Knowledge Center

Reports

Compensation & Governance Outlook 2016

December 10, 2015

Featuring commentary from Hogan Lovells

In the age of Say on Pay and increasing shareholder engagement, proxy statements are communication

vehicles between issuers, investors, proxy advisors and indeed all stakeholders. And while a majority

of investors report that proxies represent a vital source of information for making voting and investment

decisions, they also profess that these documents are excessively long and difficult to read.

Corporate issuers and boards of directors will soon be required to disclose additional information and

policies in the wake of rules proposed by the Securities and Exchange Commission (SEC) earlier in 2015.

Five years after Congress passed Dodd-Frank, issuers will soon need to disclose elements of executive

pay and company performance versus a peer group, a clawback policy for recovering incentive-based pay

following a financial restatement, and the ratio of their CEOs’ pay to that of their median employee.

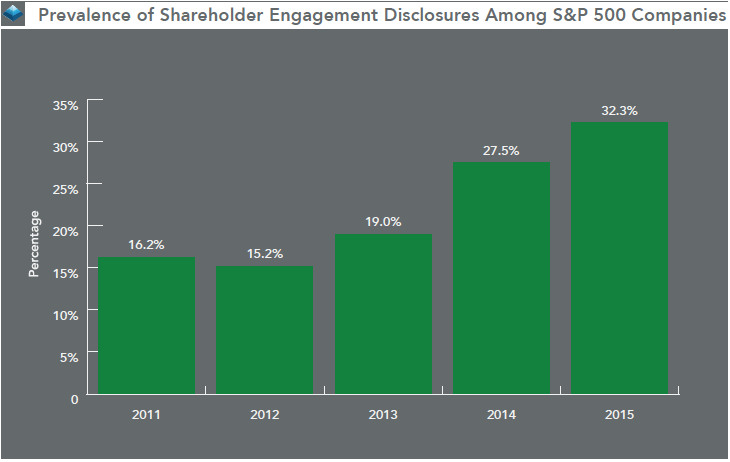

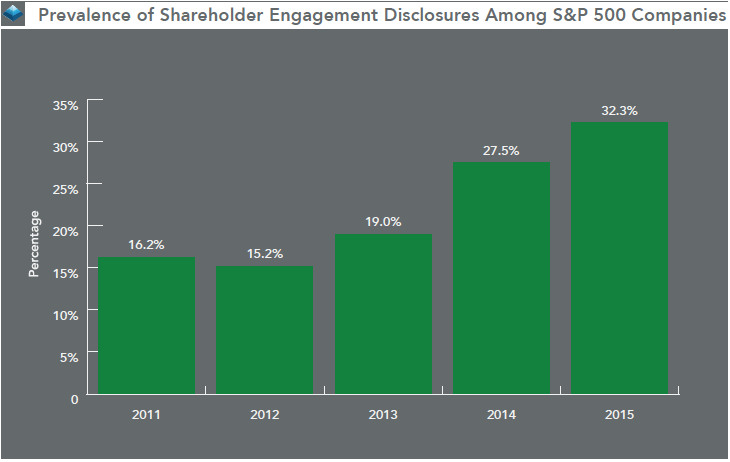

As issuers continue to engage investors and proxy advisors in a topically diverse and more frequent

fashion, governance professionals and boards of directors will engage in further shareholder outreach

efforts. In fact, the percentage of S&P 500 companies that disclosed direct engagement with shareholders

about doubled from 16.2% to 32.3% over the last five years. Transparency among all stakeholders has

become integral to these interactions, with institutional investors and proxy advisors publishing detailed

voting guidelines and clear open-door engagement policies.

“Directors and executives will continue to grapple with various governance challenges in 2016, such as

appropriate oversight of risks associated with business operations including cybersecurity as well as

ever-present risks associated with operating in a global economy, including bribery and geopolitical

volatility,” said Alex Bahn, Partner at Hogan Lovells, who contributed independent commentary to the

report. “Boards will also be faced with continuing governance pressures from shareholders on transparency

and access to the board, including through proxy access. Directors and executives can mitigate these

challenges through robust oversight of key risk management functions as well as ongoing dialogue and

interaction with shareholders to ensure key stakeholders are comfortable in the board’s understanding

and responsiveness to shareholder concerns.”

This report examines trending, marquee topics in corporate governance and shareholder engagement that

will affect issuer disclosures in 2016 and beyond. The extent to which S&P 500 companies disclose these

elements—such as pay for performance, realized pay, modifications following shareholder outreach, adoption

of proxy access, and board independence and succession planning—is displayed in terms of both overall

prevalence and use of specific disclosures. The topics highlighted are a primer for both the preparation

and transparency increasingly expected from stakeholders in the public marketplace.

For more information on Equilar’s research and reports, please contact Amit Batish, Director of Content &

Marketing Communications at abatish@equilar.com.

Solutions

Solutions