Equilar Blog Archive

December 9, 2019

As companies grapple with increased scrutiny in the world of corporate governance, many boards are attempting to recruit a diverse set of directors to their ranks.

December 6, 2019

Alphabet announced the resignation of CEO Larry Page, effective 12/3/2019. Mr. Page has been CEO since April 4, 2011. He will continue to serve on the Company's Board of Directors.

November 20, 2019

Equilar 500 companies have announced 59 CEO departures through the third quarter of 2019. This compares to a total of 80 CEO departures in all of 2018. 48 of the 59 CEOs departed by the third quarter with the other 11 expected to leave later this year.

November 18, 2019

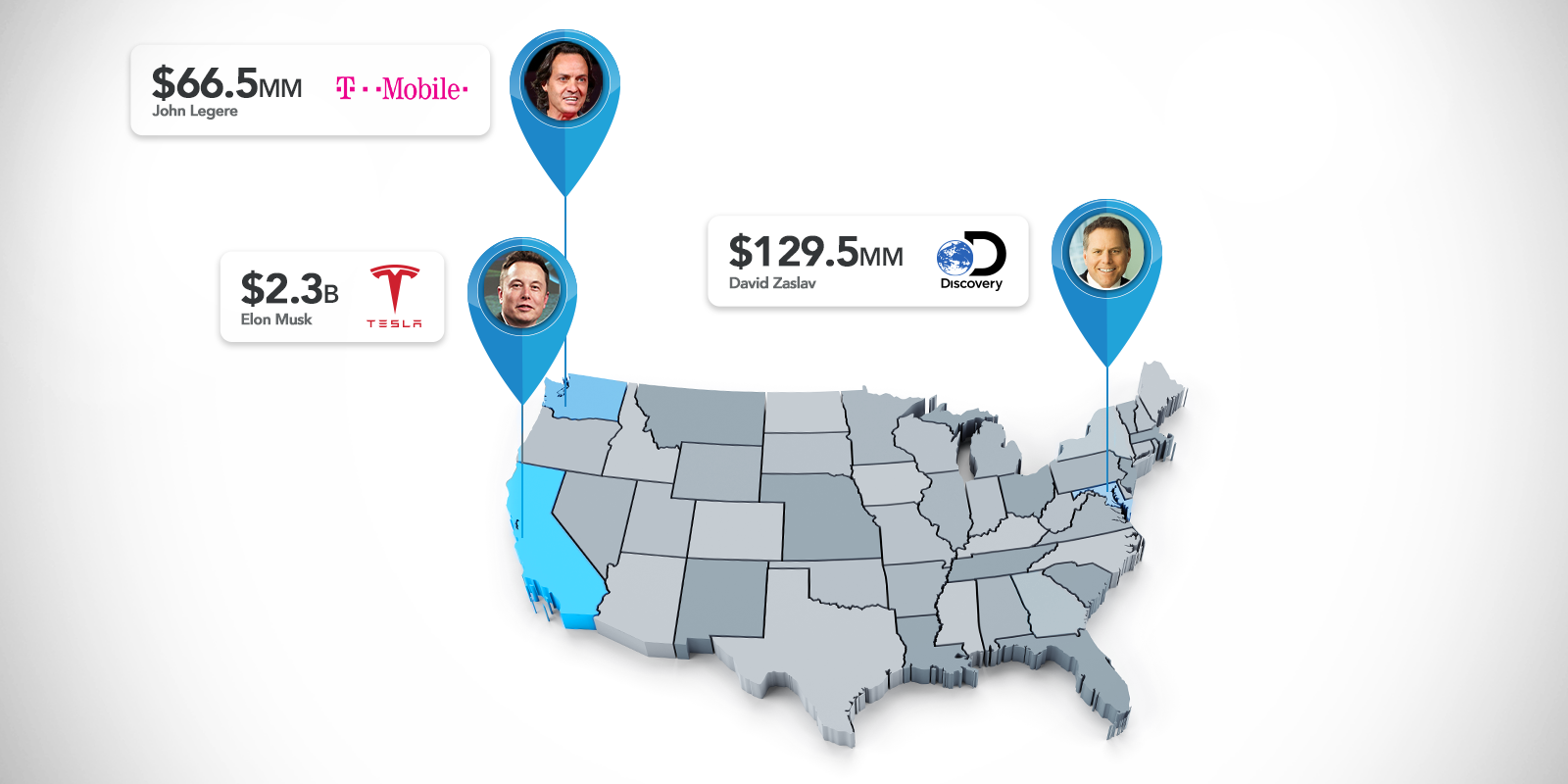

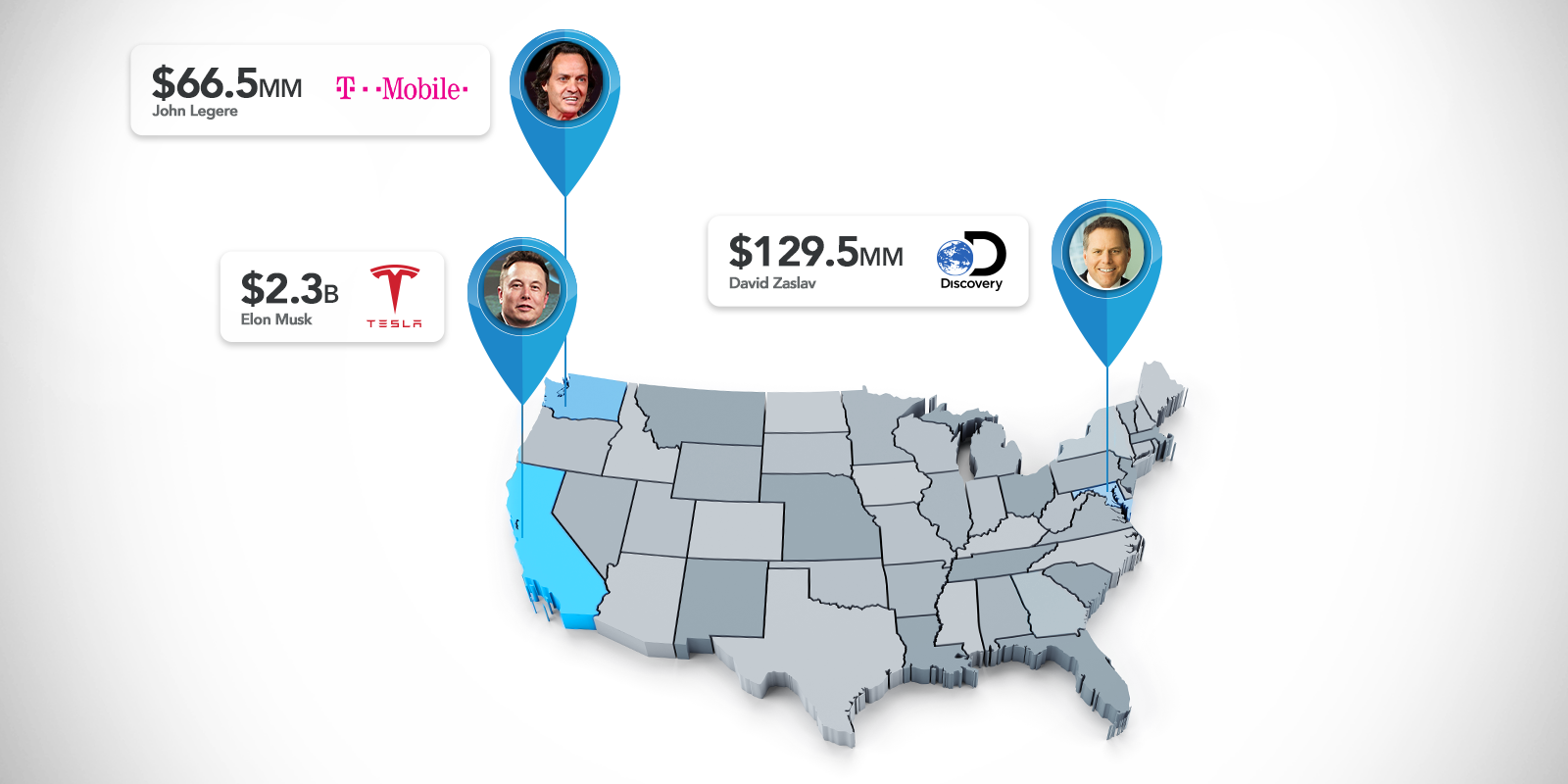

T-Mobile announced the resignation of current CEO, John Legere, effective April 30, 2020. Mr. Legere has been CEO since April 30, 2013. From 2013-2018, Legere realized $182,348,005 in total compensation.

November 15, 2019

Abbott Laboratories announced the transition of CEO and Chairman Miles D. White to Executive Chairman, effective March 31, 2020.

November 6, 2019

As reported by the Wall Street Journal, McDonald's Corporation announced the termination of Stephen Easterbrook, President, CEO and Member of the Board of Directors effective November 1, 2019.

