Knowledge Center

Reports

Corporations Lose $92 Billion in Tax Deductions—Will It Matter?

January 23, 2018

By Matthew Goforth, Senior Governance Advisor, Equilar

Featuring Commentary From:

In December 2017, the Tax Cuts and Jobs Act was signed into law, and among other changes, reduced the corporate tax rate from 35% to 21%. The act also ended the performance-based exemption to IRC Section 162(m) and expanded the pool of employees to which it applied to include the CFO. In other words, companies will no longer be able to deduct compensation in excess of $1 million paid to their top 5 executives starting in the 2018 tax year.

In 1993, the amount of compensation that corporations could deduct from their taxable income was capped at $1 million for select executive officers (the CEO and the 3 highest paid officers, excluding the CFO). The then-fresh change to the tax code came with a loophole. If the compensation was considered performance-based, then it was exempt from the rule and could be deducted—even if the executive received compensation in excess of the $1 million limit.

There were other key changes in the new legislation that affected the top officers at corporations, noted Emily Cervino, Vice President of Fidelity Stock Plan Services. “After breathing a collective sigh of relief when the nonqualified deferred compensation (NQDC) and first-in-first-out (FIFO) provisions were removed from the proposed legislation, professionals in the compensation space focused in on the remaining provisions, which impact equity awards,” she said.

Cervino said that for many plan sponsors, the most pressing issue was the changes to individual tax rates, which triggered questions and activity related to rates applied to supplemental income. Most grant activity, and thus most vest activity, occurs in Q1, so plan sponsors have an immediate need to understand the tax rate situation. IRS Notice 1036 confirmed 22% as the optional flat rate for supplemental income up to $1 million, and 37% for supplemental income of $1 million or more, down from 25% and 39.6%, respectively, in 2017. The IRS has recommended that plan sponsors apply these rates as soon as possible, and no later than February 15, 2018. “Plan sponsors who haven’t yet made these rate adjustments should look into this immediately,” Cervino stressed.

(Note: A Q&A with Fidelity on tax reform’s impact beyond the C-suite comprises the final section of this article, following an analysis of exec comp deductibility.)

Moreover, changes to 162(m) are likely to impact the administration of compensation plans, according to Amanda Benincasa, Senior Consultant at Aon Equity Services. “Tracking of 162(m) ‘once covered, always covered’ employees may prove tedious,” she said. Benincasa added that “strategy to ensure vesting dates do not cluster and push covered employees over the $1 million limit inadvertently should be considered. While before this wasn’t as much of a concern because all performance-based equity was deductible, it will matter going forward since these vesting events will drive taxation.”

The $92 Billion Elephant in the Room

Equilar examined executive compensation data from SEC filings for the Russell 3000 index over the last three fiscal years to gather a sense of how much compensation corporate America was able to deduct in recent years under the 162(m) provision—and how much they will be giving up now that it’s gone. Certain assumptions were made to arrive at an estimate of such tax deductions. Non-equity incentive plan compensation (cash awards typically paid as annual bonuses) was added to the dollar value realized upon the exercise of stock options and vesting of restricted stock awards and aggregated for the three most recently reported fiscal years. Time-vesting restricted stock awards or units were assumed to be granted from a 162(m) eligible share pool, meaning that despite their lack of performance links, companies were still able to deduct vested shares over the 162(m) cap.

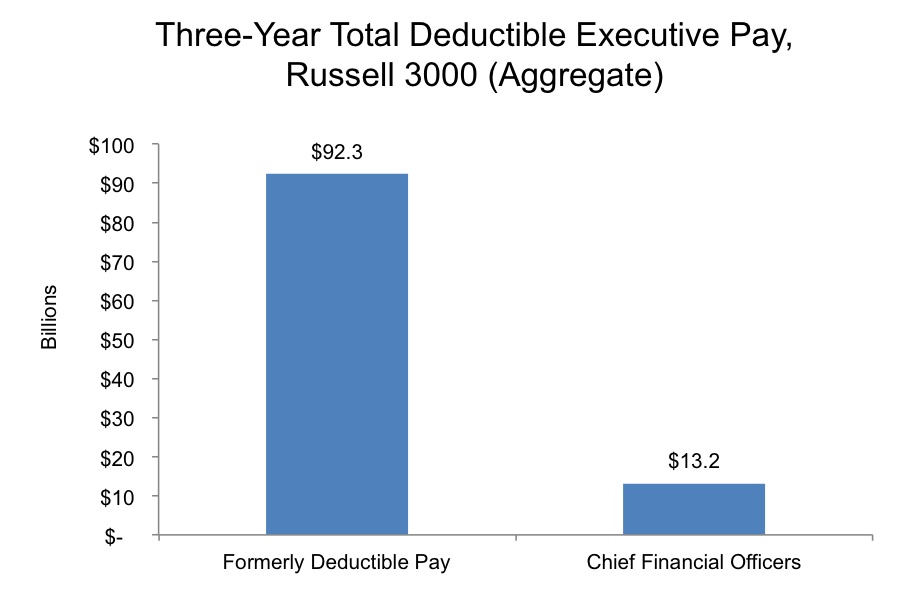

Given those parameters, Russell 3000 companies should have been able to deduct about $92 billion in aggregate based on this exemption over the last three years, applying the now-former rules under 162(m). Had CFOs been covered by 162(m)—as they will be going forward—over the same period, the index would have realized an additional $13 billion in deductions. As it stands, CFOs will be added to 162(m) covered employees, but their compensation in excess of $1 million will not qualify for deduction.

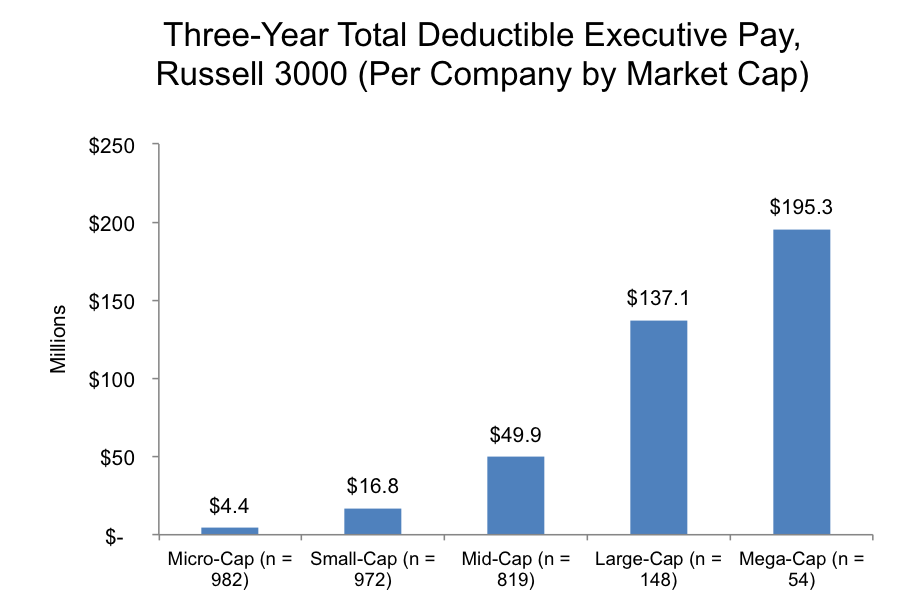

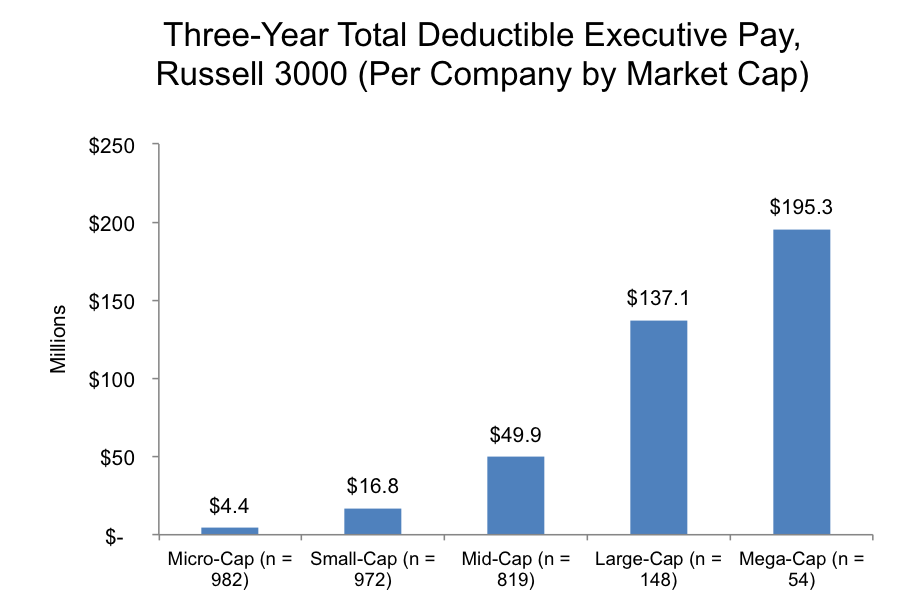

One might expect that larger companies were formerly able to deduct greater amounts of compensation under 162(m), and indeed the data show that is the case. Based on market-cap thresholds established by the Russell Indexes, Equilar divided the Russell 3000 into micro-, small-, mid-, large- and mega-cap tranches. On average, a mega-cap company deducted $195 million over the last three fiscal years, and micro-caps were able to deduct the least amount of executive compensation on a per company basis of $4.4 million. (see chart below)

In the aggregate, mid-caps were eligible to have deducted the largest amount of compensation as a group at nearly $41 billion, considering this tranche included such a large number of companies (819). Due to greater sample sizes, small-caps ($16 billion) and large-caps ($20 billion) were also able to deduct greater amounts of executive compensation than mega-caps ($11 billion) in the aggregate. Only micro-caps ($4 billion) were eligible to have deducted less than the mega-caps over the last three years.

Equilar also parsed the data by industry to gain insight on the amounts of deductible compensation generated at companies offering similar products and services. Consumer services companies and retailers topped the list with average deductible compensation of about $160 and $159 million, respectively. Banks and software companies also had averages greater than $100 million. Household and personal products companies were at the bottom of the list with an average of just under $5 million in deductible executive pay over three years. In the aggregate, the software industry (n = 86) should have been able to deduct the greatest amount of compensation ($11 billion) over the three-year period.

Table: Russell 3000 Three-Year Deductible Executive Pay, by Industry Group

|

Industry Group

|

Sample Size

|

Deductible Incentive Pay Per Company

|

Consumer Services

|

23

|

$160,433,046

|

Retailing

|

31

|

$158,598,360

|

Banks

|

25

|

$139,766,977

|

Software & Services

|

86

|

$128,360,375

|

Utilities

|

31

|

$65,521,322

|

Capital Goods

|

133

|

$51,987,104

|

Materials

|

72

|

$51,389,020

|

Semiconductors & Semiconductor Equipment

|

57

|

$48,333,893

|

Diversified Financials

|

107

|

$43,645,392

|

Real Estate

|

99

|

$43,525,394

|

Health Care Equipment & Services

|

195

|

$33,265,669

|

Media

|

125

|

$32,091,379

|

Energy

|

121

|

$29,862,419

|

Commercial & Professional Services

|

63

|

$28,414,834

|

Pharmaceuticals, Biotechnology & Life Sciences

|

263

|

$28,253,892

|

Automobiles & Components

|

91

|

$27,155,518

|

Technology Hardware & Equipment

|

172

|

$20,914,335

|

Telecommunication Services

|

53

|

$19,510,897

|

Consumer Durables & Apparel

|

170

|

$19,373,425

|

Transportation

|

123

|

$14,871,304

|

Food, Beverage & Tobacco

|

219

|

$14,279,491

|

Insurance

|

314

|

$12,115,464

|

Food & Staples Retailing

|

82

|

$11,001,864

|

Household & Personal Products

|

237

|

$4,937,274

|

Will the Corporate Tax Rate Offset the Loss of 162(m) Deductibility?

