Media Center

Press Releases

Equilar: Tech Companies Lead the S&P 1500 in Stock Units Granted

Overall, restricted stock is becoming a more significant part of equity packages

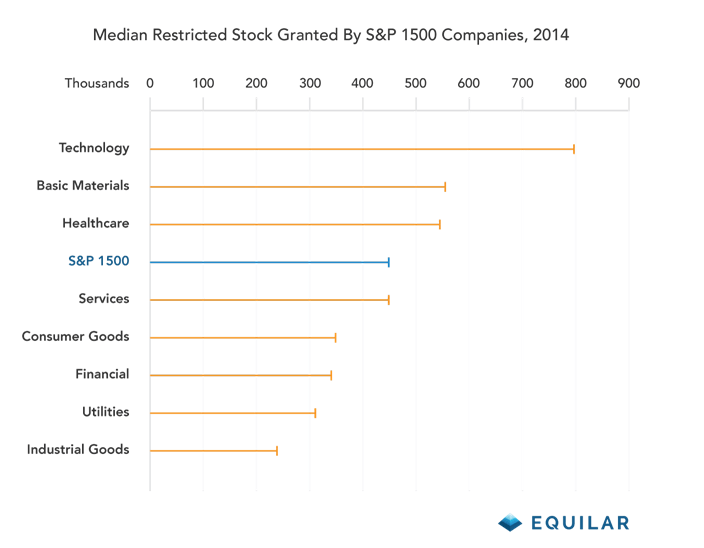

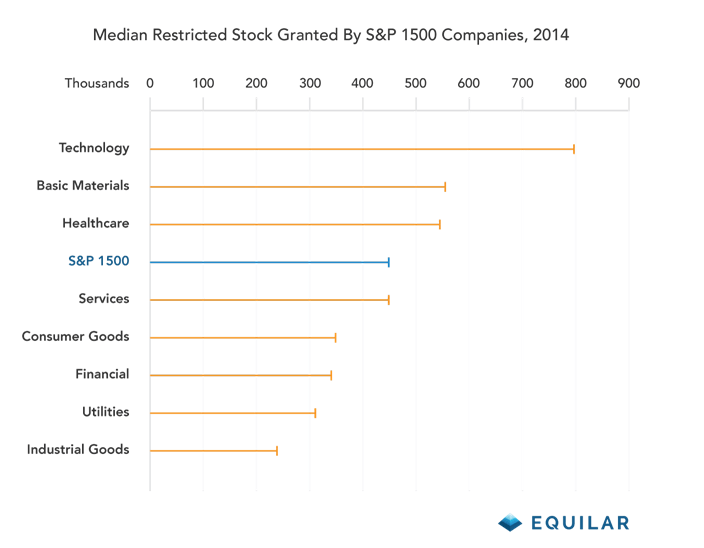

REDWOOD CITY, CA (August 26, 2015) — Technology companies stood widely apart from the rest of the S&P 1500 in terms of

stock granted in 2014, according to a new report from Equilar on equity trends. Restricted stock granted to named

executives at tech companies in the S&P 1500 totaled a median 798,000 restricted stock/restricted stock units (RS/RSUs)

in 2014, 77.3% higher than the median 450,000 RS/RSUs for the S&P 1500 as a whole.

The tech sector is an outlier from all other industries in the S&P 1500 in this way. The next highest median among

sectors in the S&P 1500 was basic materials at approximately 557,000 RS/RSUs, just ahead of healthcare at 546,000.

The industrial goods sector granted a median 240,000 RS/RSUs in 2014, the least amount of any industry.