November 5, 2019

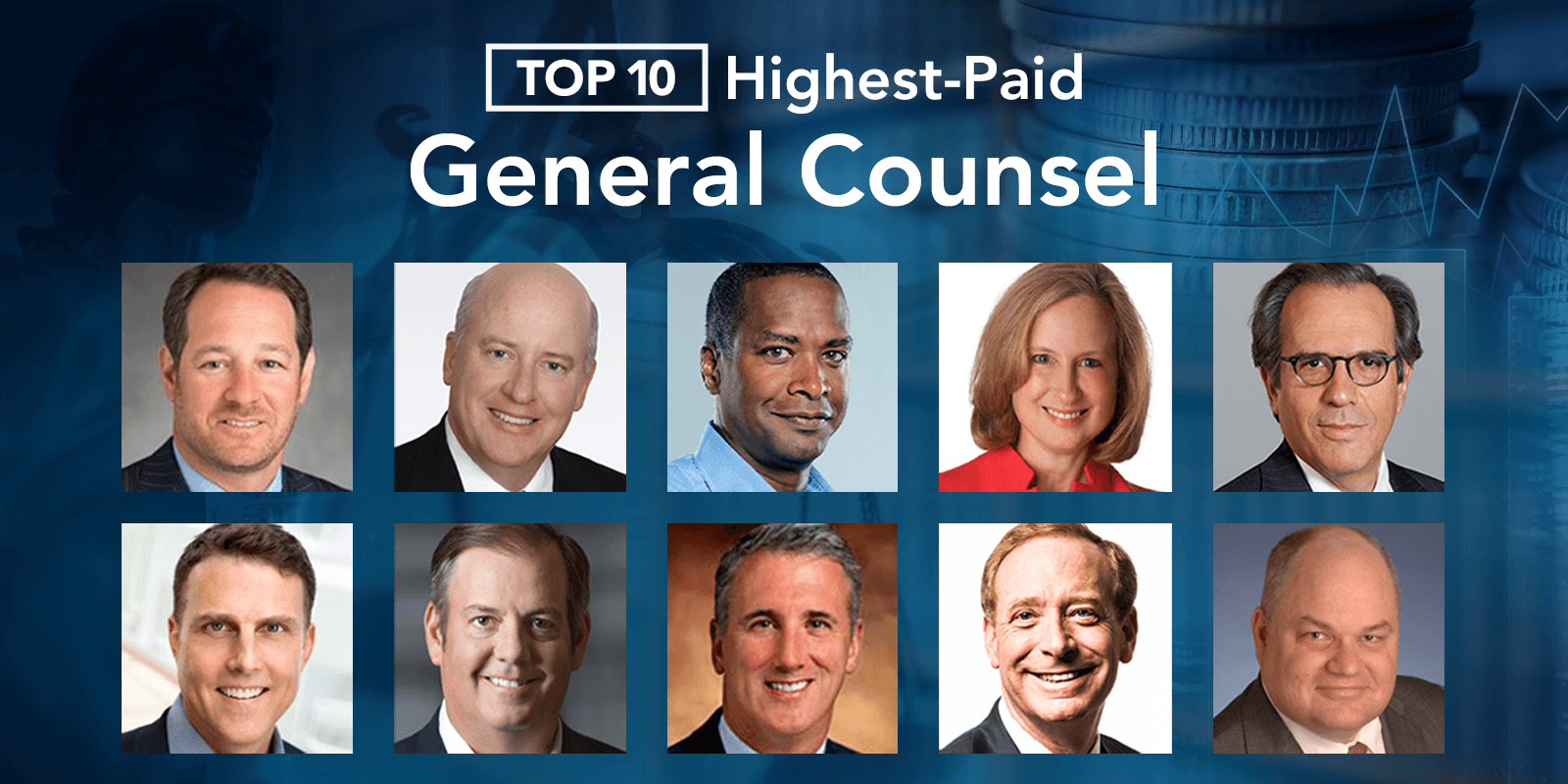

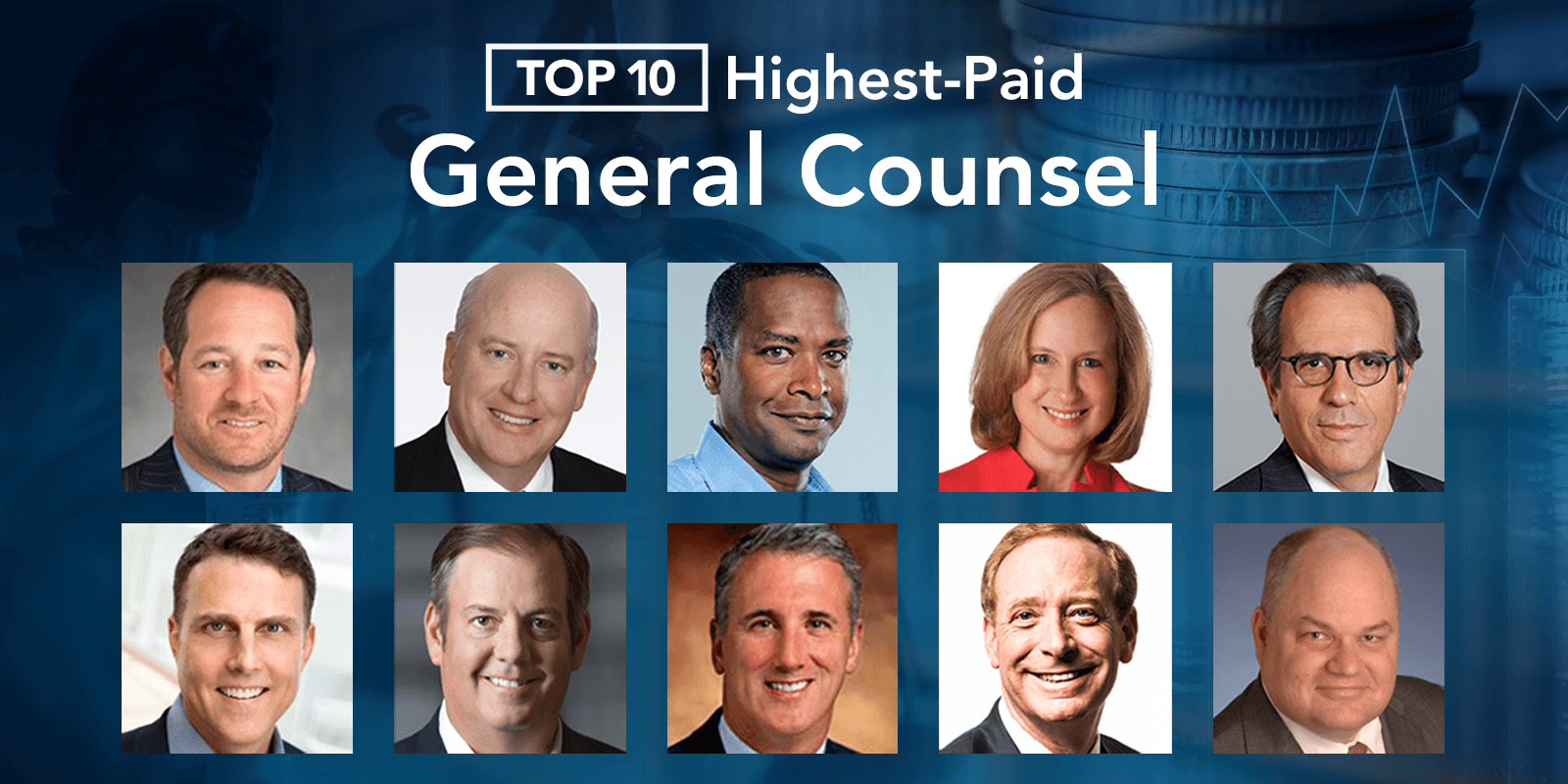

Historically, the role of General Counsel has been to ensure that all corporate activities are in compliance with laws and regulations. As the top legal officer of the corporation, General Counsel oversee litigation and enforce corporate compliance.

November 5, 2019

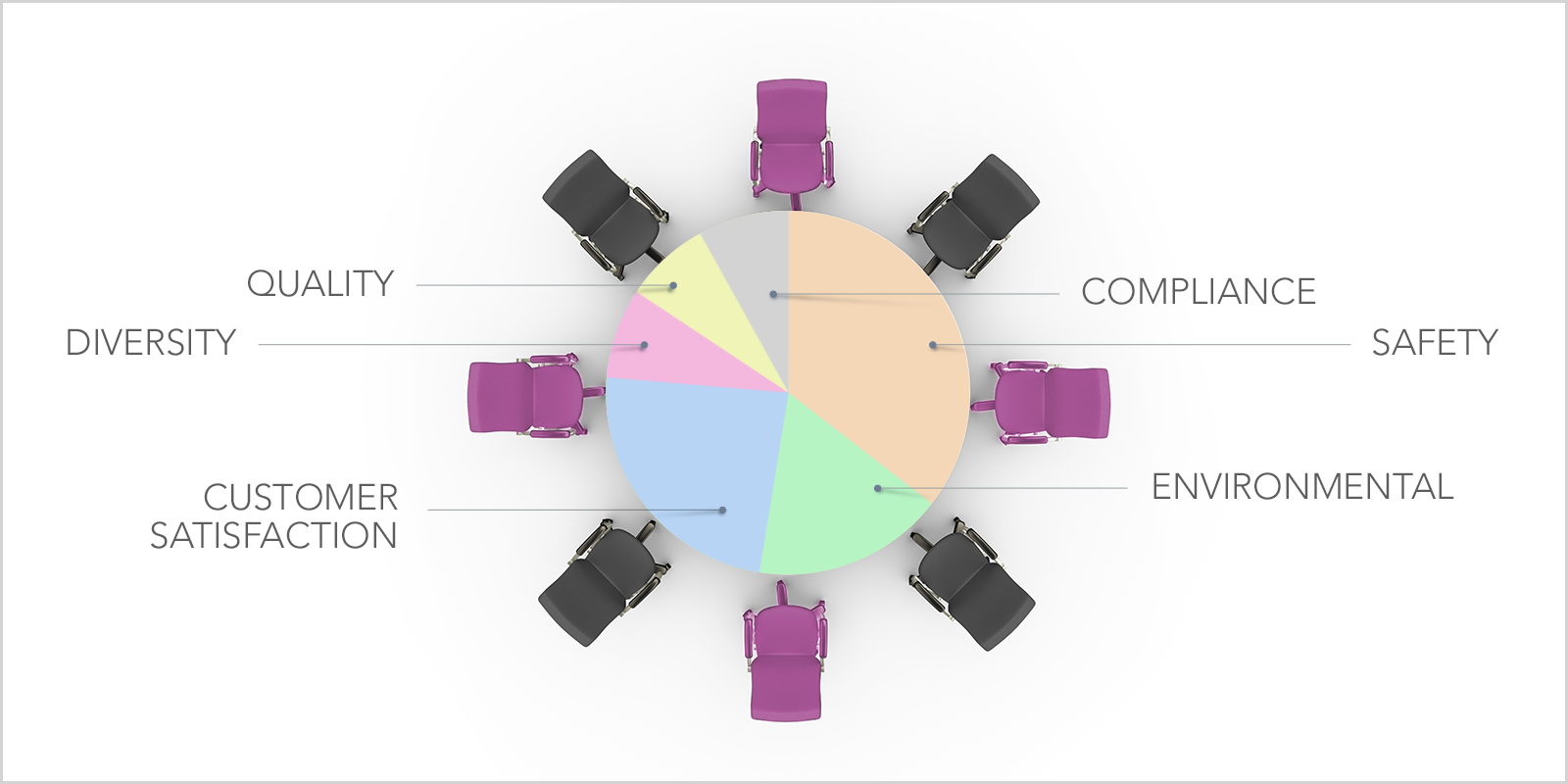

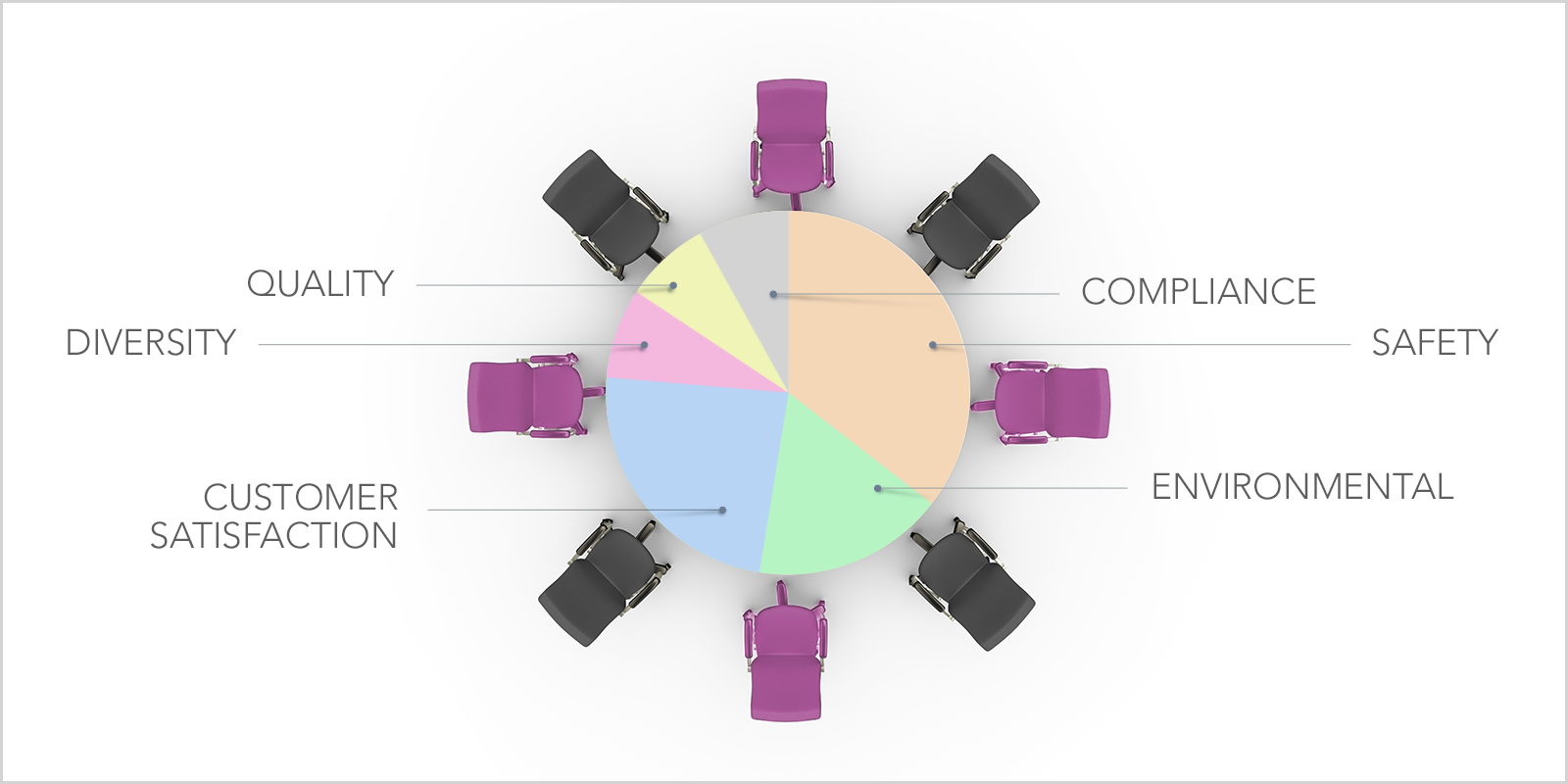

On August 19, the Business Roundtable made waves in the corporate governance community by publishing its Statement on the Purpose of a Corporation. By shifting away from a model that emphasizes shareholder return over all other considerations, the Business Roundtable asserted that companies should embrace the “Stakeholder Model,” meaning that corporations should balance the needs of all stakeholders in a business: shareholders, employees, customers and the communities in which a business operates.

October 28, 2019

NIKE, Inc. announced the transition of Mark G. Parker, President, CEO and Chairman to Executive Chairman effective January 13, 2020. Mr. Parker has been CEO of NIKE, Inc. since January 20, 2006. He previously served as President of the NIKE brand since 2001. From 2006-2019, Parker realized $371,451,753 in total compensation.

October 7, 2019

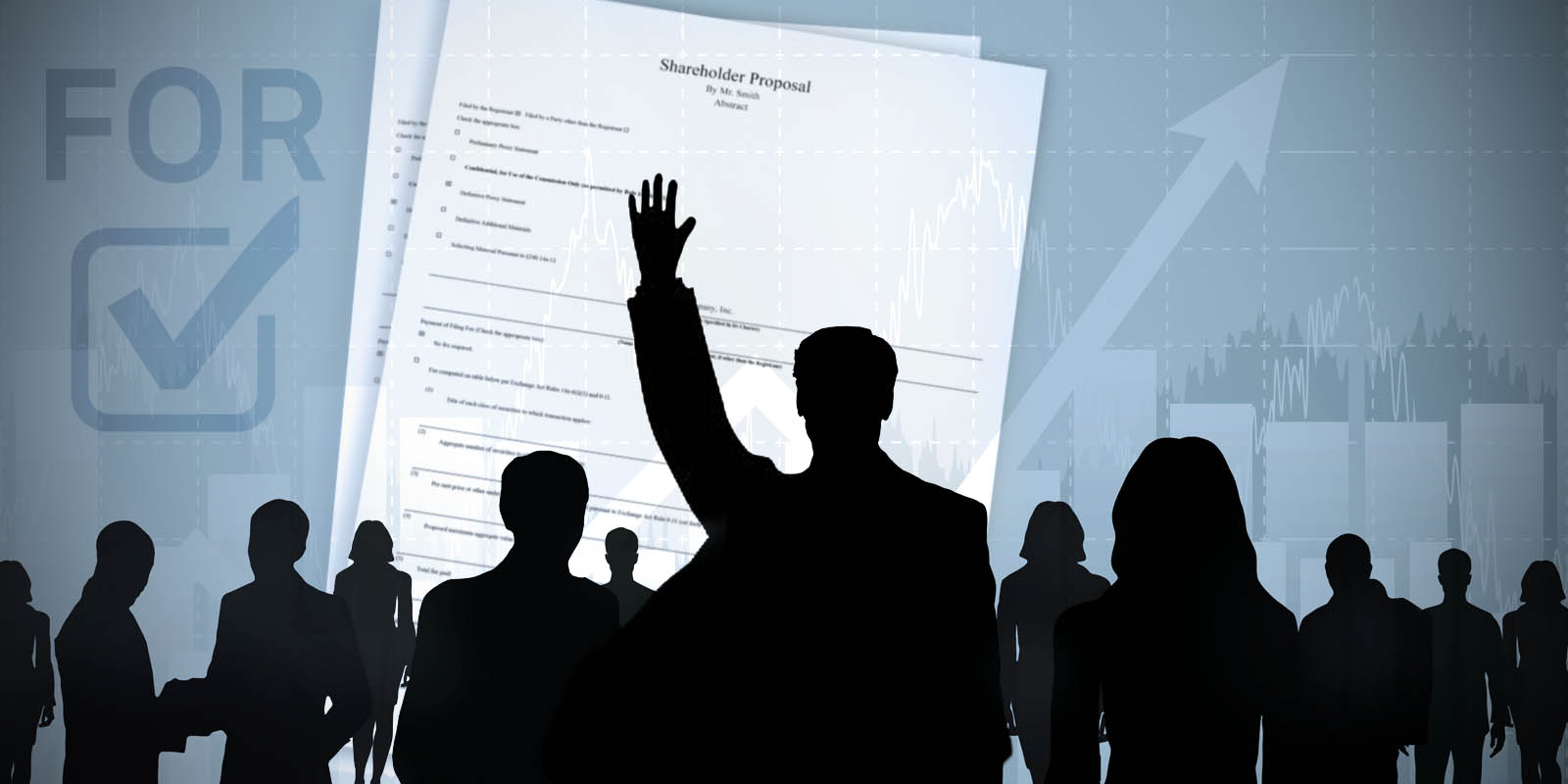

Eight years following the introduction of Say on Pay in 2011, shareholder voices are more pronounced than ever when it comes to executive compensation.

October 3, 2019

DXC Technology Company announced the transition of J. Michael Lawrie, Chairman, President and CEO, effective September 12, 2019.

September 27, 2019

CEOs of public companies in 2018 America were, for the most part, all compensated similarly. . That is not to say that they were paid at the same level— there was still a large disparity between the highest-paid CEOs and the rest.

September 13, 2019

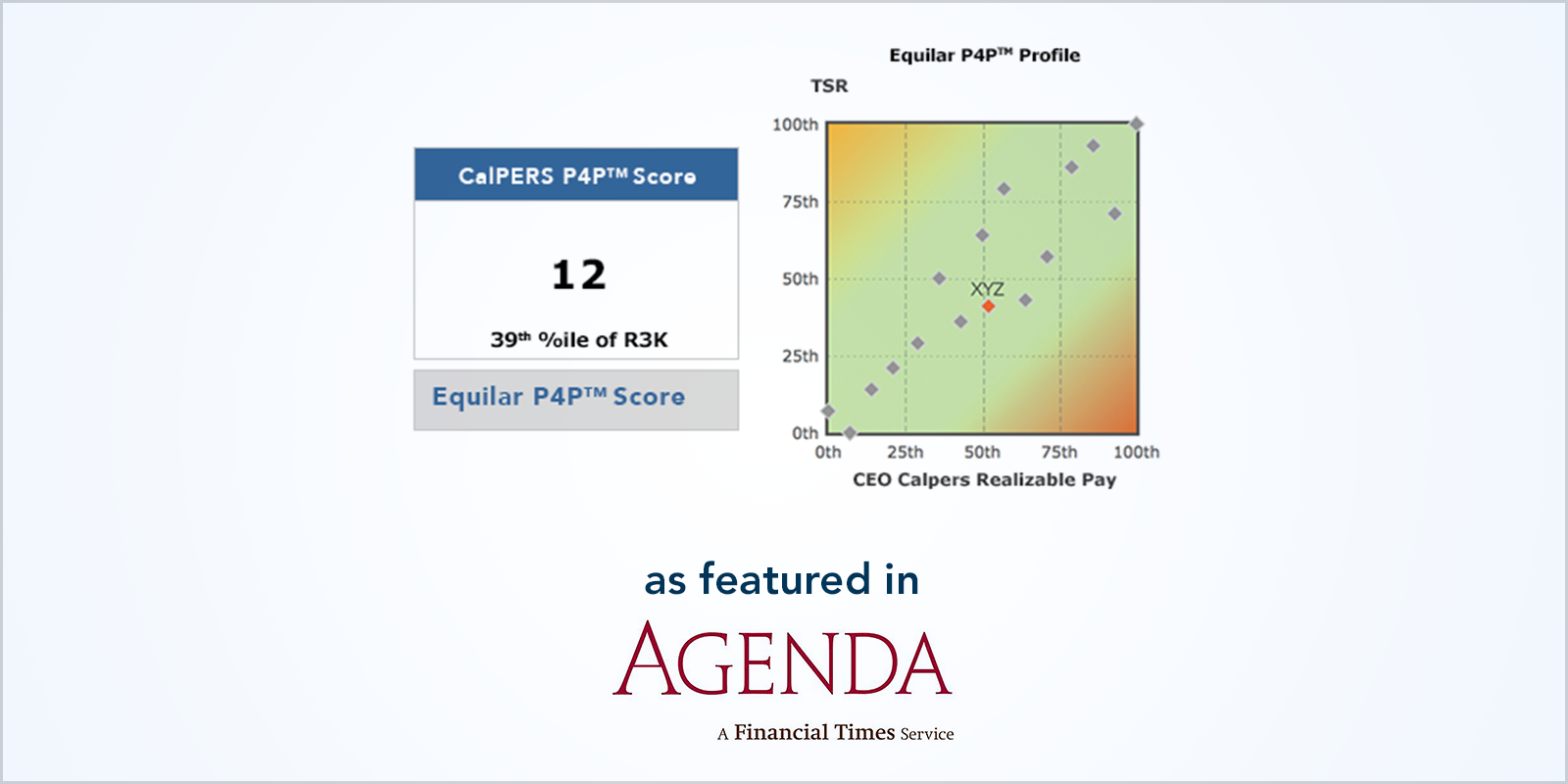

Realizable pay is often cited in the governance community as an excellent gauge of pay for performance alignment. Ideally, if a company is performing well, realizable pay will be greater than disclosed pay. And if a company is performing poorly, realizable pay will be lower than disclosed pay.

July 31, 2019

Since the passage of Say on Pay in 2010, CEO compensation has been under the public eye and shareholder attention like never before.

July 23, 2019

Equilar 500 companies have announced 42 CEO departures in 2019. This compares to a total of 80 CEO departures in all of 2018.

June 24, 2019

DTE Energy Company announced the transition of CEO and Chairman Gerard M. Anderson to Executive Chairman, effective July 1, 2019.

June 11, 2019

A new Equilar study revealed that the average representation of women on boards at 161 companies that went public in 2018 was 13.6%—an increase from 11.4% representation from IPOs in 2017.

June 6, 2019

LabCorp announced that CEO David King will retire in October 2019. According to an Equilar analysis, King earned over $170 million during his tenure and is the 32nd CEO departure of 2019.

April 13, 2019

Bed Bath & Beyond announced the resignation of Chief Executive Officer Steven Temares, effective immediately, according to The Wall Street Journal.

April 10, 2019

The Equilar CEO Tracker is a quarterly update that uncovers transition information as well as lifetime compensation figures for CEOs departing Equilar 500 companies...

April 3, 2019

The business world looks almost nothing like it did a decade ago. Every business is digital. Businesses today exist without walls and without borders...

April 3, 2019

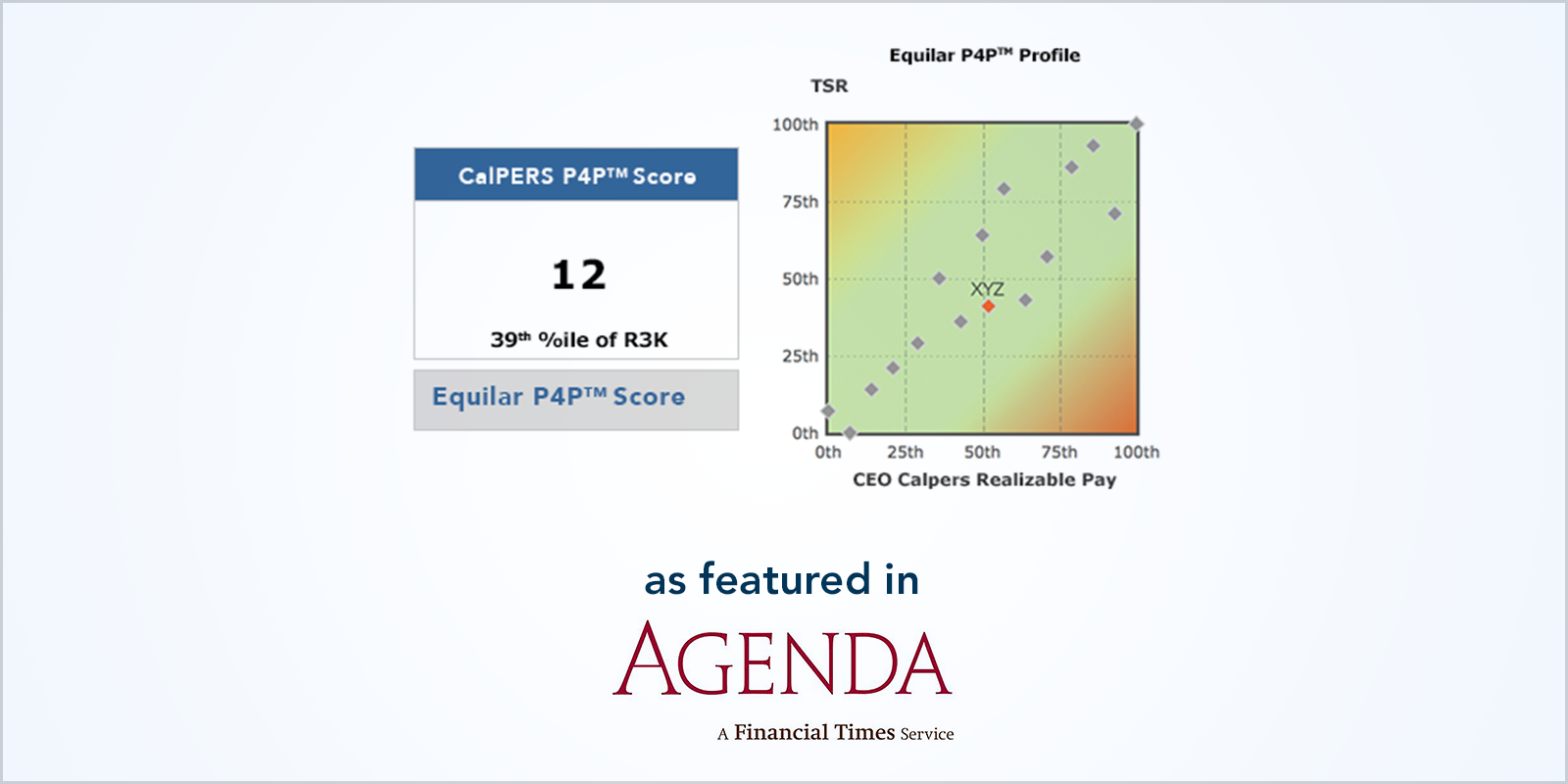

Equilar in collaboration with CalPERS has introduced an exclusive custom five-year quantitative analysis that compares total CEO realizable pay and total stock performance relative to a company’s peers...

March 28, 2019

Wells Fargo announced the resignation of Chief Executive Officer and President, Timothy Sloan, effective immediately...

March 25, 2019

Royal Dutch Shell announced in December that following its shareholder meeting, it would begin linking compensation for executives to carbon emission targets...

February 15, 2019

The financial crisis of 2008 forced the realization that the consequences of violating basic economic principles, identified by George Schultz as a lack of accountability, lack of trust, and incompetence, could no longer be ignored...

February 12, 2019

On February 11th, both Colgate-Palmolive and C.H. Robinson announced that their current CEOs—Ian Cook and John Wiehoff, respectively...

February 08, 2019

Cognizant Technology Solutions Corporation (CTSH) recently announced that Francisco D’Souza would be stepping down as Chief Executive Officer...

February 04, 2019

In response to the 2008 financial crisis, U.S. legislation was passed in the form of the Dodd-Frank Act to bring some changes in the corporate environment....

January 21, 2019

Regarding the process of benchmarking executive compensation, the SEC has detailed requirements for companies to disclose their peer group companies with appropriate justification...

January 16, 2019

Geisha Williams has stepped down as CEO of PG&E amidst wildfire and looming bankruptcy....

January 15, 2019

Under SB-826, California became the first state to pass legislation to require that publicly traded companies have at least one woman on their board...

December 21, 2018

Since the passage of Say on Pay under the Dodd-Frank Act in July 2010, greater attention has been paid to executive compensation in an effort to bring transparency and oversight to the total compensation of executives of U.S. public companies...

December 3, 2018

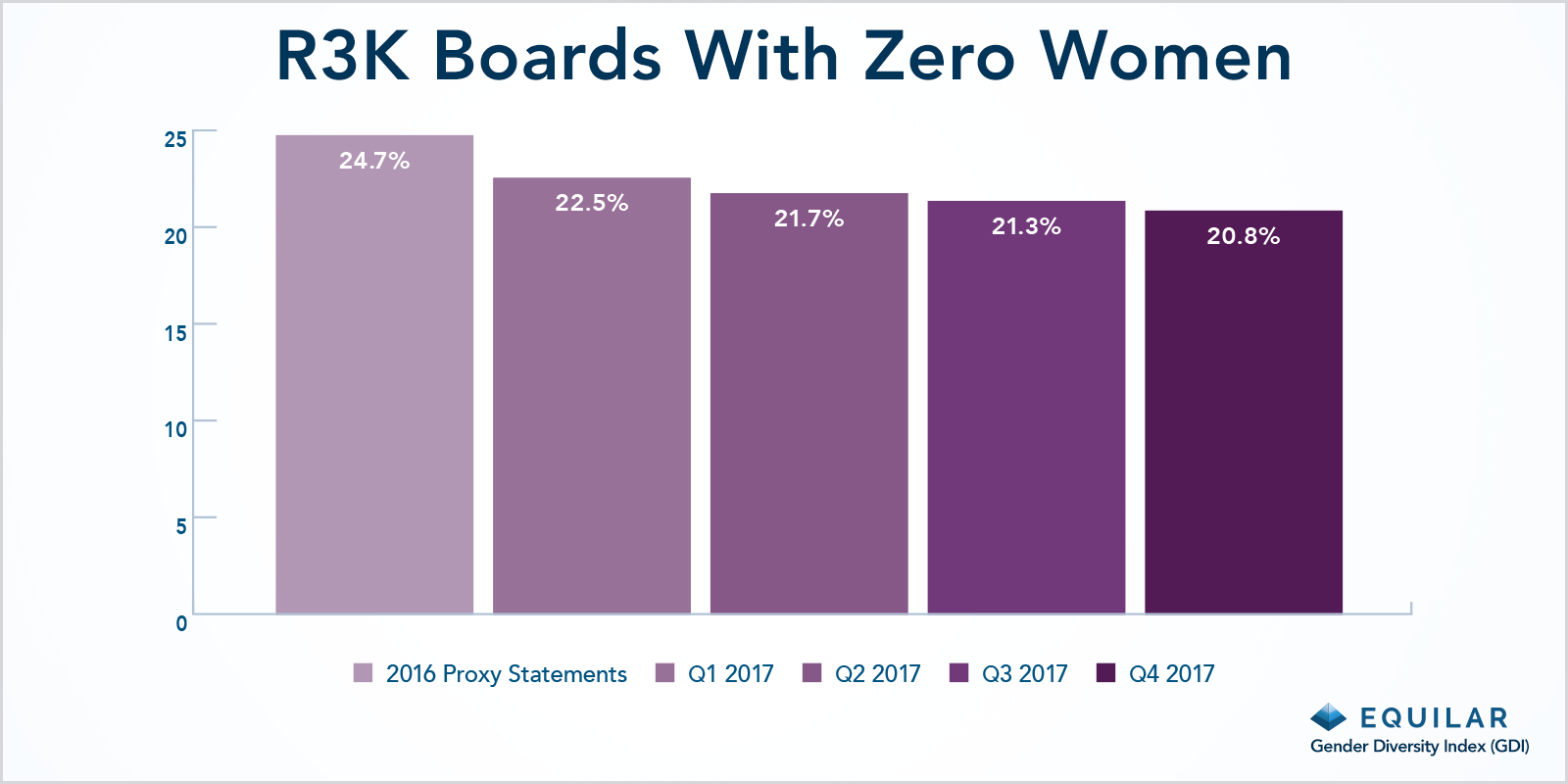

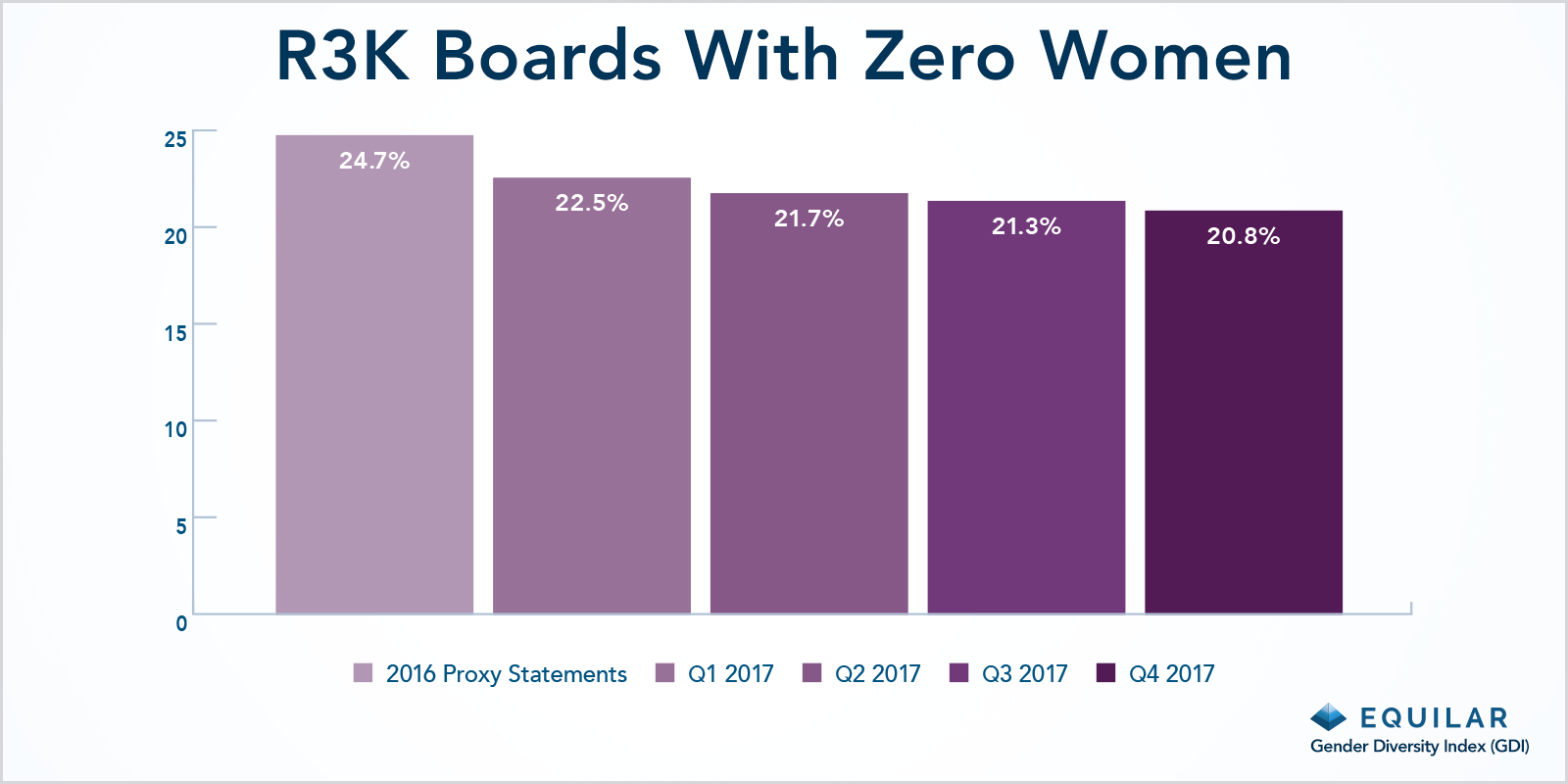

A new Equilar study examined the prevalence of all male boards in the Russell 3000 index. The study revealed that since 2000, 344 companies have not had a female on their board...

November 19, 2018

A large part of corporate governance is ensuring that management and shareholders are kept abreast of the financial decisions of the company...

October 22, 2018

As Amazon and Apple hit the $1 trillion valuation mark, there has been some speculation as to which company will be next...

October 1, 2018

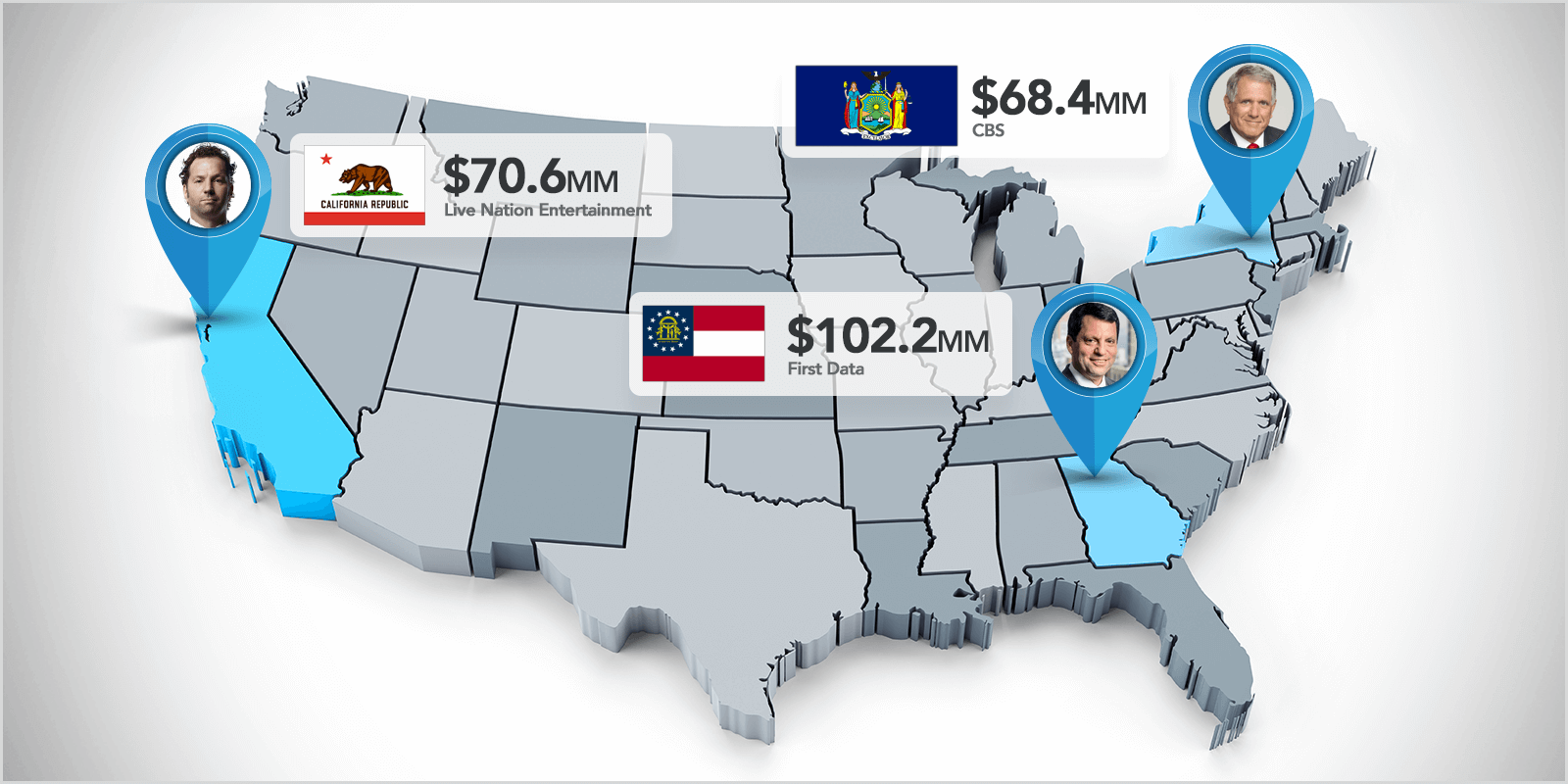

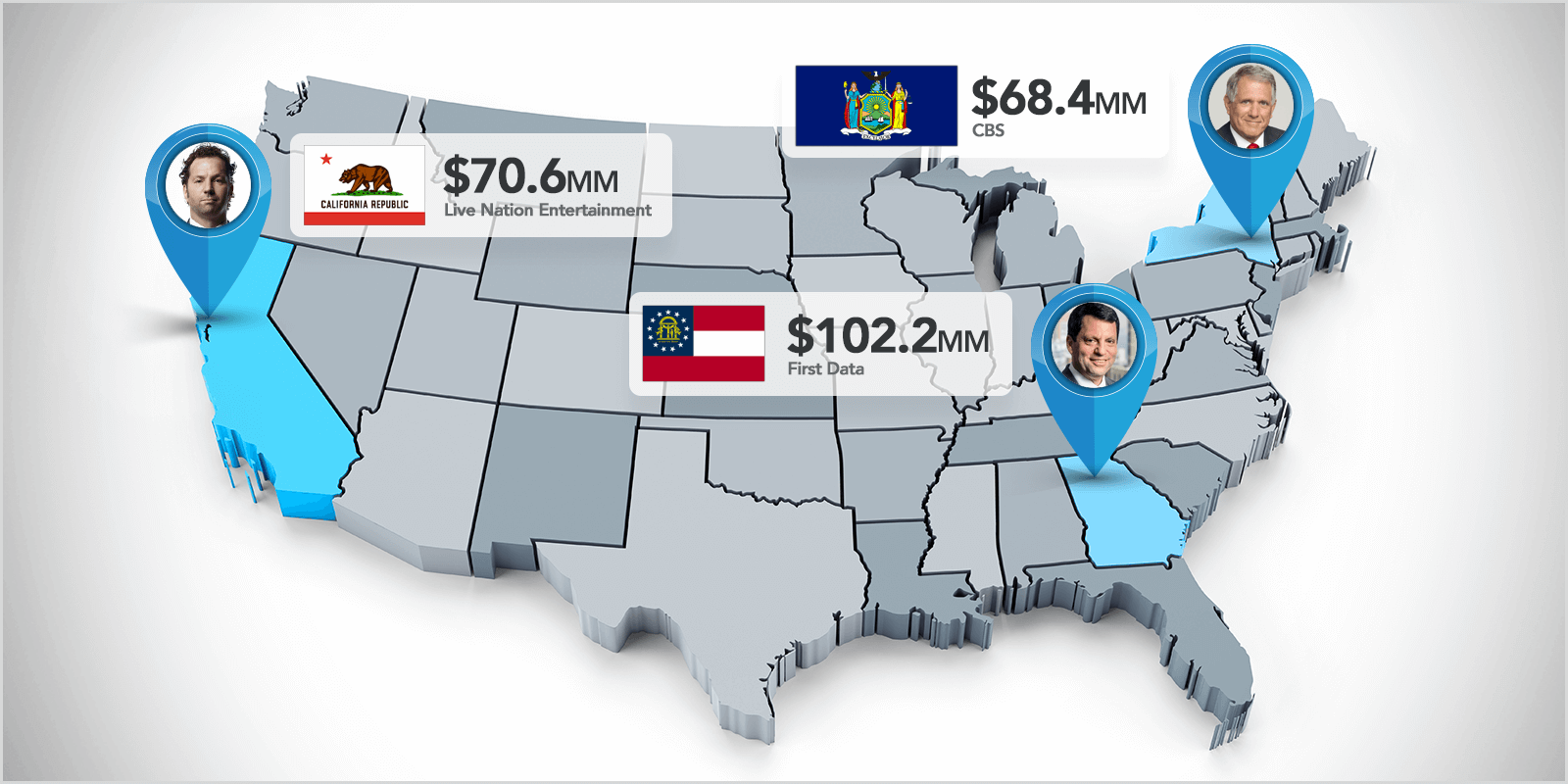

CBS recently announced that Leslie Moonves would be stepping down as Chief Executive Officer and as a director of the company effective immediately...

September 21, 2018

General Motors (GM) recently appointed Dhivya Suryadevara as its Chief Financial Officer, effective September 1st. The news made many headlines because...

September 21, 2018

Environmental, social and governance (ESG) proposals voice shareholder concerns about topics including, but not limited to, climate change disclosure, lobbying and political campaign...

September 11, 2018

Last week, Intuit announced that its Chief Executive Officer , Brad Smith, will resign after 11 years at the helm of the company on January 1, 2019, according to the company's latest press release...

August 28, 2018

Access to reliable, accurate data that explains how executives and board members are connected...

August 22, 2018

For companies with an established pattern of growth, the SEC requires the position of chief financial officer (CFO) to be disclosed as a top five executive...

August 14, 2018

Netflix CFO David Wells announced on Monday that he would be stepping down once the company announces his successor, as reported by CNBC...

August 14, 2018

By August 31, 2018, California could become the first state in the nation to mandate publicly held companies that base their operations...

August 13, 2018

Last week, Pepsi announced CEO Indra Nooyi will step down from the chief executive post following 12 years of service, CNBC reported...

October 22, 2018

As Amazon and Apple hit the $1 trillion valuation mark, there has been some speculation as to which company will be next...

October 1, 2018

CBS recently announced that Leslie Moonves would be stepping down as Chief Executive Officer and as a director of the company effective immediately...

September 21, 2018

General Motors (GM) recently appointed Dhivya Suryadevara as its Chief Financial Officer, effective September 1st. The news made many headlines because...

September 21, 2018

Environmental, social and governance (ESG) proposals voice shareholder concerns about topics including, but not limited to, climate change disclosure, lobbying and political campaign...

September 11, 2018

Last week, Intuit announced that its Chief Executive Officer , Brad Smith, will resign after 11 years at the helm of the company on January 1, 2019, according to the company's latest press release...

August 28, 2018

Access to reliable, accurate data that explains how executives and board members are connected...

August 22, 2018

For companies with an established pattern of growth, the SEC requires the position of chief financial officer (CFO) to be disclosed as a top five executive...

August 14, 2018

Netflix CFO David Wells announced on Monday that he would be stepping down once the company announces his successor, as reported by CNBC...

August 14, 2018

By August 31, 2018, California could become the first state in the nation to mandate publicly held companies that base their operations...

August 13, 2018

Last week, Pepsi announced CEO Indra Nooyi will step down from the chief executive post following 12 years of service, CNBC reported...

August 7, 2018

With most annual shareholder meetings concluded, a majority of shareholders have had the opportunity to vote on 2018 compensation packages...

August 7, 2018

As companies attempt to adapt to changing trends and technology across corporate America, new and innovative perspectives have become more necessary...

July 24, 2018

Does the presence of multiple board memberships signal an experienced and dedicated board member or one who has overcommitted his or her time...

July 17, 2018

Last week, Morgan Stanley announced the promotions of a few key executives, including Trading Chief Ted Pick, The Wall Street Journal reported...

July 12, 2018

April 10th marked Equal Pay Day 2018 in the United States. This particular date was chosen to highlight the occasion because it represents the amount of time...

July 10, 2018

Last week, Barnes & Noble announced it has fired CEO Demos Parneros and removed him from the board for violating company policies, CNBC reported...

July 9, 2018

Since the introduction of Say on Pay, shareholders have maintained a larger degree of influence over CEO compensation. The ability to vote in an advisory capacity on CEO compensation strengthened the voice of shareholders...

June 25, 2018

Palo Alto Networks announced earlier this month that, effective June 6, Nikesh Arora will serve as the new Chief Executive Officer and Chairman of the company, Reuters reported...

June 11, 2018

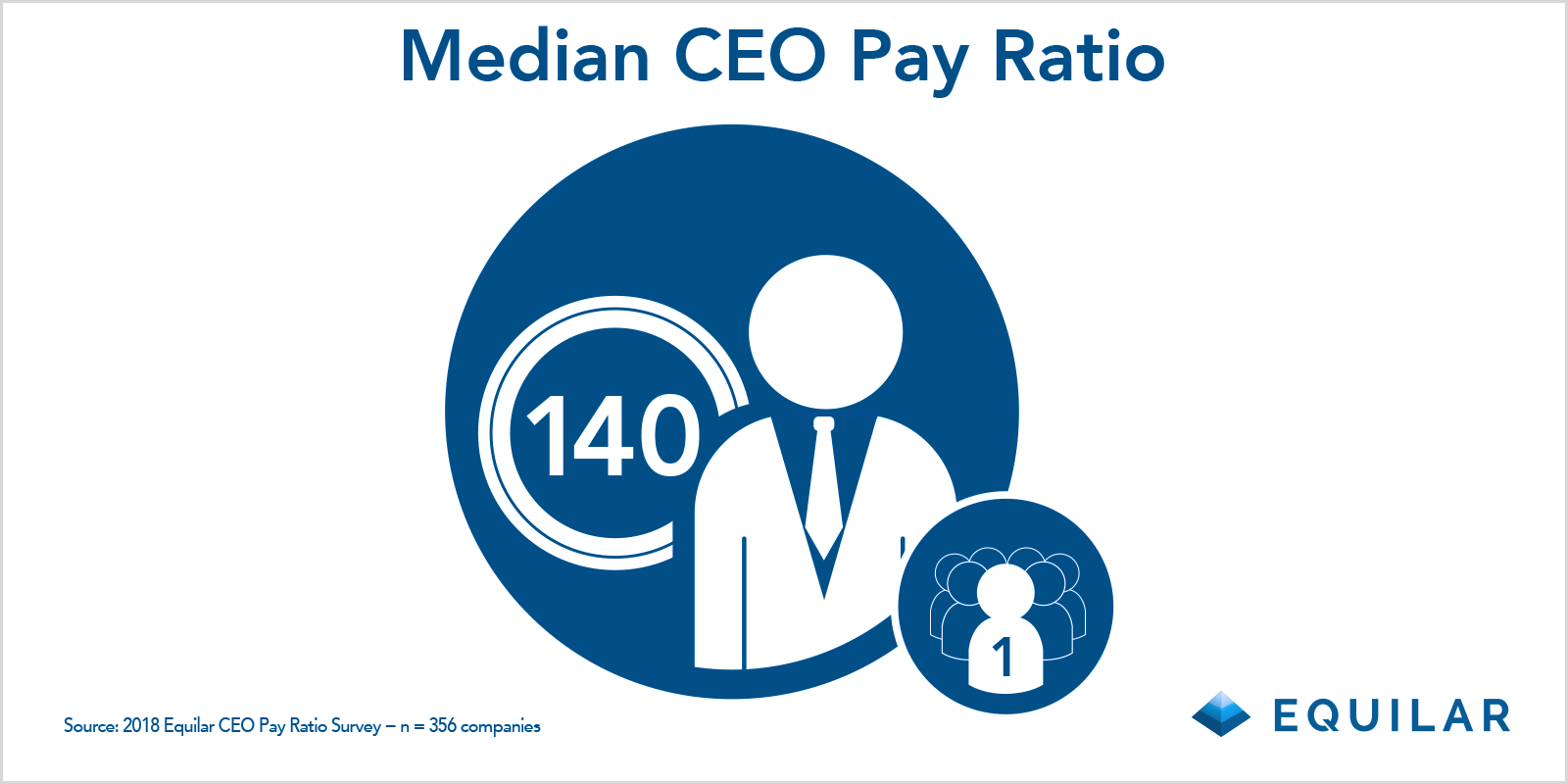

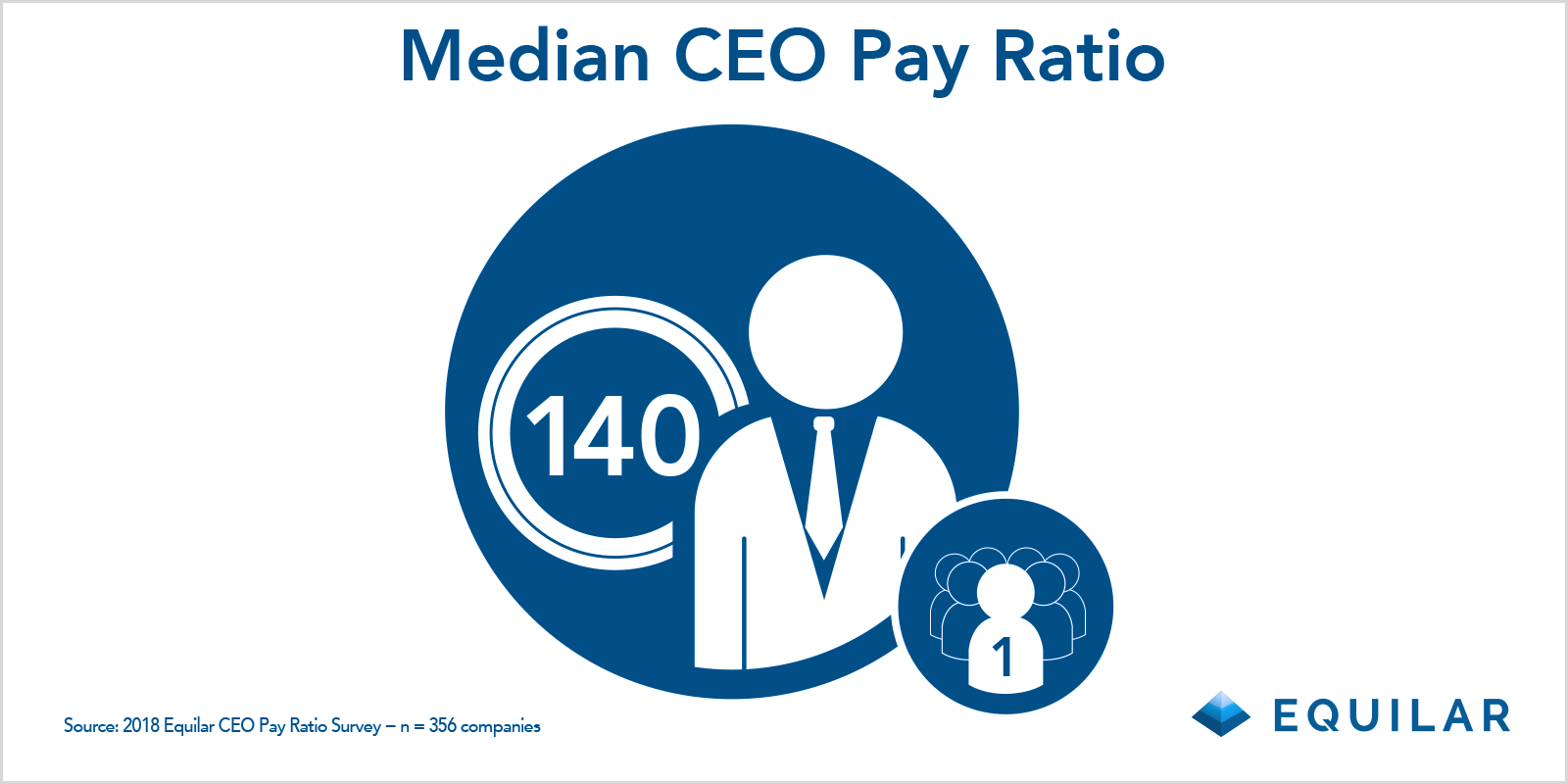

The compensation of chief executive officers has been under the spotlight, particularly with the initial release of the CEO-to-median-worker pay ratio disclosure requirement...

May 22, 2018

The introduction of the CEO Pay Ratio has created interest not only in how CEO compensation compares against pay for a company’s median employee, but also how employee pay compares across companies and industry sectors...

May 21, 2018

Amazon announced last week that it has adopted a policy that requires new board members to be selected from a pool containing female and minority candidates, modeled after the “Rooney Rule” employed by the National Football League...

May 15, 2018

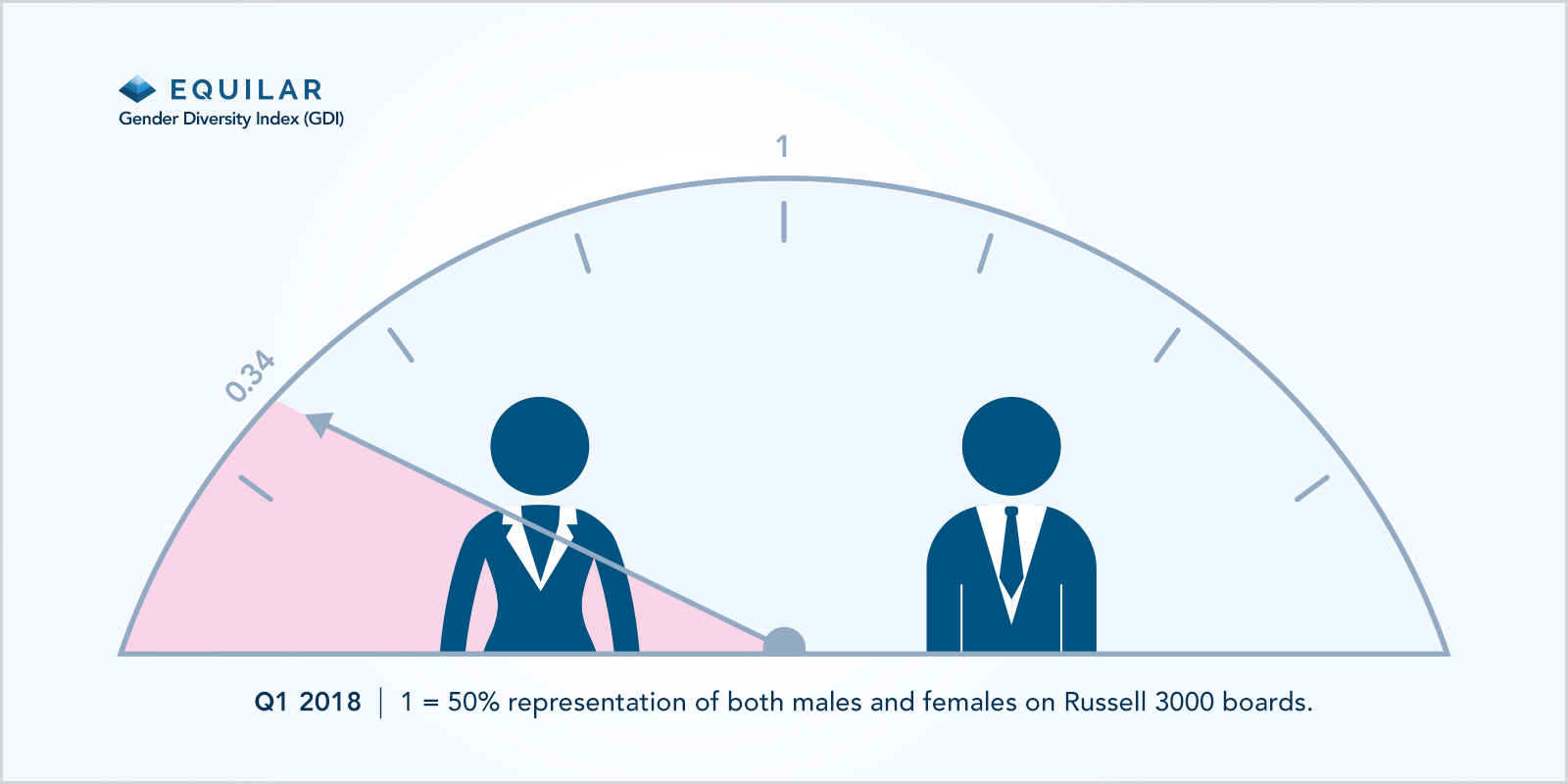

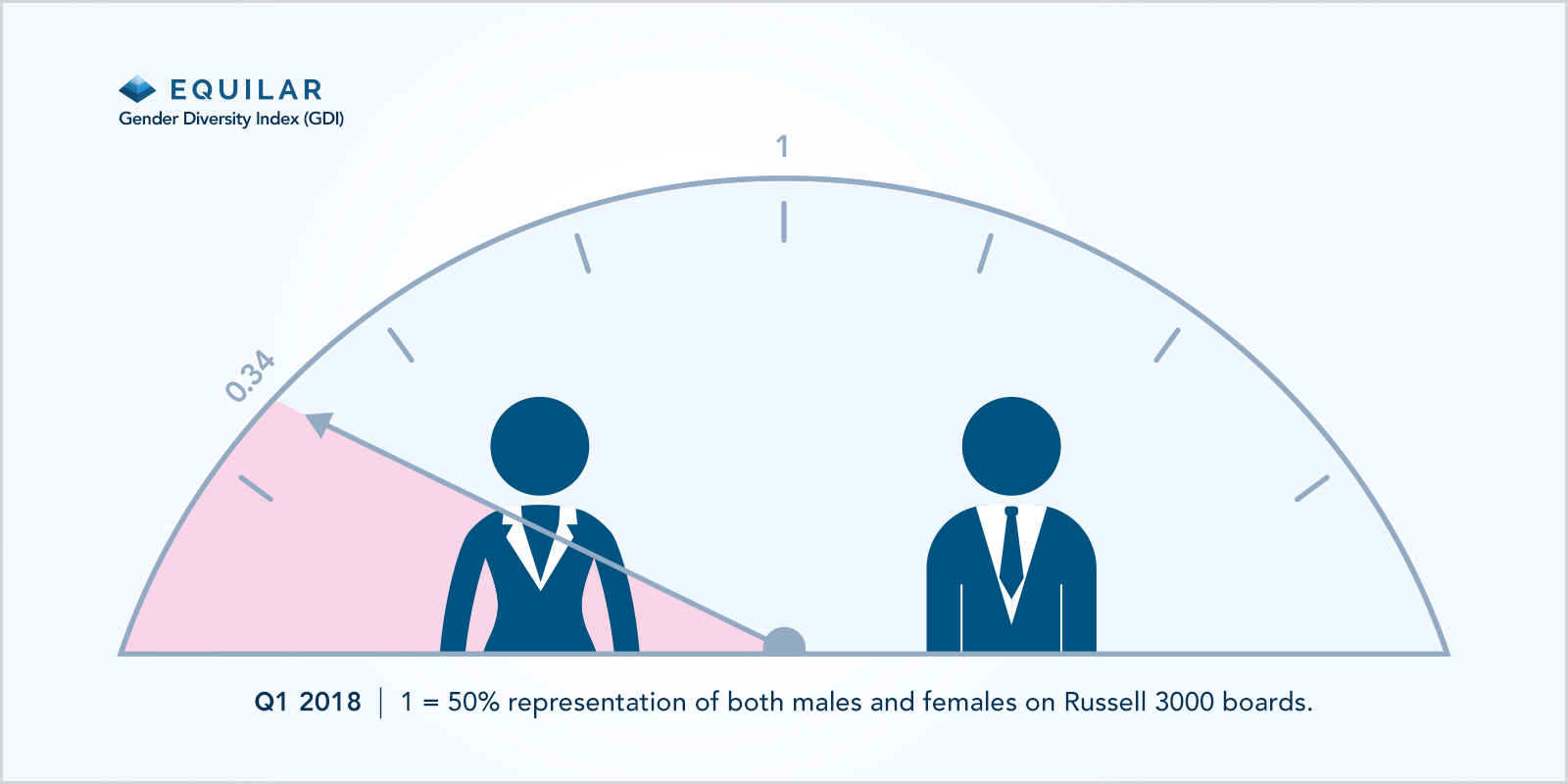

The latest Equilar Gender Diversity Index found that just 16.9% of Russell 3000 board seats were occupied by women at the end of Q1 2018. While representation of women on boards remains low, there has been recent progress...

May 14, 2018

Earlier this month, shareholders re-elected the entire Equifax board at the company’s annual meeting, the Wall Street Journal reported. This came as a surprise to several key stakeholders, particularly following the company’s massive data breach last fall...

April 30, 2018

Toy maker Mattel announced last week that it has named Ynon Kreiz as its newest CEO, replacing Margo Georgiadis, The Wall Street Journal reported. Georgiadis left the company after just one year as CEO as Mattel seeks a shake-up at the top to end a four-year sales slump....

April 30, 2018

Professional networks are business currency. The people you know and have worked with directly are the best paths available to find your next opportunity...

April 24, 2018

Corporate America is built on a network of connections that runs deep and is often intertwined. Understanding the relationships and connections between these top companies...

April 23, 2018

As proxy season 2018 is in full swing, one of the biggest headlines taking the forefront has been how companies are approaching the new CEO pay ratio disclosure requirement...

April 17, 2018

As gender equity and diversity in corporate leadership continue to be critical discussions, research is regularly published showing links between these factors and company performance...

April 9, 2018

Recent tech IPOs such as Snap, Square Inc., Blue Apron, Stitch Fix Inc. and, most recently, Spotify, have all made headlines. In terms of corporate governance, board classification...

April 3, 2018

With hundreds of proxy statements filed just before the end of the quarter, the first month of “proxy season”—generally defined as March and April—has come to a close...

April 2, 2018

Last month, Disney shareholders voted against the company’s executive compensation plan, CNBC reported. The plan—which would have rewarded CEO Bob Iger up to $48.5 million...

March 26, 2018

BlackRock announced earlier this month that it plans to add a slate of three new directors to its board as part of a new growth strategy, The Wall Street Journal reported...