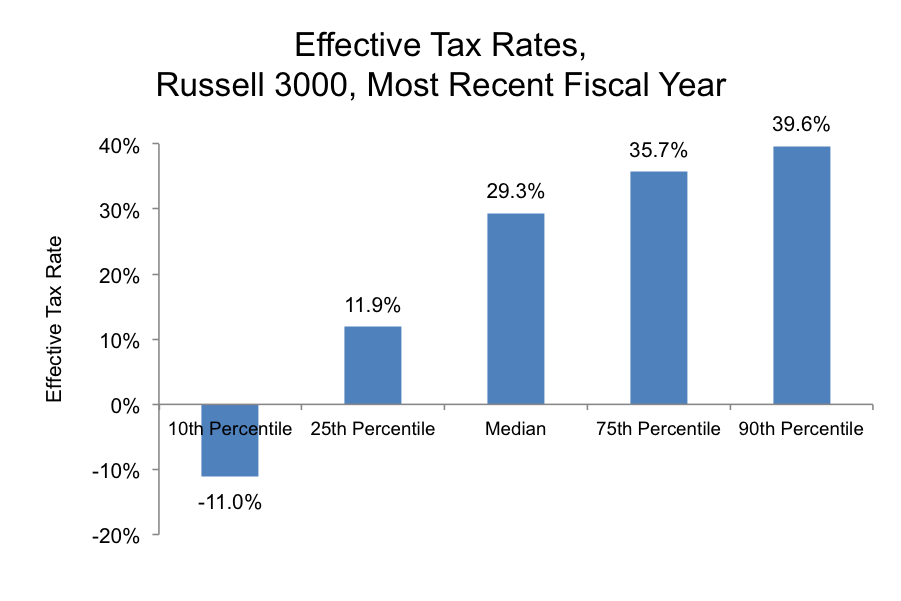

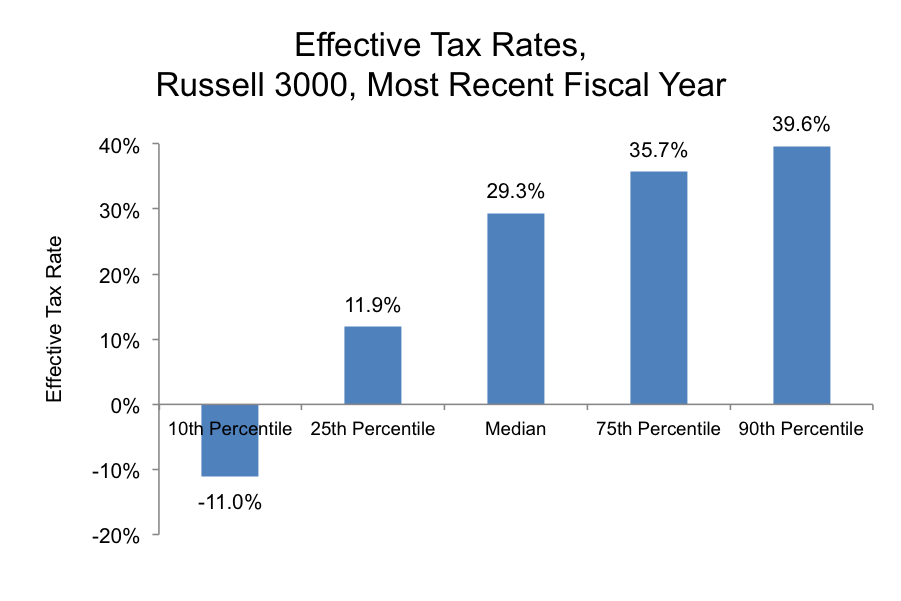

With the previously-described adjustments to the tax rules codified, Equilar also conducted a broad analysis of effective tax rates for Russell 3000 companies in order to gain a rough understanding of the materiality of lost deductions under 162(m). Well over half of the index paid an effective tax rate greater than the new 21% corporate rate in the most recently reported fiscal year. This likely indicates that for many companies, lost tax deductions will be effectively wiped out by lower overall corporate rates under the new code.

Additional analysis allowed Equilar to back into total tax expenses across the Russell 3000 for the most recent fiscal year. Among the companies sampled, tax expenses added up to nearly $377 billion at the then 35% corporate rate. If adjustments are made to reintroduce formerly-deductible executive compensation and the new 21% corporate tax rate, total tax expenses shrink to about $245 billion—a reduction in tax expense on the order of $132 billion. While these calculations don’t account for other changes to the tax code, companies will clearly save on taxes in the aggregate under the new rules.

Benincasa doesn’t foresee deduction losses making large impacts on grant practices. “With the offsetting effect of the tax rate reduction, priorities placed on talent attraction and retention should remain similar under the new 162(m) provisions,” she said.

Changes to the tax treatment of executive compensation made waves among compensation professionals from the time initial drafts of the bill were made available. Fears that the elimination of 409A would mean the end of stock options failed to materialize once provisions were removed from early versions, but changes to 162(m) provisions survived. In a move considered bold by some, Netflix recently announced changes to its executive compensation mix, namely the removal of its annual bonus program and a reallocation to base salary for senior management.

“Netflix is likely to be more of a one-off situation rather than the new standard, and ultimately, changing from incentive-based pay to higher salaries is not likely to please investors, and companies may not rush to follow suit,” said Benincasa. “We shall see how it unfolds, but generally speaking, companies still prefer to maintain a mix of pay components as the perceived value is always greater to the employee if they’re receiving more than just a paycheck.”

Taking stock of company stakeholders, she added, “ISS has issued a statement that it will continue to focus on pay for performance, and therefore we do not expect a shift away from performance awards. While ISS does not wield absolute influence, shareholders generally want to hold executives accountable through their compensation. This is unlikely to change going forward.”

Cervino’s analysis echoed the sentiment that while plans will be reviewed, pay for performance is not disappearing. “162(m) changes, including changes around covered individuals and loss of deductibility for performance based compensation, may prompt a review and evaluation of compensation plans for 162(m) covered employees,” she said. “Executive compensation is rarely designed from a singular focus of maximizing corporate tax deductions, and the reduction of corporate tax rates to 21% materially changes the overall tax situation for companies.