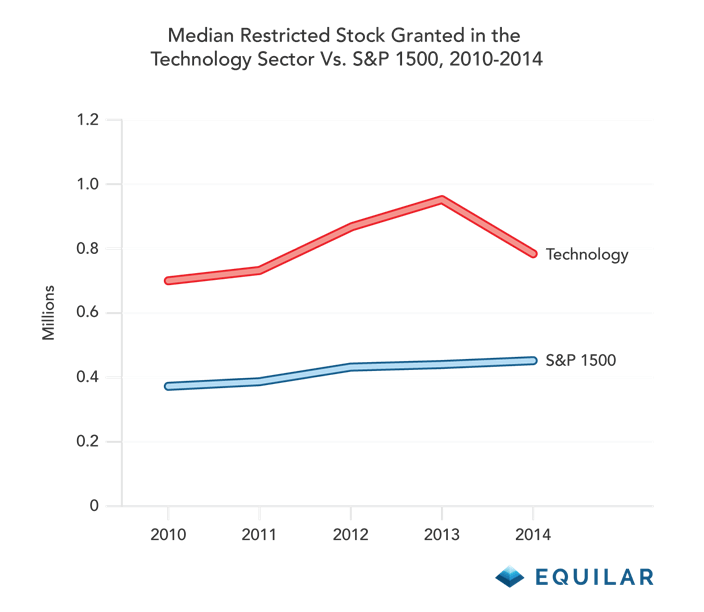

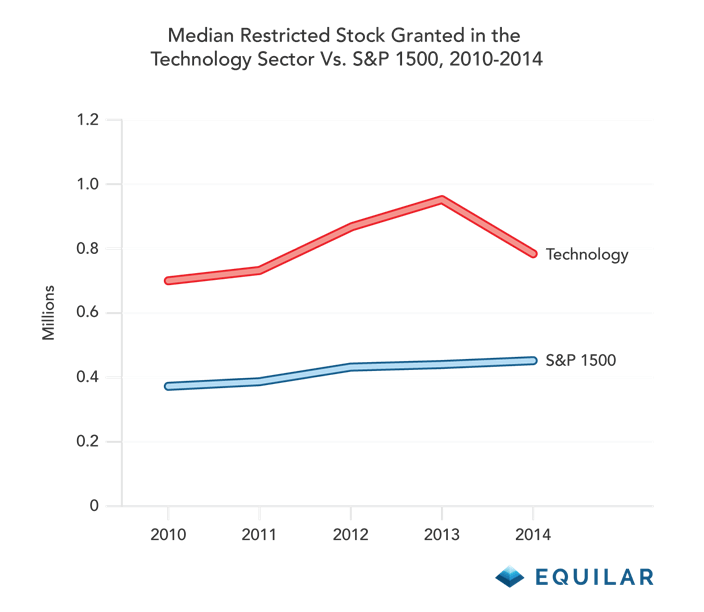

The tech sector actually saw a dip in restricted stock granted in 2014, and it stood even further afield in recent

years. In 2013, median restricted stock granted in the tech sector hit a peak of 955,000 RS/RSUs, up from 869,000

in 2012. Though 2014 marked a year of little change in terms of amount of stock granted at the index level, there

has been a steady increase in exclusive use of restricted stock among companies as an equity grant practice across

the S&P 1500. From 2010 to 2014, median stock granted across the S&P 1500 increased 20.8%.

An overall shift to stock awards away from options has occurred across the S&P 1500 since 2010. While the majority

of companies in the S&P 1500 continue to offer a mix of both RS/RSUs and option/SARs, the share of companies that

did so dipped from 67.5% in 2010 to 57.4% in 2014. Meanwhile, companies that offer RS/RSUs exclusively as equity

have become an increasing subset of the S&P 1500, totaling 37.9% in 2014, and companies that award only option/SARs

as equity accounted for only 3.3% of companies in the S&P 1500 in 2014.

Equilar’s 2015 Equity Trends Report sheds light on how the country’s largest public companies motivate and

reward their leadership. For information regarding 2014, this analysis included all named executive officers (NEOs)

in S&P 1500 companies with at least one year of publicly disclosed equity grant practices available at the time of

writing (n=1,460). For data regarding 2010 to 2013, the dataset reflected S&P 1500 companies with four years of

publicly disclosed equity grant practices (n=1,345). This reflects a change in methodology moving forward, in order

to represent trends in the S&P 1500 as an index instead of the S&P 1500 as a specific set of companies. Throughout

the report, restricted stock and restricted stock units are referred to as restricted stock. Options and stock

appreciation rights (SARs) are summed in graphs and calculations unless otherwise stated, which also applies to

restricted stock and restricted stock units.

Founded in 2000, Equilar provides proprietary executive data, unbiased research services and exclusive corporate

governance tools. Our flagship products – Insight, BoardEdge, Engage, and Atlas – translate complex, unstructured

data sets into valuable information to help executives, board members, and investors make the best decisions possible.

As the trusted data provider to 70% of the Fortune 500, Equilar helps companies accurately benchmark and track

executive and board compensation. Equilar’s research is cited regularly by The New York Times, Bloomberg, Forbes,

Associated Press, CNN Money, CNBC, The Wall Street Journal and other leading media outlets.

For more information, contact:

Amit Batish

Director, Content & Marketing Communications, Equilar

abatish@equilar.com

650-241-6697

Solutions

Solutions