Companies Request Additional Shares During COVID-19: Shareholders Voice Concern

August 12, 2020

Rachel Wang and Zeynep Akca

Companies use equity compensation as a critical form of payment to executives in order to promote long-term ownership and success. The maximum number of shares issued to executives are determined through equity incentive plans in the form of proposals subject to shareholder approval. Due to dilution, shareholders bear a cost when more shares are issued, and therefore these plans are carefully reviewed before being approved.

On the other side, companies determine the number of shares to request as well as the frequency of proposals by calculating the value that they want to deliver to their employees. When the market is strong and share prices are high, this value can be delivered with a smaller number of shares. However, when the market is weak, companies need to issue more equity to reach the intended compensation value.

Affected by the COVID-19 pandemic, the stock market has weakened since February 2020. The unrealized possibility of an oil price war triggered the first big hit in the stock market on March 9, 2020, and the decline was deepened through the remainder of the month as the virus prevailed. Against the backdrop of this weak stock market and depressed stock prices, companies are forced to grant more shares than they normally would. In order to avoid rapidly running out of available shares, one of the precautions that companies could take is accelerate their share request.

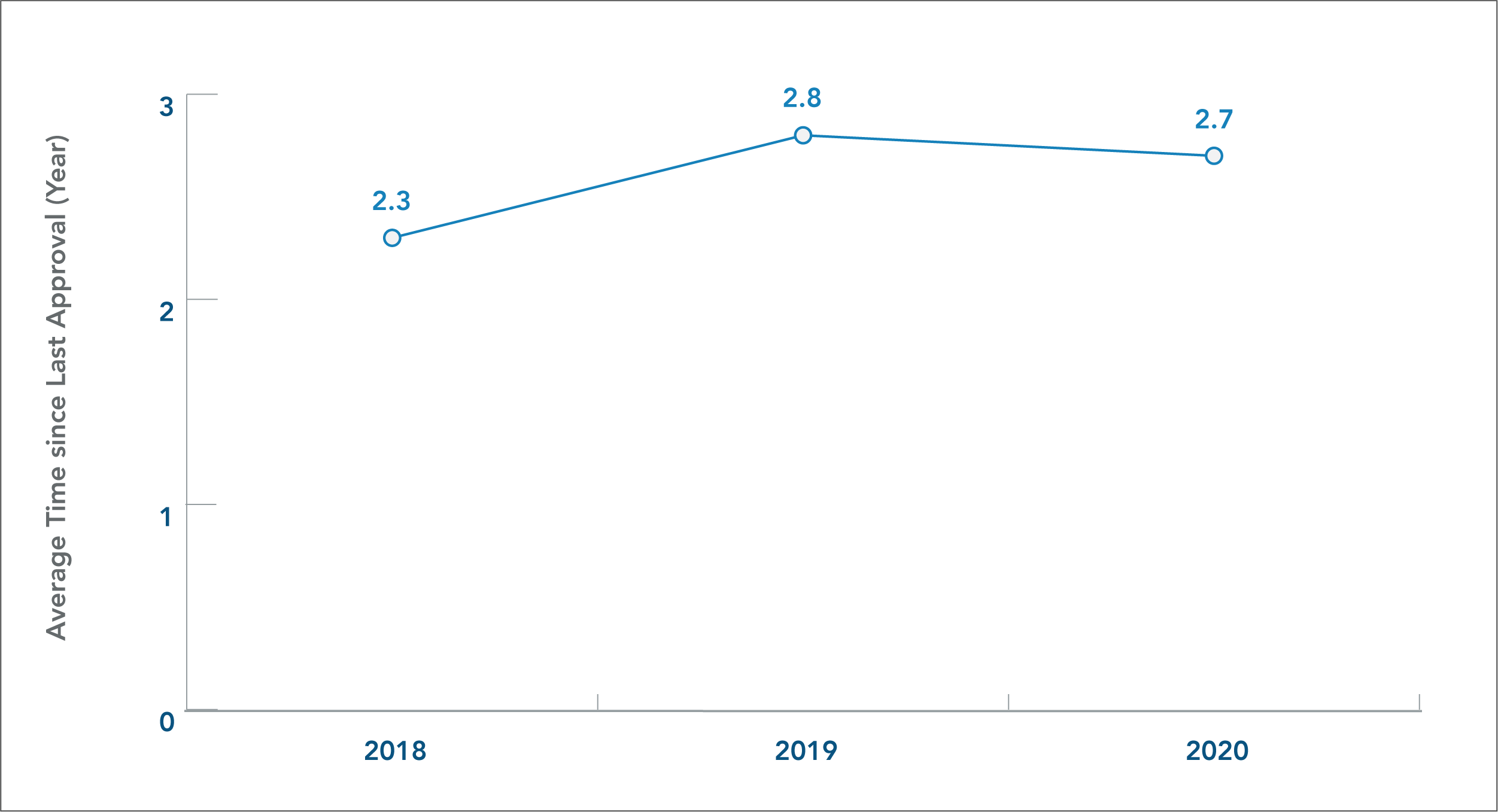

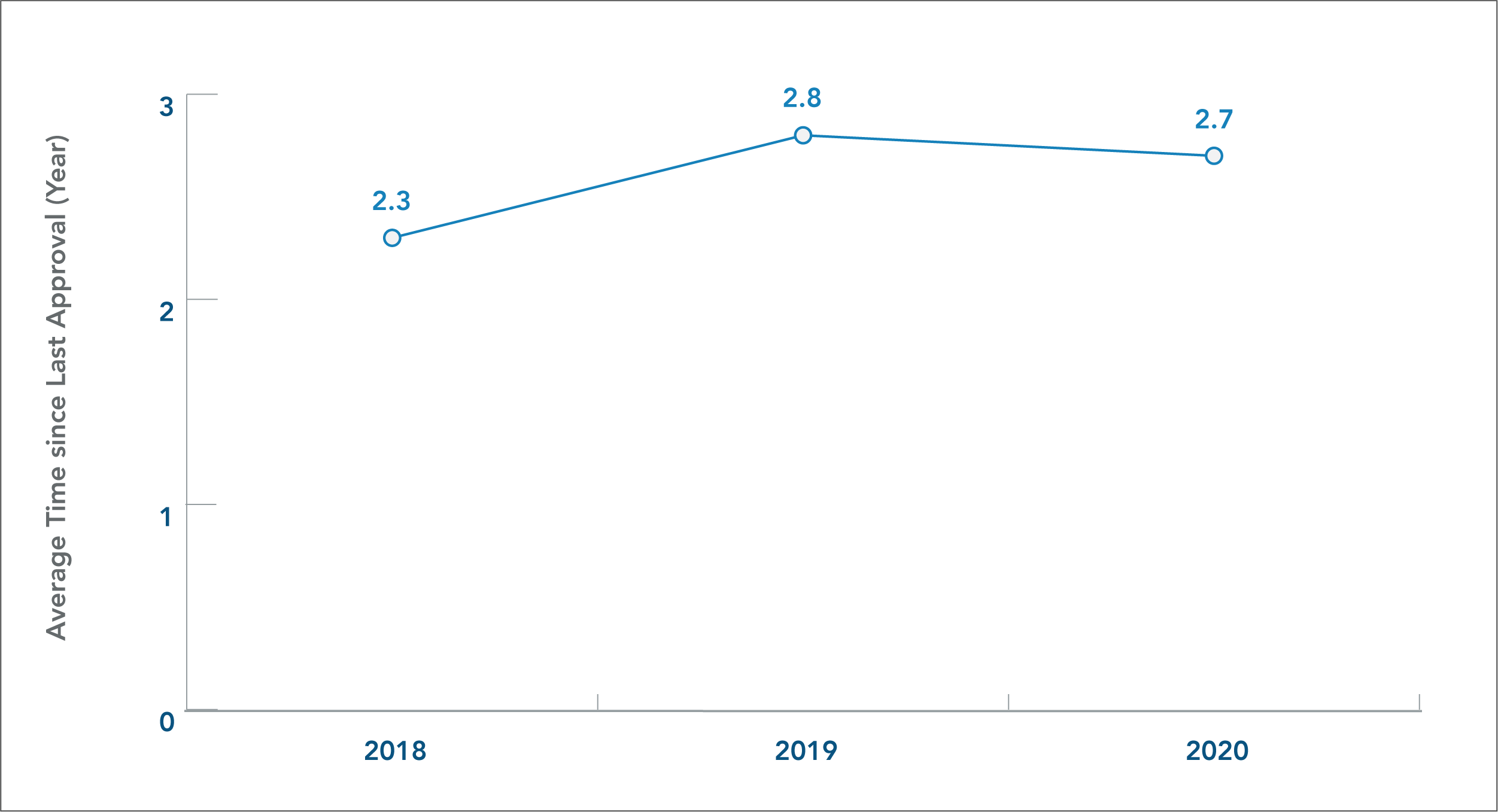

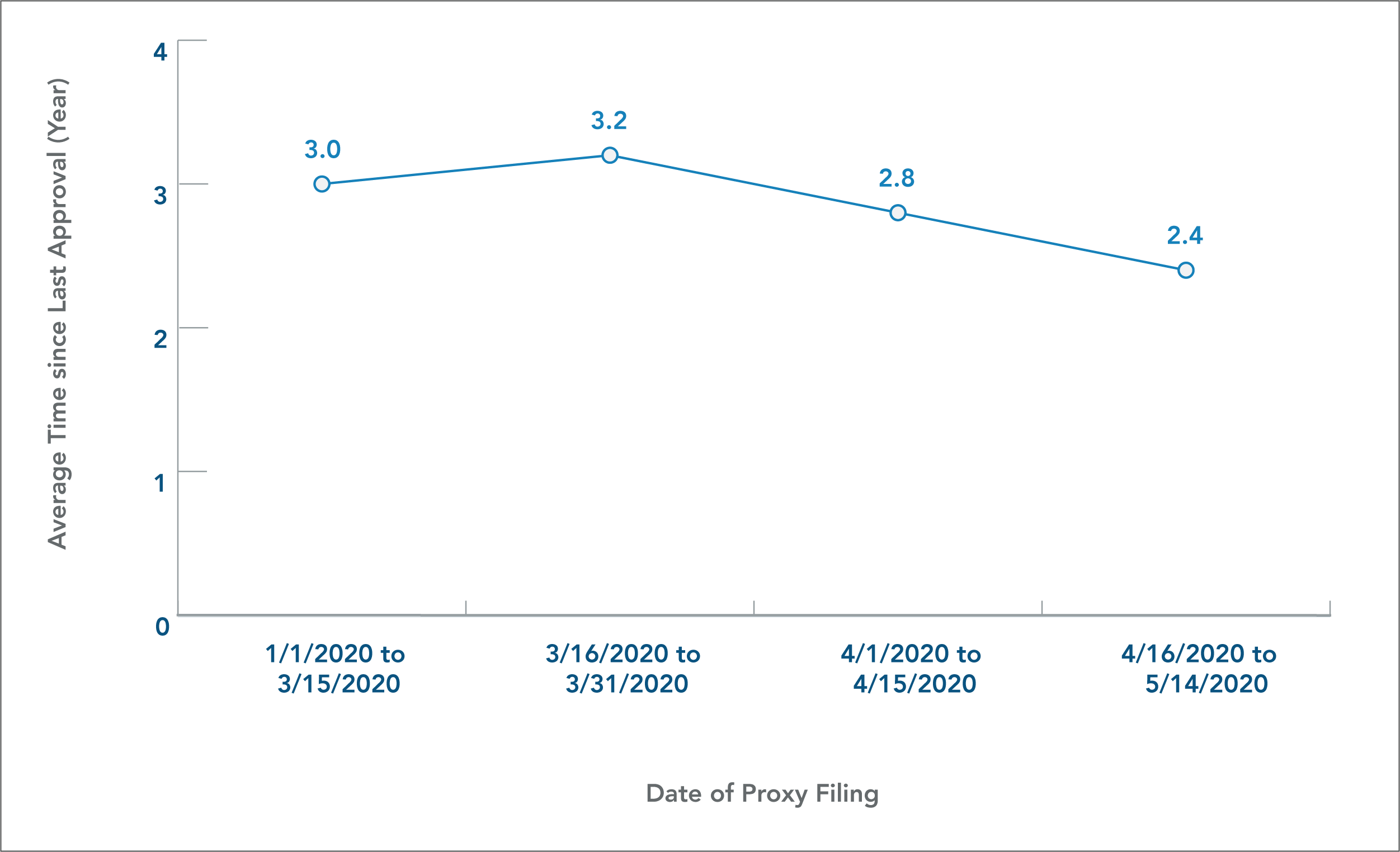

This study analyzes additional share requests for grants at Russell 3000 companies from 2018 to 2020. Figure 1 shows the average time companies wait to submit a new additional share request following the approval of their previous request under the same plan.

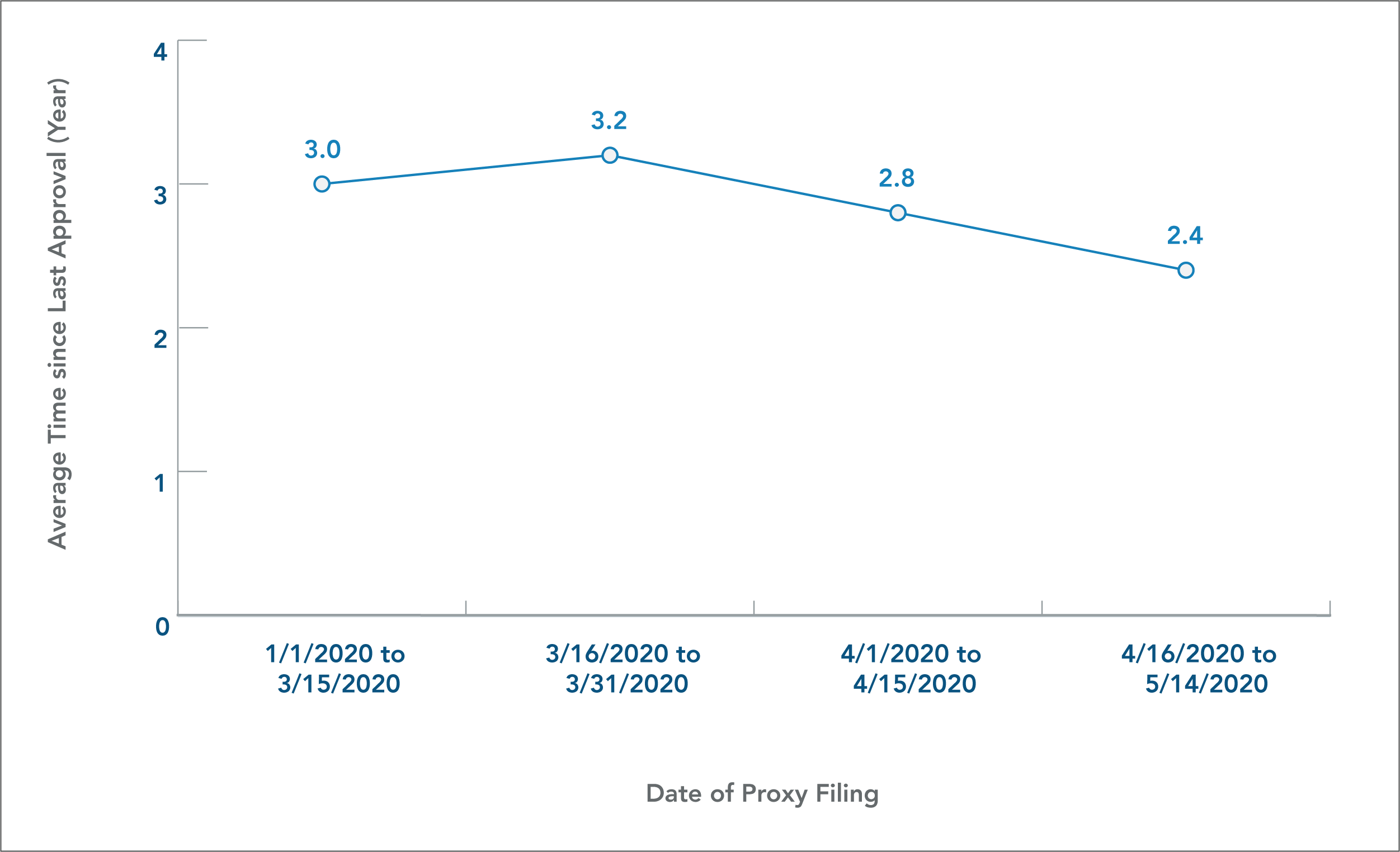

Companies proposing an increase in shares in 2020 last made a similar request 2.7 years ago, on average, under the same incentive plan. This number is not considerably different from 2019 (2.8 years) and 2018 (2.3 years). However, a closer look into 2020 tells us that companies did accelerate their share requests when the market was weak in April. Figure 2 shows that the average time since last approval shortened in April compared to the first three months of 2020. For example, in April, Red Robin Gourmet Burger Inc. requested additional shares despite shareholders approving an increase just a year earlier.

Figure 1

Figure 2

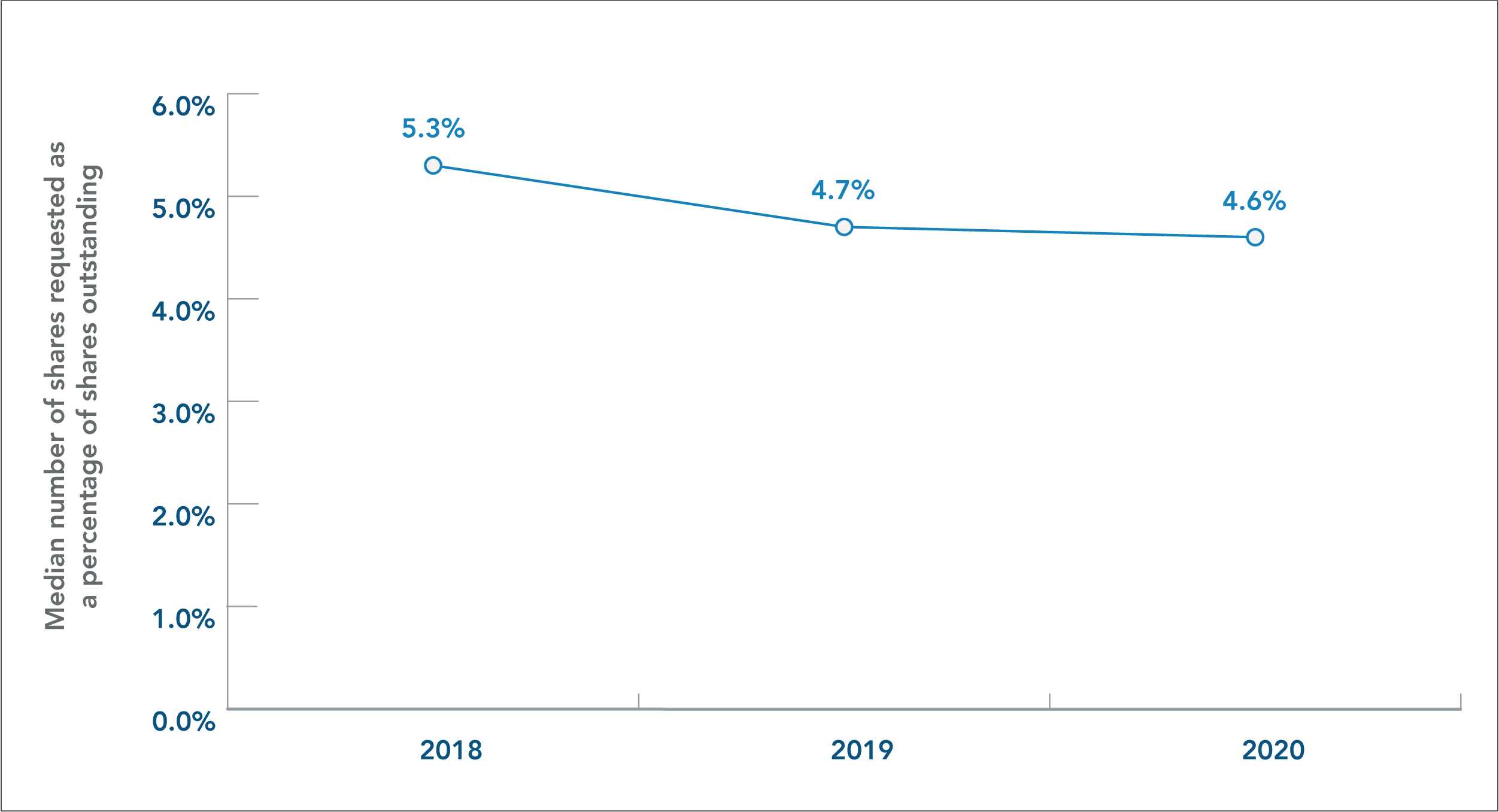

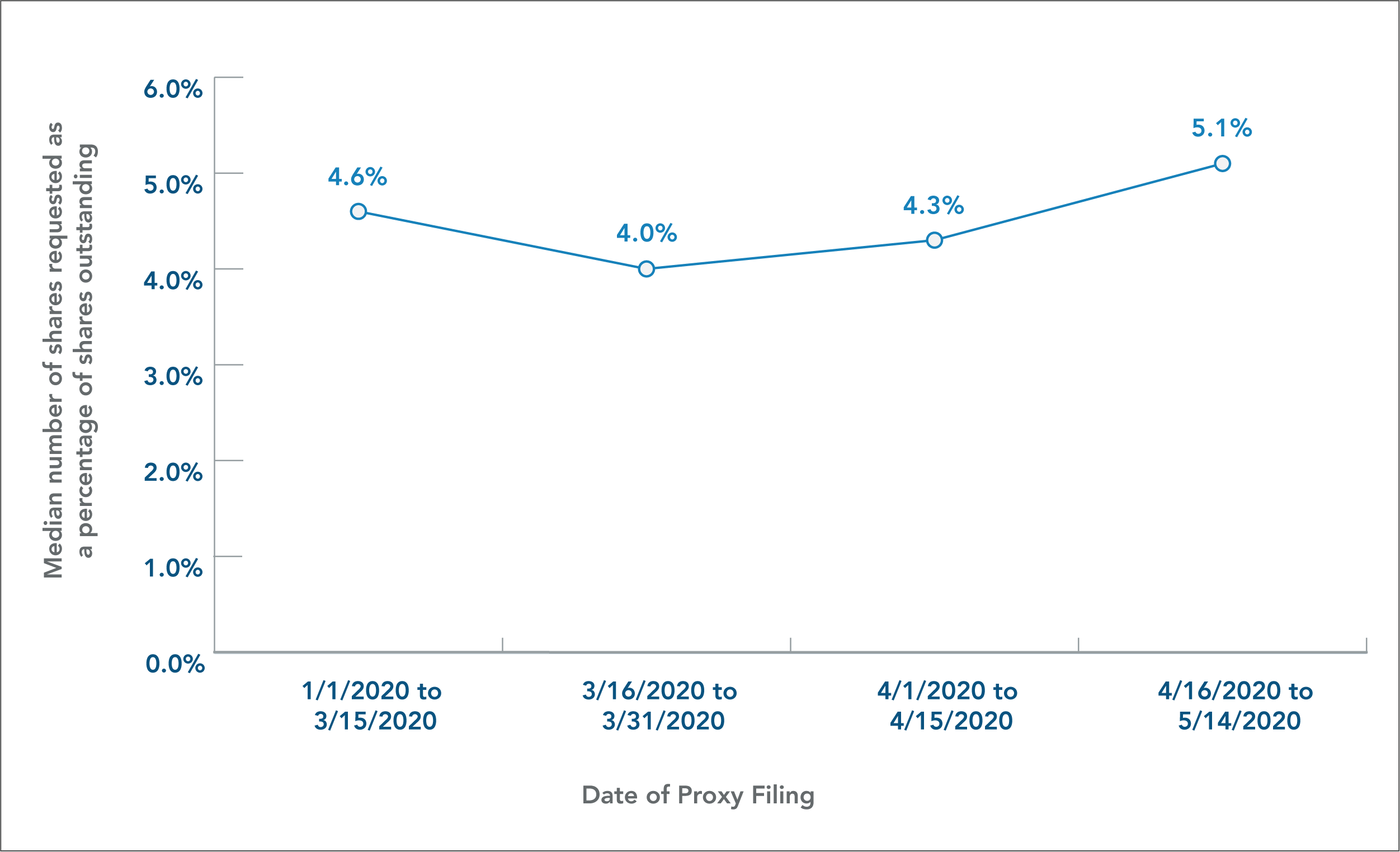

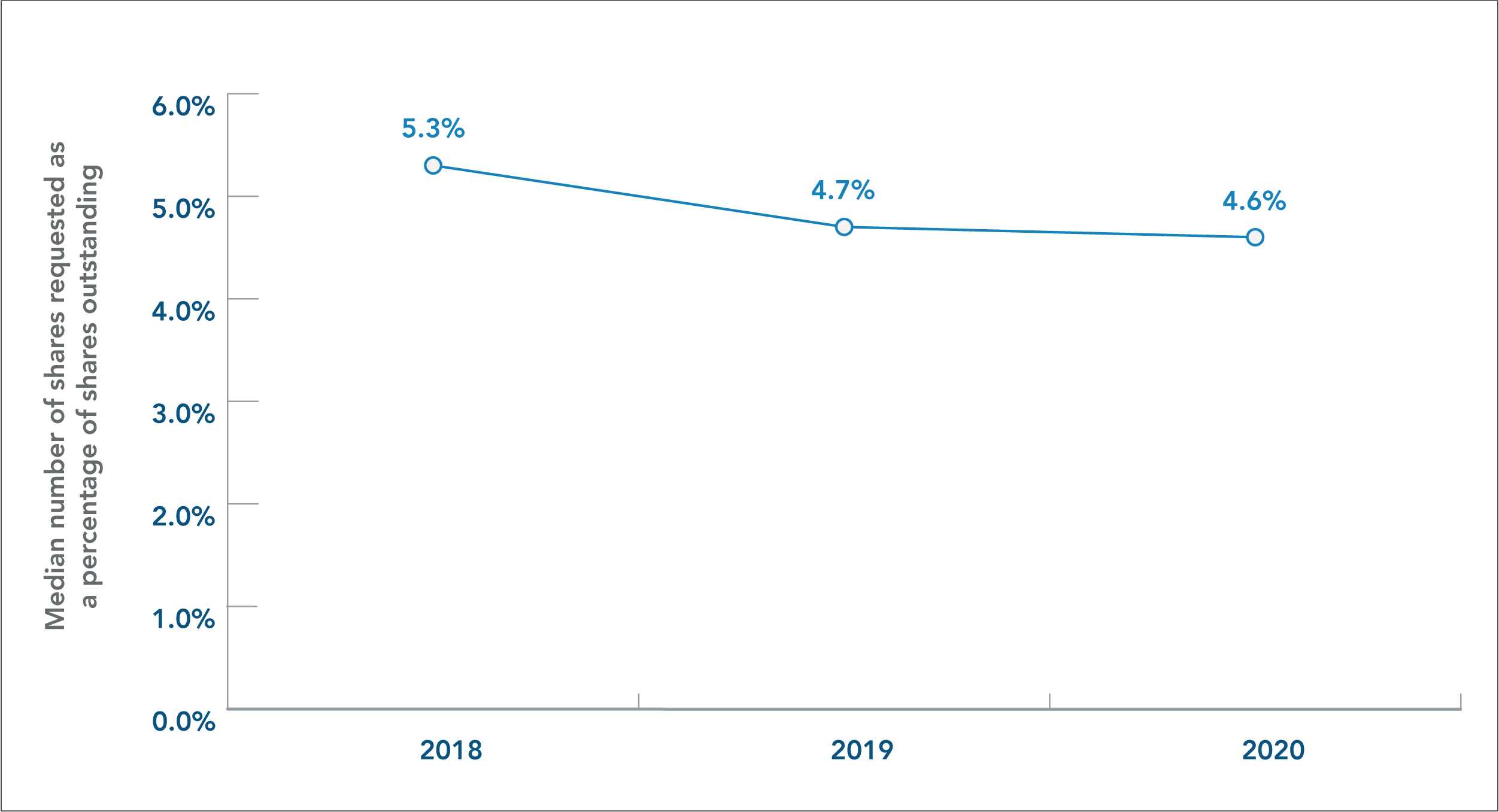

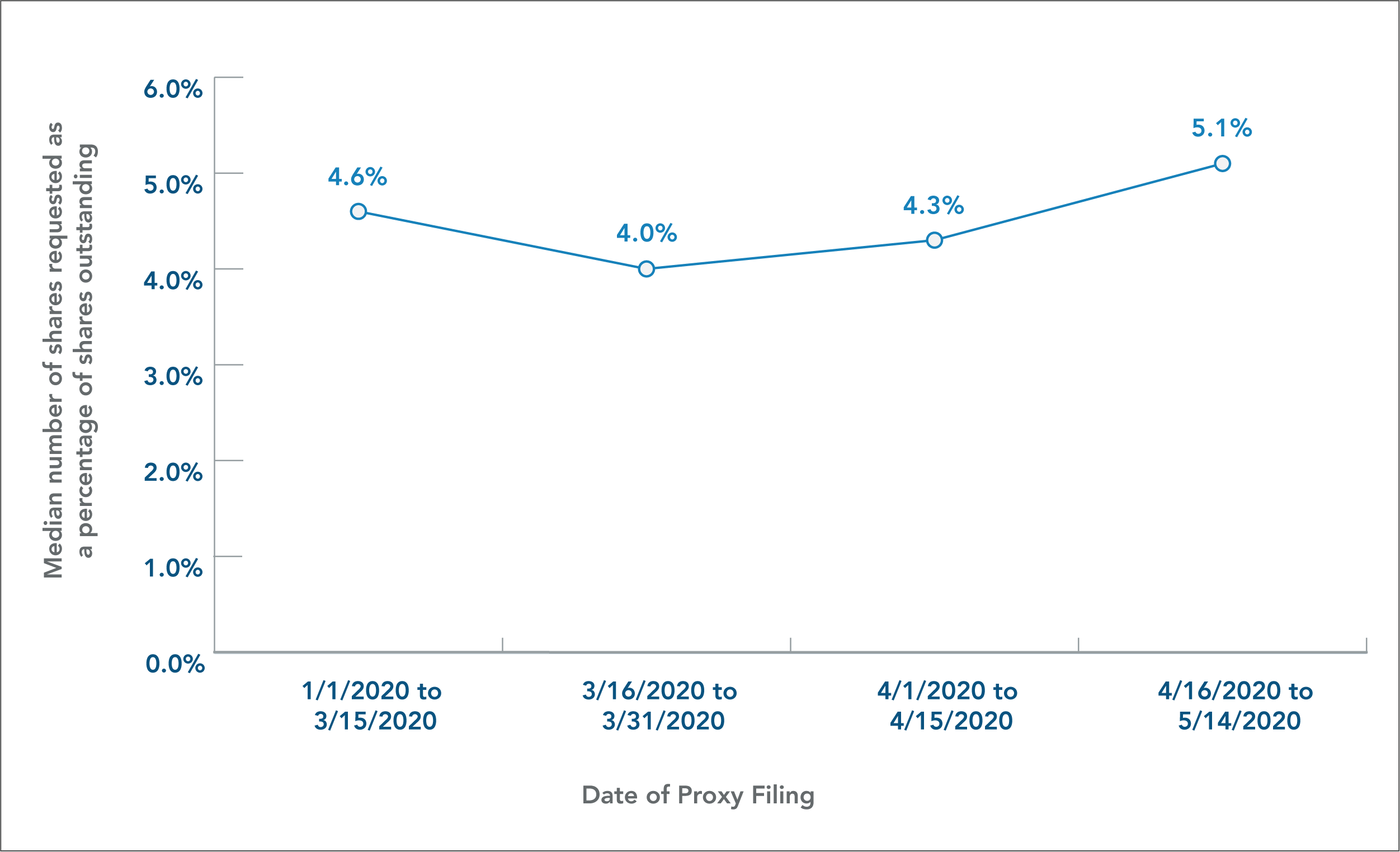

Following the trend of companies requesting additional shares more frequently, the volume of shares requested are increasing as well. The number of shares requested as a percentage of shares outstanding is calculated for each Russell 3000 company as an indicator of relative increase in a company’s share pool. Figure 3 shows the median number of shares requested as a percentage of shares outstanding by year. There is a declining trend from 5.3% in 2018 to 4.6% in 2020, indicating a strong market. On the contrary, Figure 4 shows an escalating trend in 2020, starting from April. The first half of the proxy season was interrupted when the economic impact of the COVID-19 pandemic hit the market. The breaking point at the end of March of 4% and the constant increase onwards indicates that companies adjusted their share request calculations from the original, pre-pandemic plans.

Figure 3

Figure 4

On that topic, proxy advisors also recommended against companies making requests that were too large. For example, during the 2020 proxy season, Institutional Shareholder Services (ISS) recommended shareholders vote against NETGEAR, Inc.’s proposal to increase the number of shares under the equity incentive plan by two million shares due to the concern of dilution. This was despite the fact that it had been supportive of the company’s previous years’ equity plan proposals.

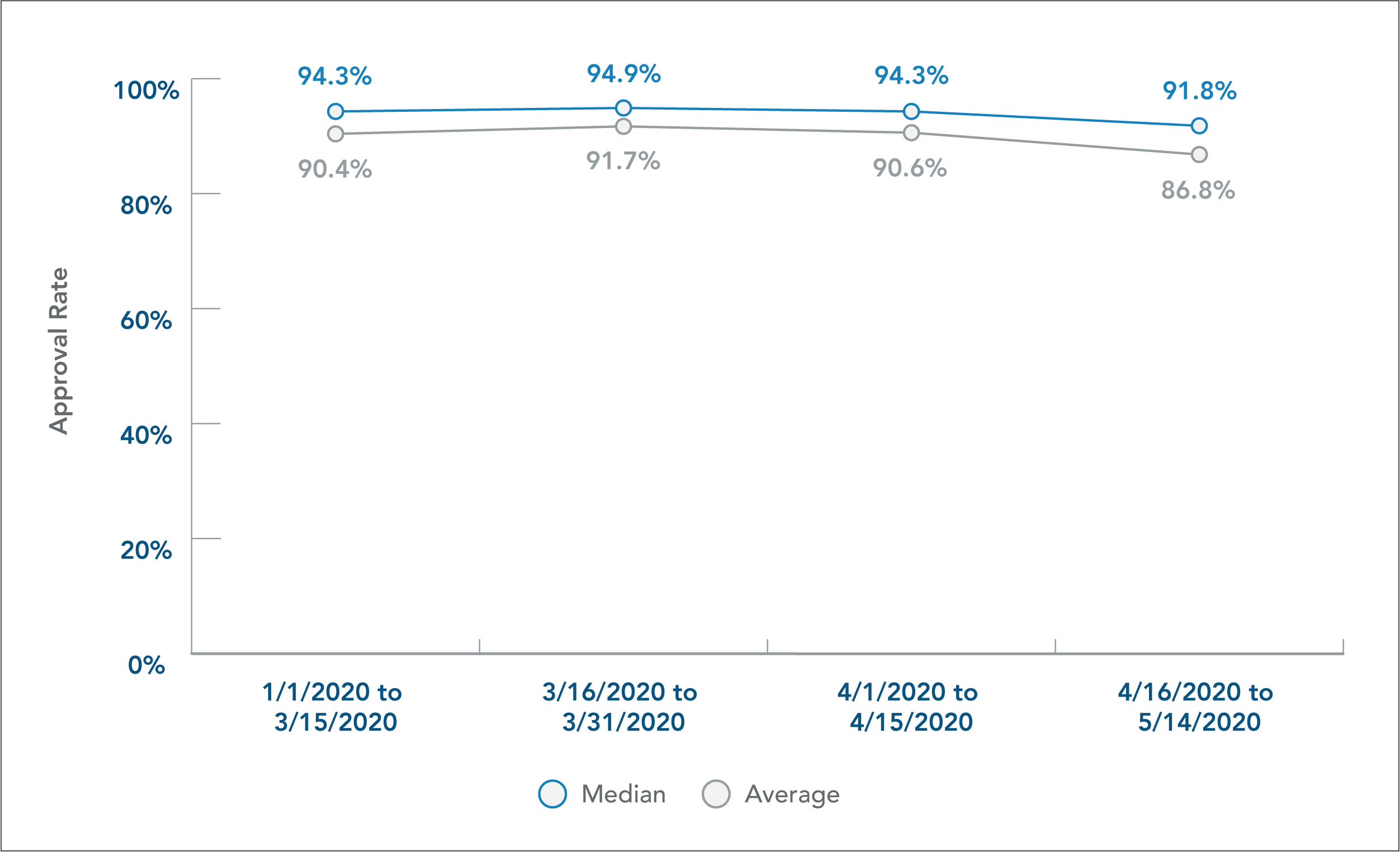

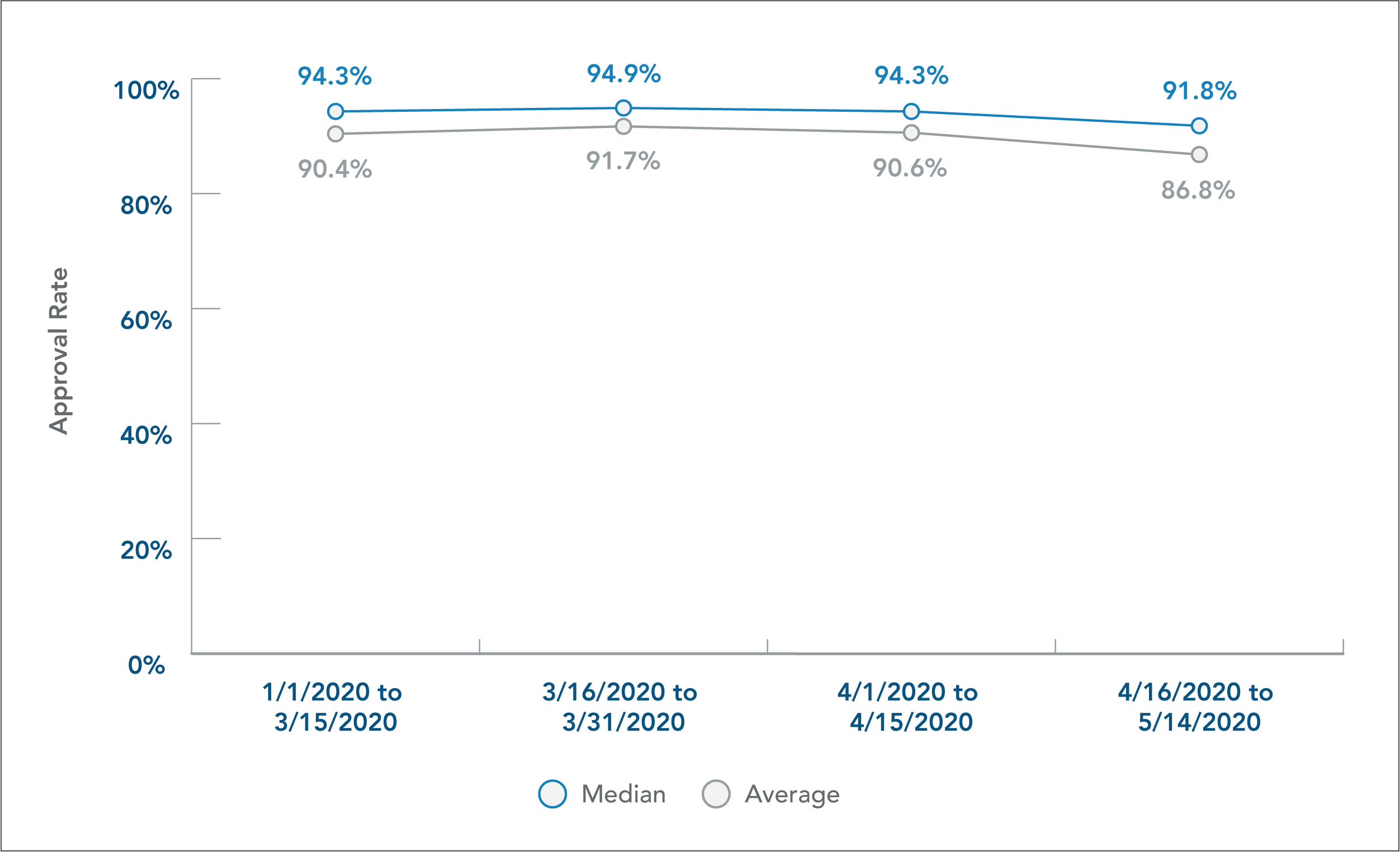

Looking at the proxy voting results of the Russell 3000 companies during the 2020 proxy season, shareholders are less satisfied as share requests become larger. Figure 5 shows the approval rates of additional share requests, where we see a clear downward trend in both average and median approval rates for proposals made in April. For requests between April 16 and April 30, the median approval rate was 91.8% and average was 86.8%. This compares to median and average approval rates of 93.5% and 88.1%, respectively, for proposals made during the same time period in 2019.

Figure 5

As the year continues to progress, more companies will be faced with additional compensation decisions. While stock markets have rebounded in recent months, companies must prepare for another potential market downturn. Because equity is such a vital component to retain and incentivize executives during this crucial time, companies should assess their shares available for grant. As we’ve seen from this proxy season, more companies needed to make requests earlier and larger than anticipated. Balancing these efforts against investor concerns will be challenging but necessary as we continue to ride out this pandemic.

Contact

Rachel Wang

Research Analyst at Equilar, co-authored this post.

Zeynep Akca

Research Analyst at Equilar, co-authored this post.

Please contact Amit Batish, Manager Content & Communications, at abatish@equilar.com for more information about this article.

Solutions

Solutions