Equilar Institute

Blog Home

Boardroom Indicator: 185

December 12, 2017

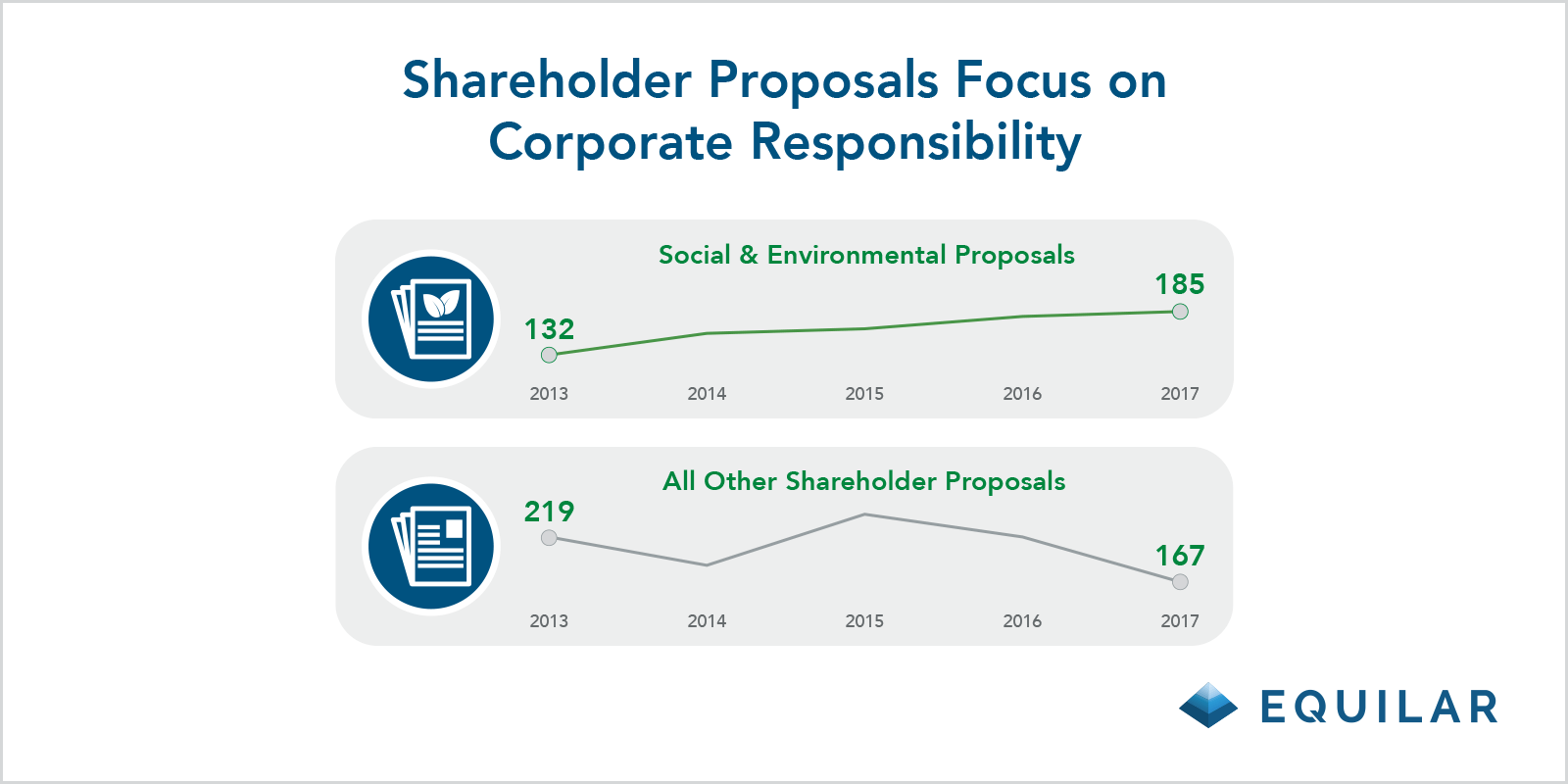

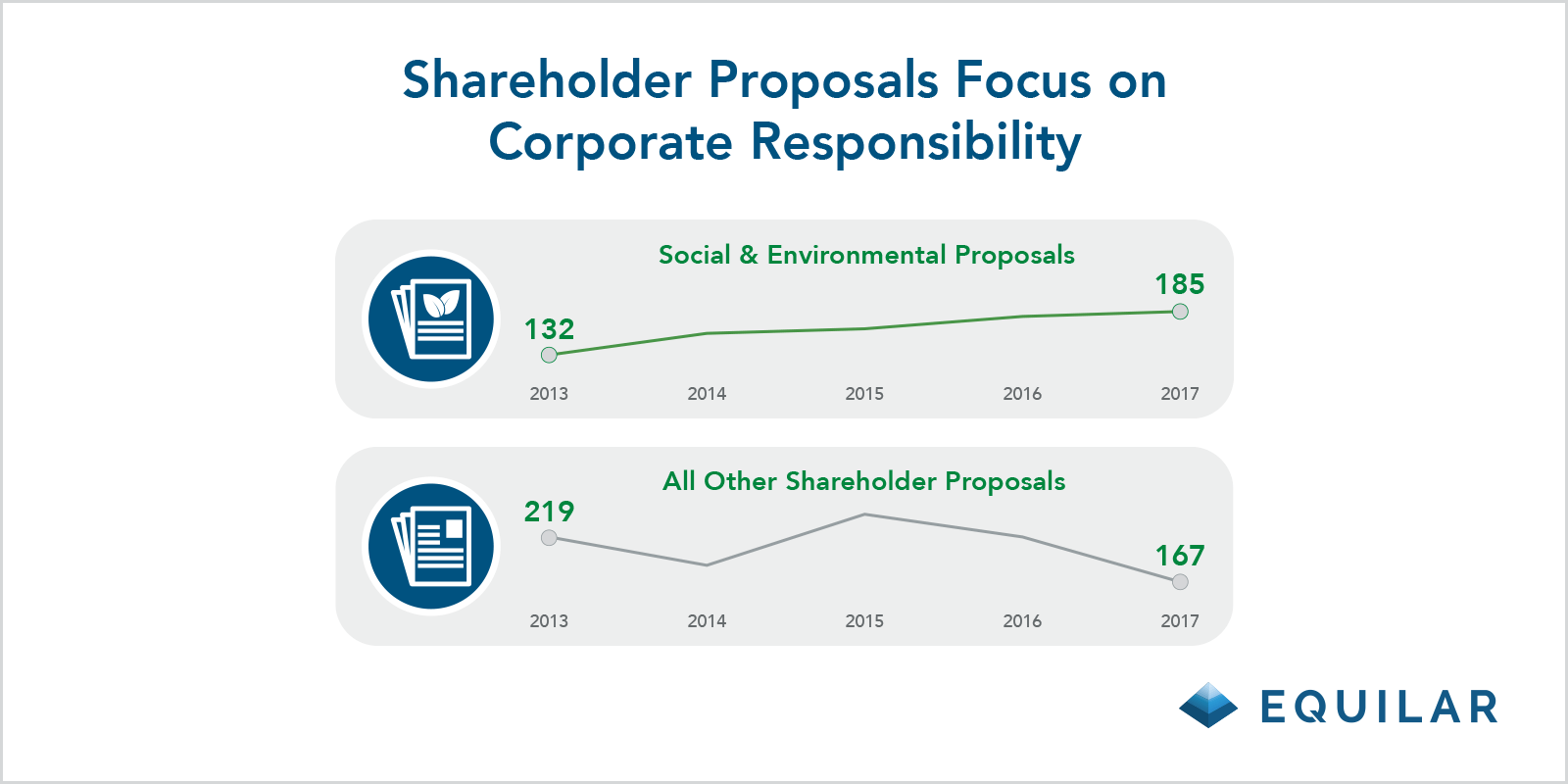

In 2013, there were 132 environmental and social shareholder proposals at Equilar 500 companies. By 2017, that figure increased more than 40% to reach 185. No other major shareholder proposal category saw net growth during that time frame.

In the last five years, the number of shareholder proposals has remained relatively consistent at large-cap companies—hovering around 350 outside of a spike in 2015 and 2016 when proposals neared 400 due to an influx of proxy access motions. In that timeframe, the mix of those proposals has changed as more investors are stepping up to demand transparency from companies on social and environmental issues. Data in the new Corporate Governance Outlook 2018 report shows that ESG proposals are creeping up steadily while others wane.

Governance experts contributing commentary to the Equilar report weighed in on this topic.

Alex Bahn

Partner,

Hogan Lovells

Lillian Tsu

Partner,

Hogan Lovells

Ron Schneider

Director of Corporate Governance Services,

Donnelley Financial Solutions

Alex Bahn: “In 2017, proposals on environment and social issues took center stage and markedly outnumbered governance-and compensation related proposals. 2017 voting results, however, indicate that investors continue to provide the highest levels of support on governance proposals, including board de-staggering, proxy access adoption and majority voting for directors. That is not to say that environmental and social proposals aren’t gaining traction. Three climate change proposals achieved majority support in 2017 compared to only one in 2016. This trend reflects the views of large institutions, such as BlackRock and Vanguard, who have become more vocal in support of environmental topics. It also is indicative of these institutions’ willingness to support shareholder proposals on environmental topics where they are not satisfied with their engagement with a company on the issue.”

Lillian Tsu: “Climate change, gender and diversity issues, and political spending continue to be frontpage news. In connection with this, the focus by institutional investors on environmental and social issues and measures has grown. Large institutional shareholders are becoming more and more vocal and likely to support shareholder proposals on environmental topics in particular, especially in industries where environmental matters and climate change risks are material to companies. Additionally, activist shareholders interested in environmental and social matters are increasingly turning to shareholder proposals as a tool to encourage corporate change.”

Ron Schneider: “With respect to environmental disclosure proposals, last year proved significant and a potential harbinger of more shareholder proposals to come for two reasons. First, proponents of certain environmental proposals shifted the focus from ‘How is the company impacting the environment?’ to ‘How is environmental change going to impact the company’s sustainability?’ By recasting the issue in terms more directly linked to shareholder value, the proponents secured support from significant indexed and other long-term investors that in the past generally did not support environmental proposals without an explicit link to shareholder value. This recasting of the issue resulted in ‘passing’ proposals at several significant energy companies, and these votes likely will embolden additional proponents on this and similar issues in the future.

“It is understandable, but misleading, to equate the absolute number of, or trend in, how frequently a certain shareholder proposal type occurs with the degree of investor interest in, or support for, a particular topic. Shareholder proposals are but one arrow in an investor’s activism quiver. For example, recently there may be fewer board-related proposals, in part because larger companies have increasingly adopted the requested measures, leaving a smaller pool of remaining targets at any particular market cap or index level. Also, there have been many past cases when in one year, an investor filed dozens of proposals on an issue, and the following year, based on strong voting results on the issue and the investor knowing they got the companies’ attention, reverted to engagement dialogue on the same issue with an expanded group of targets. These companies know that if the investor is was not satisfied with the nature and quality of the dialogue, then that investor could revert back to filing proposals that may get significant support in the future.”

Please click here to request a download of Corporate Governance Outlook 2018, featuring commentary from Hogan Lovells and Donnelley Financial Solutions and read more about this and other trends and topics.

Dan Marcec, Director of Content & Communications at Equilar, authored this post. Please contact him at dmarcec@equilar.com for more information on Equilar research and data analysis.

Solutions

Solutions