March 20, 2018

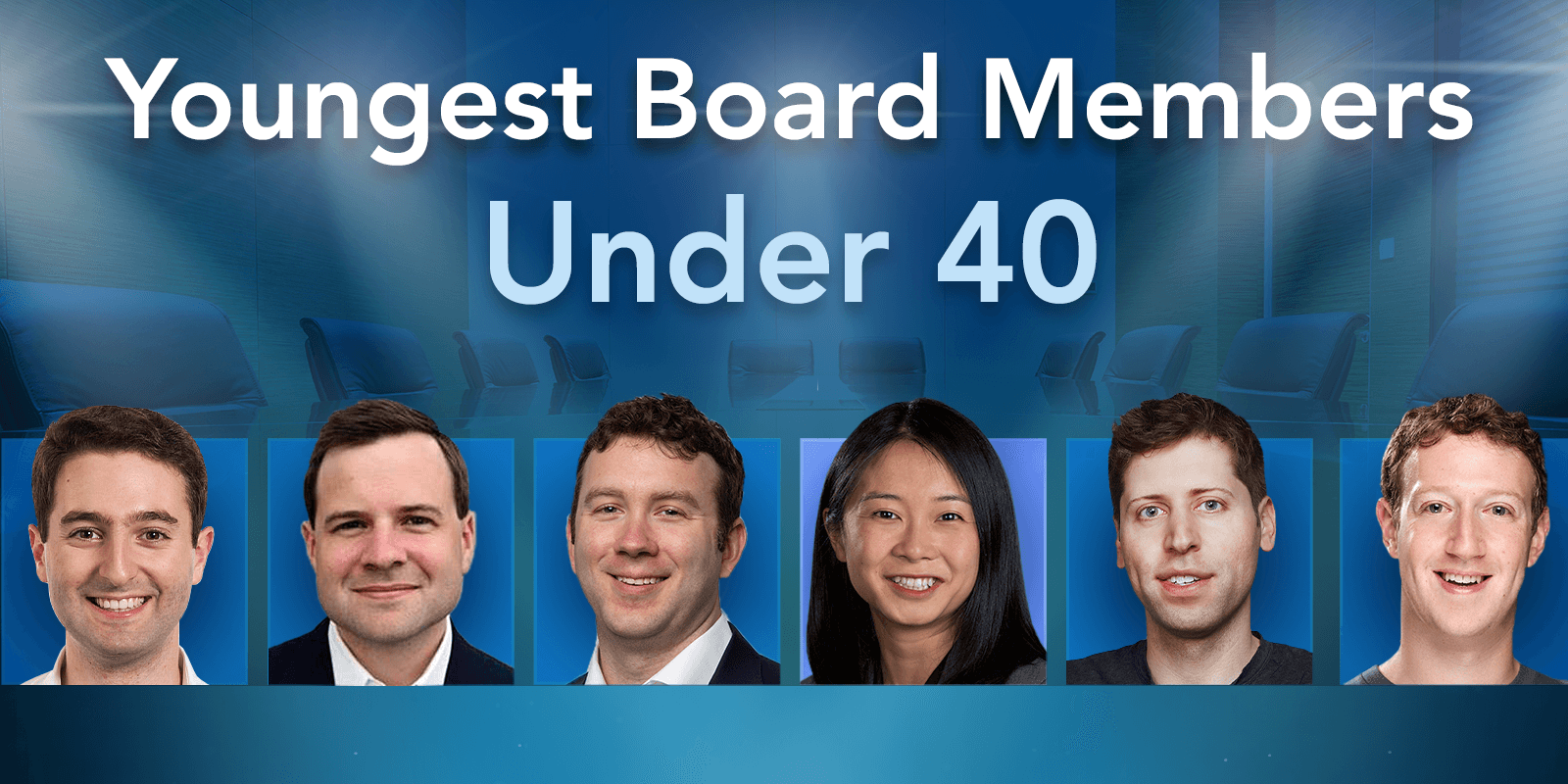

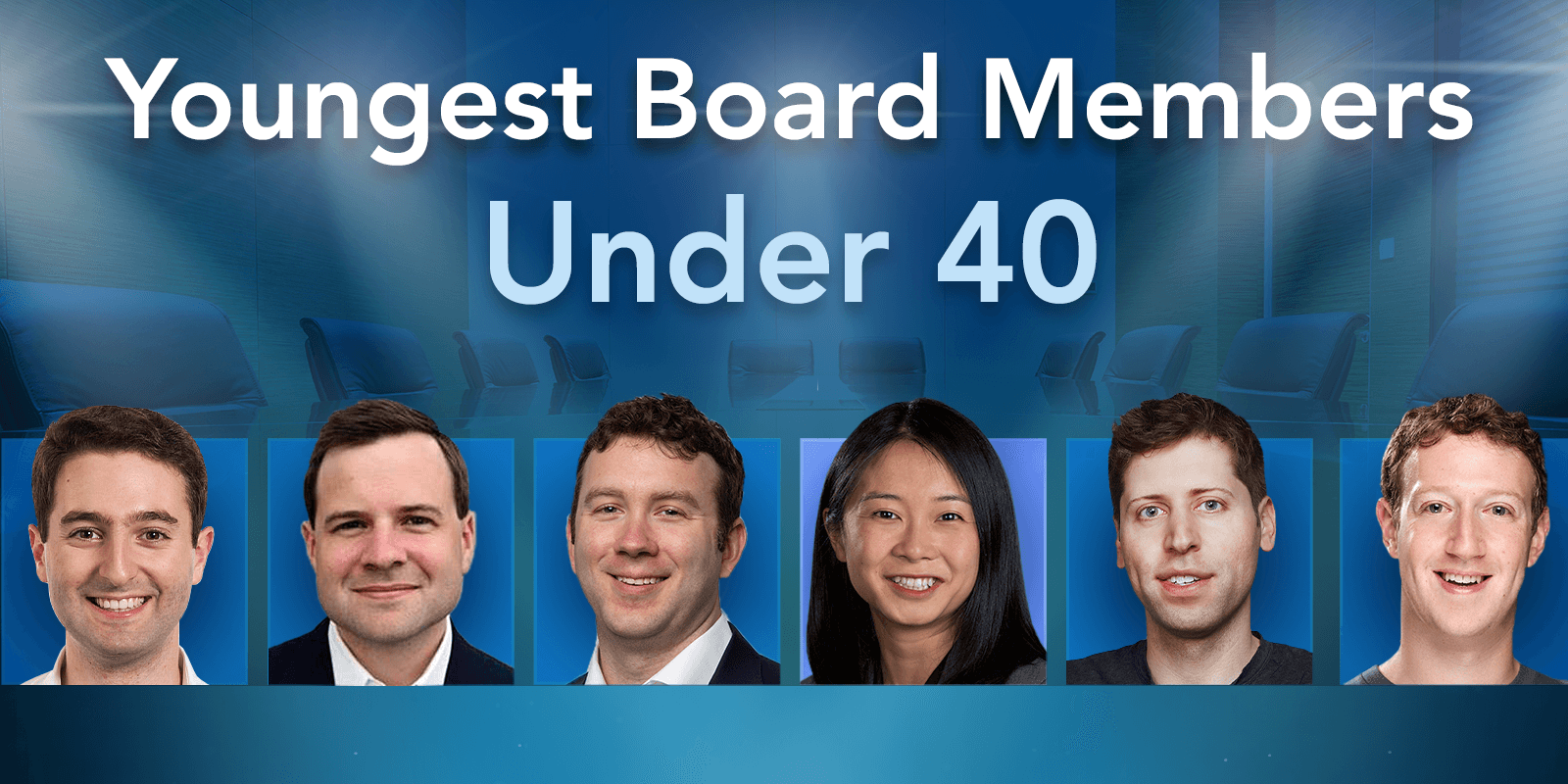

Members of public company boards of directors range in age from early 20s to well over 75. It is true that most directors are closer to retirement age...

March 13, 2018

Top sales leaders at public companies are becoming more prominent in senior executive ranks, and their pay is increasing in parallel...

March 12, 2018

Last month, Snap announced that CEO Evan Spiegel received a pay package of nearly $638 million in 2017, as detailed in the company’s recent SEC filing...

March 8, 2018

In the most recent year, CEOs at companies in the Toronto Stock Exchange (TSX) Composite were awarded a median $3.5 million, according to a new report authored by Accompass...

March 8, 2018

As part of an ongoing effort to promote diversity in America’s boardrooms, Equilar launched the Equilar Diversity Network (EDN) in 2016...

March 5, 2018

By leveraging machine learning tools and acting on the signals they provide, extending your network and increasing potential connections to the top leaders in corporate America has never been easier...

March 5, 2018

General Electric announced last week that it will overhaul its board and nominate three new directors, The Wall Street Journal reported...

February 26, 2018

The corporate world is fast-paced, and executives and board members are constantly on the move. High-level businessmen and women regularly attend conferences, dinners, and various other networking events, sharing new ideas and experiences with fellow colleagues...

February 23, 2018

Trends in proxy design generally begin with a few leading companies and see widespread adoption after shareholders react positively...

February 20, 2018

As part of a recently launched proxy fight, Starboard Value nominated 10 directors to the Newell Brands board. Equilar examined the current Newell board and how the 10 new nominees stack up in terms of experience, demographics and executive networks...

February 16, 2018

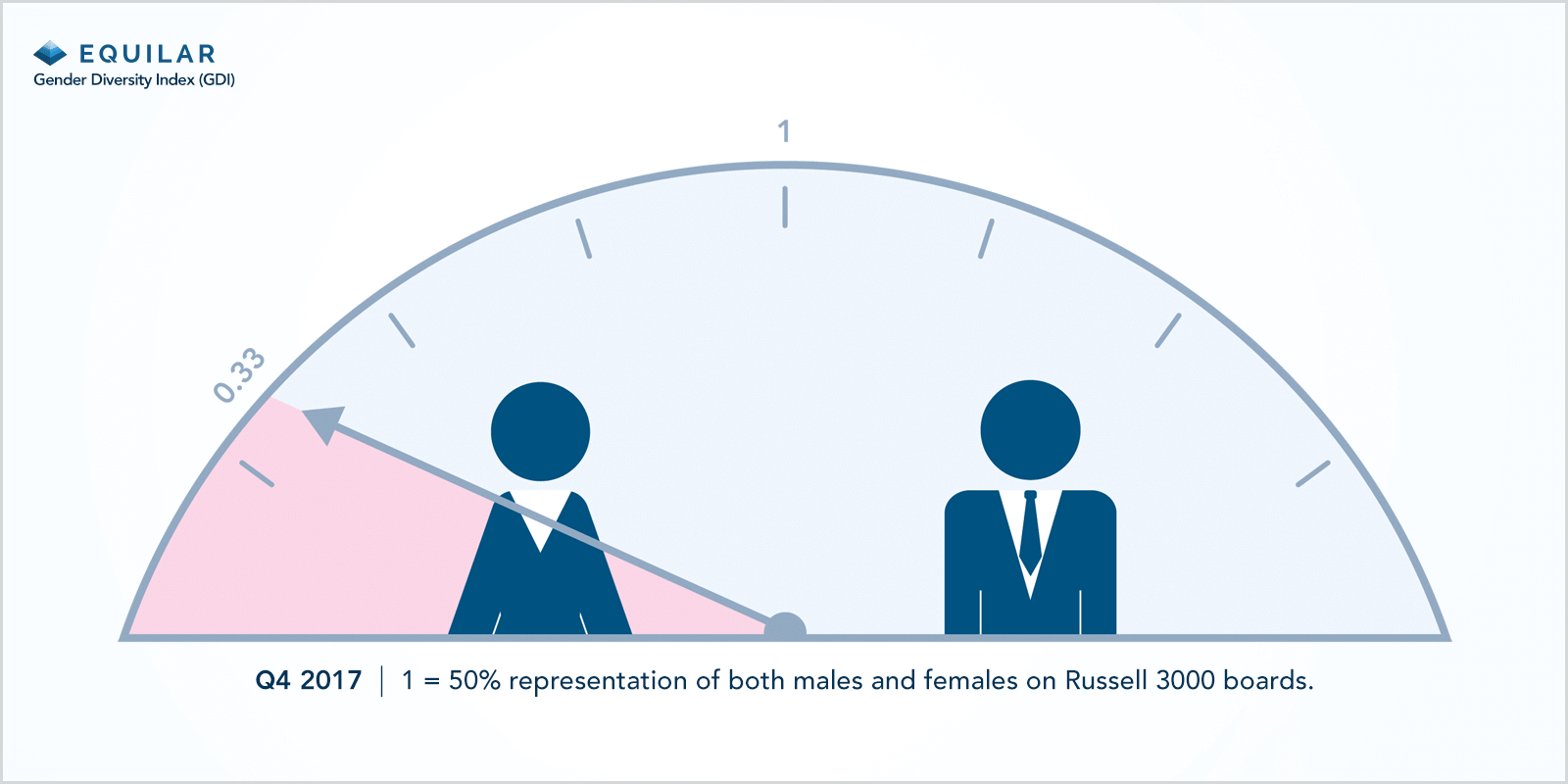

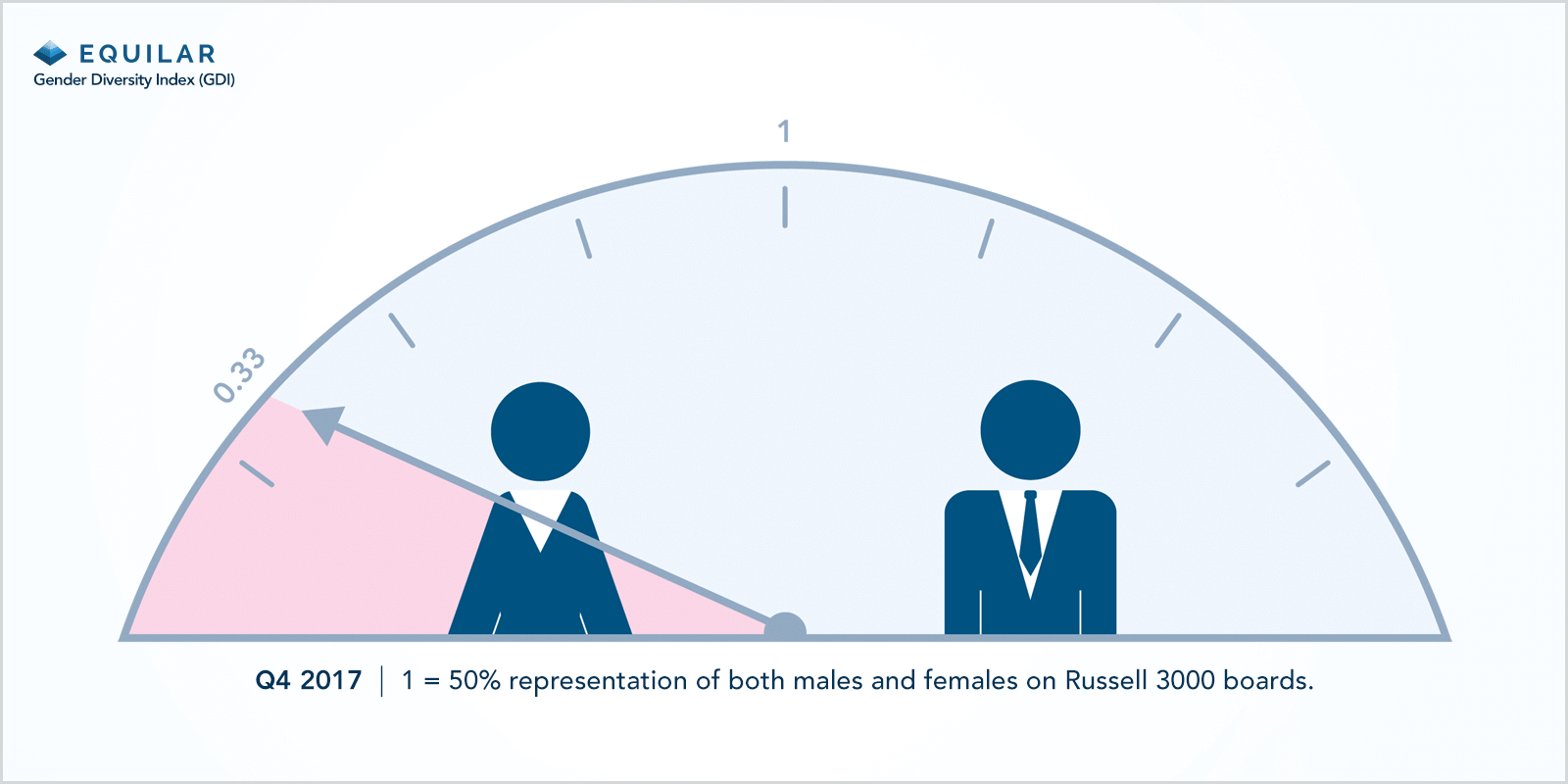

About 2.5% of Russell 3000 companies are either at or near gender parity, compared to over 20% that have no women. Equilar broke down the two different samples of companies for further insights...

February 14, 2018

Due to accelerating growth in the percentage of women on boards at Russell 3000 companies, gender parity is now expected to be achieved by 2048, according to the latest Equilar Gender Diversity Index (GDI)...

February 12, 2018

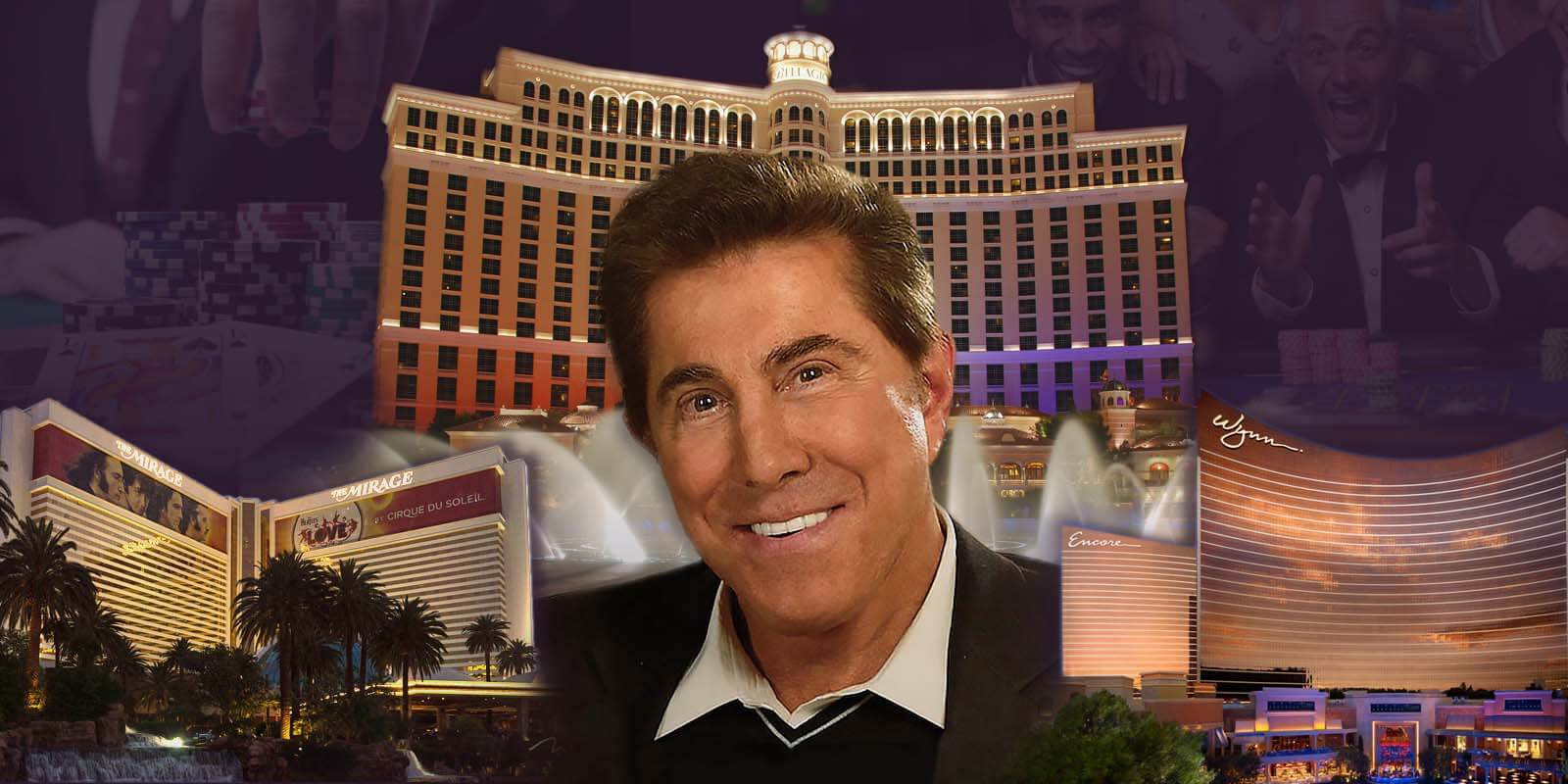

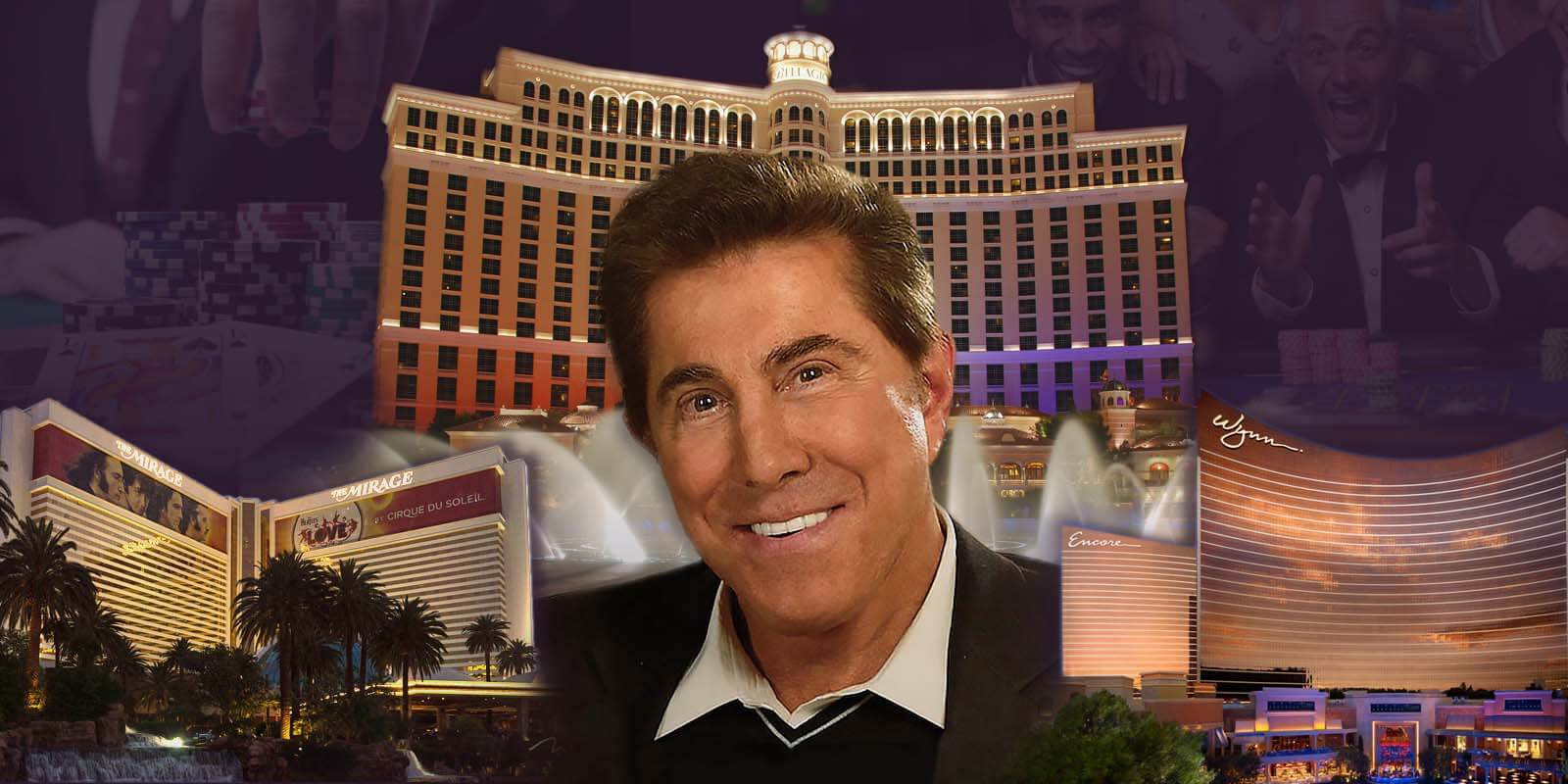

Last week, Steve Wynn stepped down as CEO of the company he founded amid allegations of sexual misconduct from dozens of female employees, which were first reported by The Wall Street Journal...

February 12, 2018

Diversity on boards of directors at public companies is at the forefront of the corporate governance world...

February 9, 2018

The influence of general counsels (GCs) in corporate strategy has increased over the years and is showing no signs of diminishing...

February 5, 2018

The shareholder proposal process provides a voice for investors of many sizes, forcing issuers’ hands to actively address a specific topic of concern...

February 2, 2018

Chief Human Resources Officers (CHROs) are taking on a more pivotal role at the executive level and in the boardroom...

February 1, 2018

Eight years following the passage of Dodd-Frank, public companies will be required to disclose their CEO Pay Ratios in 2018 proxy statements...

January 29, 2018

Billionaire activist investors Carl Icahn and Darwin Deason issued a statement last week urging Xerox to explore a sale and remove CEO Jeff Jacobson, The Wall Street Journal reported...

January 26, 2018

For anyone concerned about performance-based compensation going away because it’s no longer tax deductible, have no fear...

January 22, 2018

The world’s top business, economic and political leaders will gather this week in Davos for the 48th annual World Economic Forum (WEF)...

January 19, 2018

In the past five years, CEOs transitions have become more common than they had been in the preceding five years...

January 16, 2018

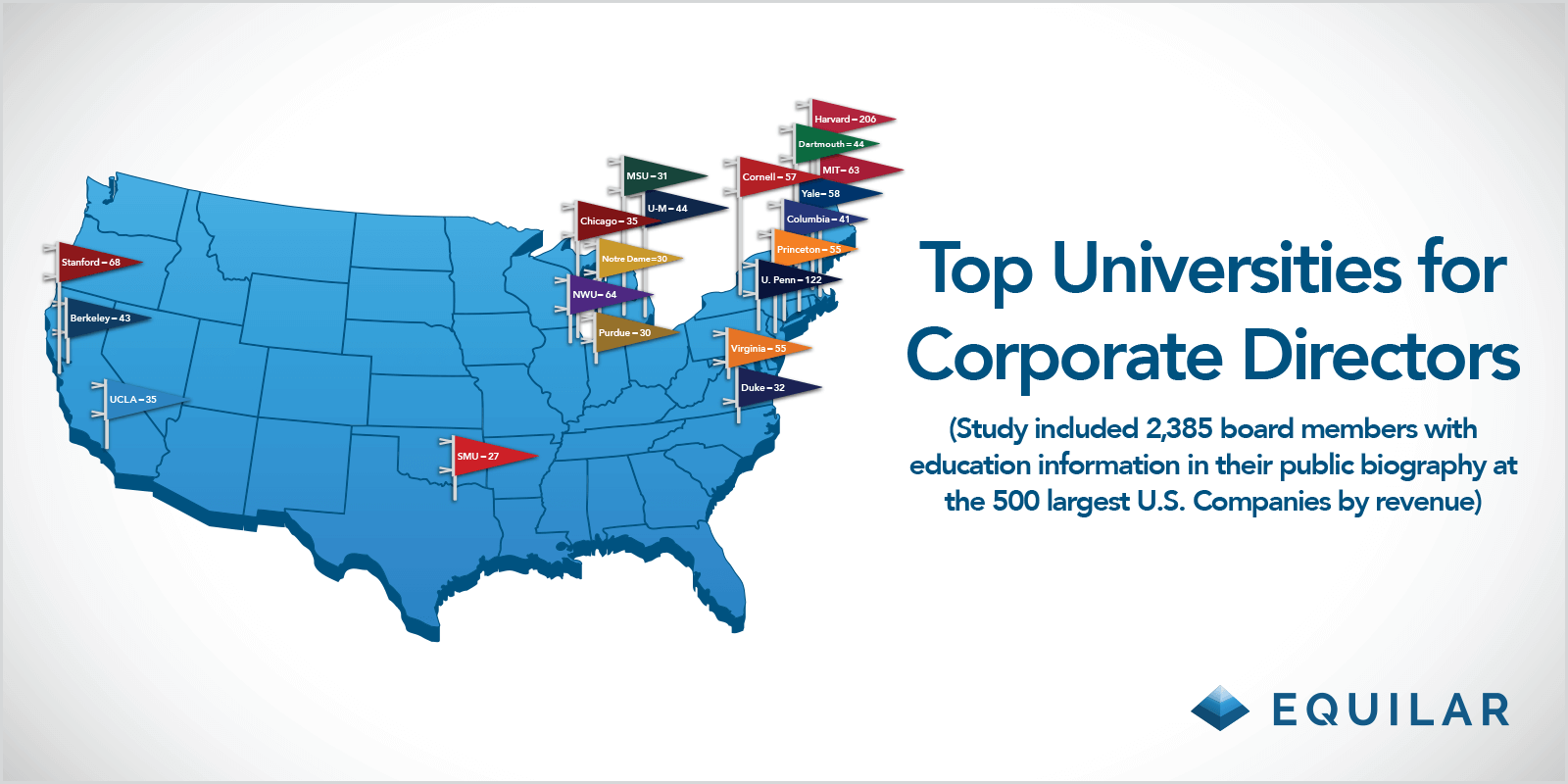

With the college football season coming to a close last week, there’s no question who’s Number 1 on the field...

January 15, 2018

Since the enactment of Say on Pay following the passage of Dodd-Frank, executive compensation has been closely watched and scrutinized by corporate shareholders...

Solutions

Solutions