“Pay for performance continues to be an important issue for plan sponsors and institutional shareholders, so the loss of deductibility for performance-based compensation is unlikely to trigger dramatic changes,” Cervino added. “Plan sponsors will likely review compensation plans for covered employees to assess the impact of these changes. Some possible areas for consideration will be using incentive stock options (ISOs) and possibly shifting some value from what was formerly 162(m) performance-based compensation to time-based. And, companies will be relieved from managing the technical requirements of 162(m), including more flexibility with the composition of their Compensation Committee and the selection and/or modification of performance conditions, yet companies are likely to still be mindful of good corporate governance practices.”

After the corporate tax rate was slashed 14 percentage points and 162(m) exemptions removed, an evolution towards a more employee-friendly compensation scheme may prove popular as compensation committees and professionals learn and adjust to the new landscape. As talent management comes to the fore, expect stakeholders like proxy advisory firms and investors to maintain pressure on boards to allocate an appreciable mix to performance-based incentive pay. The phenomenon that accelerated in the wake of Dodd-Frank and Say on Pay is not likely to reverse itself anytime soon.

Changes Beyond the C-Suite

The Equilar database is centered on executive and board member information available in public filings, so the analyses above on these tax changes on compensation are limited to those high-ranking professionals. Emily Cervino of Fidelity Stock Plan Services provided additional commentary and context to how these tax changes will affect compensation beyond the C-suite and across the organization.

Emily Cervino, CEP

Vice President

Fidelity Stock Plan Services

Equilar: How will the tax changes influence compensation and equity awards deeper in the organization beyond the C-suite?

Cervino: The most immediate impact for employees across the organization is the reduction in withholding rates applied to supplemental income. For employees with restricted stock distributions or option exercises in January, they may have already seen this reduction, and will continue to see it for future transactions. These rates are set to expire after 2025, reverting back to 2017 rates unless there is further legislative action.

Employees of private companies may begin to see a benefit from the new Qualified Equity Grants, and employees who receive ISO now benefit from the higher AMT exemptions, but, for most employees, it is largely business-as-usual with respect to equity compensation. However, employees should note the reduction in individual tax rates with no reduction in capital gains rates may have some impact on financial planning and decisions to hold or sell company stock acquired upon exercise or distribution.

Equilar: What effect will the changes in the alternative minimum tax have on compensation? Does this make incentive stock options more viable?

Cervino: ISOs could indeed be more attractive. ISOs never generated a corporate tax deduction. As discussed above, companies can no longer recognize a tax deduction for performance based compensation for 162(m) covered employees, so ISOs may be worth another look. If the company can’t benefit from the tax deduction, why not pass along the favorable tax benefits to the executive? Of course, the ISOs requirements limit shares vesting in future tax years to $100K, so this generally won’t accommodate a full shift of compensation delivery, but, it could mean ISOs experience a resurgence of interest.

Beyond the 162(m) ranks, NQSOs remain deductible, so companies may prefer to remain with NQSOs for this population. However, the increase in AMT exemptions means that more employees could benefit from favorable treatment of ISOs. When you balance that with the ISO limitations, the more challenging administration, and importantly the prevalence of disqualifying dispositions with ISOs, it is unlikely that companies make a major shift to ISOs.

About the Contributor

Emily Cervino, CEP, is Vice President at Fidelity Stock Plan Services. Working in varying roles in the equity compensation industry since 1996, Emily has a unique understanding of the opportunities and challenges of equity compensation. At Fidelity Stock Plan Services, she focuses on strategic marketing initiatives, thought leadership, and building Fidelity’s strong industry presence.

In her former role as executive director of the Certified Equity Professional Institute (CEPI) at Santa Clara University, Emily was involved in all aspects of certification, research, and program marketing. She also managed all the equity compensation programs at National Semiconductor, and held various roles at E*TRADE/ShareData. Emily is a frequent speaker at equity compensation events, a board member for the Certified Equity Professional Institute, member of the NASPP Executive Advisory Committee, recipient of the 2015 NASPP Individual Achievement Award, and a representative on GEO’s Partner Alliance Council. She is a Certified Equity Professional and holds Series 7 and 63 securities registrations.

Disclosures:

Views and opinions are subject to change at any time.

Content is provided under arrangement with Equilar, an independent source of plan education.

Equilar and Fidelity Stock Plan Services, LLC are not affiliated.

735584.3.0

Matthew Goforth, Senior Governance Advisor at Equilar, authored this article. Please contact Amit Batish, Content Manager, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions