Paying and Retaining Executive Talent During M&A Activity

September 9, 2021

Samar Feghhi

During the first six months of 2021, businesses spent an unprecedented $1.74 trillion on mergers and acquisitions. This figure is in relation to the value of M&A deals, but it poses the question of where else are acquiring companies spending money to ensure a successful outcome? An article by Willis Towers Watson states that retaining key talent is critical during periods of change with companies budgeting 1% or more of purchase price towards retention pay. This illustrates the connection between stable leadership and M&A success, warranting a deeper look at how companies are paying to retain leadership of the companies they acquire and the various compensation structures employed.

An Equilar analysis of public technology acquisitions valued at over $1 billion since 2018 provides insight into trends of longer-term retention awards. This study was limited to awards with a six-month or greater post-merger vesting period. The data showed that roughly 76% of awards granted were in cash and 97% were time-based. Looking at the bigger picture, a survey done by Chief Executive Group in 2020 found that longer vesting, cash awards, or a “pay to stay” approach, were used by 84% of survey respondents. Another facet of longer-term retention demonstrated by Equilar’s analysis is a positive correlation between award value and vesting period. BroadSoft, Inc. granted its CEO and Chief Technology Officer $4.3 and $3.5 million, respectively, for awards with three-year vesting periods, while its CFO was granted $200,000 for an award with 1.5 year vesting. Similarly, SendGrid’s awards were valued under $120,000 with three to six month vesting periods compared to FitBit’s $16 million and $7 million awards for a vesting period of four years. Thus, within this study, larger award values correlate to a longer post-merger vesting period.

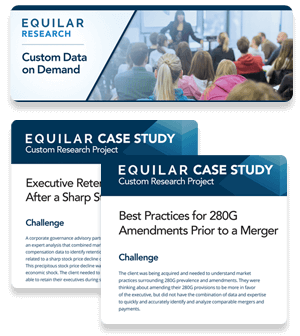

Examining boardroom compensation displays a different realm of M&A retention. An analysis by Equilar looking at merger awards, valued over $100,000 annualized, to directors allows for a glimpse into board retention. The data demonstrates that directors were compensated with special committee retainers or with one-time bonuses effective immediately upon closing. The disclosures further emphasize that these awards were limited to directors who played significant roles in closing the deal. Community Health Systems mentioned the award was “to recognize efforts and extraordinary time commitments,” and HRG Group (Figure 1) stated that the award was “in consideration of the expected time and effort.”

Figure 1: HRG Group Disclosure

It is important to note that high-value director awards are not commonly used in M&A retention as they can be seen as self-dealing. Because directors are the ones to approve a merger, rewarding themselves with a large sum for a successful closing is not viewed as good governance. Regardless of their rarity, rewarding directors for the work required to achieve a successful deal reinforces the strong link between successful transactions and leadership retention. Though companies may not be looking to retain their directors in the same way as their executives, these awards exemplify the importance placed on consistent leadership throughout the merger process.

Lastly, looking further into vesting provisions depicts the different purposes M&A awards serve. Longer-term awards, similar to those analyzed by Equilar and adopted by Chief Executive Group’s respondents, are often used to retain executives that have institutional knowledge of the acquired company. Since this knowledge is valuable post merger, granting longer vesting awards is an effective way to retain these executives for an extended period of time. On the other hand, shorter post-merger vesting periods are used when wanting to ensure a smooth transition of power between the incoming and incumbent executives teams. Using a vesting structure of six months or less post-merger provides companies with an effective way to ensure leadership for a transitional period of time rather than focusing longer-term.

In the final category of vesting structures are awards that vest at the closing of the merger. These awards, seen via Equilar’s analysis of director pay, are geared towards ensuring the closing itself rather than retaining key executives or creating a smooth transition of power. Thus, this form of retention pay is ideal for companies that want to focus their efforts on stable leadership for the purposes of cultivating a successful deal completion.

Through Equilar’s data and Chief Executive Group’s survey, the various forms of M&A retention pay are evident. Though Equilar’s analyses provide a narrower lens, they depict the differing awards companies may turn to based on the goals they are looking to achieve. Whether it’s using longer vesting awards for knowledge retention, short-term pay for transitional purposes or special committee retainers, there are different approaches when it comes to retention pay. As M&A activity continues to reach new heights, leadership retention will continue playing a significant role in company spending and achieving the various goals corporations set.

Equilar Custom Research Services

Combining expertise with comprehensive data, the Equilar Research Services Team can capture data on even the most unique circumstances. Projects include topics related to special awards granted in connection with mergers or spinoffs, CEO employment agreements, executive change-in-control programs and much more. Contact us to learn more.

Contact

Samar Feghhi

Research Analyst at Equilar

Samar Feghhi, Research Analyst at Equilar, authored this post. Please contact Amit Batish, Director, Content & Communications, at abatish@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions