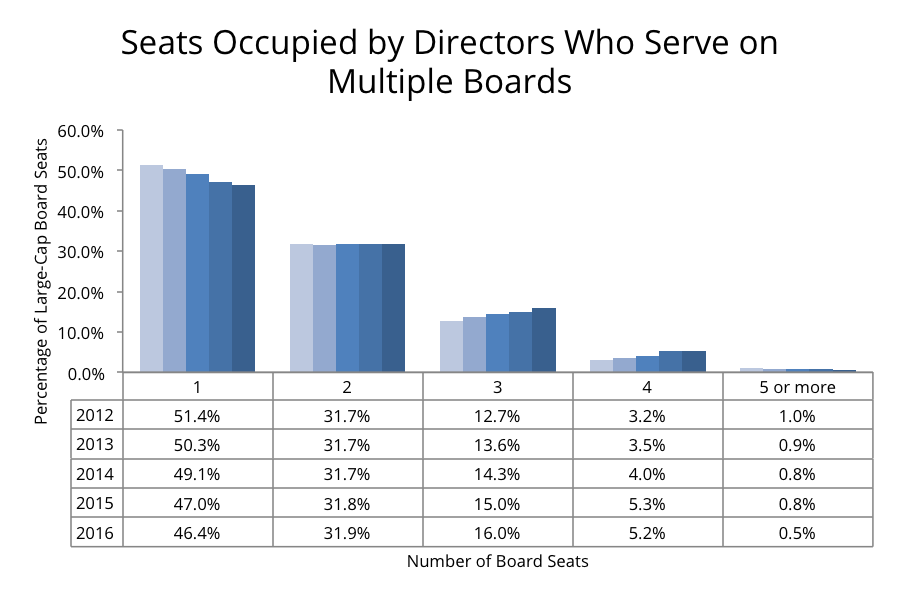

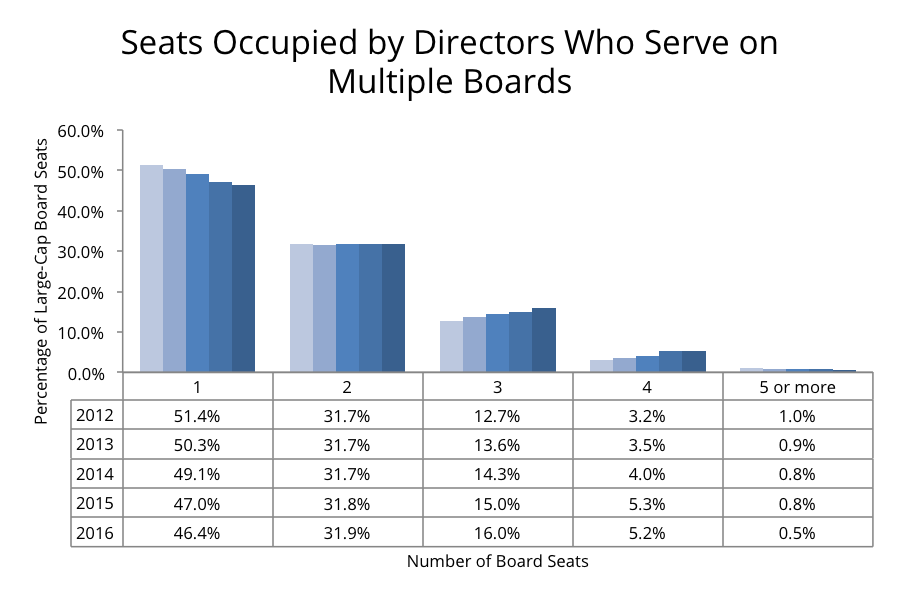

Whether a risk or an asset, multi-boarded seats are becoming more prevalent at large-cap public companies*. According to an Equilar study, the percentage of director seats occupied by an individual that serves on multiple public boards increased from 48.6% to 53.6% over the past five years. The graph below demonstrates that while the percentage of seats occupied by a director with two memberships has hovered around 32% since 2012, the percentages of seats occupied by triple- and quadruple-boarded directors have increased from 12.7% to 16.0%, and from 3.2% to 5.2%, respectively. Less than 1% of seats are occupied by board members with five or more directorships, likely due in part to proxy advisor recommendations against such directors.

Boards’ interest in recruiting directors with shareholder engagement and corporate governance experience might be contributing to these increases. As boards face greater scrutiny from their investors and stricter regulatory requirements, hiring candidates that are well-versed in these issues may give them a strategic advantage.

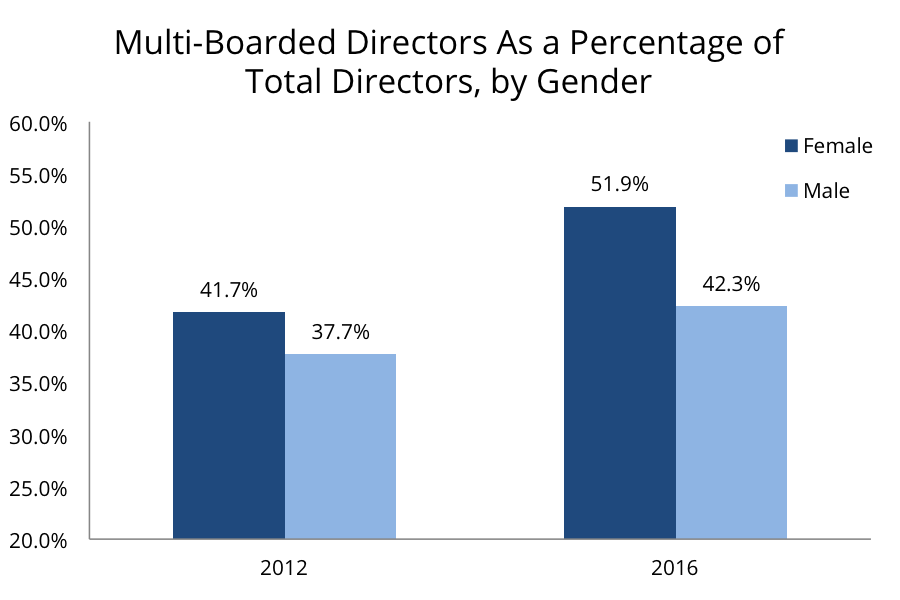

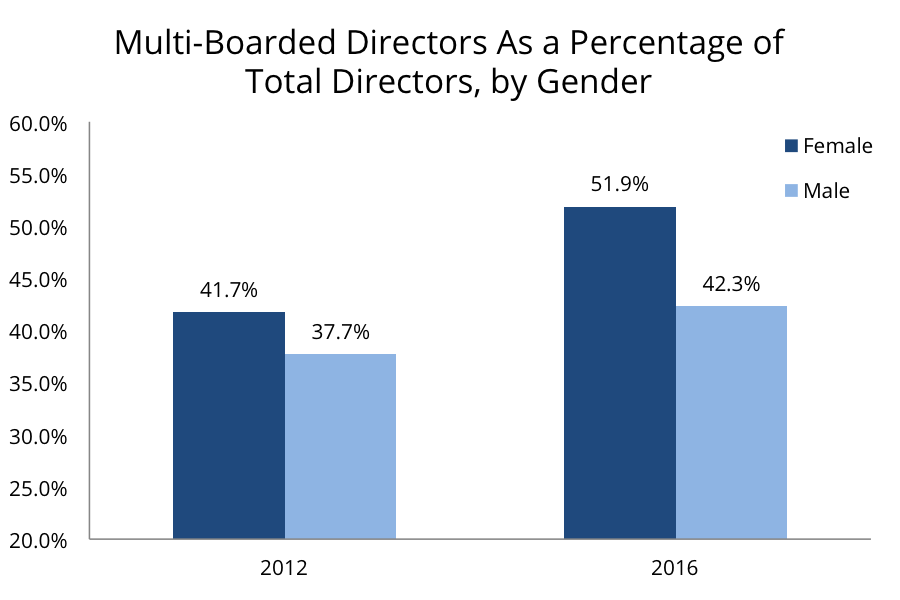

The increasing prevalence of female directors may also be contributing to this trend. The proportion of women who are multi-boarded is greater than that of men, and is increasing at a much faster rate. In 2012, 41.7% of female directors served on more than one board, compared to 37.7% of male directors. By 2016 the percentage of female directors who were multi-boarded had increased more than ten percentage points, while the proportion of multi-boarded men had increased by less than five. So as the number of female directors grows, so too does the prevalence of multi-boarding. One explanation for this relationship is that boards looking to recruit women prefer those who already have public directorship experience.

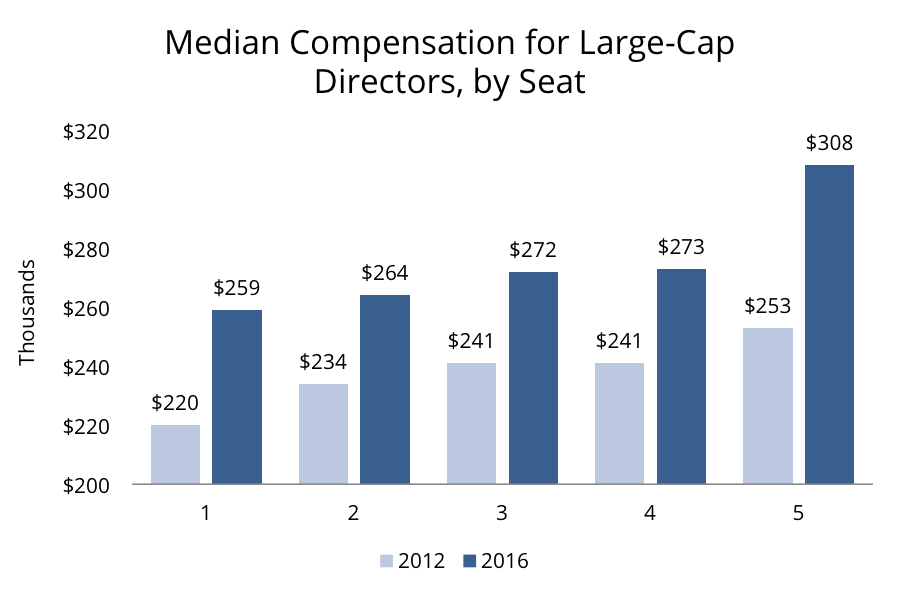

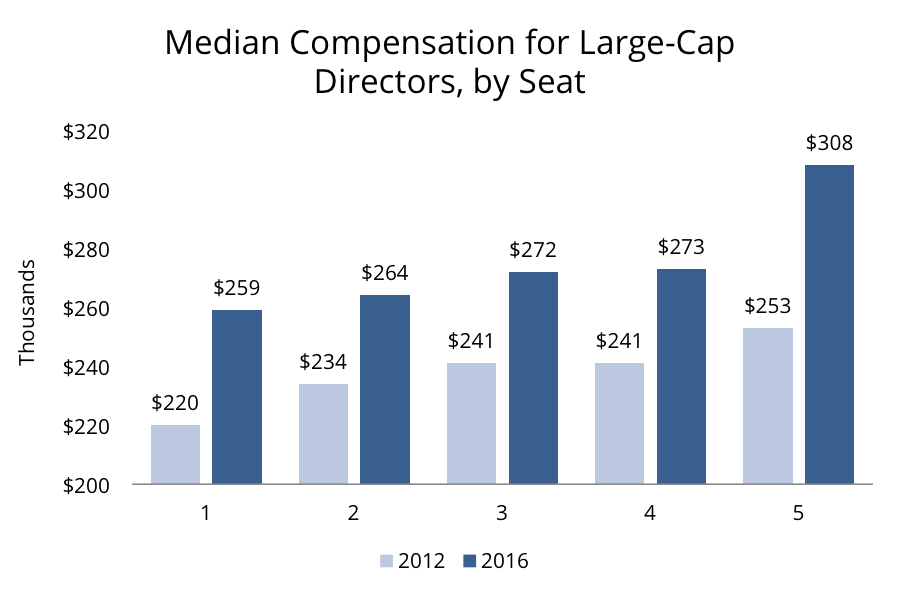

The study also revealed that multi-boarded seats tend to pay more than their single-boarded counterparts. For example, the median total compensation among large-cap board positions filled by an individual serving on five or more boards was 19% higher than the median of positions filled by a single-boarded individual. Indeed, median pay increased progressively as more positions were held by a director in a particular seat.

It is important to note that the analysis for this article did not aggregate compensation paid to individuals sitting on multiple boards. Instead, total compensation (as disclosed in proxy director compensation tables) was included as a unique data point, and medians were calculated for each sample. This means that each data point represents total compensation for serving a unique board, and not the sum of compensation paid to a unique director from multiple boards.

Why multi-boarded seats pay more than single-boarded ones is not entirely clear. One reason might be that directors serving on multiple boards leverage their experience to seek out higher-paying directorships. Or perhaps companies with higher-paying board seats tend to recruit individuals who already serve on a board because they value the directors’ current board experience and are willing to pay more for it. In addition, an individual already serving in one directorship may be more likely to obtain a leadership role on the next board they join. Positions like committee chair, lead director and chairman usually include additional fees that would increase a seat’s total compensation. Alternatively, a network effect may be present: The more boards one serves on, the more connected one is to higher-paying seat opportunities at other public companies.

It is unlikely that just one of the above explanations is driving this trend. The actual cause is probably a complex blend. Nevertheless, it appears that large-cap boards are increasingly recruiting and paying more for multi-boarded directors.

*Note: “Large-cap companies” are defined as the companies included in the S&P 500 index, as listed on Wikipedia.

With Equilar BoardEdge, use the latest data to benchmark the composition of your board against your peers, discover the right candidates for your succession planning needs, and connect with individuals using your executive and board network.

For information regarding the studies referenced in this post and to purchase the underlying datasets, or to learn more about Equilar Research Services, please contact the Equilar research team at researchservices@equilar.com.

For more information on Equilar research and data analysis, please contact Dan Marcec, Director of Content & Communications at dmarcec@equilar.com. Andrew Abeles, research analyst, contributed to this post.

Solutions

Solutions